Q1 Healthcare REIT Highlights

- Mark-to-Market Lease Growth: In-place rents rose to $25/SF with 3%+ escalators, vs. $35/SF new construction, leaving ample runway for leasing spreads.

- Future Occupancy Pipeline: Reported 89.3% same-store occupancy with 630,000 SF SNO, expected to add 165 bps to occupancy in 2025.

- Strategic Dispositions & Deleveraging: Sold $28M in assets with a target of $400–$500M for the year to improve balance sheet flexibility and address 6.4x net debt/EBITDA.

- 5% NOI Growth from Leasing Spreads: Delivered 5% same-store NOI growth driven by 4.1% positive rent mark-to-market and tenant retention.

- Post-Merger Portfolio Strategy: Outpatient medical now over 50% of portfolio following the merger with Physicians Realty Trust, reaffirming MOB as the core focus.

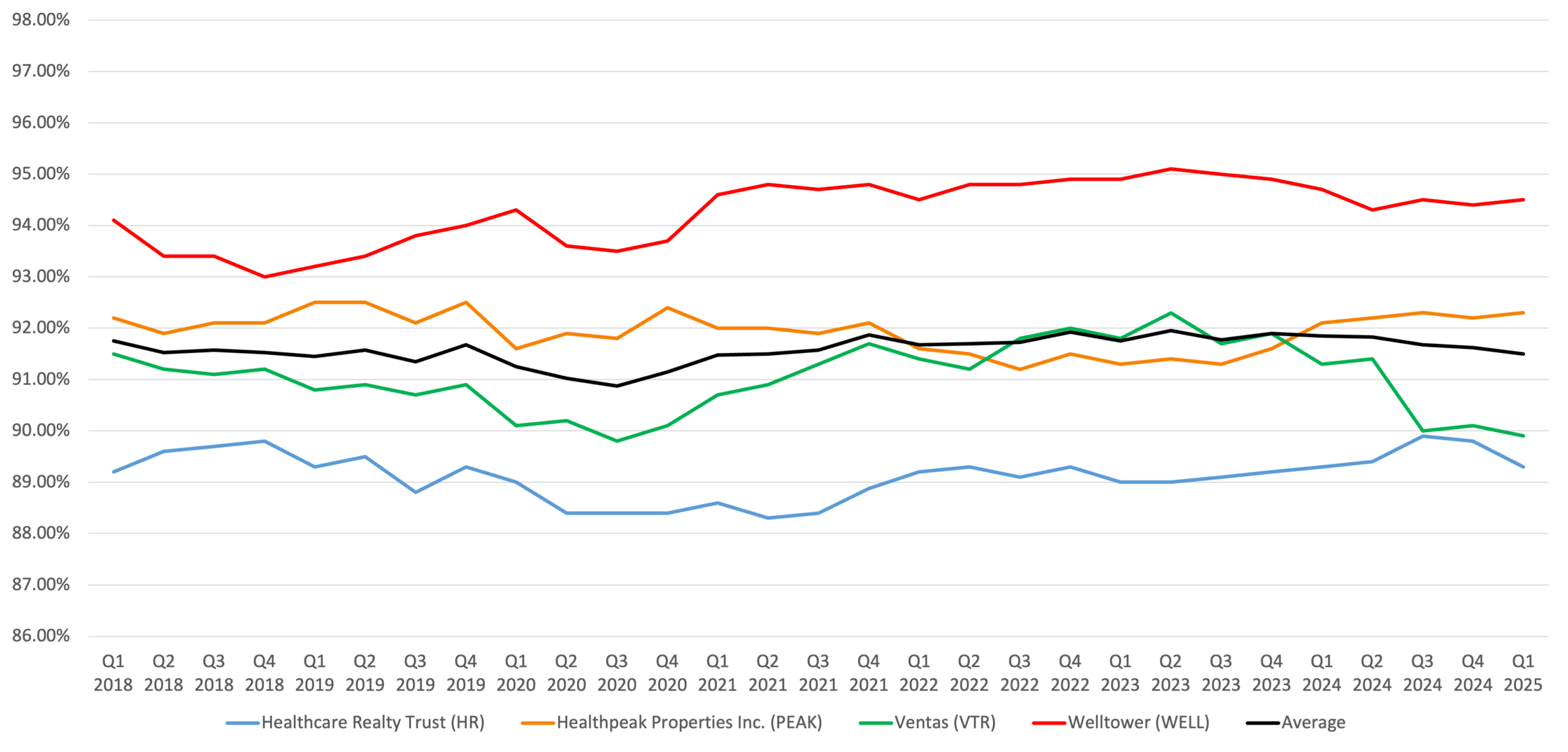

- Strong and Stable MOB Occupancy: Occupancy across its outpatient medical portfolio remained strong and stable, reflecting continued tenant demand and alignment with health system leasing priorities.

- Active Leasing Pipeline: Ventas reported executing a significant volume of outpatient leasing during Q1 2025 and highlighted entering Q2 with a “strong and active pipeline,” underscoring continued tenant demand and leasing momentum.

- Stable Pricing Environment: Despite broader market volatility, Ventas noted that pricing for stabilized medical office assets remains competitive, supported by strong buyer interest and limited available supply.

- Strength in Lillibridge Portfolio: Management emphasized that “fundamentals for the outpatient business have never been stronger,” pointing to compounding growth and robust demand within its Lillibridge-managed MOB platform, driven by long-term shifts toward outpatient care.

- Stable Rent Collection and Tenant Retention: Welltower reaffirmed stable rent collection and solid tenant retention within its outpatient medical portfolio, reflecting ongoing demand strength and operational consistency.

- Selective Investment Strategy: Management emphasized a more selective acquisition and disposition approach, driven by interest rate volatility and broader macroeconomic uncertainty, leading to more cautious underwriting.

- Execution Strength Without Cap Rate Guidance: Strong execution capabilities and continued buyer demand in a constrained market environment.

Thoughts from the CEO's

Healthcare Realty Trust

Todd Meredith

President & Chief Executive Officer

“First, Healthcare Realty is the only pure-play outpatient medical REIT. Our focus is 100% on a single asset class, and our vision is simple: to be the first choice for equity investors when they are seeking exposure to outpatient medical, and to be the landlord of choice for health systems.”

Healthpeak Properties Inc.

Scott M. Brinker

President & Chief Executive Officer

“Execution is important in any environment, but particularly in this backdrop. This team has worked diligently to meet or exceed expectations, including earnings, leasing and merger synergies.”

Ventas

Debra A. Cafaro

Chairman and Chief Executive Officer

“We are focused on delivering superior, multiyear growth fueled by internal and external expansion in our senior housing business, which is benefiting from secular, demographically driven demand and catalyzed by our advantage platform.”

Welltower

Shankh Mitra

Chief Executive Officer

“Ultimately, we believe that the days of generating returns through financial wizardry and levered beta are over. Instead, as an operating company in a real estate wrapper, we’re convinced that the only path to delivering satisfactory returns will be through compounding of cash flow generated by superior operations and supplemented with capital allocation to sub-optimize assets, further growing our network effect.”

Macroeconomic Highlights

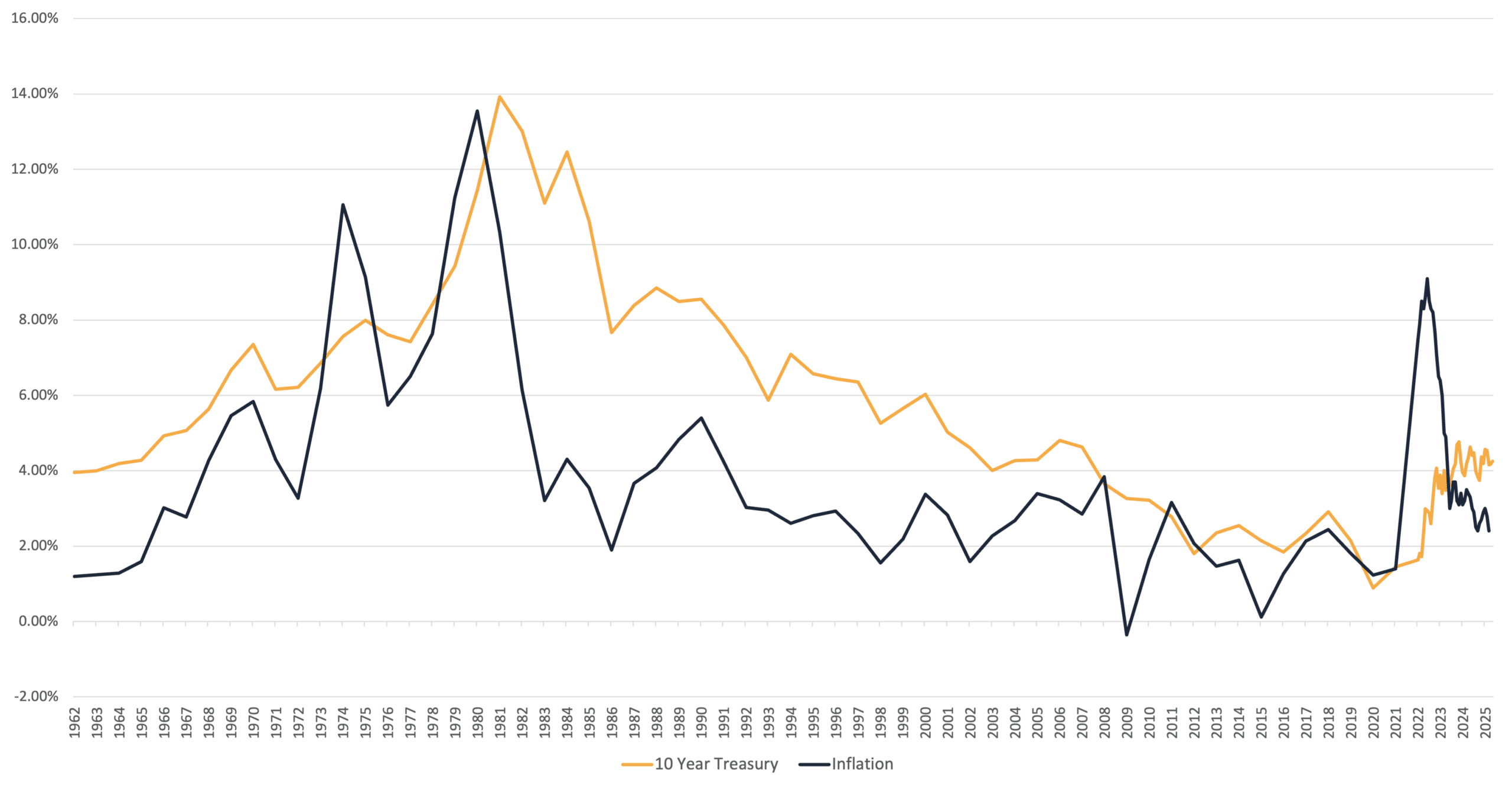

In Q1 2025, macroeconomic conditions remained complex, marked by persistent inflation, interest rate volatility, and regionally uneven demand trends. Elevated borrowing costs continued to constrain transaction volume across all sectors, widening bid-ask spreads and prolonging asset sales. The Federal Reserve’s cautious stance on rate cuts—delaying any major pivot due to stubborn service sector inflation—has kept capital markets dislocated. However, sector-specific fundamentals proved resilient. Medical office REITs benefitted from long-term demand tailwinds in outpatient care and health system expansion, while manufactured housing operators sustained momentum through affordability-driven demand and strong rent collections. In contrast, self-storage REITs navigated a softer leasing environment in overbuilt Sunbelt markets, with street rates and occupancy under pressure, but sequential improvement by April hinted at potential seasonal uplift.

Notably, structural affordability challenges in the U.S. housing market—compounded by limited new supply and elevated mortgage rates—have bolstered demand for both manufactured housing and rental storage solutions. UMH and Sun Communities reported strong rent growth and high tenant retention, aided by constrained housing alternatives and capital recycling strategies such as Sun’s $5.65 billion Safe Harbor Marinas divestiture. Meanwhile, healthcare REITs such as Healthcare Realty Trust and Healthpeak highlighted disciplined pricing and lease-up pipelines, counterbalancing concerns over operating cost inflation and policy uncertainty. Though all sectors face varying degrees of weather-related and inflationary headwinds, their exposure to essential services and demand-stable demographics continues to provide a durable buffer in today’s high-rate, low-growth macro environment

Inflation and the 10-Year Treasury Since 2022

Inflation and the 10-Year Treasury Since 1962

Q1 2025 Healthcare REIT Data Overview

| Healthcare Realty Trust (HR) | Healthpeak Properties Inc. (PEAK) | Ventas (VTR) | Welltower (WELL) | ||

| Ending Occupancy (Same Store) | 2025 | 89.30% | 92.30% | 89.90% | 94.50% |

| 2024 | 89.30% | 92.10% | 91.30% | 94.70% | |

| YoY Revenue Increase (Same Store) | 2025 | 3.0% | 4.1% | 2.0% | 2.4% |

| 2024 | 2.5% | 2.2% | 4.8% | 2.1% | |

| YoY Expense Increase (Same Store) | 2025 | 4.3% | 2.5% | 2.5% | 1.9% |

| 2024 | 1.7% | 1.5% | 5.1% | 2.3% | |

| YoY NOI Increase (Same Store) | 2025 | 2.3% | 5.0% | 1.7% | 2.7% |

| 2024 | 3.0% | 2.6% | 4.7% | 2.0% | |

| NOI/Occupied SF (Same Store) | 2025 | $23.05 | $23.45 | $24.34 | $27.14 |

| 2024 | $23.10 | $22.20 | $24.88 | $27.00 | |

| Average Lease Term Remaining (Yrs) | 4.4 | 6.2 | 6.5 | 7.1 | |

| Q1 Medical Office Acquisitions | 0 | 3 | 0 | 1 | |

| Total Properties | 562 | 527 | 397 | 433 |

Q1 2025 Healthcare Real Estate Operating Fundamentals

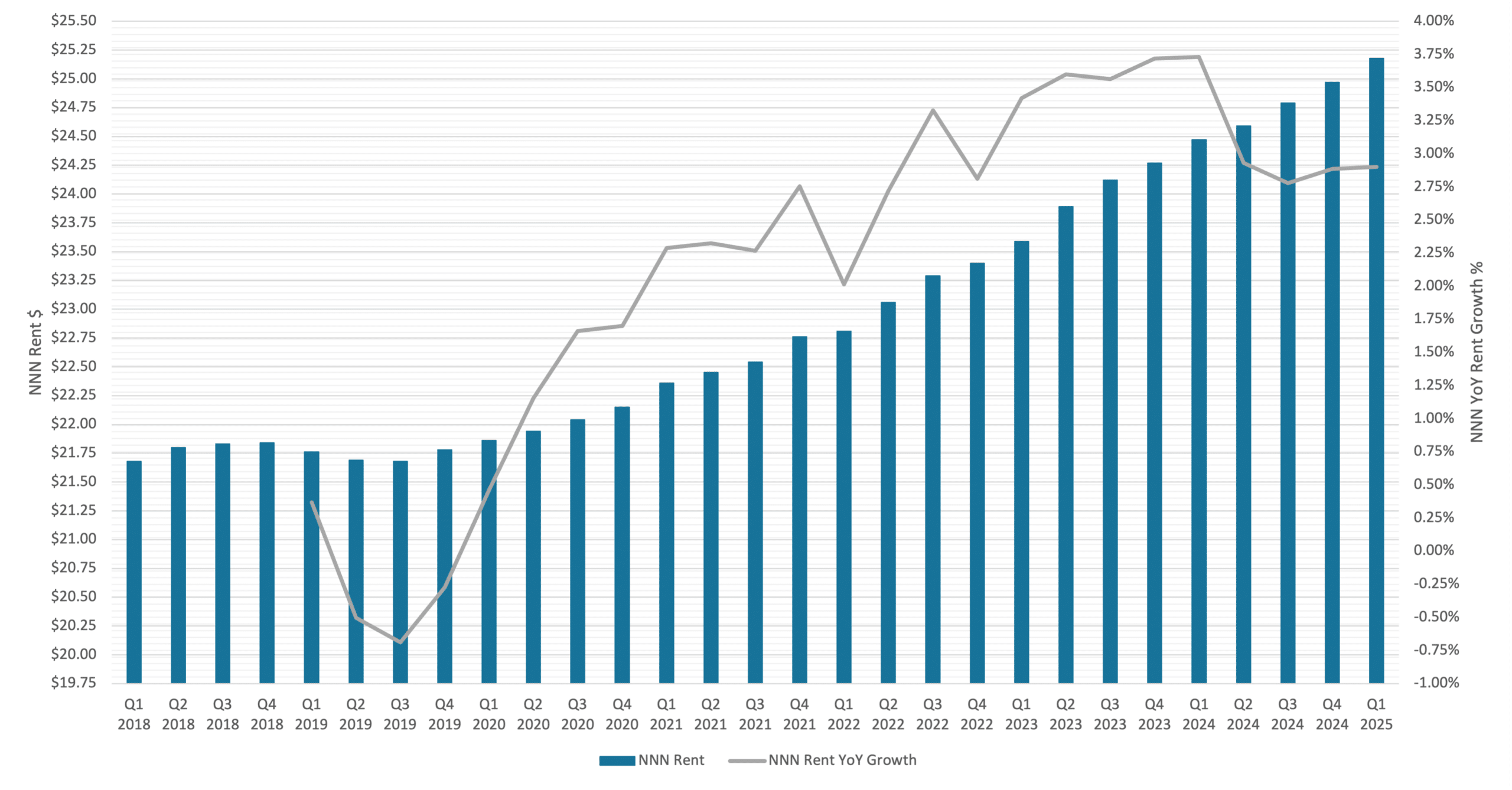

Healthcare Real Estate Lease Rates

In Q1 2025, medical office lease rates continued their upward trajectory, supported by disciplined pricing and long-term structural demand. Healthcare Realty Trust reported that average in-place rents across its MOB portfolio are now $25 per square foot, up 20% over the past four to five years, with lease escalators routinely at 3% or better. The company contrasted this with $35 per square foot rates on new construction, suggesting an extended runway for mark-to-market leasing. CEO Peter Scott emphasized a focus on achieving “the best lease economics possible” on every deal, while balancing rent growth with occupancy progress. Healthpeak Properties stated that demand across its outpatient portfolio remains robust and that it is achieving leasing spreads of approximately 5%, though the company did not disclose base rents or escalator trends. Ventas disclosed that it executed nearly 1 million square feet of outpatient leases during the quarter, including 265,000 square feet of new leasing, and noted a “strong and active pipeline” entering Q2. Management emphasized that fundamentals for the outpatient business have never been stronger, pointing to ongoing efforts to translate this strength into higher occupancy, stronger rent mark-to-market, and cash flow growth. While Welltower reaffirmed stable rent collection and retention in its outpatient portfolio, it did not provide lease spread or rate figures during the quarter.

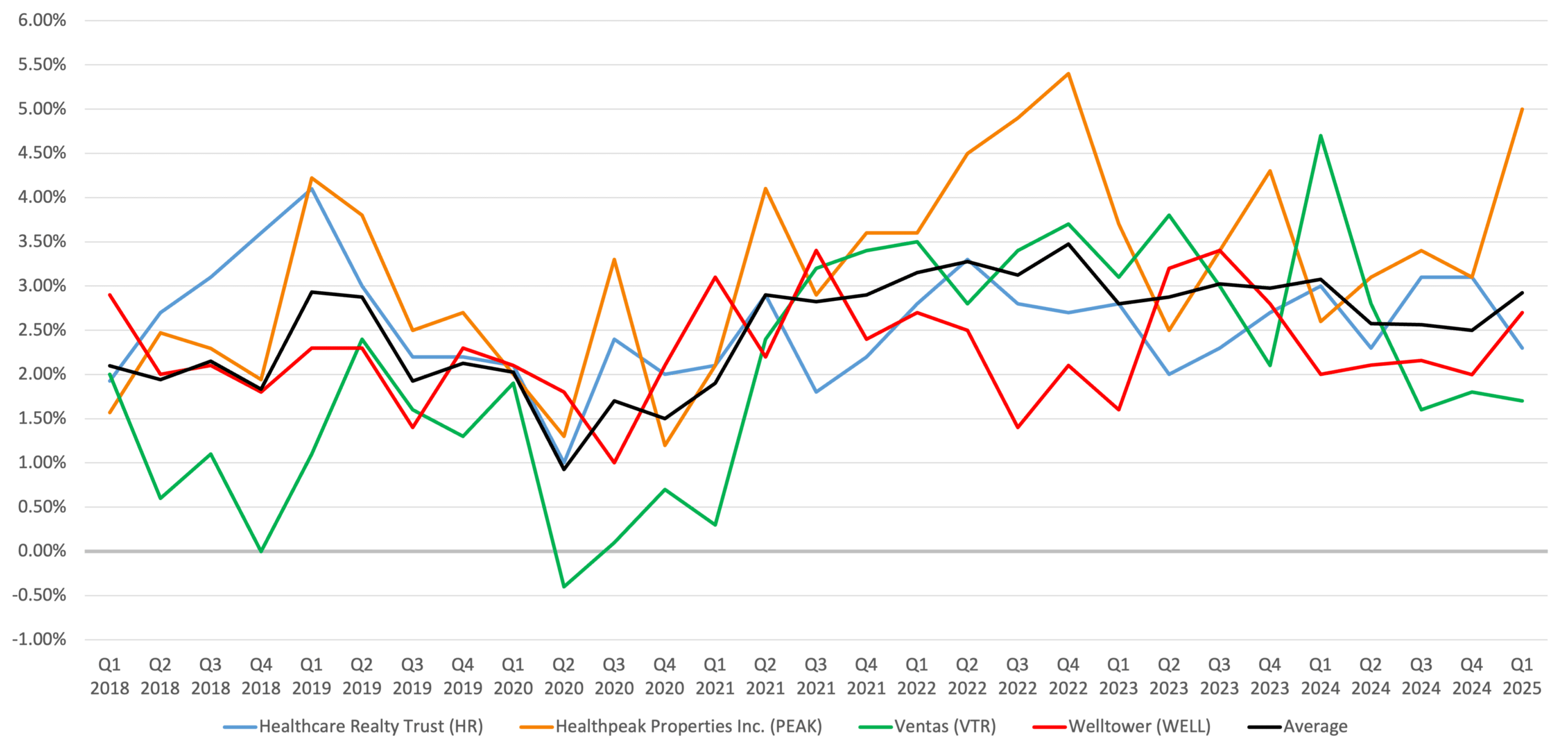

NOI/Occupied SF (Same Store)

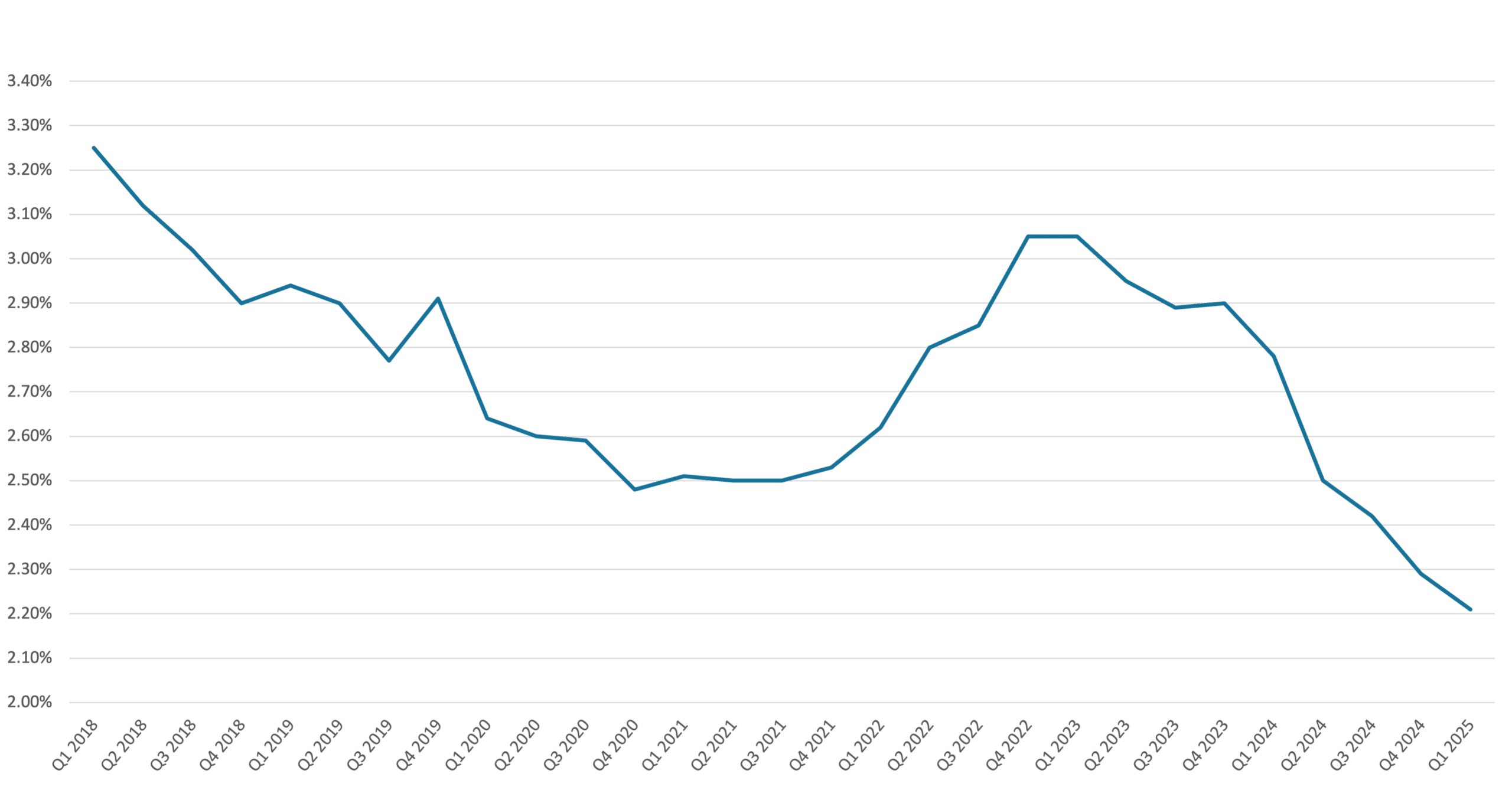

Top 100 MSA Medical Office Building NNN Rent

* Source: Revista

Healthcare Real Estate Occupancy

Occupancy remained resilient in Q1 2025, with most healthcare REITs reporting stable to improving levels supported by health system expansion and favorable leasing pipelines. Healthcare Realty Trust reported 89.3% same-store occupancy, up slightly from the prior quarter, driven by a tenant retention rate of nearly 85%, with a signed-not-occupied (SNO) pipeline of over 630,000 square feet, representing 165 basis points of future occupancy gains. The company recorded 1.5 million square feet of total lease commencements, including 370,000 square feet of new leases, and expects 75 to 125 basis points of net absorption across the portfolio in 2025. Healthpeak stated that MOB occupancy was strong and stable, anchored by on-campus locations and leading healthcare systemslike HCA and Providence. Ventas saw continued occupancy momentum across its MOB platform, benefiting from health system alignments and tenant renewals. Welltower also cited solid occupancy in its outpatient medical buildings, driven by strong healthcare employment trends and tenant expansion.

Period Ending Occupancy (Same Store)

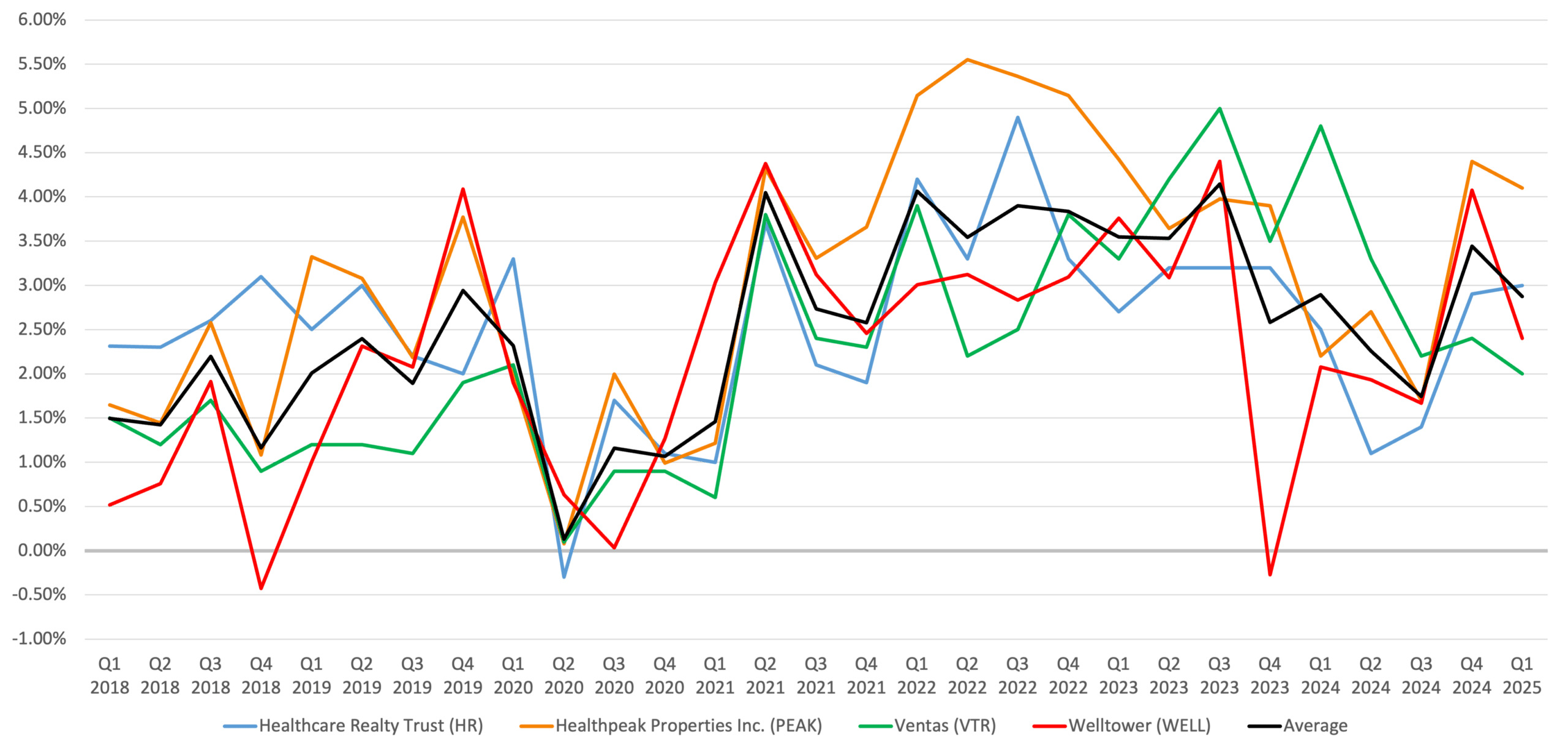

Healthcare Real Estate Income & Expenses

Same-property NOI growth across medical office portfolios in Q1 2025 reflected seasonal cost pressures but remained directionally positive Healthcare Realty Trust reported 2.3% same-store cash NOI growth, noting that results were affected by higher-than-normal operating expenses caused by winter storms and seasonal volatility. While Q1 is typically the softest quarter, management confirmed that these expense spikes are not expected to recur in Q2. The company is actively pursuing margin expansion, stating that NOI margins currently sit in the low 60% range. To improve this, HR is pushing property-level responsibility to local markets and evaluating technology investments and organizational changes to reduce costs. Healthpeak Properties reported 5% same-store NOI growth in its outpatient medical segment, driven by strong tenant retention, a 4.1% positive rent mark-to-market, and operational benefits from ongoing internalization efforts. While Ventas saw a 1.7% increase in same store NOI, a decrease compared to the 4.7% gain in q1 of 2024, management emphasized the sector’s strong fundamentals and highlighted leasing momentum entering Q2. Welltower referenced stable outpatient property revenue performance in key markets such as Texas and Florida, supported by solid tenant retention and healthcare sector tailwinds, but did not break out segment-specific income or cost figures.

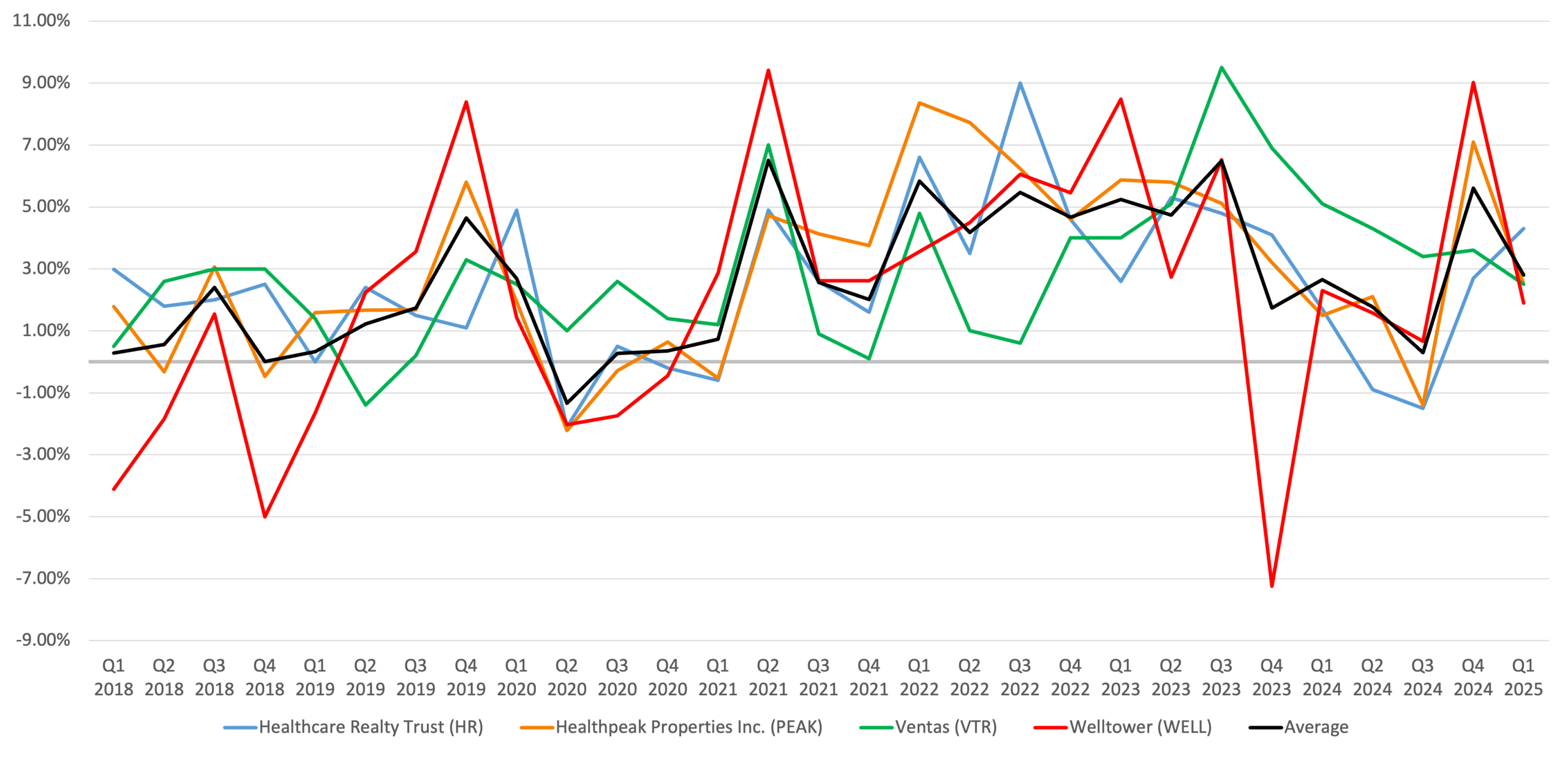

YoY Revenue Growth (Same Store)

YoY Expense Growth (Same Store)

YoY NOI Growth (Same Store)

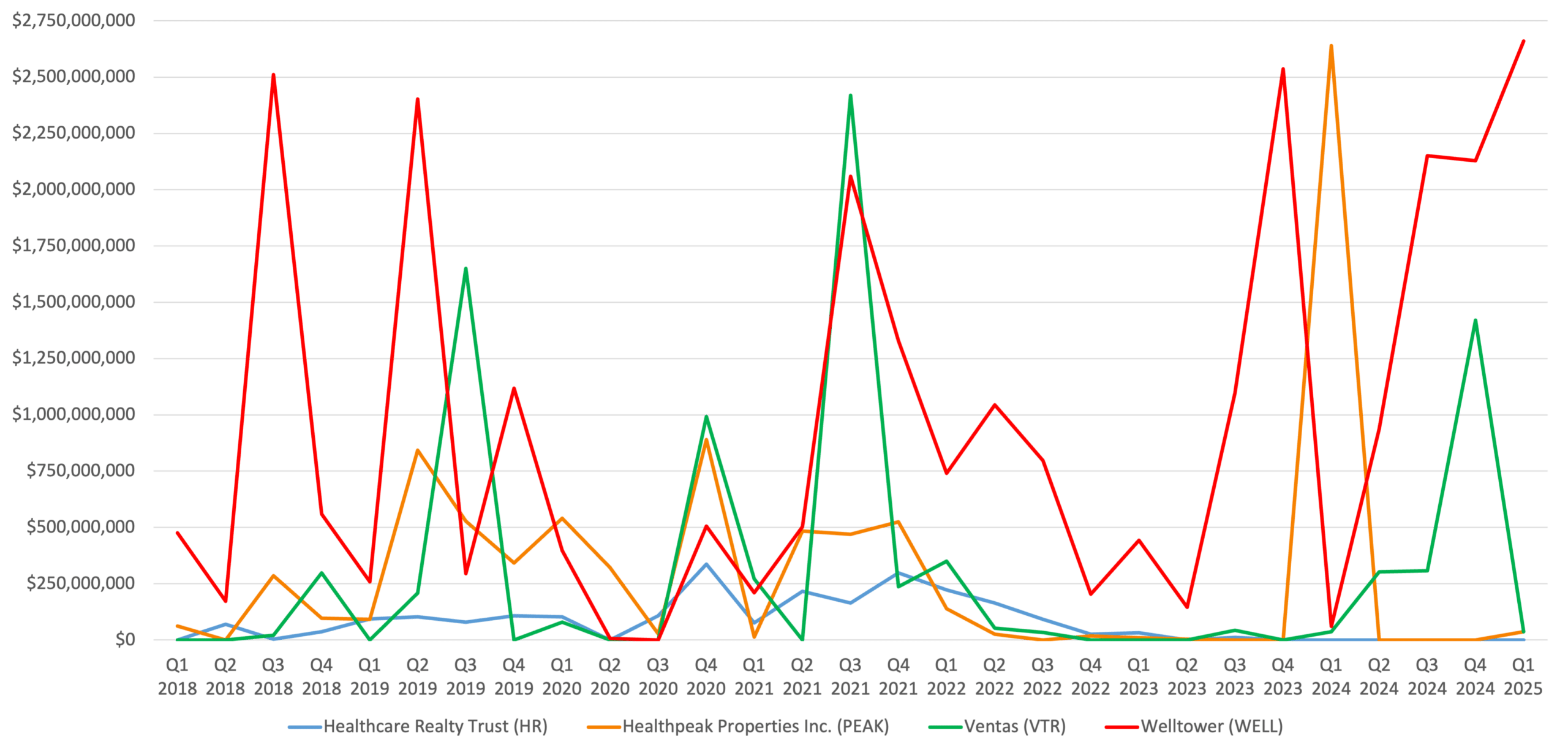

Healthcare Real Estate Investment & Transaction Activity

Investment activity in Q1 was concentrated around strategic dispositions and portfolio repositioning, with REITs maintaining capital discipline amid limited MOB supply. Healthcare Realty Trust sold four buildings for $28 million, complemented by a $38 million loan payoff post-quarter, and reiterated its full-year disposition target of $400 to $500 million. Assets sold were located in low-scale or orphan markets and often required significant capital investment. Healthpeak stated that its Outpatient Medical segment now represents just over 50% of the company’s portfolio, a result of its completed merger with Physicians Realty Trust, and emphasized the central role of this segment in its long-term growth focus.

Acquisition Dollar Amount History

*Excludes Healthcare Realty Trust merger with Healthcare Trust of America, for $7.75 billion in Q2 2022

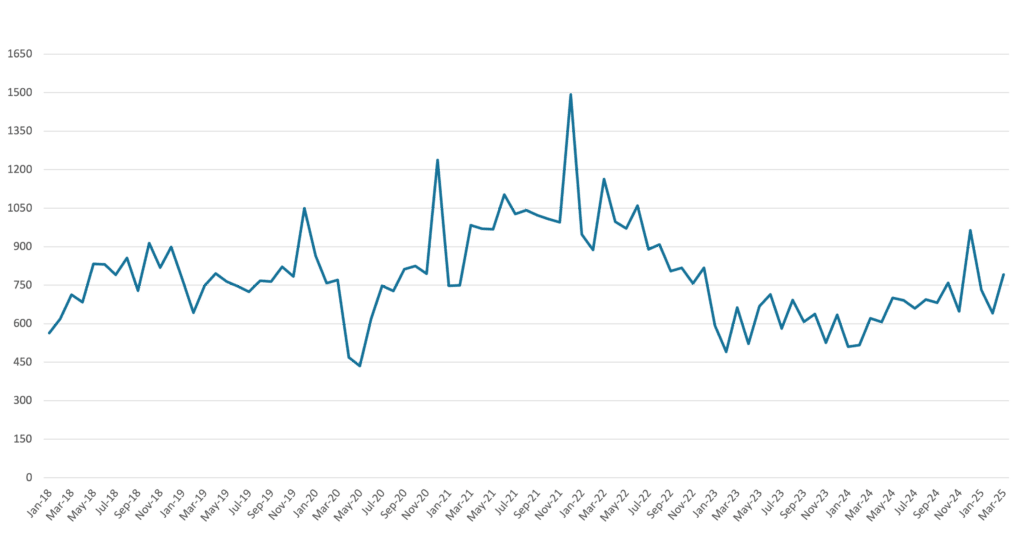

Healthcare Real Estate Monthly Transactions 2018-2025

* Source: CoStar

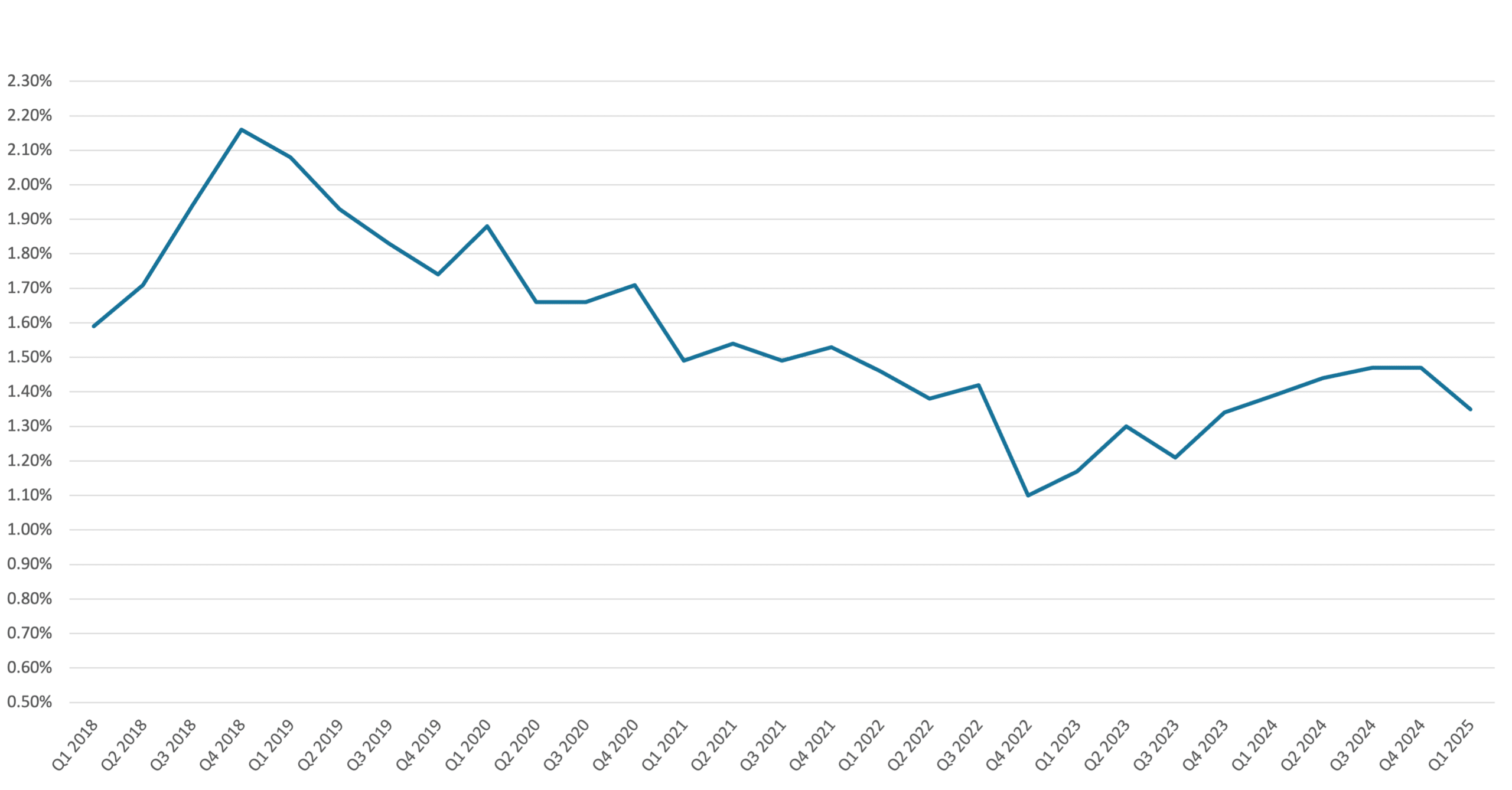

Top 100 MSA Medical Office Building SF Under Construction as a % of Starting Inventory

* Source: Revista

Top 100 MSA Medical Office Building SF Delivered as a % of Starting Inventory

* Source: Revista

Healthcare Real Estate Cap Rates & Bid-Ask Spread

Transaction market conditions for medical office properties in Q1 2025 were described as favorable, with limited supply for sale and strong buyer interest helping maintain pricing discipline. Healthcare Realty Trust’s CIO reported continued favorable market conditions from 2024 into 2025, driven by an abundance of equity dry powder, eager lending partners, and a “relatively low supply” of MOBs for sale. While the company did not disclose specific cap rates, it emphasized that it was “not a price taker” and is focusing on full asset sales rather than joint venture contributions to maximize pricing. Ventas echoed these dynamics, stating that despite market volatility, pricing for stabilized medical office assets remains competitive, although they refrained from citing specific cap rates. Healthpeak also did not provide exact transaction metrics but indicated that capital recycling efforts have achieved satisfactory returns and pricing. Welltower, despite executing large-scale dispositions, provided no MOB-specific cap rate commentary but emphasized execution strength and buyer demand.

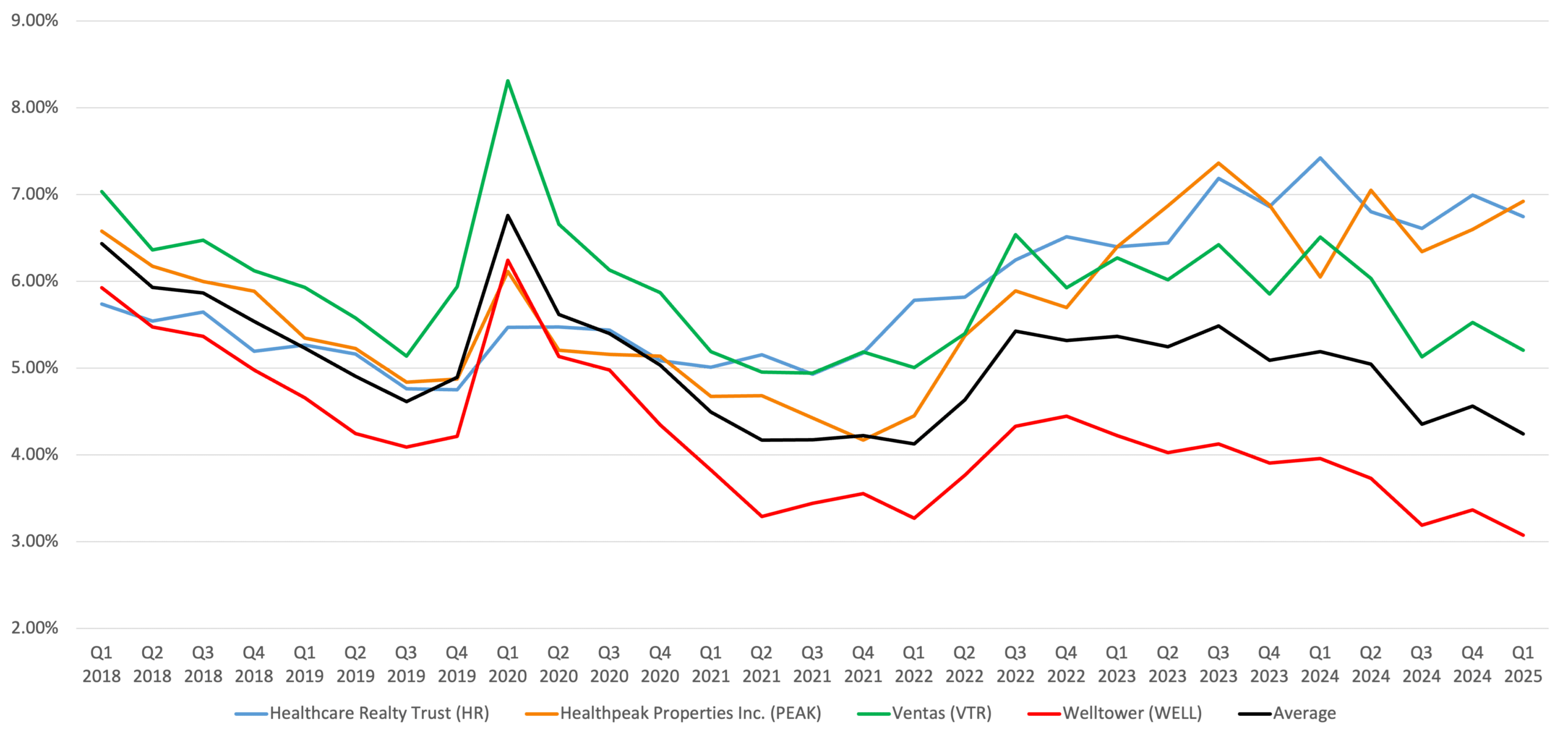

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Top 100 MSA Medical Office Building TTM Cap Rate History

* Source: Revista

Enterprise Value History

Headwinds in the Healthcare Real Estate Market

While fundamentals remained strong, healthcare REITs acknowledged persistent headwinds related to leverage, operating cost inflation, and policy risk. Healthcare Realty Trust reported net debt to adjusted EBITDA of 6.4x and emphasized deleveraging as a near-term strategic priority, particularly with $1.2 billion in debt maturities and over $500 million in swaps coming due in 2026. Management clearly stated that “6.4 times is just too high,” and signaled an intent to improve balance sheet flexibility before addressing dividend decisions or capital redeployment.

Policy uncertainty, especially around site neutrality and Medicaid cuts, was another sector-wide concern. However, Healthcare Realty’s CEO noted these had “very little impact” on their portfolio as currently structured, though he acknowledged ongoing monitoring of developments in Washington.

Ventas and Healthpeak cited inflation in operating expenses and staffing pressures at the property level as key challenges. These cost pressures were particularly impactful in the outpatient segment, where margins remain sensitive to labor market tightness and utility rate increases. Welltower, meanwhile, flagged interest rate volatility and general macroeconomic unpredictability as major factors contributing to greater underwriting caution and a more selective pace of acquisitions and dispositions. These combined headwinds have led to a more cautious stance across the board, even amid a favorable long-term demand outlook.

Tailwinds in the Healthcare Real Estate Market

All four REITs cited robust demand fundamentals driven by health system expansion, favorable demographics, and the shift toward outpatient care settings. Healthcare Realty Trust noted that health system leasing has nearly doubled as a percentage of new signed leases over the past five quarters, and that systems are requesting larger spaces—including multiple instances of doubling previously leased footprints. The company also reported an A+ rating for its on-campus portfolio in a third-party industry study. Healthpeak emphasized continued internalization of property management, covering 4.5 million square feet of outpatient space since January, and reported 5% same-store NOI growth in the segment. Management highlighted strong tenant retention, positive 4.1% rent mark-to-market, and steady leasing momentum as key drivers of operational strength. Ventas stated that fundamentals for the outpatient business have never been stronger, highlighting solid compounding growth within its Lillibridge-managed portfolio and continued benefit from trends favoring lower-cost care delivery settings.

Contributors

Steven Paul

Senior Financial Analyst

Robert King

Managing Director

David Kuper

Vice President