Key Takeaways

- Healthcare REITs exhibited robust leasing activity with high retention rates and favorable lease terms. Welltower, Ventas, Healthpeak, and Healthcare Realty all demonstrated significant leasing volume, reflecting strong demand for medical office space.

- Occupancy rates across various healthcare REITs showed remarkable strength and improvement, indicating effective property management and strong demand. Welltower maintained an industry-leading same-store occupancy rate nearing 95%, while other REITs like Ventas and Healthpeak also reported significant increases in occupancy rates.

- The financial performance of these REITs was marked by stable or growing net operating income (NOI). For instance, Welltower achieved a 2% year-over-year same-store NOI increase, while Ventas reported nearly 5% same-store cash NOI growth, driven by higher occupancy rates and effective lease management.

- Significant investment and transaction activities were reported, aimed at enhancing portfolio quality and strategic positioning. Welltower closed or contracted $2.8 billion in investments, and Healthpeak executed a merger with Physicians Realty while engaging in capital recycling. These strategic moves are aimed at optimizing portfolios and driving long-term growth.

Contributors

Steven Paul

Senior Financial Analyst

Scott Schoettlin

Managing Director

Q1 2024 Healthcare REIT Data Overview

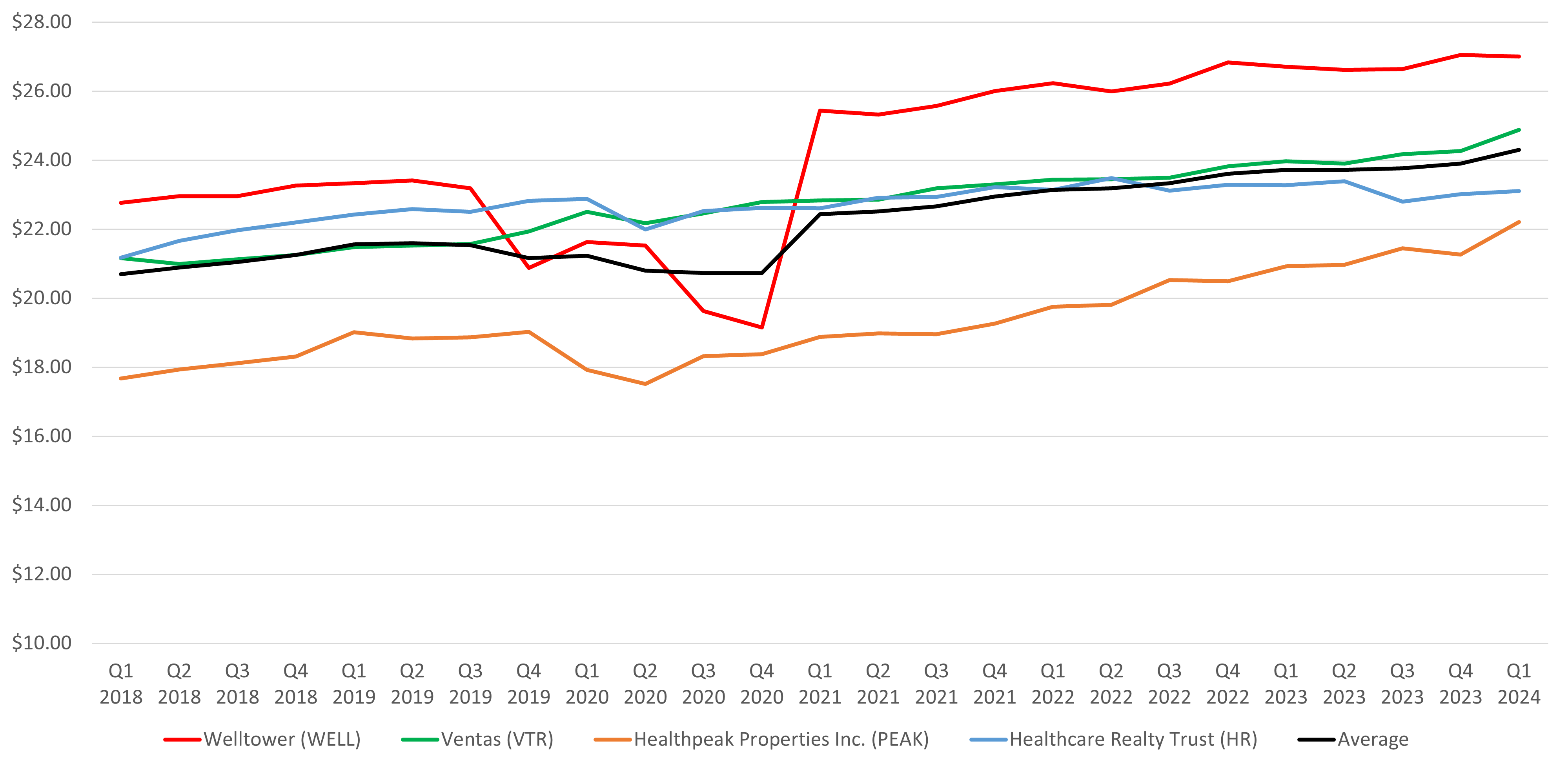

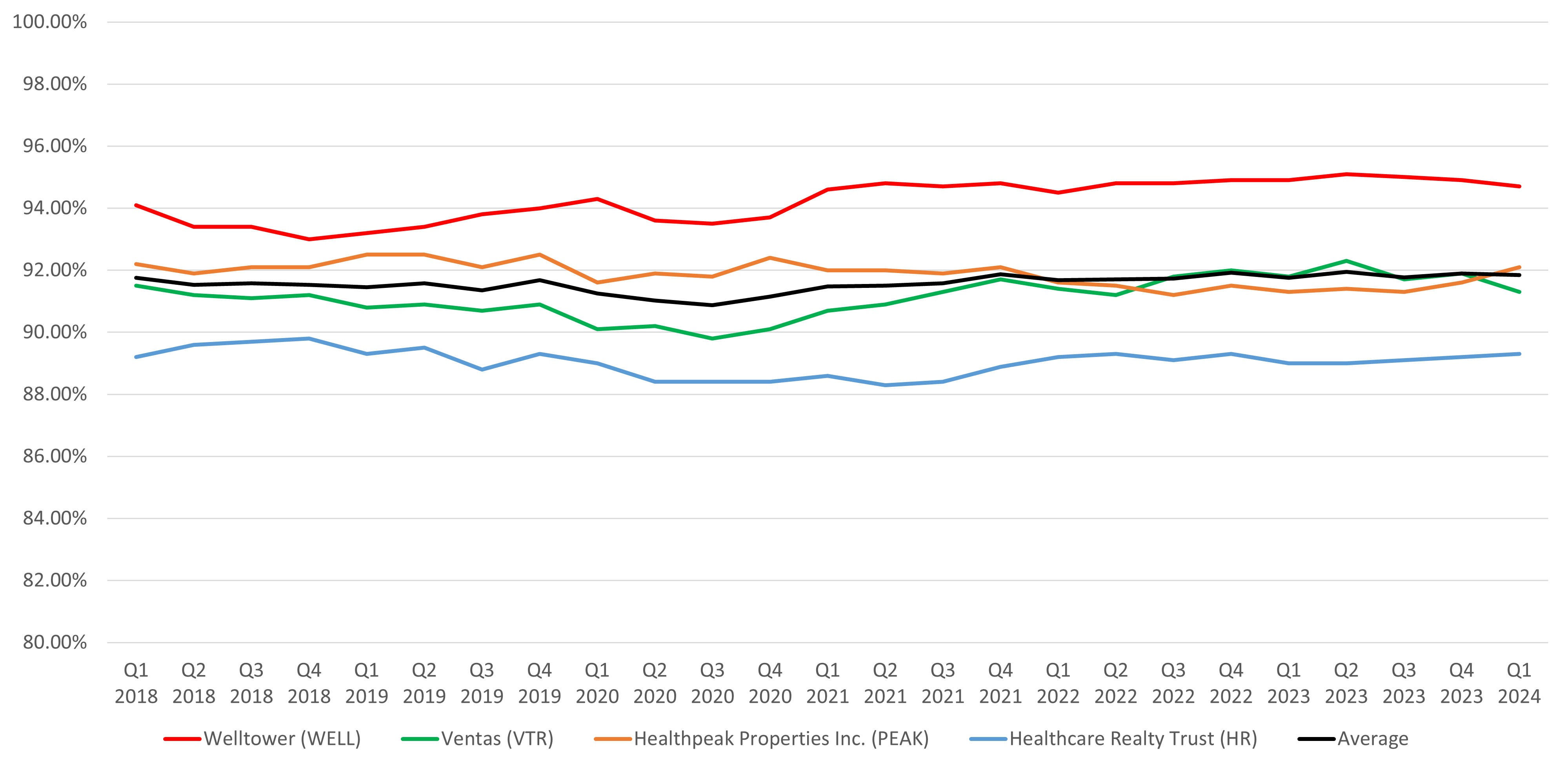

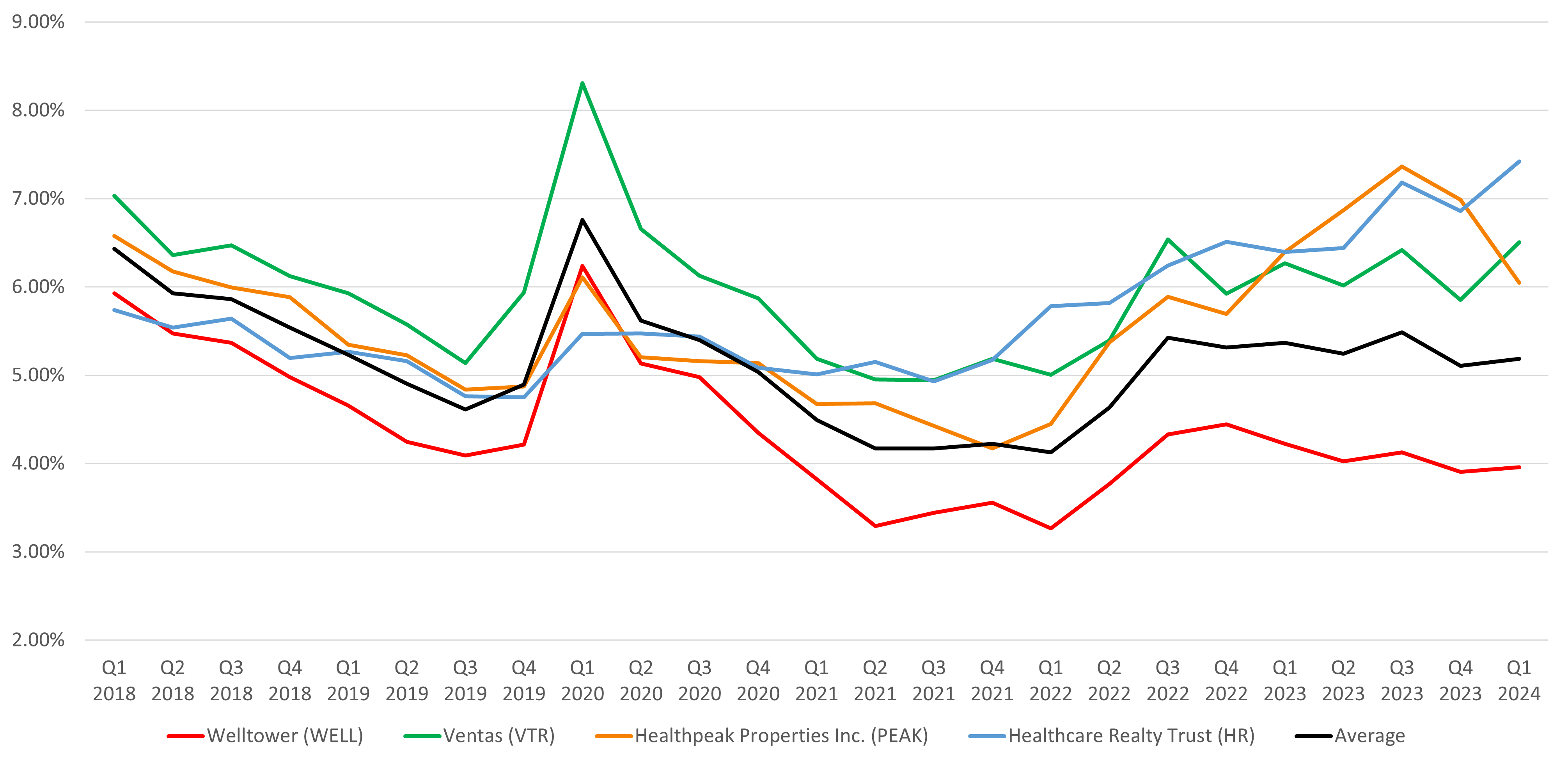

| Ending Occupancy (Same Store) | YoY Revenue Increase (Same Store) | YoY Expense Increase (Same Store) | YoY NOI Increase (Same Store) | NOI/Occupied SF (Same Store) | Average Lease Term Remaining (Yrs) | Average Building Size (SF) | Q1 Medical Office Acquisitions | Total Properties | ||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||

| Welltower (WELL) | 94.70% | 94.90% | 2.1% | 3.8% | 2.3% | 8.5% | 2.0% | 1.6% | $27.00 | $26.71 | 6.6 | 59,095 | 0 | 427 |

| Ventas (VTR) | 91.30% | 91.80% | 4.8% | 3.3% | 5.1% | 4.0% | 4.7% | 3.1% | $24.88 | $23.97 | 5.5 | 53,133 | 0 | 399 |

| Healthpeak Properties Inc. (PEAK) | 92.10% | 91.30% | 2.2% | 3.8% | 1.5% | 5.8% | 2.6% | 2.7% | $22.20 | $20.92 | 6.3 | 68,264 | 0 | 594 |

| Healthcare Realty Trust (HR) | 89.30% | 89.00% | 2.5% | 3.6% | 1.7% | 5.0% | 3.0% | 2.9% | $23.10 | $23.28 | 4.3 | 60,835 | 0 | 630 |

Q1 Healthcare REIT Highlights

- Maintained strong leasing rates with a retention rate exceeding 90%, highlighting the ability to retain tenants and ensure portfolio stability.

- Achieved an industry-leading same-store occupancy rate nearing 95%, demonstrating resilience and effective property management.

- Closed or contracted $2.8 billion in investments across 23 transactions, focusing on high-quality acquisitions and development funding to enhance regional density and optimize its portfolio.

- Executed 900,000 square feet of new and renewal leases, a 50% increase from the previous year, indicating high demand for medical office space.

- Experienced a 300 basis point increase in occupancy for its outpatient medical assets acquired from its equitized loan portfolio, highlighting successful asset and property management strategies.

- Reported nearly 5% same-store cash NOI growth driven by higher occupancy rates and effective lease management.

- Signed nearly 1.5 million square feet of new leases, reflecting strong demand and favorable market conditions, with lease renewals showing a positive rent mark-to-market of 3.4%.

- Maintained robust occupancy rates and secured leases for 1.5 million square feet, with active discussions for an additional 2.5 million square feet, including 700,000 square feet under letters of intent (LOI).

- Delivered a 2.6% same-store NOI growth, bolstered by high lease retention and significant financial benefits from internalizing property management in 10 markets covering 17 million square feet.

- Reported cash leasing spreads of 3.7%, up from 3.3% in the previous quarter, with new leasing volumes exceeding 400,000 square feet for the third consecutive quarter.

- Achieved a 70 basis point absorption over the past two quarters, including a 17 basis point improvement in the first quarter alone, with a high tenant retention rate of 85%.

- Experienced 3% same-store cash NOI growth and improved cash NOI margins despite a $250 million goodwill write-off, achieved through disciplined property tax management and reduced labor costs.

Q1 2024 Healthcare Real Estate Operating Fundamentals

Healthcare Real Estate Rental Rates

In the first quarter of 2024, healthcare REITs exhibited robust leasing performance and favorable lease terms across their medical office sectors. Welltower’s medical office sector maintained strong leasing rates with a retention rate exceeding 90%, underscoring the company’s ability to retain tenants and ensure portfolio stability. Lease renewals were aligned with market conditions, highlighting the attractiveness of Welltower’s properties. Ventas demonstrated significant leasing activity, executing 900,000 square feet of new and renewal leases—a 50% increase from the previous year. This surge indicates a high demand for medical office space, suggesting Ventas is achieving favorable lease terms and potentially longer lease durations. Healthpeak Properties signed nearly 1.5 million square feet of new leases, reflecting strong demand and favorable market conditions. The company’s lease renewals showed a positive rent mark-to-market of 3.4%, and it maintained a high retention rate of 84%, indicating tenant satisfaction and portfolio stability. Healthcare Realty Trust reported cash leasing spreads of 3.7%, up from 3.3% in the previous quarter, with new leasing volumes exceeding 400,000 square feet for the third consecutive quarter. The retention rate improved significantly to 85% from 78% in the previous quarter, driven by strong demand for medical office buildings and increasing replacement net rents nearing $40 per square foot.

Healthcare Real Estate Occupancy

Occupancy rates across various Healthcare REITs have demonstrated remarkable strength and improvement, reflecting effective management strategies and robust demand for healthcare properties. Welltower’s medical office sector maintained an industry-leading same-store occupancy rate nearing 95%, underscoring the resilience of the medical office sector and the company’s proficient property management amidst broader economic uncertainties. Ventas experienced a notable 300 basis point increase in occupancy for its outpatient medical assets acquired from its equitized loan portfolio, highlighting successful asset and property management strategies. Healthpeak’s medical office and outpatient facilities reported robust occupancy rates, significantly contributing to portfolio stability. During the quarter, Healthpeak secured leases for 1.5 million square feet and maintained active discussions for an additional 2.5 million square feet, including 700,000 square feet under letters of intent (LOI). These efforts, coupled with internalized property management functions, increased tenant engagement and satisfaction, driving occupancy rates higher. Healthcare Realty achieved promising results in increasing multi-tenant occupancy, with a 70 basis point absorption over the past two quarters, including a 17 basis point improvement in the first quarter alone. This equated to an additional 57,000 square feet of leased space. Despite substantial scheduled lease expirations of 1.6 million square feet in the first quarter, Healthcare Realty maintained a high tenant retention rate of 85%, consistent across both legacy Healthcare Realty and HTA portfolios. Looking forward, Healthcare Realty anticipates continued occupancy gains, bolstered by a robust new lease pipeline of 1.7 million square feet and a lower expiration schedule averaging just over 1 million square feet per quarter for the remainder of 2024.

Healthcare Real Estate Income & Expenses

In the first quarter of 2024, the medical office and outpatient medical segments of Welltower, Ventas, Healthpeak, and Healthcare Realty showcased robust financial performance marked by effective income growth and disciplined expense management. Welltower achieved a stable 2% year-over-year same-store net operating income (NOI) increase, supported by easing inflationary pressures and efficient management strategies. Ventas reported nearly 5% same-store cash NOI growth driven by higher occupancy rates and effective lease management, indicating strong demand and controlled expenses. Healthpeak delivered a 2.6% same-store NOI growth, bolstered by a 3.4% rent mark-to-market and high lease retention, with significant financial benefits from internalizing property management in 10 markets covering 17 million square feet, and plans to internalize an additional 4 million square feet by year-end. Healthcare Realty experienced 3% same-store cash NOI growth and improved cash NOI margins despite a $250 million goodwill write-off, achieved through disciplined property tax management and reduced labor costs. Collectively, these REITs demonstrated strong operational efficiency, balancing income growth with expense control, highlighting their robust financial health.

Healthcare Real Estate Investment & Transaction Activity

In the first quarter of 2024, Welltower, Ventas, Healthpeak, and Healthcare Realty demonstrated robust investment and transaction activities to enhance their portfolios and strategic positioning in the healthcare real estate sector. Welltower was notably active, closing or contracting $2.8 billion in investments across 23 transactions, focusing on high-quality acquisitions and development funding to enhance regional density and optimize its portfolio. Ventas concentrated on the medical office/outpatient sector, adhering to its “right market, right asset, right operator” framework to ensure alignment with strategic goals and favorable market dynamics. Healthpeak executed a significant merger with Physicians Realty and engaged in capital recycling by selling stabilized assets at a 5.8% cap rate and an R&D flex office portfolio at a 6% cap rate, reinvesting proceeds into higher-yield opportunities or stock buybacks. Meanwhile, Healthcare Realty entered a strategic joint venture with KKR, contributing properties valued at $383 million, which, along with additional transactions and stock repurchases at an 8% implied cap rate, is expected to yield substantial proceeds, enhancing shareholder value and dividend coverage. These activities across the four REITs underscore their commitment to strategic growth and portfolio optimization, leveraging cap rates effectively to maximize returns.

Healthcare Real Estate Cap Rates & Bid-Ask Spread

Current market conditions for healthcare real estate investment trusts (REITs) reveal a tightening of cap rates for high-quality medical office properties due to strong investor demand and stable income profiles. Despite this, Welltower and other REITs like Healthpeak and Healthcare Realty have observed a notable bid-ask spread caused by sellers’ price expectations still anchored to pre-pandemic interest rate environments. This disconnect presents both challenges and opportunities, as seen in Healthpeak’s strategic stock repurchase at an implied cap rate of 8%, significantly higher than their recent asset sales’ cap rates of 5.8% to 6%. Healthcare Realty also capitalized on market conditions with a stock repurchase at an 8% implied cap rate and a joint venture with KKR at a 6.6% cap rate, highlighting strong demand and competitive pricing. Ventas has seen strong leasing activity and occupancy improvements, suggesting favorable investment conditions and competitive cap rates. Overall, the narrowing bid-ask spread, driven by substantial investor interest and improved financing markets, facilitates transactions aligning with REITs’ capital allocation strategies.

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Tailwinds in the Healthcare Real Estate Market

The medical office market is experiencing several favorable conditions that contribute to its growth and resilience. Demographic trends, particularly the aging population, are driving demand for healthcare services and medical office spaces. Institutions and health systems are increasingly focusing on outpatient services, which are more convenient and cost-effective, further boosting the demand for these spaces. Additionally, easing inflationary pressures, technological advancements, and innovations in healthcare services are supporting the sector’s expansion. The limited supply of new developments due to high construction and financing costs is creating a favorable supply-demand dynamic, enhancing leasing spreads and occupancy rates. Companies like Welltower, Ventas, Healthpeak, and Healthcare Realty are well-positioned to capitalize on these trends through strategic focus on high-quality assets, regional density, and strong relationships with key health systems.

Headwinds in the Healthcare Real Estate Market

Despite positive trends, the medical office market faces significant headwinds. Rising interest rates and tighter credit markets increase the cost of capital, impacting the feasibility of new investments and development projects. This environment leads to higher financing costs and affects cap rates and property valuations, potentially slowing transaction activity. Broader economic uncertainties, including potential recessions, could impact tenant financial stability, occupancy rates, and leasing decisions, leading to cautious behavior and affecting leasing volumes and rental rates. Additionally, regulatory changes in healthcare policies and reimbursement rates may influence the financial performance of healthcare providers, indirectly affecting demand for medical office spaces. Companies like Welltower, Ventas, Healthpeak, and Healthcare Realty must navigate these challenges by leveraging strategic planning, financial prudence, strong platforms, and disciplined capital allocation to sustain growth and performance in the sector.