Q3 Healthcare REIT Highlights

- Leasing Rates and Lease Terms: Executed 565,000 square feet of new leases, contributing to a year-over-year NOI growth of 3.1%. Tenant retention remained above 80%, ensuring stable income streams.

- Occupancy: Maintained robust occupancy levels, supported by strong tenant demand for healthcare-focused properties and proactive lease renewals.

- Income and Expenses: Reduced same-store expenses by 1.5%, bolstering a 3.5% NOI growth in its multi-tenant portfolio.

- Leasing Rates and Lease Terms: Achieved a 10% cash rent mark-to-market increase, one of its highest re-leasing spreads in recent years. Adjusted rent escalators to 3% on new leases, surpassing the traditional 2.5%.

- Occupancy: Reported 94.5% occupancy in outpatient medical properties, supported by a tenant retention rate of 94%.

- Income and Expenses: Posted 3.4% same-store NOI growth, driven by leasing over 5 million square feet year-to-date and favorable rent escalations.

- Leasing Rates and Lease Terms: Tenant retention in its outpatient medical portfolio reached 85%, reflecting high lease renewal rates and strong tenant demand.

- Occupancy: Outpatient medical occupancy increased by 20 basis points year-over-year, bolstered by proactive leasing efforts covering 1 million square feet.

- Income and Expenses: Focused on stable operating performance while completing $1.7 billion in strategic acquisitions, prioritizing outpatient and senior housing facilities.

- Leasing Rates and Lease Terms: Reported 94% of investment activity through off-market deals, allowing for favorable pricing within a 7-8% cap rate range.

- Occupancy: Maintained 94.5% occupancy in outpatient medical properties, with gains of 120 basis points year-over-year.

- Income and Expenses: Achieved same-store NOI growth of 2.2%, driven by high occupancy and consistent rent escalations.

Thoughts from the CEO's

Healthcare Realty Trust

Todd Meredith

President & Chief Executive Officer

- “MOB market fundamentals are strong with demand for outpatient space outstripping supply. We are benefiting from the secular tailwinds of aging demographics and the shift in care to outpatient settings. I’m proud of our leasing team for producing their fifth consecutive quarter of over 400,000 square feet of new signed leases in the multi-tenant portfolio.”

Healthpeak Properties Inc.

Scott M. Brinker

President & Chief Executive Officer

- “We’ve grown earnings per share by mid-double digits the last three years and we have four levers to accelerate that growth moving forward: merger synergies, leasing momentum in labs, demand in outpatient medical, and disciplined capital allocation. The merger has proven to be a catalyst culturally and financially, with year-one synergies now tracking 25% above our initial forecast. Our portfolio and balance sheet have never been stronger.”

Ventas

Debra A. Cafaro

Chairman and Chief Executive Officer

- “Ventas thrives at the intersection of demographic-driven demand and disciplined execution. With our senior housing platform, we’re capitalizing on unprecedented multi-year growth opportunities, leveraging a 15% year-over-year NOI growth in SHOP, strategic acquisitions, and powerful operational tools. This unique blend of organic and external growth positions us as a leader in capturing the longevity economy, delivering exceptional environments for our residents, and driving shareholder value.”

Welltower

Shankh Mitra

Chief Executive Officer

- “This quarter also marks the first time in our company’s history in which our quarterly revenue exceeded $2 billion. With eight consecutive quarters of 20%+ same-store NOI growth in our senior housing portfolio, we believe we are still in the early stages of an extraordinary growth cycle, driven by demographic tailwinds, historically wide margins, and the rollout of our innovative operating platform.”

Macroeconomic Highlights

Recession Fears and Economic Outlook:

Economic uncertainty continues to weigh heavily on sentiment as the U.S. economy faces growing concerns about a potential recession. While GDP growth remained positive in Q3, the Federal Reserve’s aggressive interest rate hikes aimed at reining in inflation have sparked fears of a slowdown. Consumer spending, a key driver of economic activity, has shown resilience but is expected to decelerate as excess pandemic-era savings are depleted and borrowing costs rise. The labor market, while still robust, is beginning to show signs of strain, with an uptick in delinquencies among subprime borrowers and the resumption of federal student loan payments adding further pressure to household budgets. Despite these headwinds, pockets of optimism persist, driven by continued investment in infrastructure and technology sectors.

Geopolitical Tensions and Their Impact on CRE:

The commercial real estate (CRE) market is navigating the ripple effects of recent geopolitical tensions and evolving federal policies following the U.S. presidential election. With shifts in corporate tax structures, environmental mandates, and infrastructure spending, investors are closely monitoring policy changes that could significantly impact industrial, office, and multifamily real estate. Stricter regulations and potential tax increases have prompted stakeholders to reassess long-term strategies.

Moreover, Federal Reserve interest rate policies and economic stimulus measures remain critical factors influencing CRE investment decisions. These dynamics contributed to a cautious market in Q3, with transaction activity slowing as participants adjusted to the post-election policy landscape and its implications for 2025 and beyond.

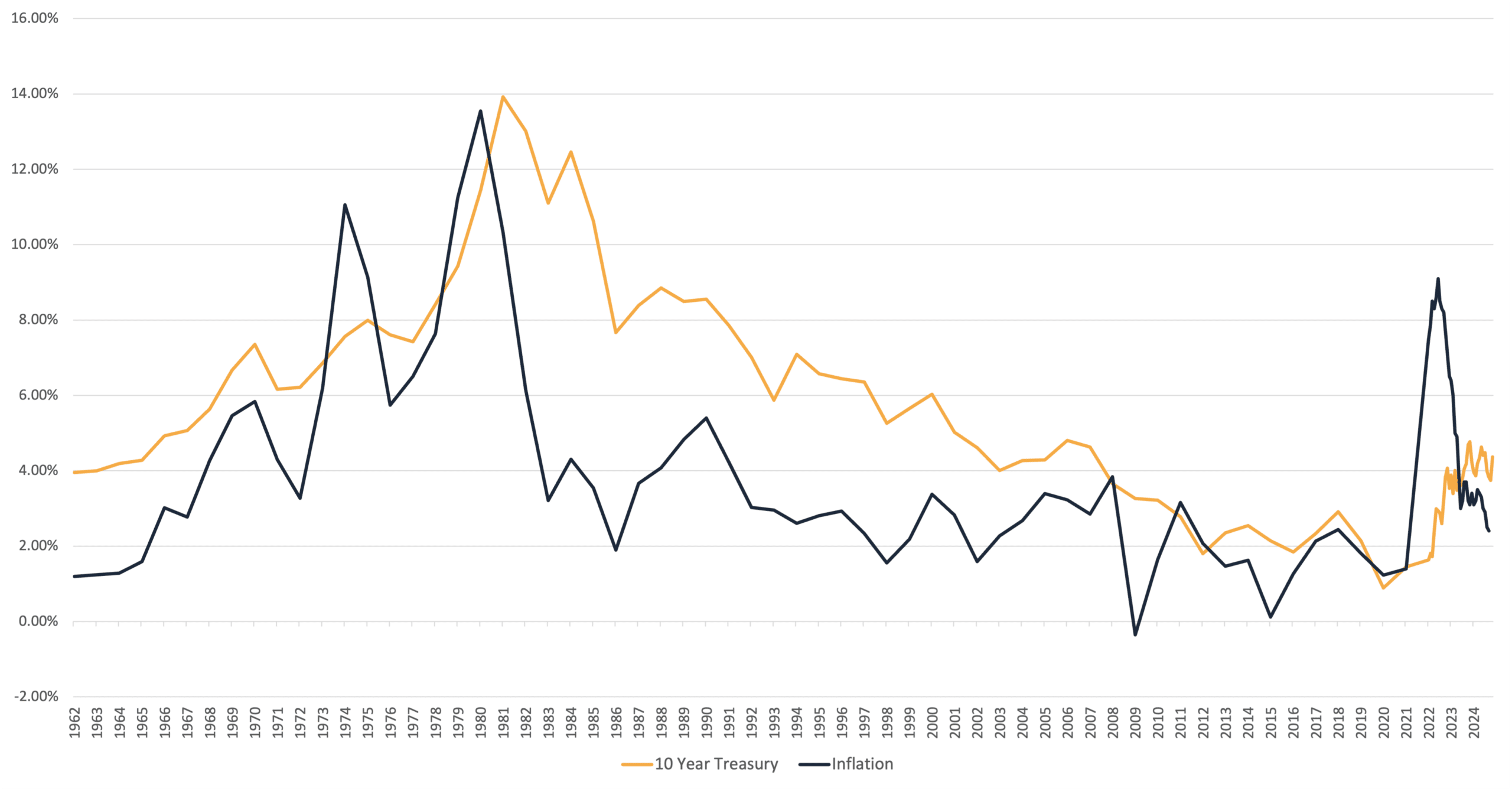

Inflation and the 10-year Treasury Since 1962

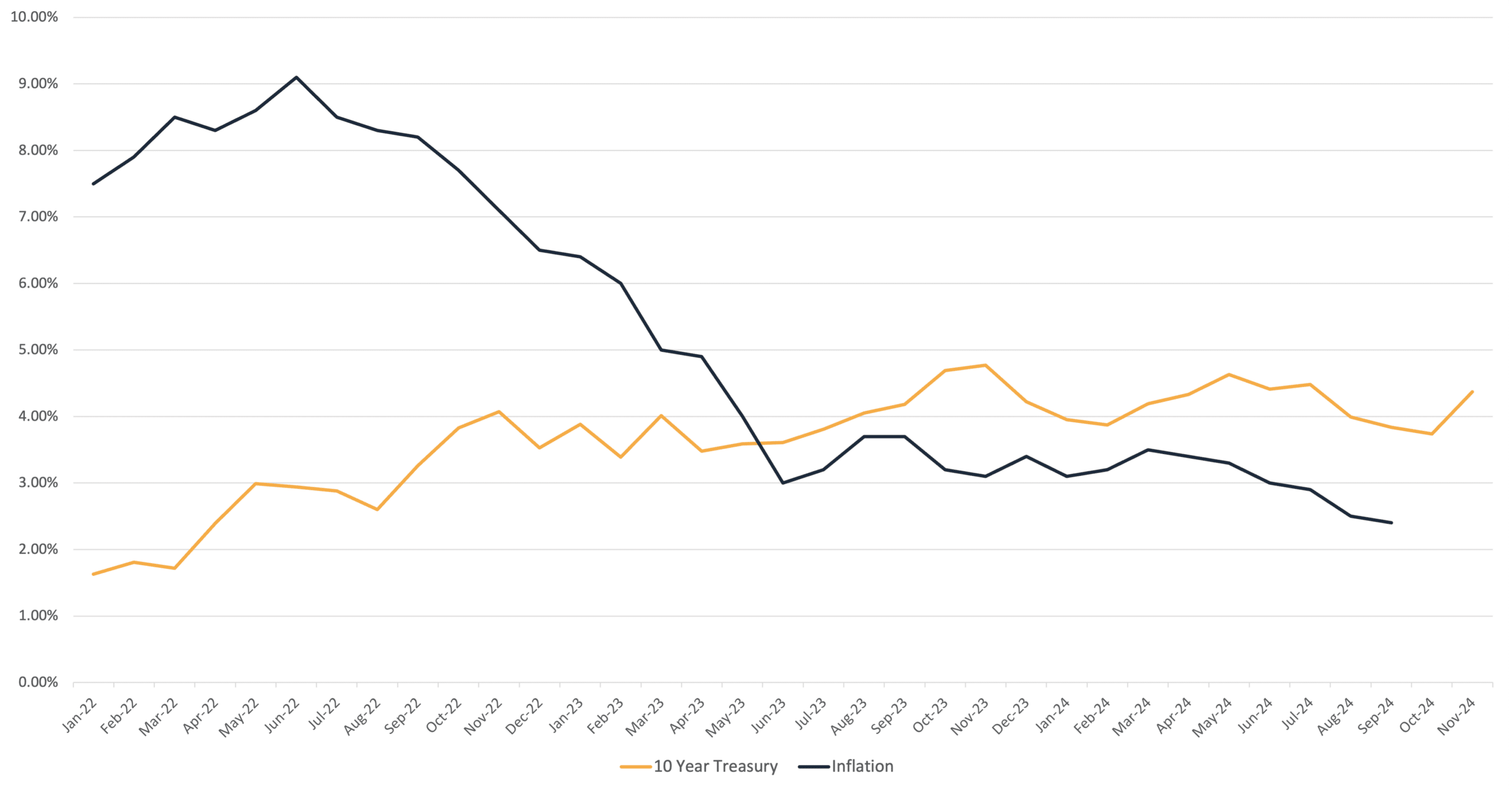

Inflation and the 10-year Treasury Since 2022

Q3 2024 Healthcare REIT Data Overview - Medical Office

| Healthcare Realty Trust (HR) | Healthpeak Properties Inc. (PEAK) | Ventas (VTR) | Welltower (WELL) | ||

| Ending Occupancy (Same Store) | 2024 | 89.90% | 92.30% | 90.00% | 94.50% |

| 2023 | 89.10% | 91.30% | 91.70% | 95.00% | |

| YoY Revenue Increase (Same Store) | 2024 | 1.4% | 1.7% | 2.2% | 1.7% |

| 2023 | 3.2% | 4.0% | 5.0% | 4.4% | |

| YoY Expense Increase (Same Store) | 2024 | -1.5% | -1.4% | 3.4% | 0.7% |

| 2023 | 4.8% | 5.1% | 9.5% | 6.5% | |

| YoY NOI Increase (Same Store) | 2024 | 3.1% | 3.4% | 1.6% | 2.2% |

| 2023 | 2.3% | 3.4% | 3.0% | 3.4% | |

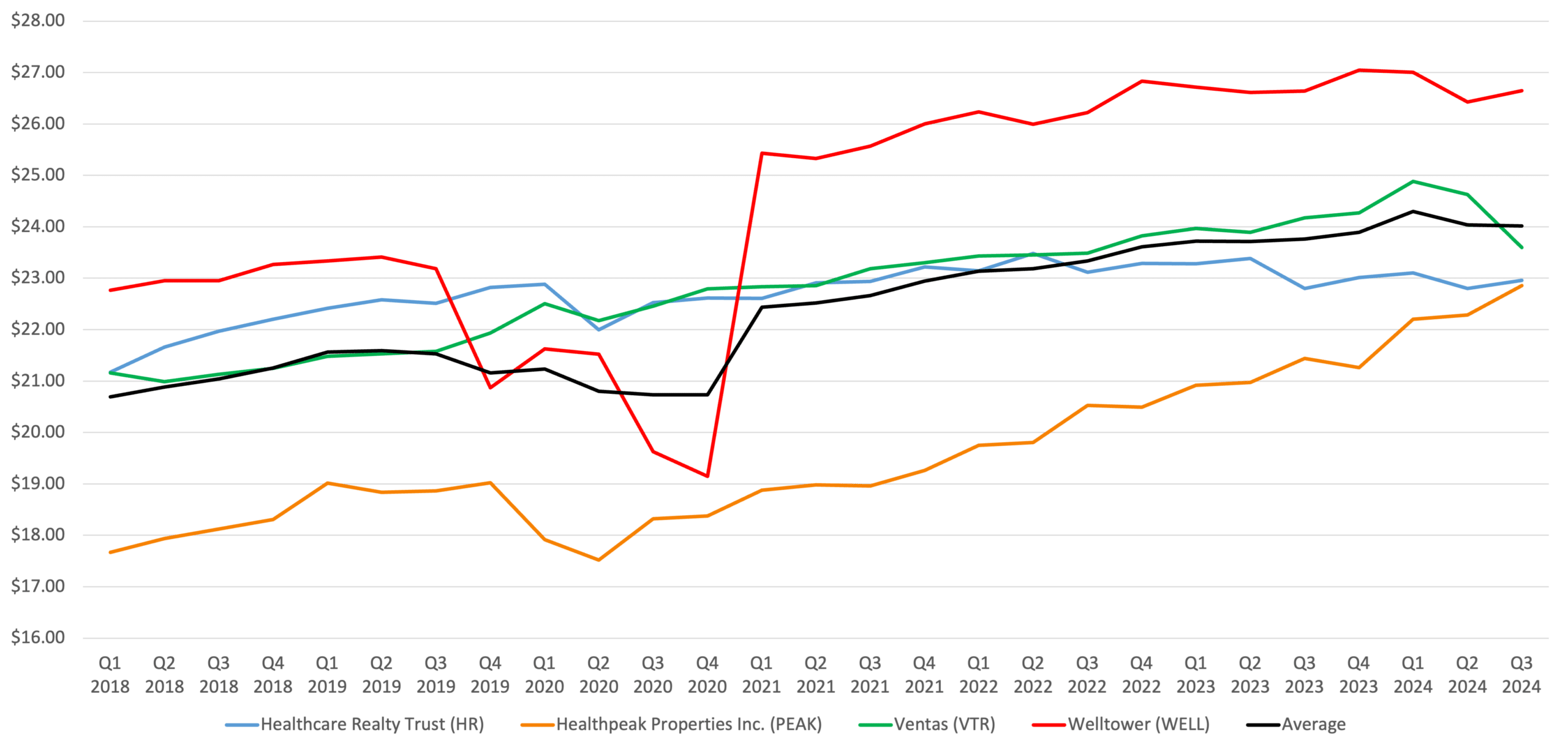

| NOI/Occupied SF (Same Store) | 2024 | $22.96 | $22.85 | $23.60 | $26.65 |

| 2023 | $22.80 | $21.44 | $24.17 | $26.64 | |

| Average Lease Term Remaining (Yrs) | 4.4 | 6.2 | 8.4 | 7.0 | |

| Q2 Medical Office Acquisitions | 0 | 0 | 0 | 0 | |

| Total Properties | 632 | 527 | 397 | 426 |

Q3 2024 Healthcare Real Estate Operating Fundamentals

Healthcare Real Estate Lease Rates

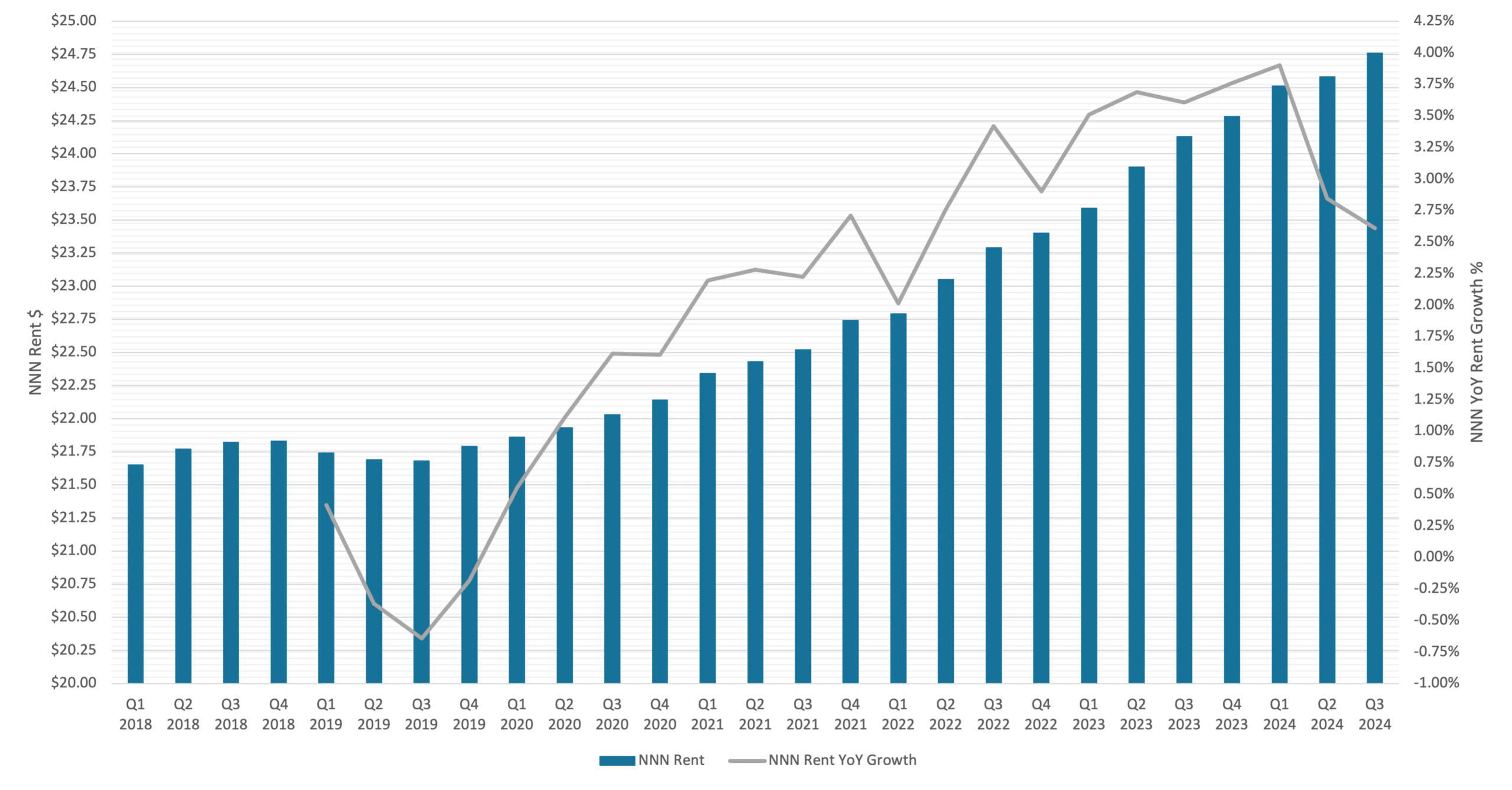

Leasing rates in the medical office REIT sector remain strong, supported by high re-leasing spreads and favorable rent escalators. Healthpeak Properties achieved a 10% cash rent mark-to-market increase, marking one of its highest re-leasing spreads in recent years. Healthpeak also adjusted rent escalators to 3% on new leases, moving beyond the traditional 2.5%, a shift that highlights the demand for medical office space and the favorable leasing environment. Healthcare Realty reported cash leasing spreads of 3.9% with tenant retention above 80%, sustaining stable income streams. Leasing activity has been robust, with Healthcare Realty executing 565,000 square feet of new leases, contributing to NOI growth of 3.1% year-over-year. Ventas saw a tenant retention rate of 85% in its outpatient medical portfolio, further reflecting strong demand and long-term lease stability. Collectively, these leasing rates and high retention figures indicate a strong leasing environment where tenant demand for medical office space supports upward pressure on rents.

NOI/Occupied SF (Same Store)

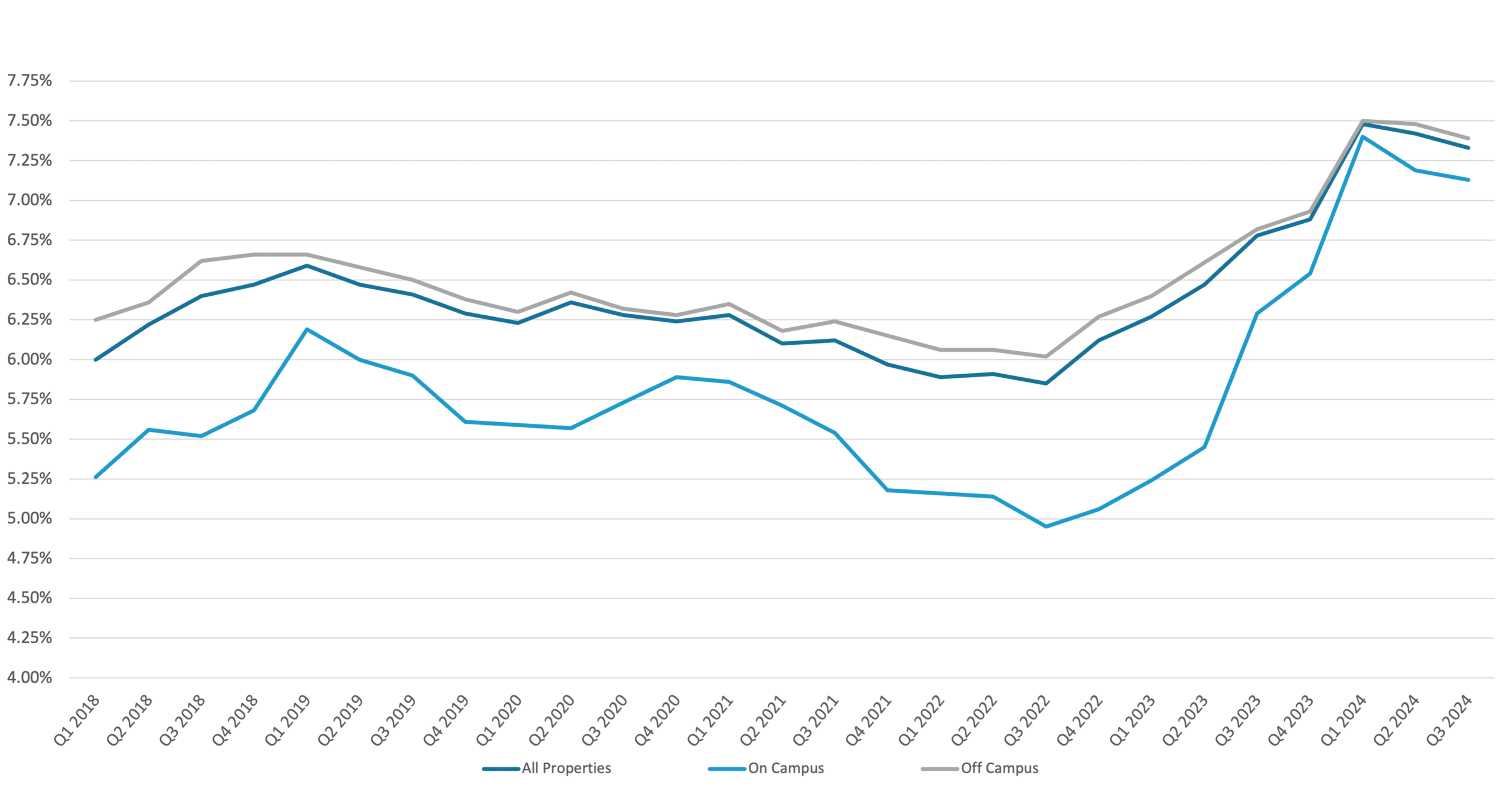

Top 100 MSA Medical Office Building NNN Rent

* Source: Revista

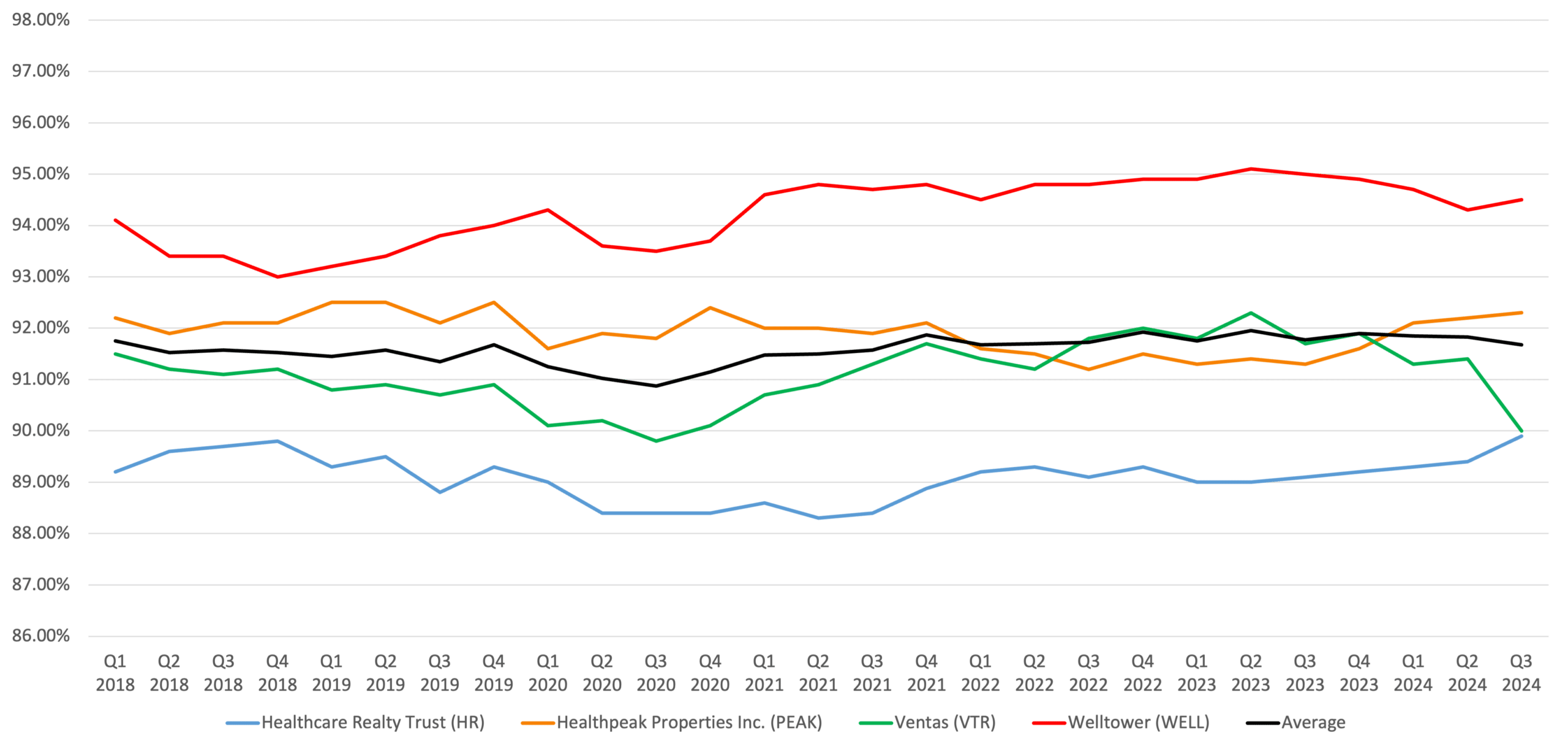

Healthcare Real Estate Occupancy

Occupancy rates in the medical office sector remain elevated, driven by steady tenant demand for healthcare-focused real estate. Healthpeak’s same store outpatient medical properties reported a strong occupancy level of 92.3%, supported by a 94% tenant retention rate that highlights the sector’s stability. Welltower maintained a similar occupancy rate in its outpatient medical properties, reaching an industry-leading 94.5% occupancy. The strength in occupancy was further demonstrated by Ventas, which saw an ending occupancy of 90% in same store outpatient medical properties due to proactive leasing and renewal activities, covering 1 million square feet. These stable occupancy rates across REIT portfolios underscore the resilience of the sector and the high value tenants place on retaining space in well-located medical office facilities, especially as healthcare systems expand their outpatient services.

Period Ending Occupancy (Same Store)

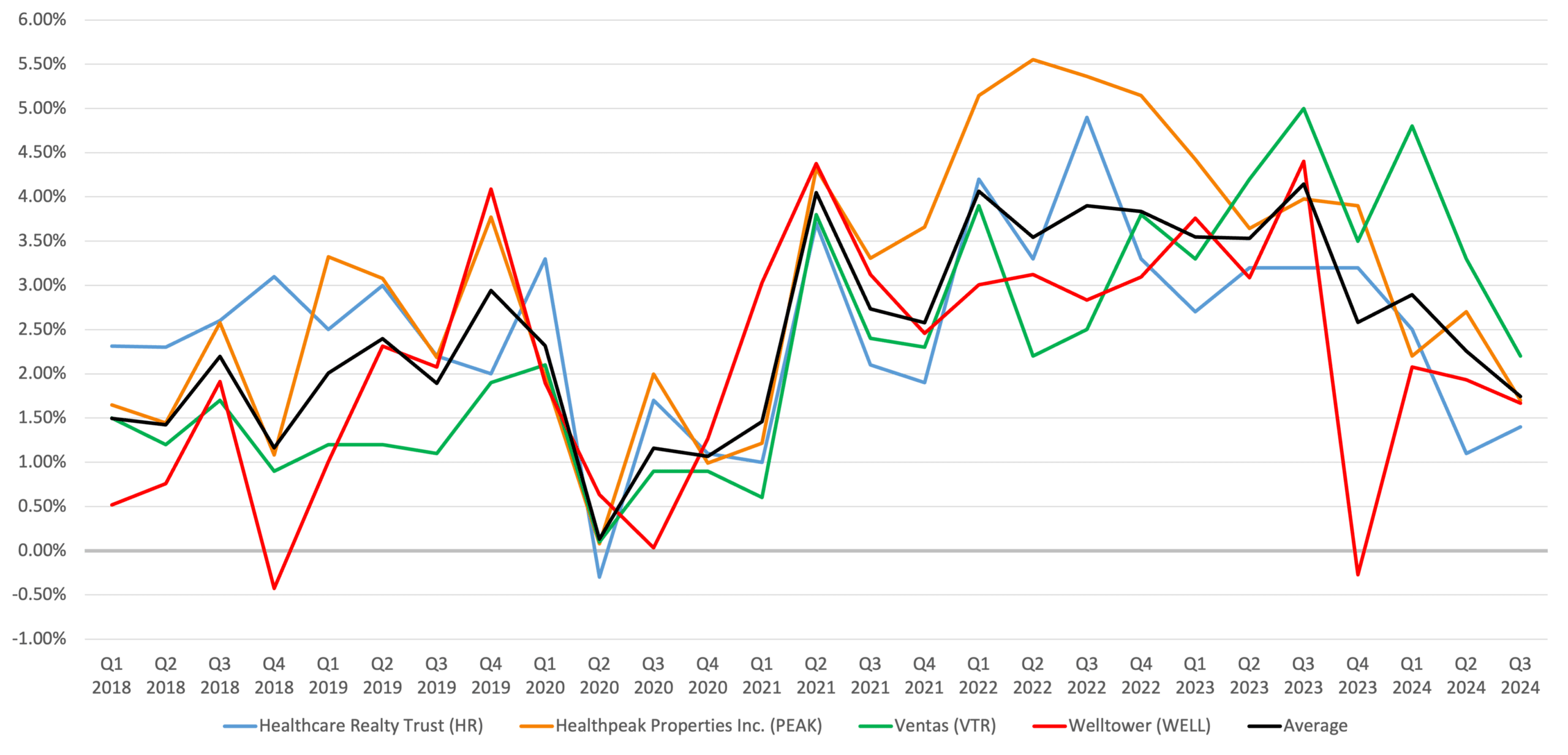

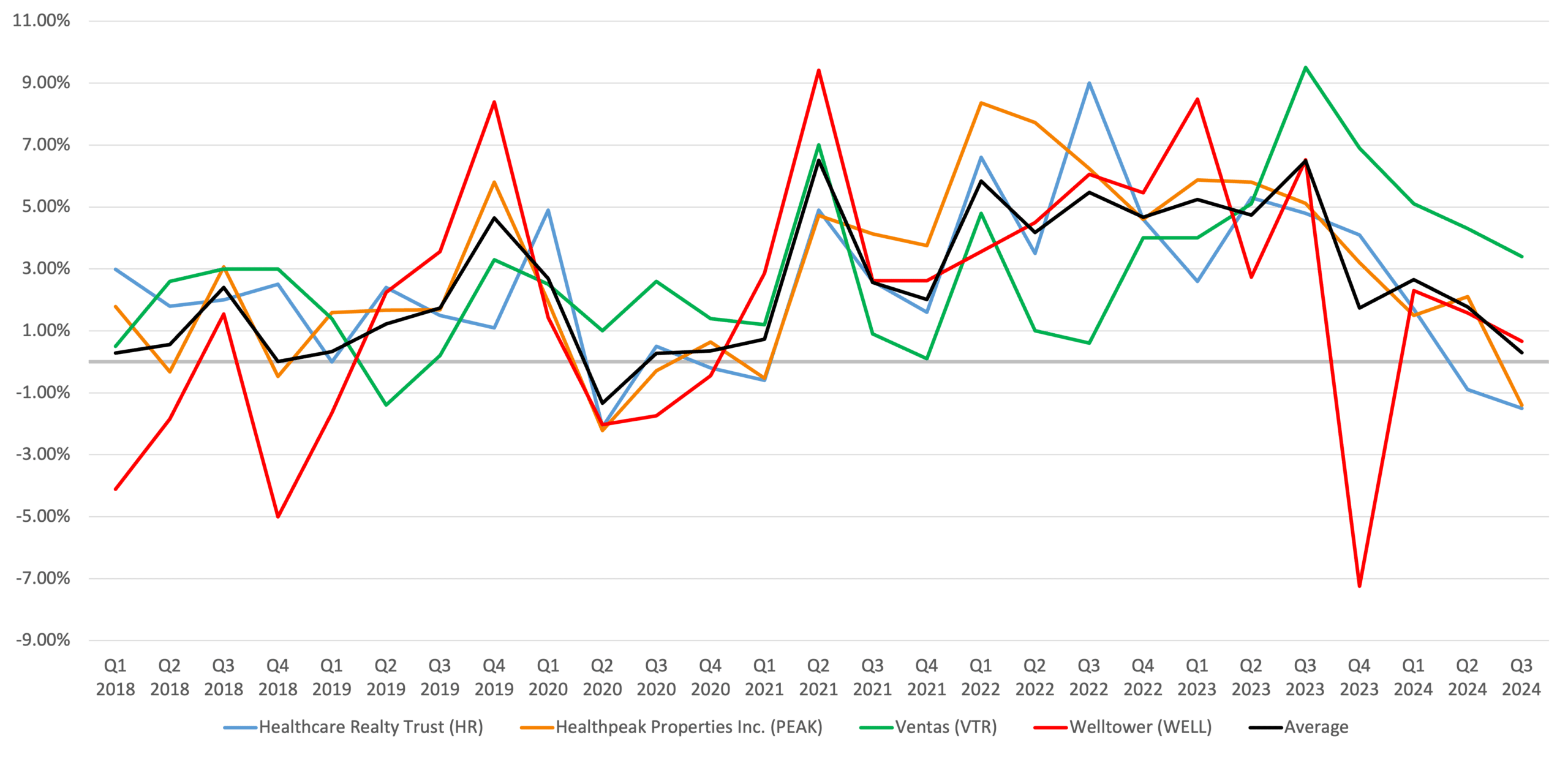

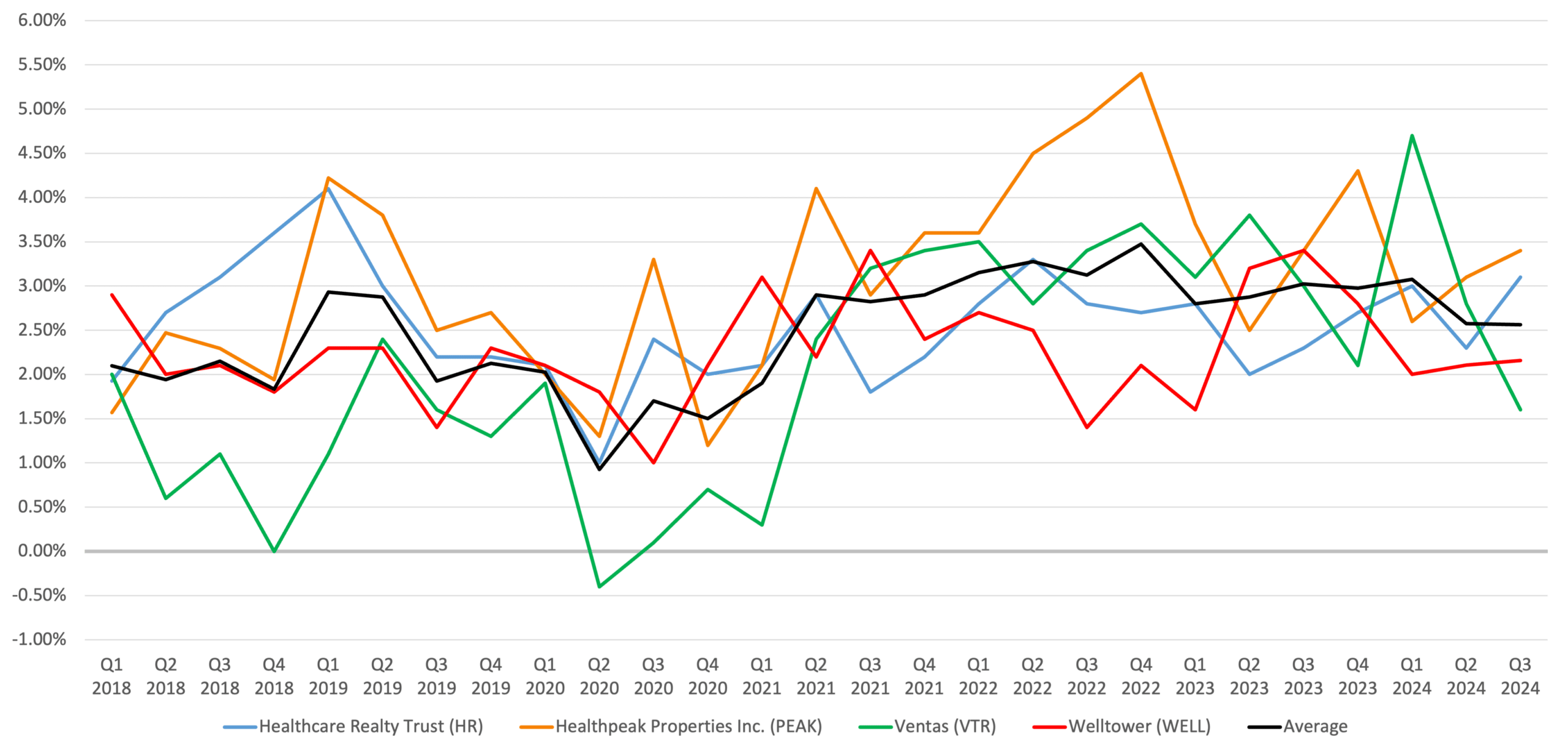

Healthcare Real Estate Income & Expenses

Medical office portfolios are generating consistent income driven by high occupancy and leasing spreads, complemented by effective cost control measures. Welltower reported same-store NOI growth of 2.2% in its outpatient medical segment, achieved through high occupancy and positive rent escalations. Healthpeak posted a strong 3.4% increase in same-store NOI in its outpatient medical properties, bolstered by leasing over 5 million square feet year-to-date and favorable rent escalations. Healthcare Realty demonstrated a successful cost management approach, reducing same-store expenses by 1.5% year-over-year, contributing to overall NOI growth of 3.1% for its same store portfolio. REITs across the board are finding ways to keep operating costs stable despite inflationary pressures, which helps bolster operating margins and provides a steady foundation for long-term income growth.

YoY Revenue Growth (Same Store)

YoY Expense Growth (Same Store)

YoY NOI Growth (Same Store)

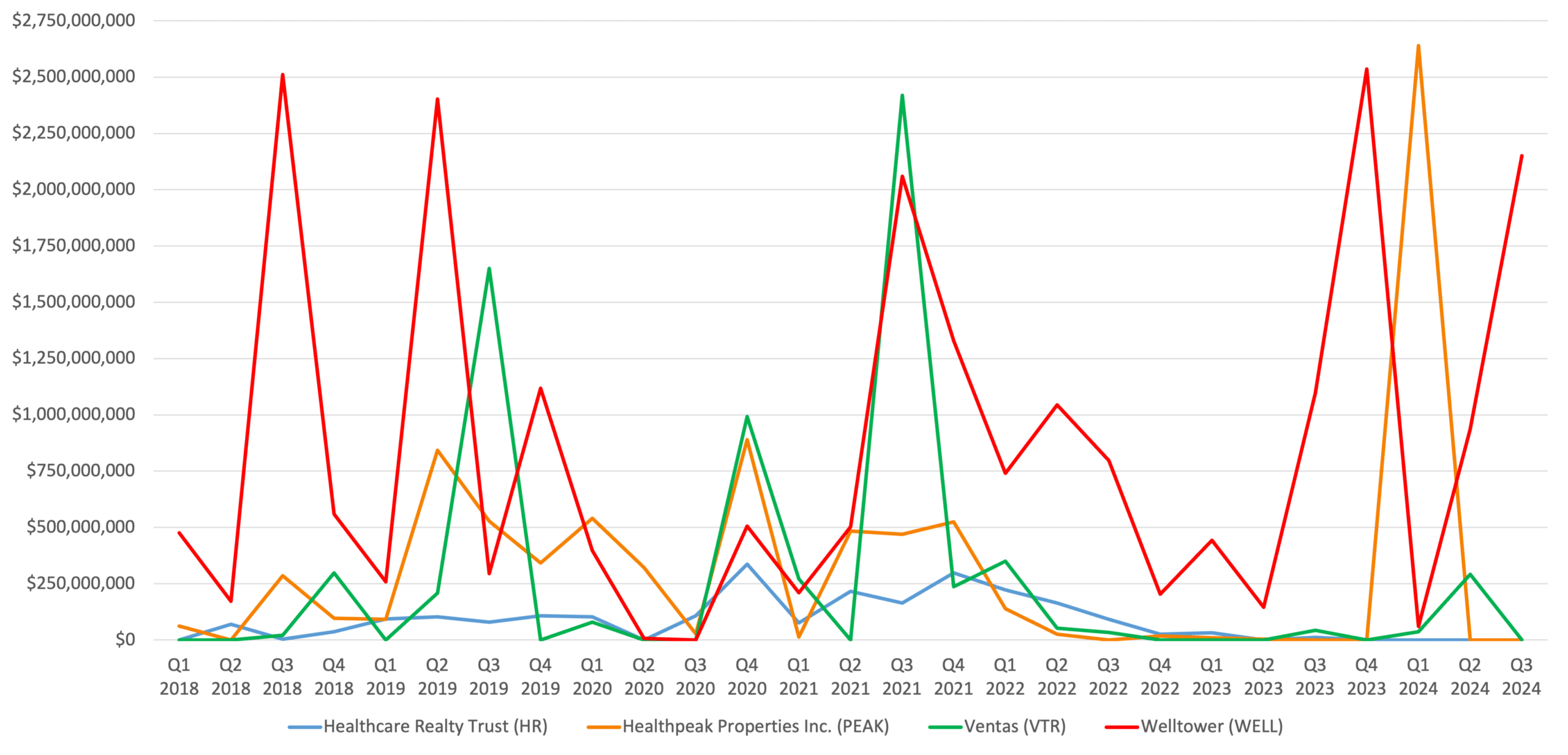

Healthcare Real Estate Investment & Transaction Activity

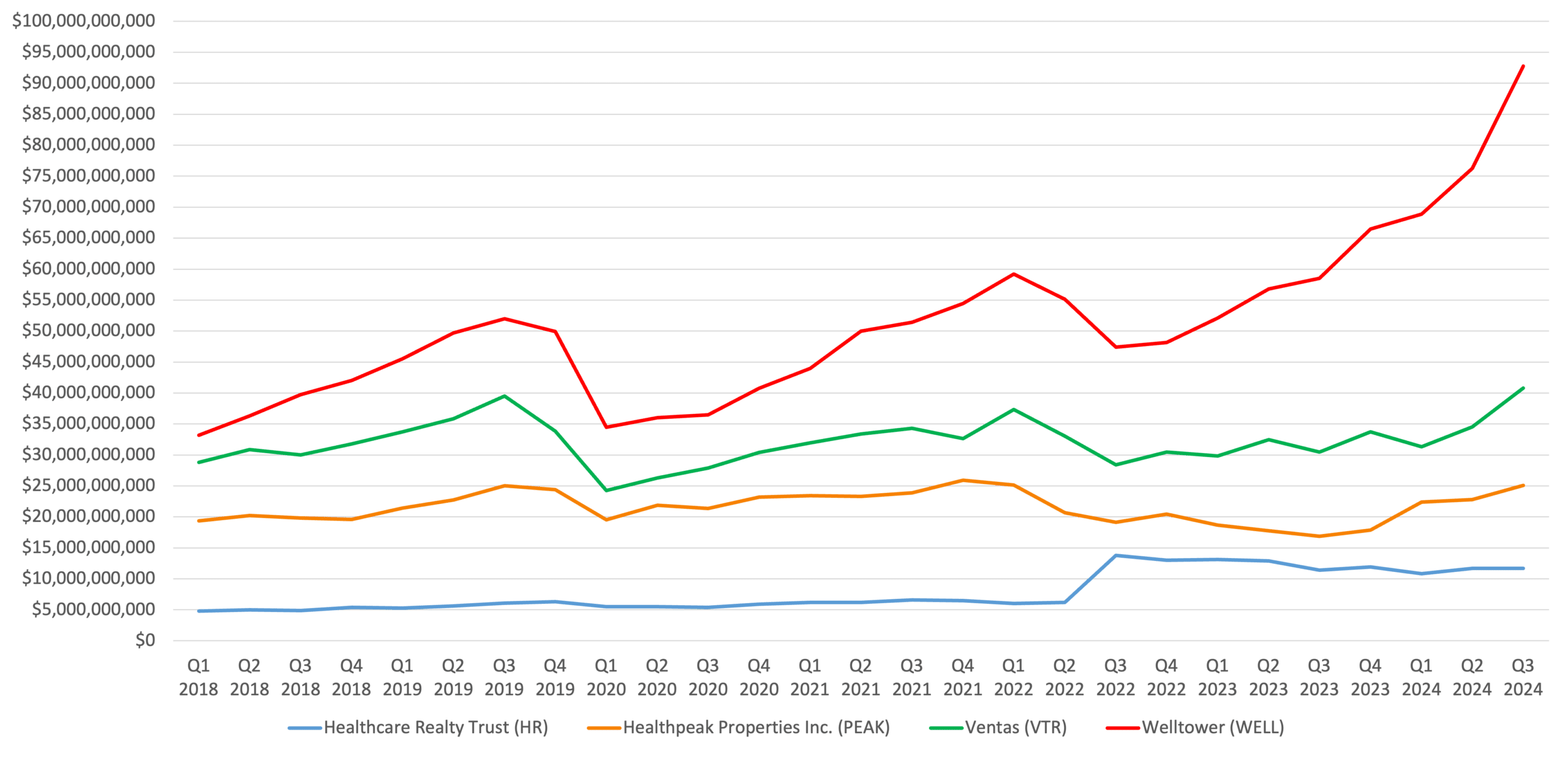

Medical office REITs are actively expanding their portfolios through strategic acquisitions, focusing on high-quality properties that enhance regional density and improve overall portfolio resilience. Welltower led this trend with a record $6.1 billion in investment activity year-to-date, with acquisitions across 40 properties and over 5,200 units at an average price of $244,000 per unit. This acquisition cost represents a significant discount to replacement costs, allowing Welltower to generate attractive returns while enhancing its regional presence. Ventas accelerated its acquisition activity with $1.7 billion in deals, prioritizing outpatient and senior housing facilities with strong growth potential. Healthcare Realty generated approximately $1 billion through joint ventures and dispositions, reinvesting in capital projects with high absorption rates. These investment moves showcase a disciplined approach to acquisitions, as REITs target high-value assets in regions where they already have market depth, strengthening long-term stability and portfolio value.

Acquisition Dollar Amount History

*Excludes Healthcare Realty Trust merger with Healthcare Trust of America, for $7.75 billion in Q2 2022

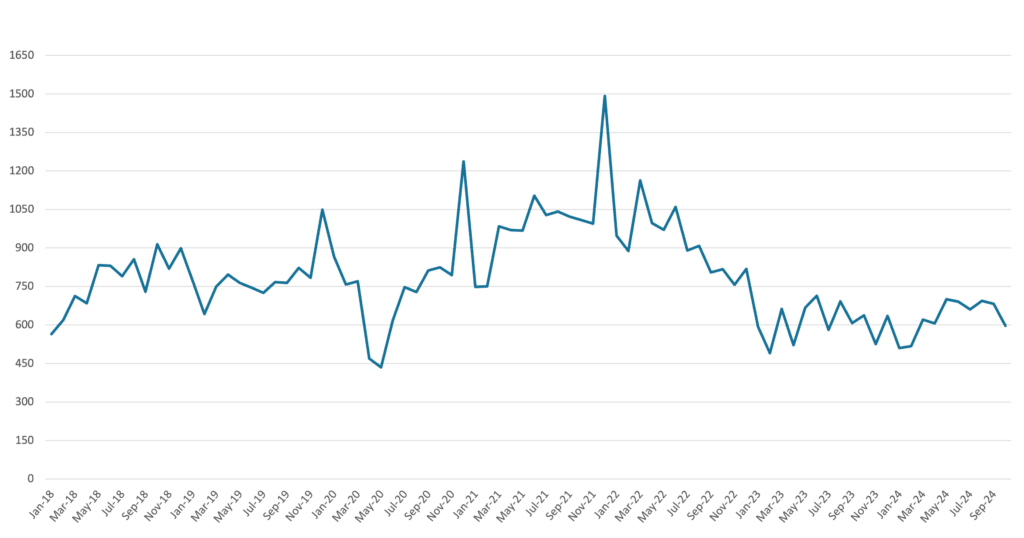

Healthcare Real Estate Monthly Transactions 2018-2024

* Source: CoStar

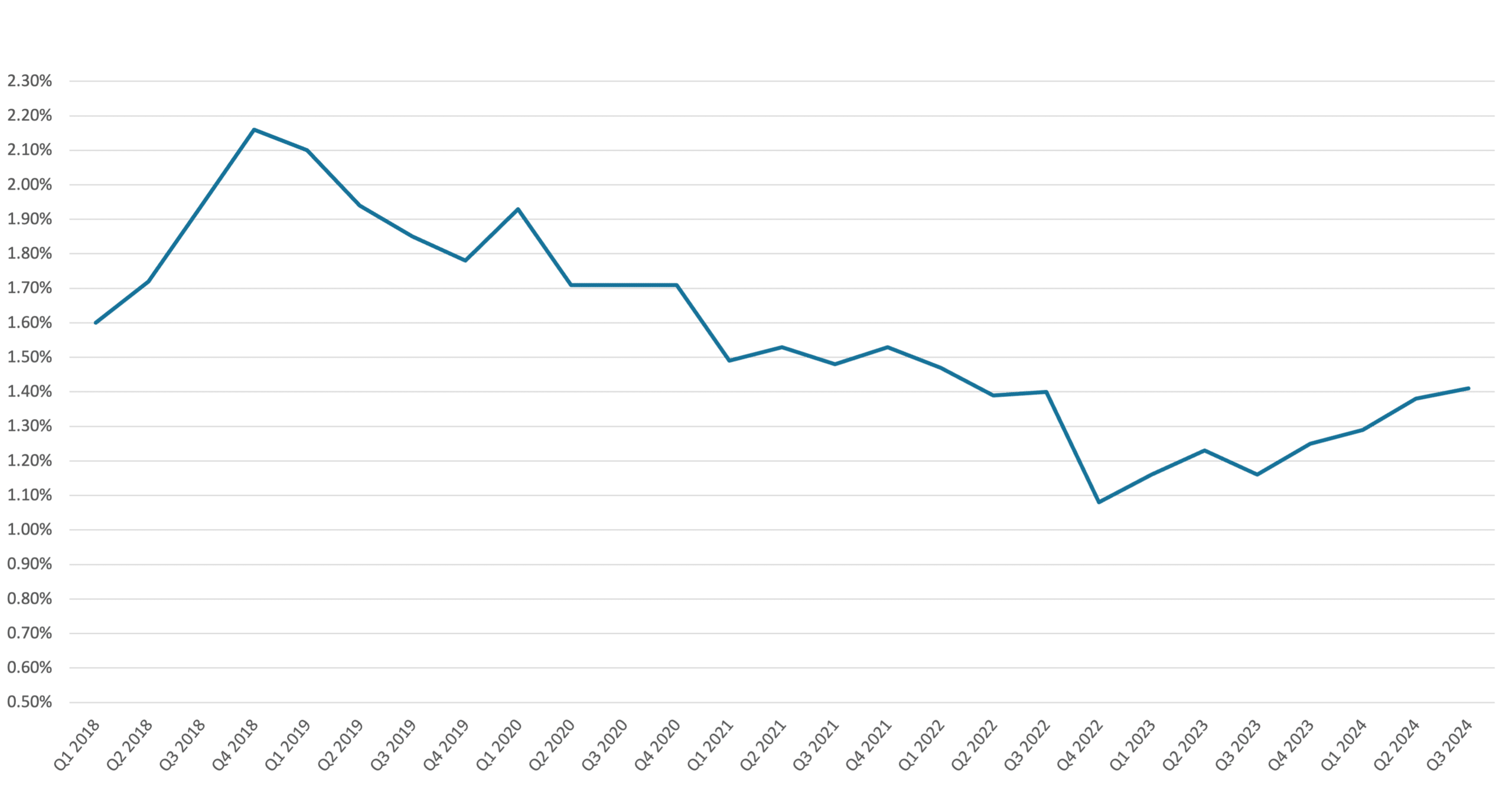

Under Construction SF as a % of Starting Inventory

* Source: Revista

SF Delivered as a % of Starting Inventory

* Source: Revista

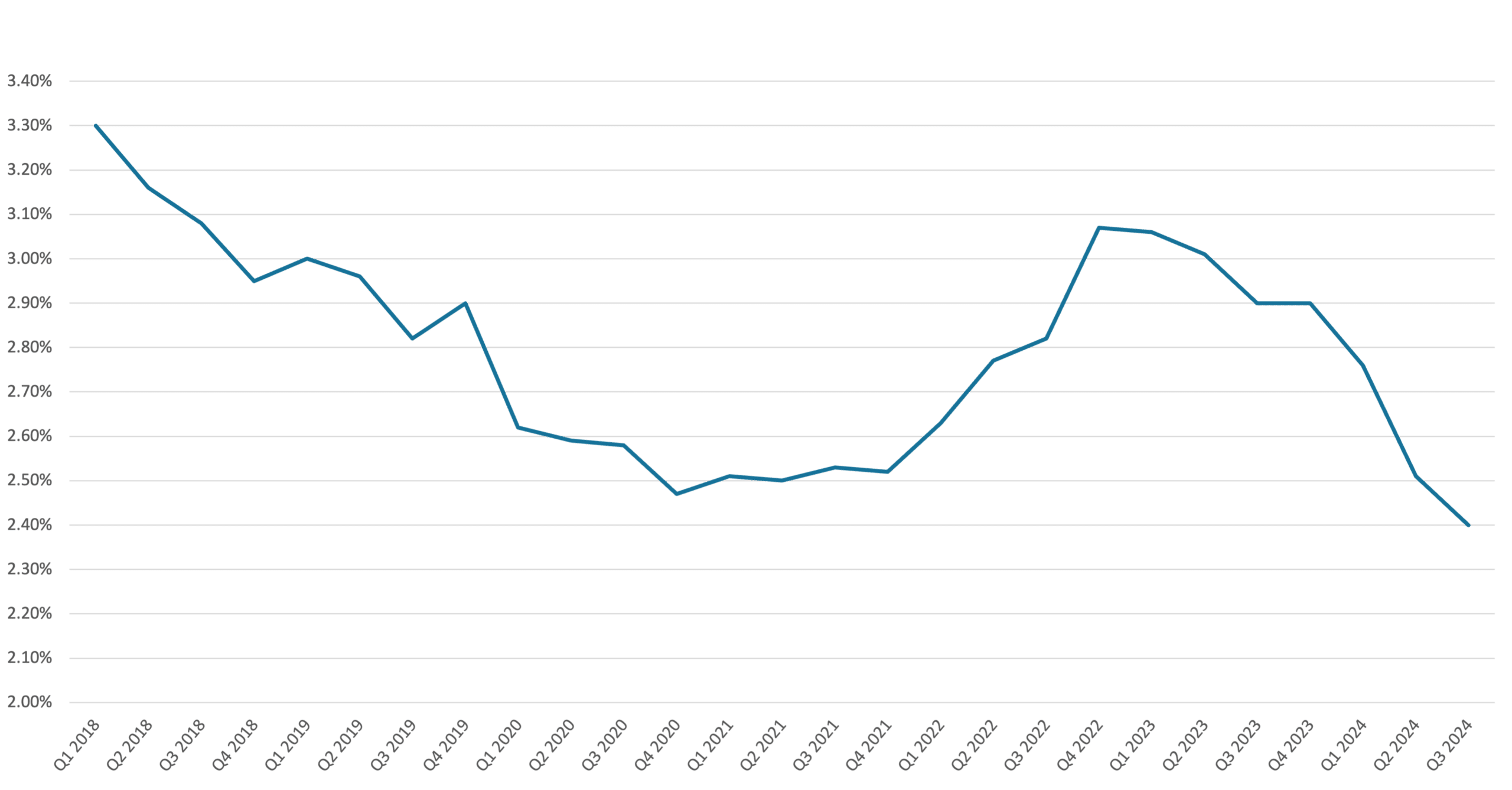

Healthcare Real Estate Cap Rates & Bid-Ask Spread

Medical office REITs are navigating a cap rate environment that reflects shifts due to rising interest rates, with transactions generally yielding cap rates in the 7-8% range for outpatient medical and senior housing properties. This rate is attractive relative to other real estate sectors, such as multifamily and industrial, where cap rates are typically around 4-5%. Welltower, for example, has focused on off-market deals, comprising approximately 94% of its total investment volume, allowing it to secure favorable pricing within its targeted cap rate range. Similarly, Ventas has acquired high-quality assets at these cap rates to align with its required internal returns. Healthpeak maintains a disciplined acquisition strategy, ensuring that bid-ask spreads align with their expectations for accretive investments. These cap rates and bid-ask spreads reflect a carefully managed approach in which REITs are balancing yield with quality acquisitions, maintaining long-term growth potential without sacrificing portfolio quality.

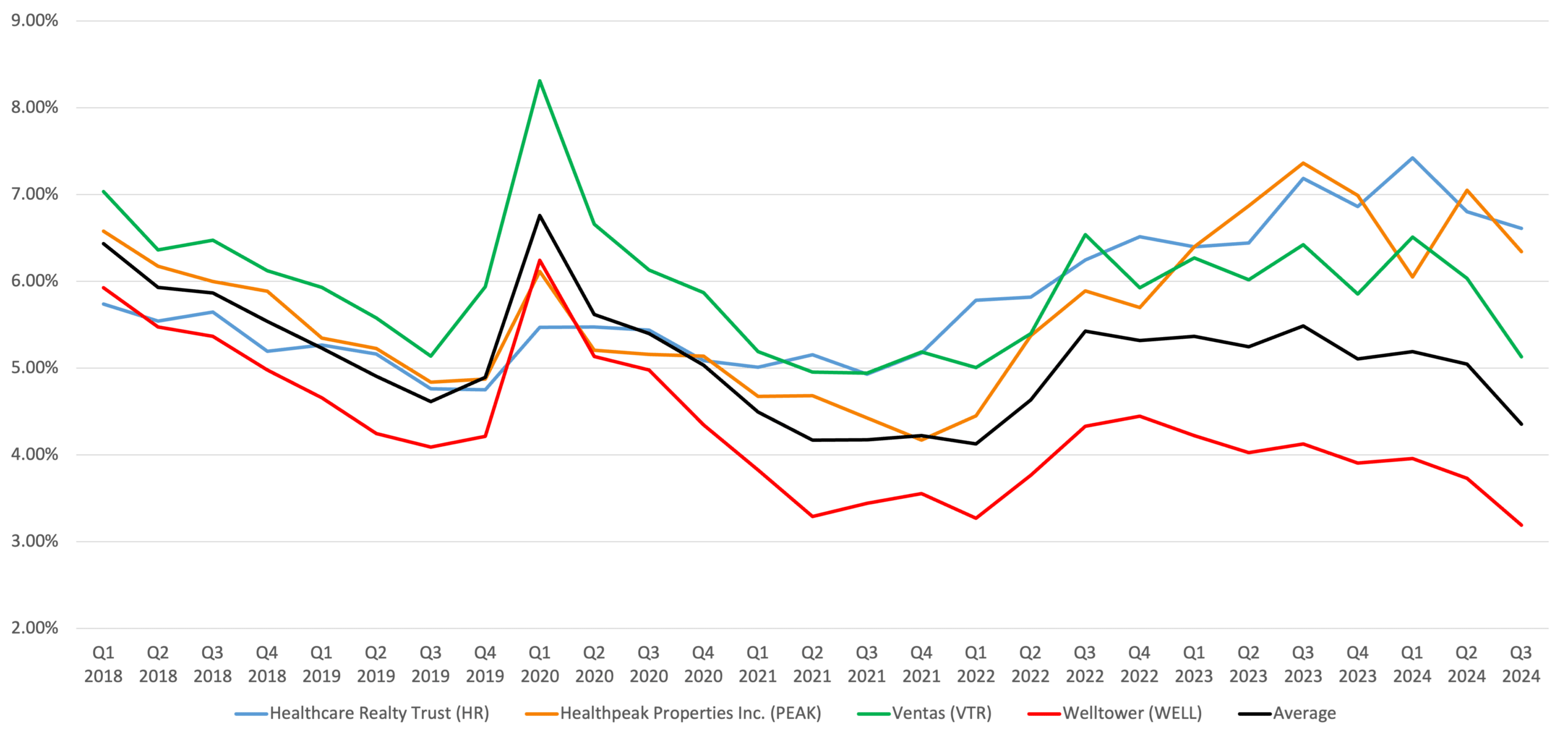

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Top 100 MSA Medical Office Building TTM Cap Rate History

* Source: Revista

Enterprise Value History

Headwinds in the Healthcare Real Estate Market

Despite positive market drivers, medical office REITs face several headwinds that could impact growth. Rising interest rates have increased financing costs, making acquisitions and development more challenging, especially as new projects face stricter lending requirements. The high costs of construction and labor further constrain new supply, impacting REITs’ ability to expand organically. Both Welltower and Ventas indicated that current cost structures make new outpatient medical projects financially challenging, thus slowing the growth of new supply and forcing REITs to focus on optimizing existing assets. The broader economic context, including inflation and tight labor markets, adds to operational expenses for tenants, requiring careful expense management and strategic investments to offset these pressures. Additionally, restricted access to financing—particularly for smaller operators or developers—limits new construction, placing greater emphasis on asset optimization for revenue growth. This environment calls for a cautious approach to capital allocation and selective acquisitions, balancing expense control with strategic investments that can withstand higher operating costs and reduced financing flexibility.

Tailwinds in the Healthcare Real Estate Market

The medical office market benefits from several key tailwinds supporting sustained growth. Aging demographics, particularly in the 80-plus age group, are driving demand for outpatient medical facilities as healthcare systems shift care to outpatient settings that are both cost-effective and convenient for patients. Healthpeak noted that the population aged 80 and older is projected to grow by 27% over the next five years, creating increased demand for outpatient facilities. Welltower highlighted the “silver tsunami” effect, where baby boomers’ aging and the rise in chronic conditions are fueling needs-based medical care. These trends, coupled with limited new construction, create favorable supply-demand dynamics that contribute to stable rental growth and occupancy levels across portfolios. The shift in healthcare delivery models to outpatient care, propelled by demographic shifts, is expected to drive long-term growth for the medical office market.

Contributors

Steven Paul

Senior Financial Analyst

Robert King

Managing Director

David Kuper

Vice President