Strong Fundamentals in Medical Office Real Estate

Amidst the challenging commercial real estate landscape of the past year, SkyView Advisors identifies reasons for cautious optimism in the current market. In the medical office/healthcare real estate (HRE) asset class, there’s been an uptick in demand from buyers following a lower-than-normal transaction volume across the industry in 2023. At SkyView, we’ve observed buyers returning, with a notable increase in groups underwriting and offering on current deals, as well as recent closings in this space. The bid/ask delta has narrowed as sellers have adjusted to cap rate expectations.

Strong fundamentals in the space and an influx of new capital and institutional buying groups further enhance investment opportunities. Rental rates and occupancy rates are increasing. There is low inventory on the market where in most major markets, supply and new supply is not keeping up with absorption. There is dry powder on the sidelines with pent up demand from buyers who waited out last year wondering where interest rates would go.

Despite some slowdowns attributed to broader real estate market fluctuations, promising investment opportunities have emerged.

High quality properties that are primed for the current market are in demand and will get attention. What does high quality mean? Newer, full occupancy, strong lease rates and/or upcoming renewals, and minimal deferred maintenance. The market recognizes that replacement costs are high and seems to be heeding the advice of Warren Buffet that “It’s far better to buy a wonderful asset at a fair price than a fair asset at a wonderful price.”

Looking ahead, these trends suggest a dynamic market landscape with continued opportunities for investors, particularly in emerging markets and resilient asset classes like self-storage and medical office/HRE. As buyers and sellers adapt to evolving market conditions, there’s potential for further growth and development in the commercial real estate sector.

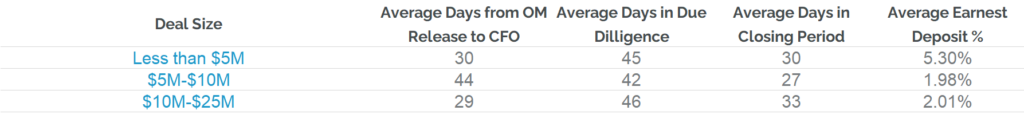

In the initial section of this report, we share proprietary SkyView metrics across our asset classes of self-storage, healthcare, and manufactured housing. The data reflects the average time from offering memorandum release to call for offers deadline, average days in due diligence, average days in the closing period, and mean of the earnest deposit percentage for each deal size. This data creates full transparency on the transaction process timeline. Below, SkyView’s on-market data reflects all 12 months of 2023, categorized by deal size. The latter sections of this report are based primarily on public REIT data.

SkyView On Market Data

REIT Operating Fundamentals

Leasing Rates & Lease Terms

In the fourth quarter of 2023, leading Healthcare Real Estate Investment Trusts (REITs) demonstrated robust leasing trends and favorable lease terms within the medical office sector. Welltower (WELL) reported a positive 2.8% same-store portfolio growth in the Outpatient Medical segment, indicating a stable and profitable leasing environment. Ventas (VTR) showcased continuous compounding growth in its outpatient medical and research portfolio, with strong leasing activity supported by high tenant satisfaction. Healthpeak Properties Inc. (PEAK) reported record leasing volumes, attributing success to a two-decade operating history, high-quality assets, and effective tenant relationship management. The company anticipates a positive outlook for 2024, with a same-store growth rate exceeding historical averages due to the merger with Physicians Realty Trust. Healthcare Realty Trust (HR) demonstrated strong performance, achieving over 50 basis points of positive absorption and a lease retention rate of just over 78%. The leasing team’s success in signing new leases, averaging over 400,000 square feet for three consecutive quarters, contributed to favorable lease terms. Overall, these REITs indicate a thriving and competitive landscape in the medical office leasing market.

Occupancy

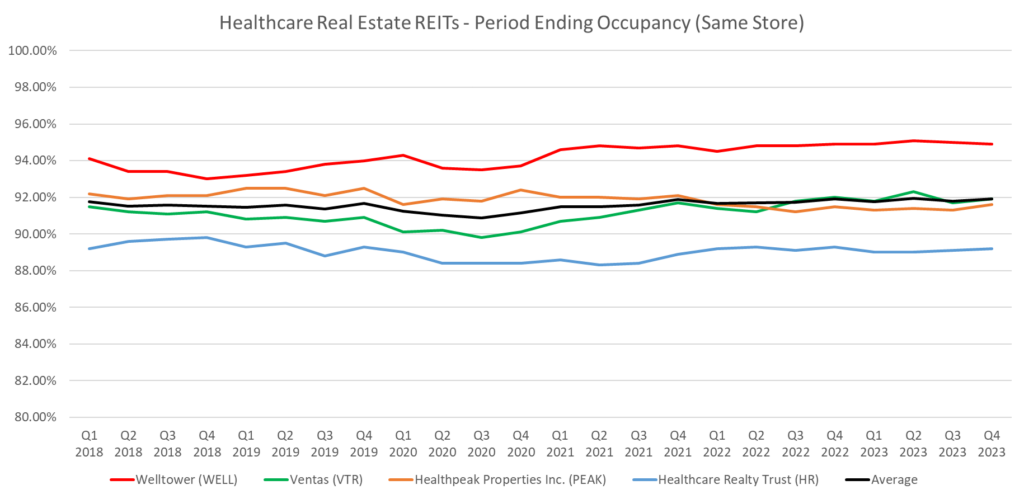

In the healthcare real estate investment trust (REIT) sector, Welltower (WELL) reported flat growth on its same store medical office portfolio occupancy during the fourth quarter of 2023. Ventas (VTR) demonstrated solid performance in its medical office portfolio, with positive trends in occupancy driven by strong retention and leasing activity, particularly in the U.S. outpatient medical sector. Healthpeak Properties Inc. (PEAK) emphasized its strategic focus on outpatient medical facilities, closing the year with an impressive 91% occupancy rate in its medical office segment. The merger with Physicians Realty Trust is anticipated to further enhance Healthpeak’s position. Healthcare Realty Trust (HR) experienced substantial growth in multi-tenant occupancy within its medical office portfolio, achieving a 53 basis points increase in the fourth quarter, surpassing expectations. The company anticipates sustained positive momentum throughout 2024, projecting a gain of 100 to 150 basis points in medical office occupancy absorption. Overall, these healthcare REITs showcased strong occupancy trends, reflecting the sector’s resilience and potential for continued growth.

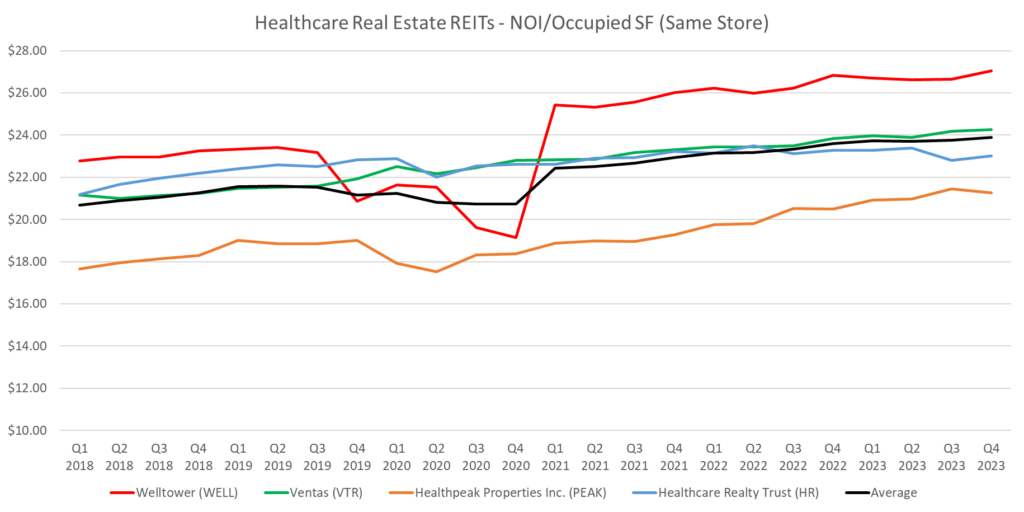

Income & Expense Information

In the healthcare real estate investment trust (REIT) sector, Welltower (WELL) showcased positive income and expense trends, particularly in the Outpatient Medical portfolio, with a notable 220 basis points year-over-year increase in operating margin, reaching 71.4%. Effective expense management, including successful real estate tax reductions through a proactive appeal process, contributed to a 9% reduction in expenses for Q4, leading to a 2.8% increase in net operating income (NOI) for its medical office portfolio. Ventas (VTR) reported nearly 3% growth in same-store cash NOI for 2023 in its outpatient medical and research segment, attributing the success to effective leasing activities, strong tenant satisfaction, and robust demand for medical office spaces. Healthpeak Properties Inc. (PEAK) achieved a strong finish for the fiscal year in its medical office segment, with a 2.3% NOI same-store growth for the fourth quarter and a reduced expense increase of 3.2% compared to the previous year’s 4.4%. Healthcare Realty Trust (HR) experienced just over 4% growth in operating expenses for the fourth quarter, partially driven by lower property taxes. The medical office sector demonstrated positive same-store revenue fundamentals, with year-over-year quarterly same-store NOI growth reaching 2.7%, attributed to a 3% rise in revenue per occupied square foot and a 20-basis point improvement in average occupancy.

Investment & Transaction Activity

In the healthcare real estate investment landscape, Welltower led the pack with a dynamic capital deployment strategy, investing nearly $6 billion in various transactions throughout 2023 and maintaining momentum into the first quarter of 2024. Focused on growth with existing partners, the company strategically acquired assets at discounted rates from sources seeking liquidity, leveraging pre-negotiated documents and strong relationships forged during the capital market volatility in 2023. Ventas, in its commitment to NOI-generating CapEx, emphasized continued investments in outpatient medical and research segments, actively pursuing opportunities with low to mid-teen unlevered IRRs. Healthpeak Properties Inc. remained actively engaged in medical office investments, culminating in a strategic combination with Physicians Realty Trust, highlighting their dedication to optimizing operations. Meanwhile, Healthcare Realty Trust strategically sold 19 properties for $656 million during the year, with an average cap rate of 6.6%, enhancing the quality and growth profile of its medical office portfolio, with plans for routine annual portfolio optimization in 2024, aligning with dispositions of $150 million to $250 million to support capital needs in the sector.

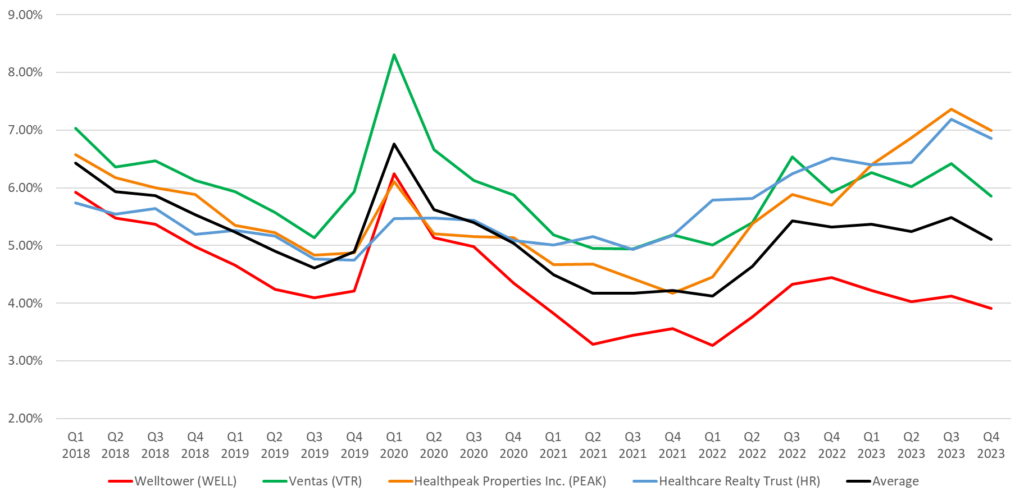

Cap Rates & Bid-Ask Spread

In the Healthcare REIT sector, Welltower (WELL) anticipates seizing opportunities arising from a potential regional banking crisis and maturing Senior Housing loans, viewing these challenges as a catalyst for their strong market position. Ventas (VTR) adopts a disciplined approach in assessing investment opportunities, emphasizing attractive yields, below replacement costs, and mid-teen unlevered IRRs amid favorable market dynamics. Healthpeak Properties Inc. (PEAK) focuses on capital recycling in its medical office portfolio, with the merger with Physicians Realty Trust aimed at optimizing cap rates and addressing bid-ask spreads for enhanced efficiency. Healthcare Realty Trust (HR) navigates the medical office market’s cap rate landscape, noting interest rate volatility’s influence, with properties trading between 6% to 7% and higher quality assets in the low to mid-6s, while remaining mindful of ongoing fluctuations impacting transaction volumes and deal sizes.

Tailwinds in the Market

Healthcare REITs are currently experiencing positive tailwinds in the medical office market. Welltower’s optimistic business outlook, driven by improving demand-supply dynamics and the success of its operating platform buildout, indirectly indicates favorable conditions for various segments, including Medical Office. Ventas identifies outpatient medical and research as a key growth driver, leveraging strong leasing activity and focusing on capturing value-creating external growth opportunities in medical offices, benefiting from continued demand in the sector. Healthpeak Properties Inc. underscores tailwinds in the medical office market, with outpatient medical segments benefiting from demand surpassing supply and anticipating further growth driven by strong fundamentals, high-quality assets, and the merger with Physicians Realty Trust. Healthcare Realty Trust anticipates positive tailwinds for 2024, highlighting a robust new lease pipeline, decreased MOB development starts, and rising occupancy, driven by increased demand from health systems and independent physician groups, contributing to favorable market conditions in the medical office sector.

Headwinds in the Market

Across the Healthcare REIT sector, including Welltower (WELL), Ventas (VTR), Healthpeak Properties Inc. (PEAK), and Healthcare Realty Trust (HR), there’s a common recognition of potential headwinds in the broader market. While Welltower does not explicitly mention specific challenges for its Medical Office segment, it acknowledges the presence of broader market uncertainties like volatility and regional banking crises. Ventas, while not detailing medical office-specific headwinds, emphasizes its overall preparedness to navigate challenges in different segments, showcasing a proactive stance. Healthpeak Properties Inc. expresses optimism about its medical office segment but remains cautious about macroeconomic factors, such as interest rate increases. Healthcare Realty Trust identifies headwinds in interest rate volatility affecting medical office transactions and increased annual costs due to new interest rate swaps. Overall, these REITs demonstrate a shared awareness of potential challenges in the broader market, signaling a need for strategic resilience and adaptability within the healthcare real estate sector.

REIT Data Summary

Healthcare Real Estate REIT Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Achieved Rates & Occupancies (Same Store)

Healthcare Real Estate REITs - Period Ending Occupancy (Same Store)

Our Proprietary Data

As we continue to build our proprietary dataset and technology stack, our analytics will continue to evolve and lead the way. Our unique transaction analysis directly correlates to market conditions. This next-level combination of informative statistics is geared to help you formulate a strategic business plan for your asset, regardless of your position. We look forward to leading the way as thought leaders in order to help you achieve your ultimate goals.

Contributions:

Steven Paul

Senior Financial Analyst

Scott Schoettlin

Managing Director

Aaron Sanchez

Managing Director

Robert King

Vice President, Healthcare Real Estate