Q2 Medical Office REITs Highlights

- Occupancy Growth: Healthcare Realty Trust reported a 55 basis point increase in multi-tenant occupancy during the first half of 2024, with a retention rate improvement to 85%, reflecting strong demand for medical office space.

- Income Stability: The company achieved a 2.3% increase in same-store NOI, with multi-tenant NOI growing by 3.9% due to better-than-expected leasing activity and controlled expenses.

- Capital Allocation: Healthcare Realty Trust focused on expanding its joint ventures, generating over $1 billion in proceeds from asset sales and JV contributions, which were used to enhance its core portfolio and balance sheet.

- Leasing Success: Healthpeak achieved a 4.7% increase in rent on outpatient medical lease renewals and a 6% increase in lab leases, supported by strong demand in both segments.

- Income Growth: The company reported a 3.1% year-over-year increase in same-store NOI, driven by higher occupancy rates and effective cost management across its portfolio.

- Strategic Dispositions: Healthpeak completed $853 million in outpatient medical sales during Q2 2024, achieving a blended cap rate of 6.5%, part of its ongoing strategy to optimize its portfolio.

- Leasing Activity: Ventas signed 1.3 million square feet of new and renewal leases in its medical office portfolio, contributing to a 3.2% rent growth on renewals during Q2 2024, indicating strong leasing momentum.

- Capital Recycling: The company completed $600 million in dispositions, which were strategically reinvested into high-growth sectors like life sciences, optimizing its portfolio for better returns.

- Portfolio Optimization: Ventas focused on enhancing its portfolio by acquiring high-quality medical office and life sciences assets while disposing of non-core properties, reflecting a disciplined capital allocation strategy.

- Leasing Success: Welltower reported robust leasing activity in its medical office portfolio, achieving a 3.2% rent growth on renewals in Q2 2024. This reflects strong demand in the medical office sector and the company’s ability to maintain favorable leasing terms.

- Strategic Dispositions: The company generated over $500 million from asset sales, which were redeployed into high-growth investments, including life sciences and outpatient medical facilities, aligning with their long-term strategic goals.

- Income Growth: Welltower achieved significant income growth across its medical office and life sciences portfolios, driven by increased occupancy and effective cost management.

Thoughts from the CEO's

Healthcare Realty Trust

Todd Meredith

President & Chief Executive Officer

- “We are making notable progress on our capital allocation objectives and accelerating our operational momentum, with strong leasing trends and increasing occupancy gains setting the stage for continued growth.”

Healthpeak Properties Inc.

Scott M. Brinker

President & Chief Executive Officer

- “Our strategic disposition program and robust leasing activity have positioned us to outperform expectations, demonstrating the strength and resilience of our portfolio.”

Ventas

Debra A. Cafaro

Chairman and Chief Executive Officer

- “It’s an exciting time for our business as we are driving performance in the early stages of an unprecedented multi-year NOI growth opportunity fueled by powerful demographic demand and the most favorable fundamentals ever in the senior housing industry.”

Welltower

Shankh Mitra

Chief Executive Officer

- “We are proud of our continued momentum, as we achieve double-digit NOI growth and execute on strategic acquisitions that will further strengthen our leadership in the healthcare real estate sector.”

Macroeconomic Highlights

Recession Fears and Economic Outlook: Economic uncertainty remains a significant concern as the U.S. navigates the possibility of a recession. While GDP growth has been positive, the Federal Reserve’s interest rate hikes aimed at curbing inflation have led to concerns about a potential economic slowdown. Consumer spending has been resilient but is expected to weaken as pandemic-era savings dwindle and borrowing costs rise. Meanwhile, the labor market remains strong, but there are signs of stress, including rising delinquencies in subprime loans and the potential impact of restarting student loan payments.

Geopolitical Tensions and Their Impact: The upcoming election is likely to significantly influence the commercial real estate market as potential policy shifts could affect key areas such as taxation, regulation, and federal spending. Issues like corporate tax rates, environmental regulations, and infrastructure investment are particularly crucial for sectors like industrial, office, and multifamily properties. As the election approaches, market participants may adopt a cautious stance, leading to temporary uncertainty and slowed transaction activity. Additionally, the election’s outcome could impact interest rate policy and economic stimulus measures, both of which are vital to commercial real estate investment and development.

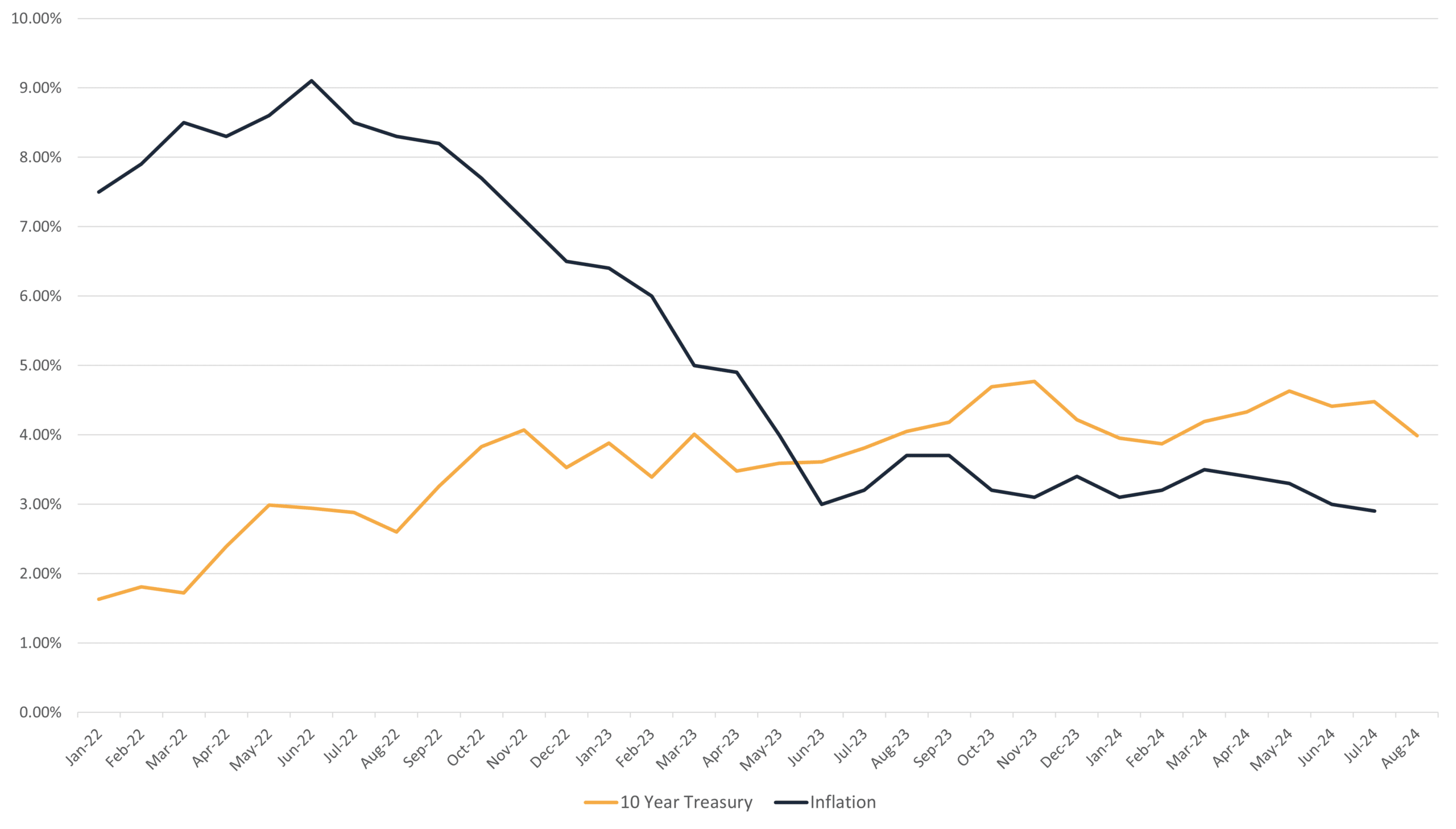

Inflation and the 10-Year Treasury Since 2022

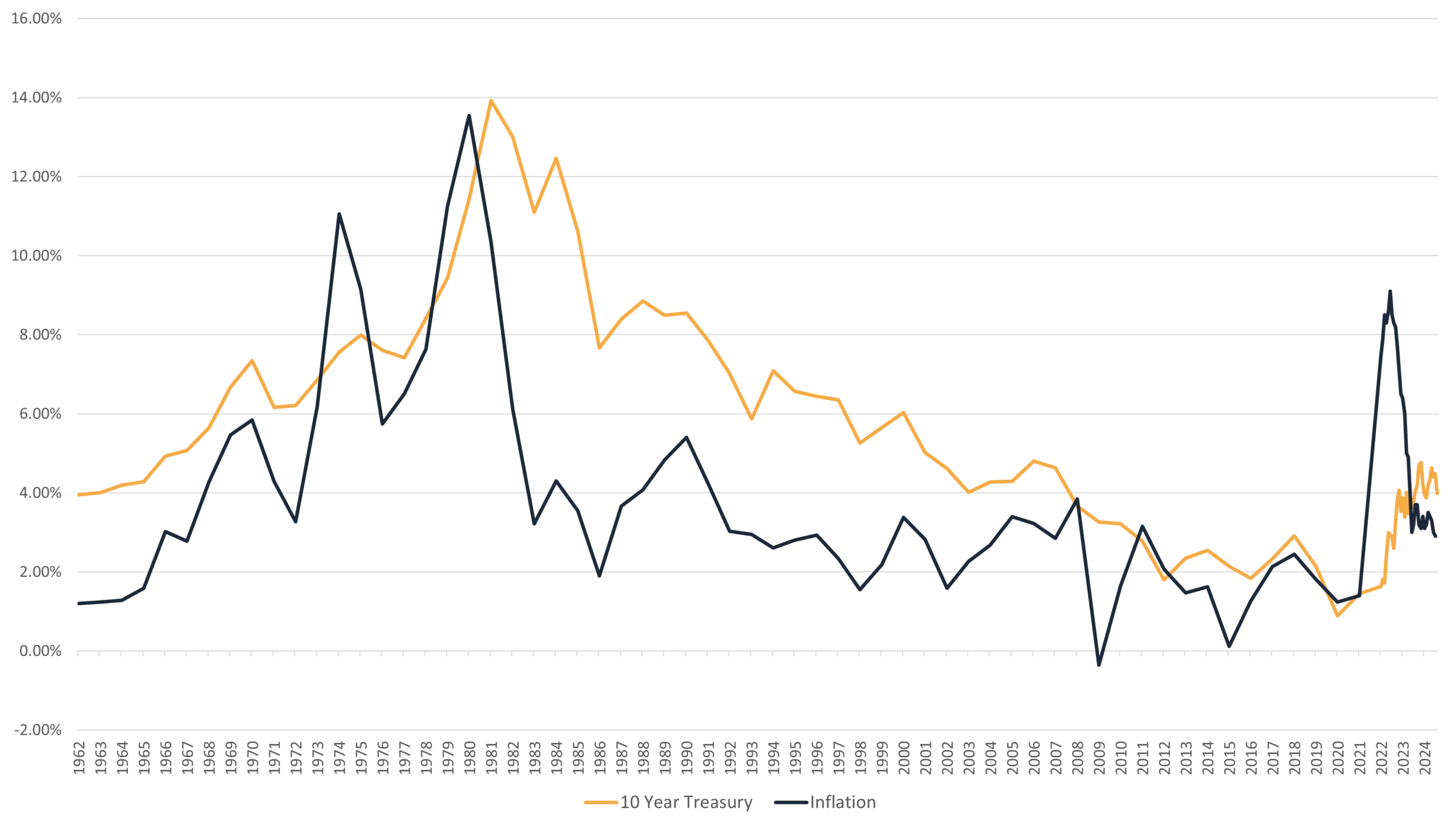

Inflation and the 10-Year Treasury Since 1962

Q2 2024 Medical Office Data Overview

| Healthcare Realty Trust (HR) | Healthpeak Properties Inc. (PEAK) | Ventas (VTR) | Welltower (WELL) | ||

| Ending Occupancy (Same Store) | 2024 | 89.40% | 92.20% | 91.40% | 94.30% |

| 2023 | 89.00% | 91.40% | 92.30% | 95.10% | |

| YoY Revenue Increase (Same Store) | 2024 | 1.1% | 2.7% | 3.3% | 1.9% |

| 2023 | 3.2% | 3.6% | 4.2% | 3.1% | |

| YoY Expense Increase (Same Store) | 2024 | -0.9% | 2.1% | 4.3% | 1.6% |

| 2023 | 5.3% | 5.8% | 5.1% | 2.7% | |

| YoY NOI Increase (Same Store) | 2024 | 2.3% | 3.1% | 2.8% | 2.1% |

| 2023 | 2.0% | 2.5% | 3.8% | 3.2% | |

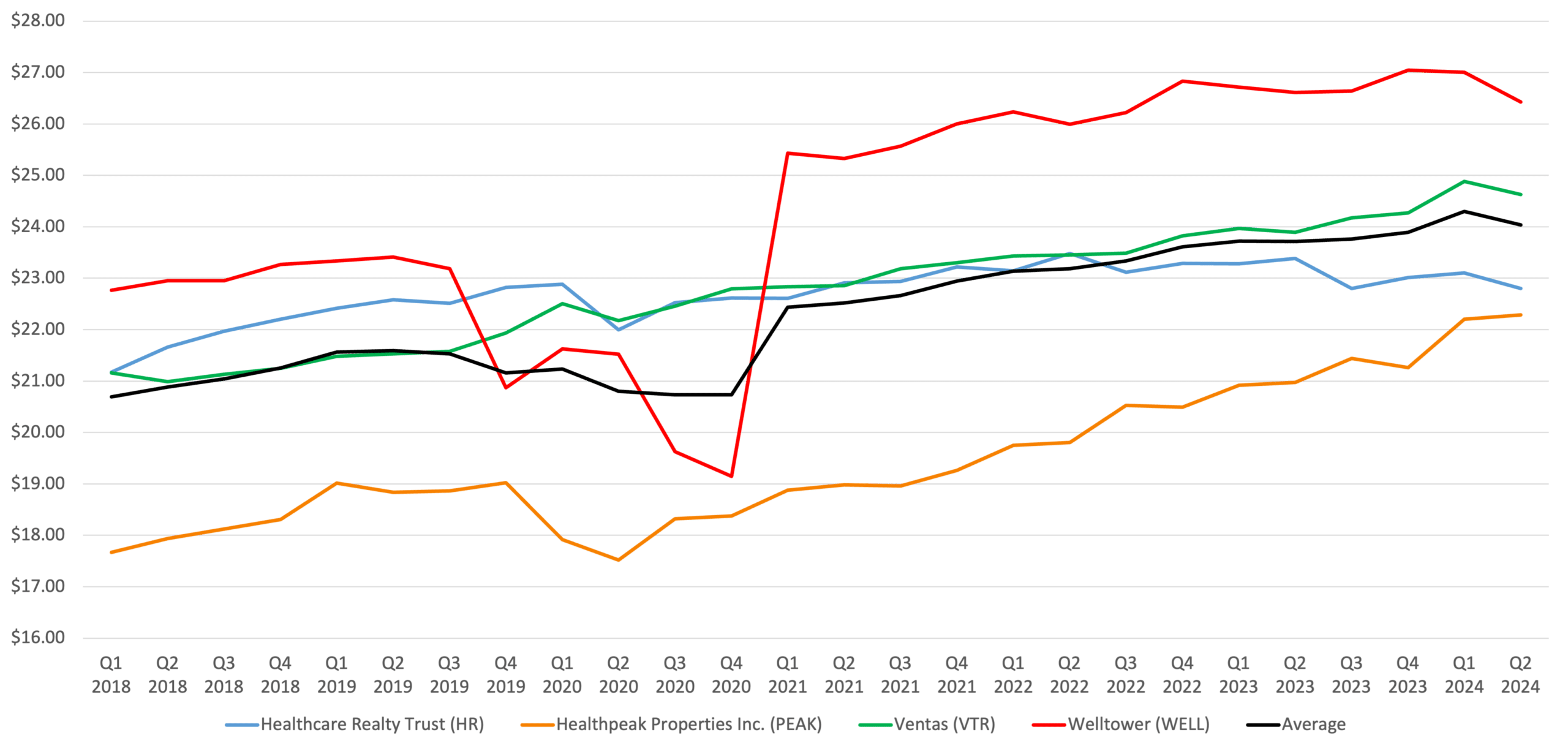

| NOI/Occupied SF (Same Store) | 2024 | $22.80 | $22.29 | $24.63 | $26.42 |

| 2023 | $23.38 | $20.97 | $23.90 | $26.61 | |

| Average Lease Term Remaining (Yrs) | 4.3 | 6.3 | 6.4 | 6.8 | |

| Average Building Size (SF) | 59,034 | 68,648 | 53,133 | 60,360 | |

| Q2 Medical Office Acquisitions | 0 | 0 | 0 | 1 | |

| Total Properties | 630 | 585 | 399 | 425 |

Q2 2024 Medical Office Operating Fundamentals

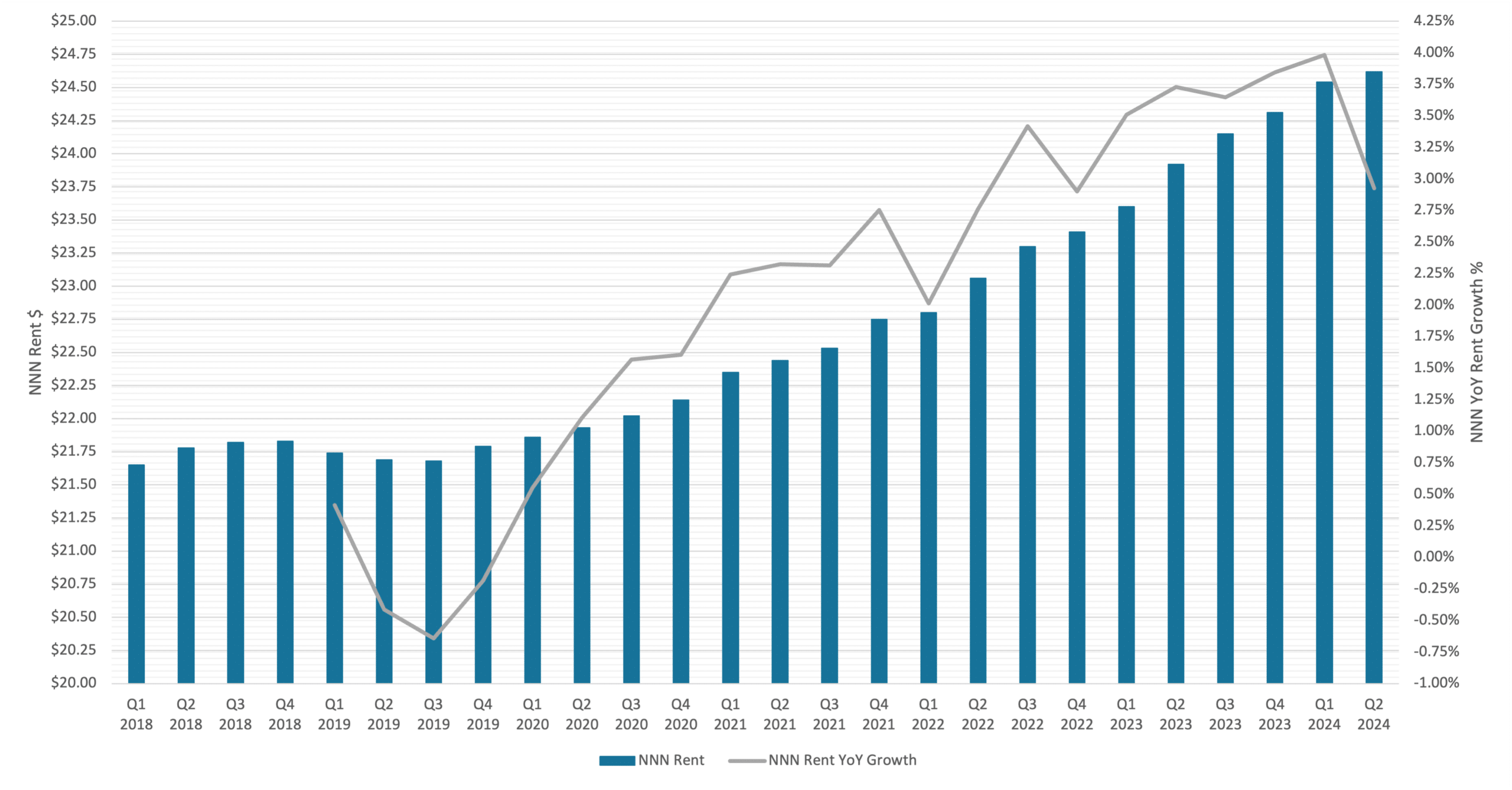

Medical Office Lease Rates

Leasing rates and lease terms remained robust across the healthcare REIT sector in Q2 2024, driven by consistent demand for medical office spaces and senior housing. Healthpeak Properties reported a 4.7% increase in rent on renewals for outpatient medical spaces and a 6.0% increase for lab leases. These increases reflect strong demand in high-growth sectors such as life sciences and outpatient medical services. Healthcare Realty Trust echoed this trend, signing over 400,000 square feet of new leases for the fourth consecutive quarter, with a 2.9% cash leasing spread. The stability in leasing rates and favorable terms across these REITs underscore the sector’s resilience and ability to negotiate effectively in a competitive market.

NOI/Occupied SF (Same Store)

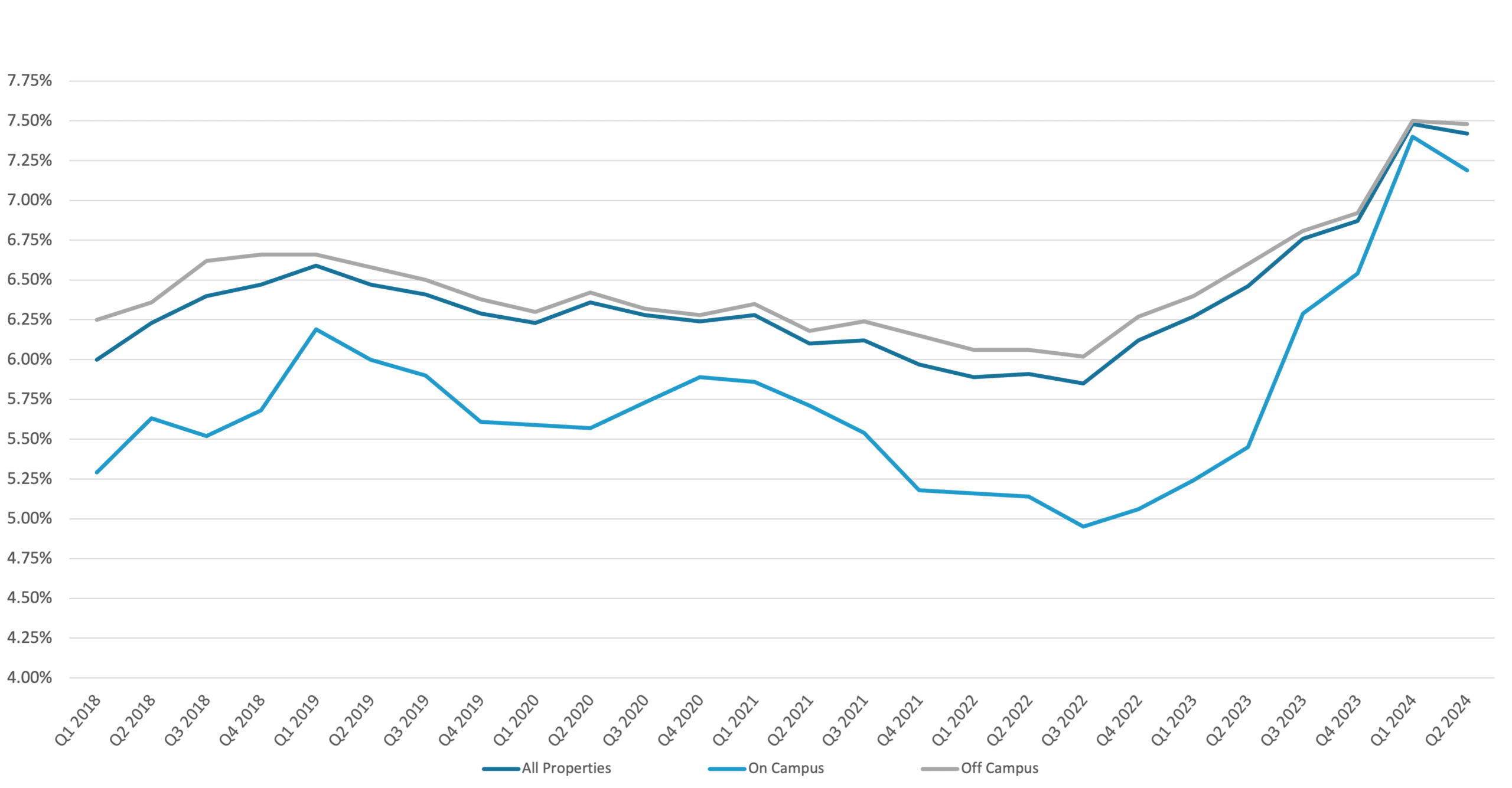

Top 100 MSA Medical Office Building NNN Rent

* Source: Revista

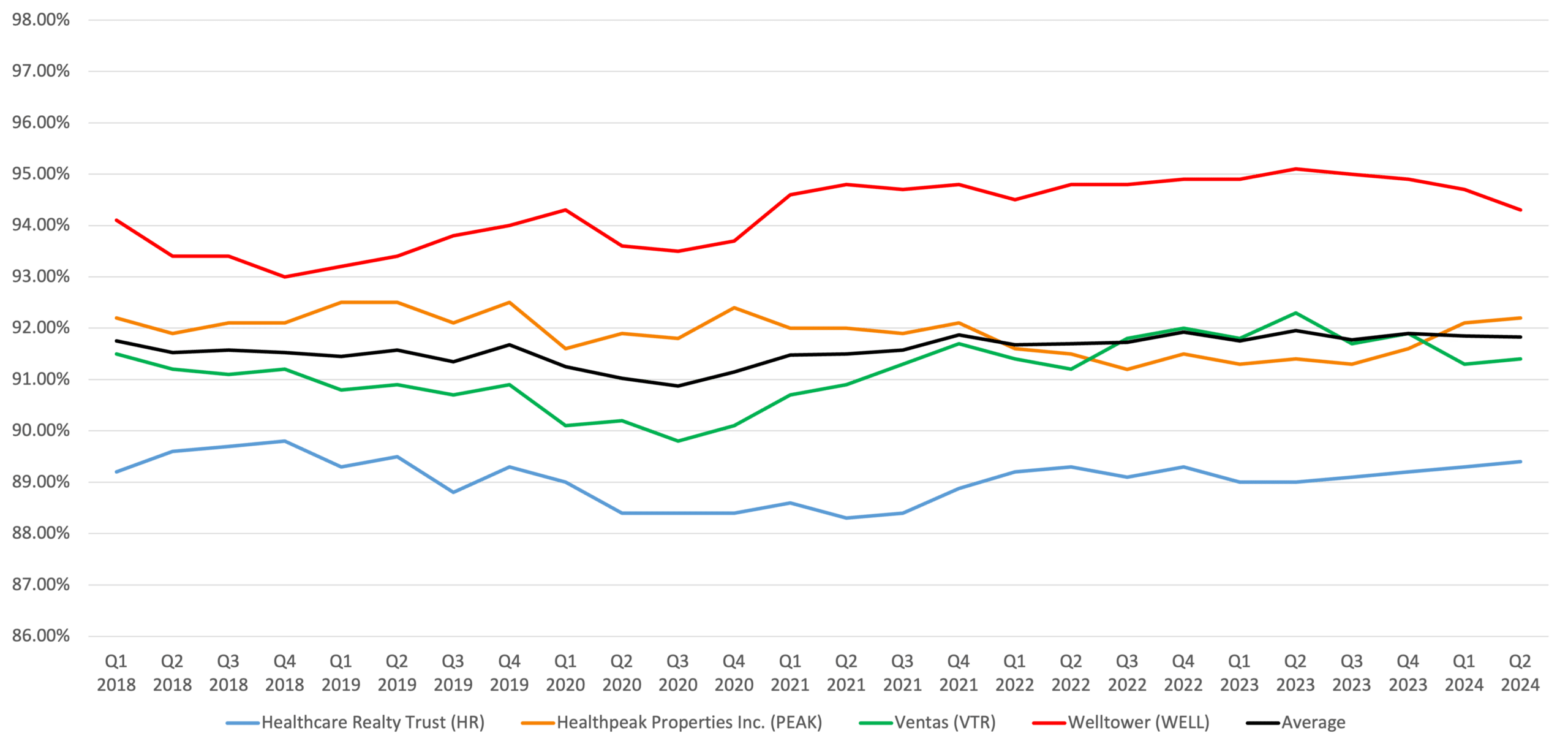

Medical Office Occupancy

Occupancy levels across healthcare REITs have remained strong, reflecting sustained demand for healthcare services. Welltower reported a slight decline in ending occupancy of 80 basis points in its MOB same store properties. Healthcare Realty Trust reported significant gains, with a 55 basis point increase in multi-tenant occupancy in the first half of 2024, marking the fourth consecutive quarter of growth. Healthpeak Properties maintained high occupancy across its medical office and life sciences segments, with key properties in strategic locations achieving over 95% occupancy. These figures highlight the strong demand for healthcare real estate, particularly in senior housing and medical office segments, which continue to benefit from favorable demographic trends.

Period Ending Occupancy (Same Store)

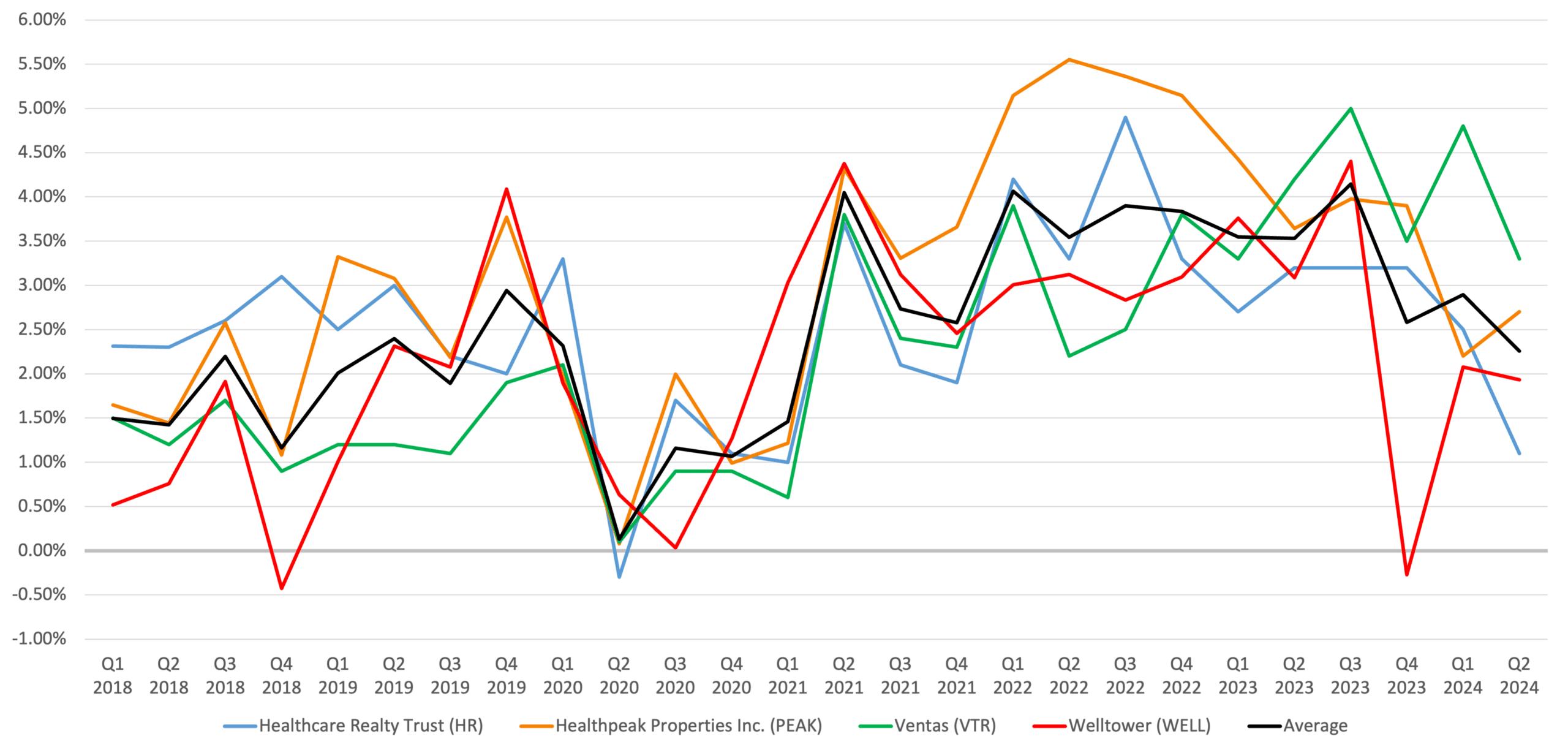

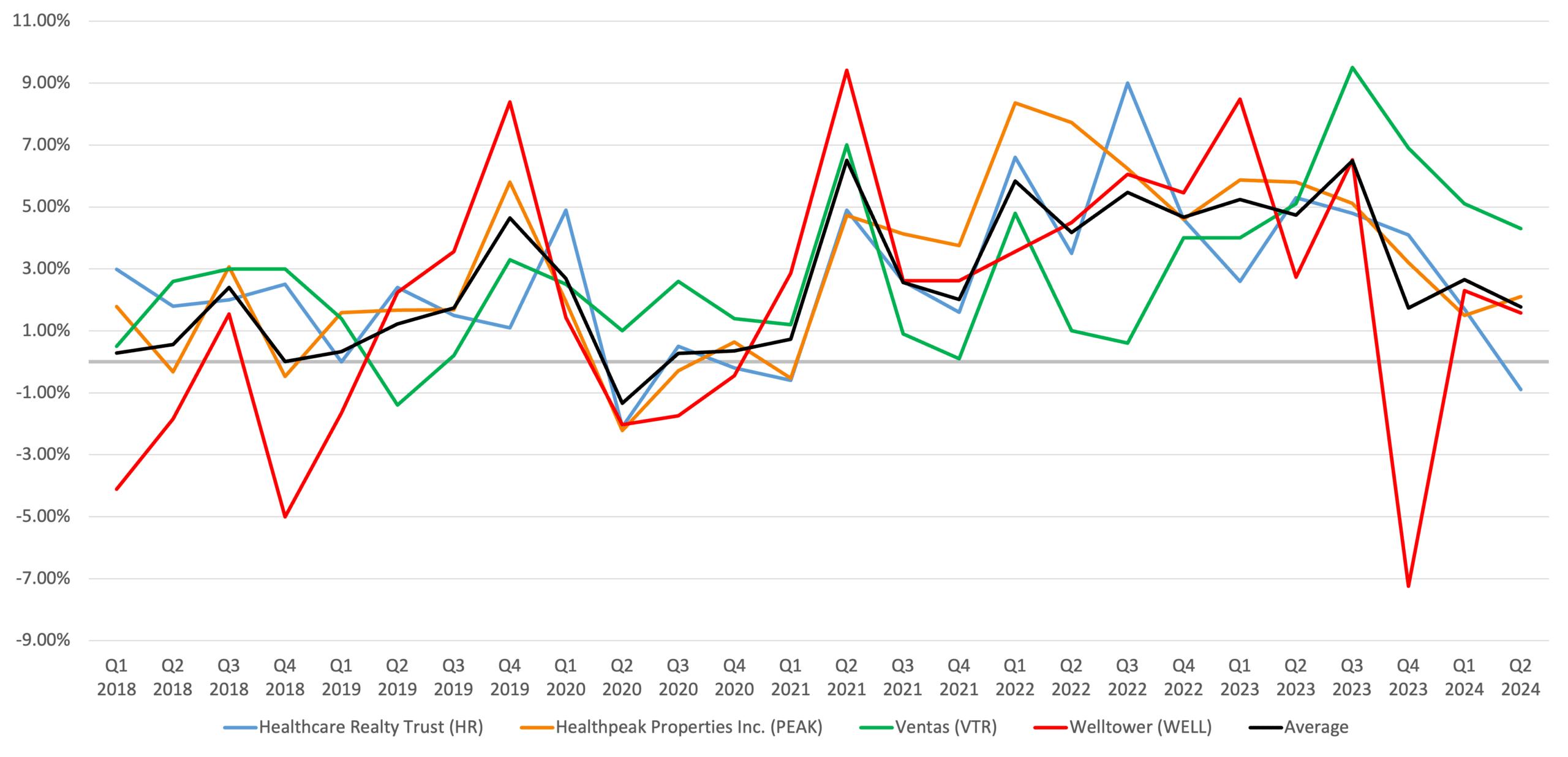

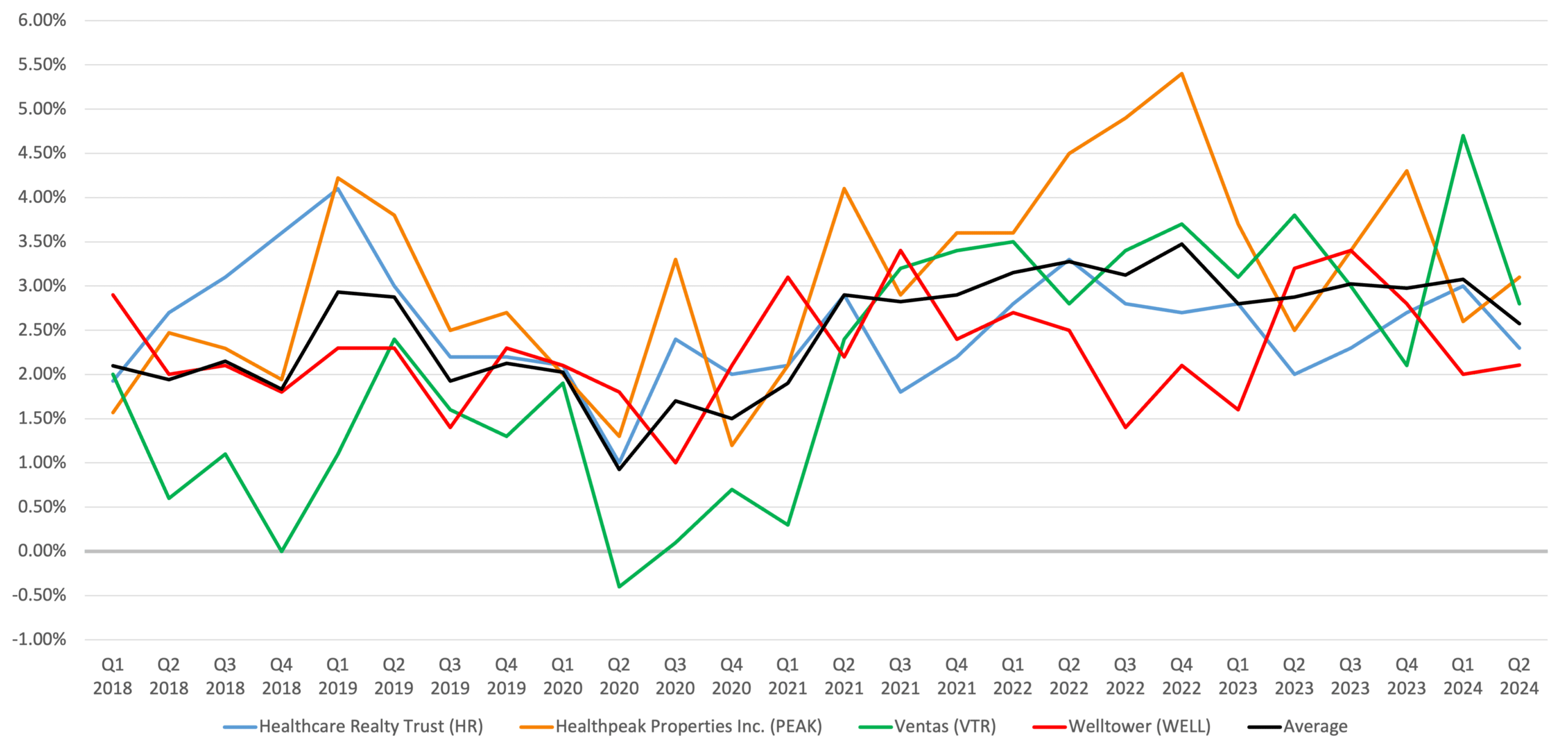

Medical Office Income & Expenses

Income growth was strong across the healthcare REIT sector, supported by higher occupancy and effective expense management. Healthpeak Properties reported a 3.1% year-over-year increase in same-store net operating income (NOI) for Q2 2024 on its medical office properties. This growth was achieved despite inflationary pressures, thanks to disciplined expense management and strategic rent escalations. Healthcare Realty Trust reported a 2.3% increase in same-store NOI, with multi-tenant properties seeing a 3.9% increase in NOI, largely due to strong occupancy gains and controlled expense growth below 2%. Welltower, benefiting from improved occupancy and operational efficiencies, also saw a significant boost in NOI, reflecting the sector’s ability to navigate rising costs while maintaining income growth.

YoY Revenue Growth (Same Store)

YoY Expense Growth (Same Store)

YoY NOI Growth (Same Store)

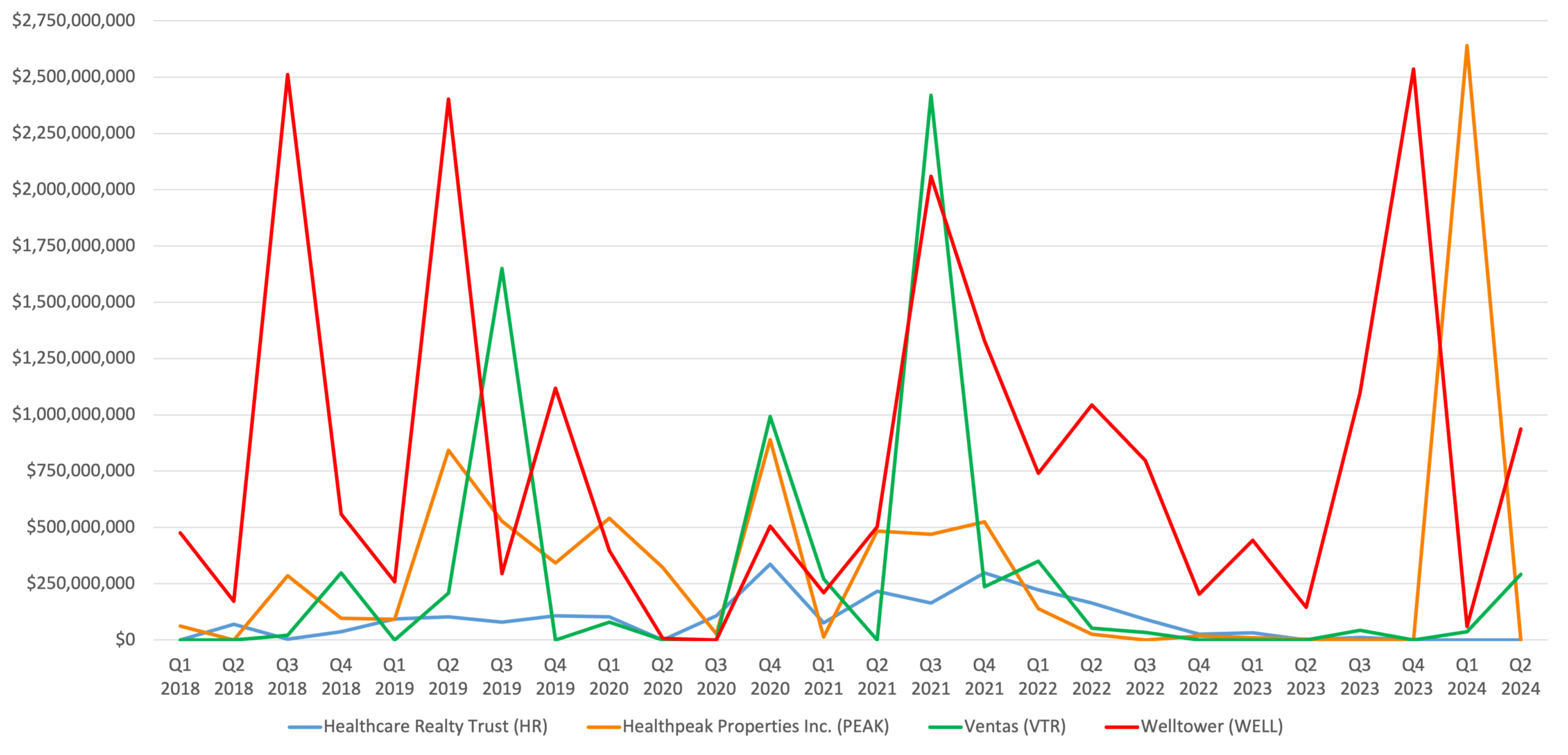

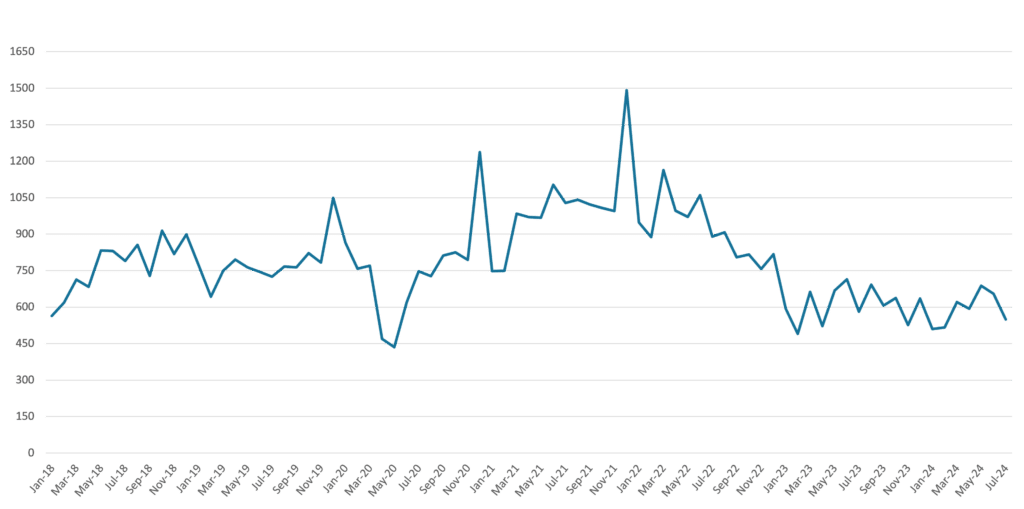

Medical Office Investment & Transaction Activity

Investment and transaction activity in the healthcare REIT sector has been strategic, with a focus on optimizing portfolios and capital deployment. Healthpeak Properties completed $853 million in outpatient medical sales during Q2 2024, achieving a blended cap rate of 6.5%, and closed $1.2 billion in year-to-date dispositions. The company also invested in two new outpatient medical developments with a total projected cost of $53 million, featuring pre-leasing rates of 84% and stabilized yields in the mid-7% range. Healthcare Realty Trust, meanwhile, focused on expanding joint ventures (JVs) with partners like KKR and Nuveen, contributing over $1 billion in proceeds from asset sales and JV contributions. Welltower concentrated on value-enhancing capital recycling, generating over $500 million in proceeds from asset sales, which were then redeployed into higher-yielding investments. These activities highlight a cautious but strategic approach to growth, with REITs focusing on high-quality assets in prime markets while navigating the challenges of a tighter financing environment.

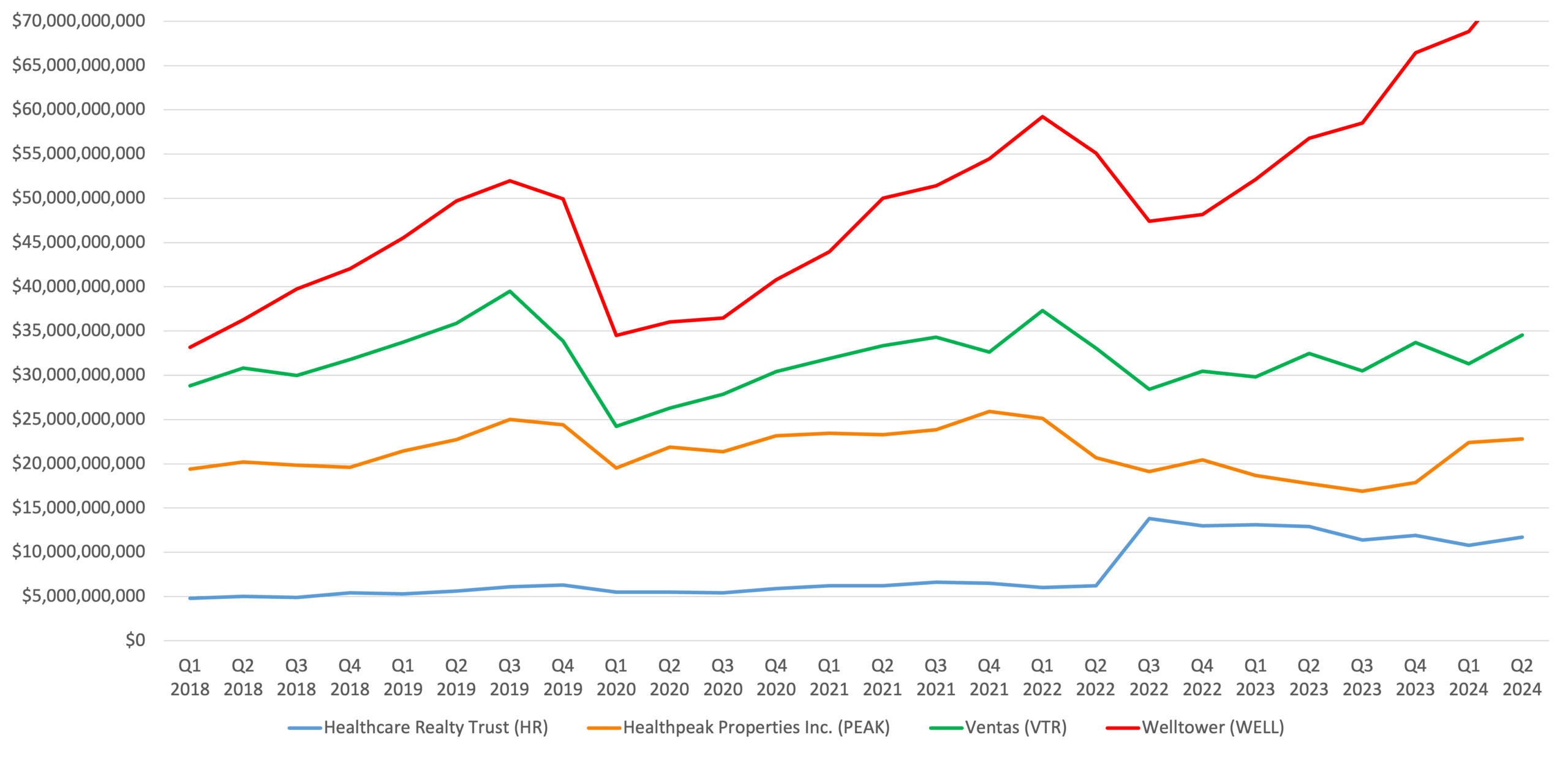

Acquisition Dollar Amount History

*Excludes Healthcare Realty Trust merger with Healthcare Trust of America, for $7.75 billion in Q2 2022

Medical Office Monthly Transactions 2018-2024

* Source: CoStar

Under Construction SF as a % of Starting Inventory

* Source: Revista

SF Delivered as a % of Starting Inventory

* Source: Revista

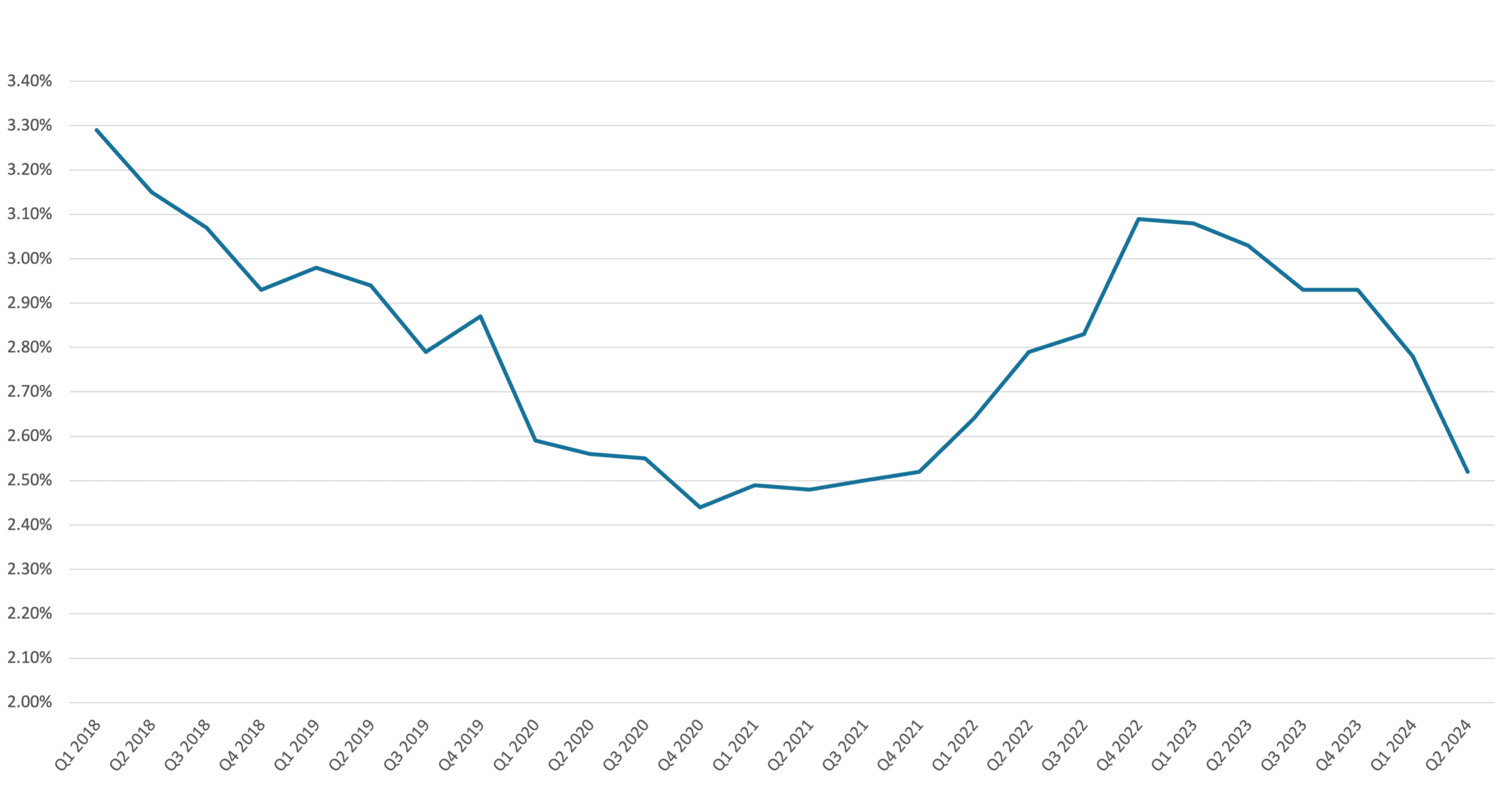

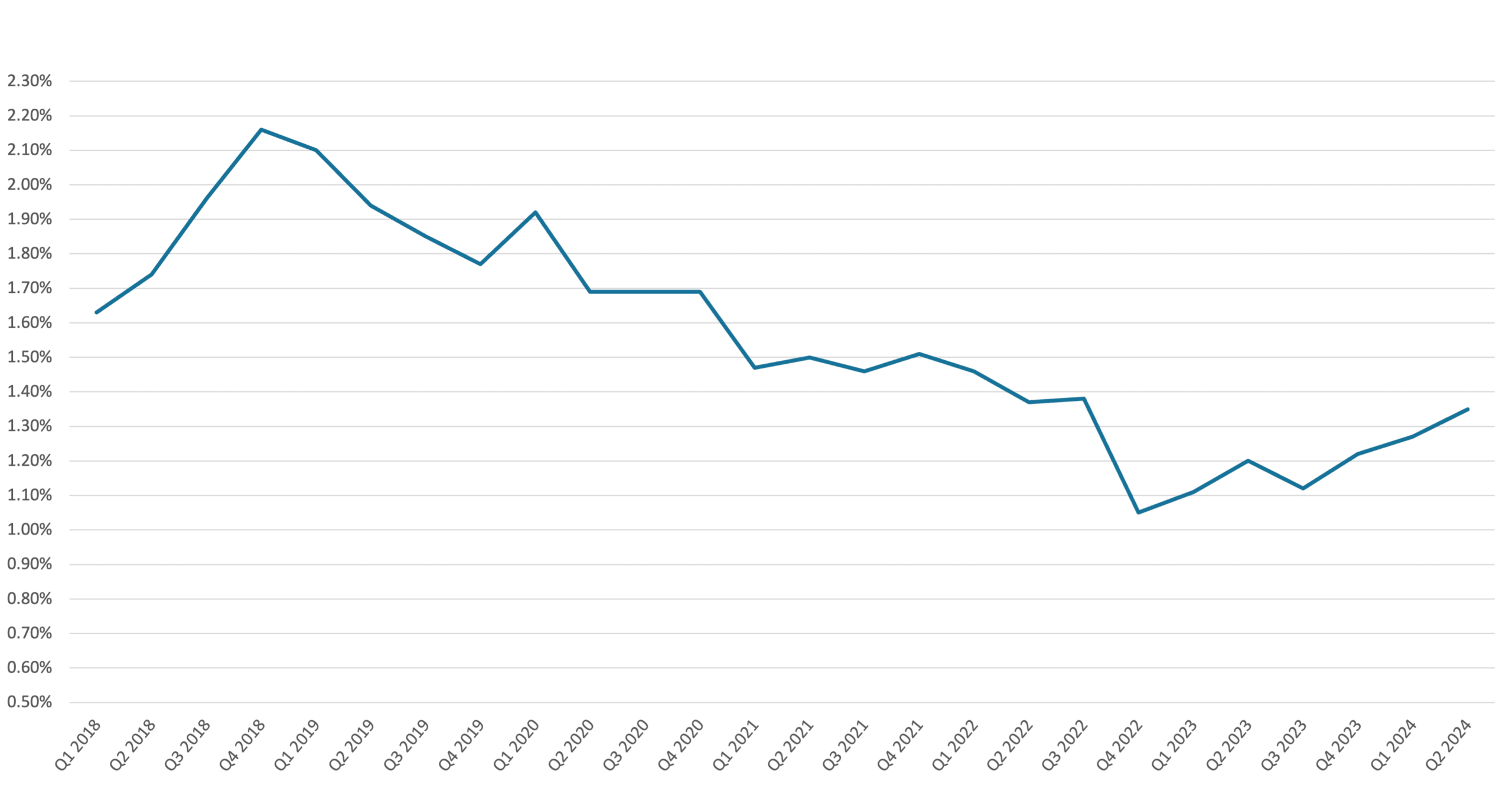

Medical Office Cap Rates & Bid-Ask Spread

The healthcare REIT sector has experienced challenges in the transaction market due to the widening bid-ask spread caused by rising interest rates. Healthpeak Properties reported that the spread between buyers and sellers has widened, complicating acquisition efforts and making it more difficult to achieve transactions at favorable cap rates. Despite these challenges, Healthpeak successfully executed dispositions with cap rates averaging 6.5%, balancing portfolio optimization with financial discipline. Healthcare Realty Trust noted similar difficulties, with a cap rate of approximately 6.6% for JV contributions and asset sales, but managed to maintain a strategic focus on acquisitions that align with long-term goals. Welltower also encountered a challenging cap rate environment but achieved favorable outcomes through selective acquisitions and disposals. These dynamics underscore the importance of strategic capital allocation and disciplined investment approaches in the current market.

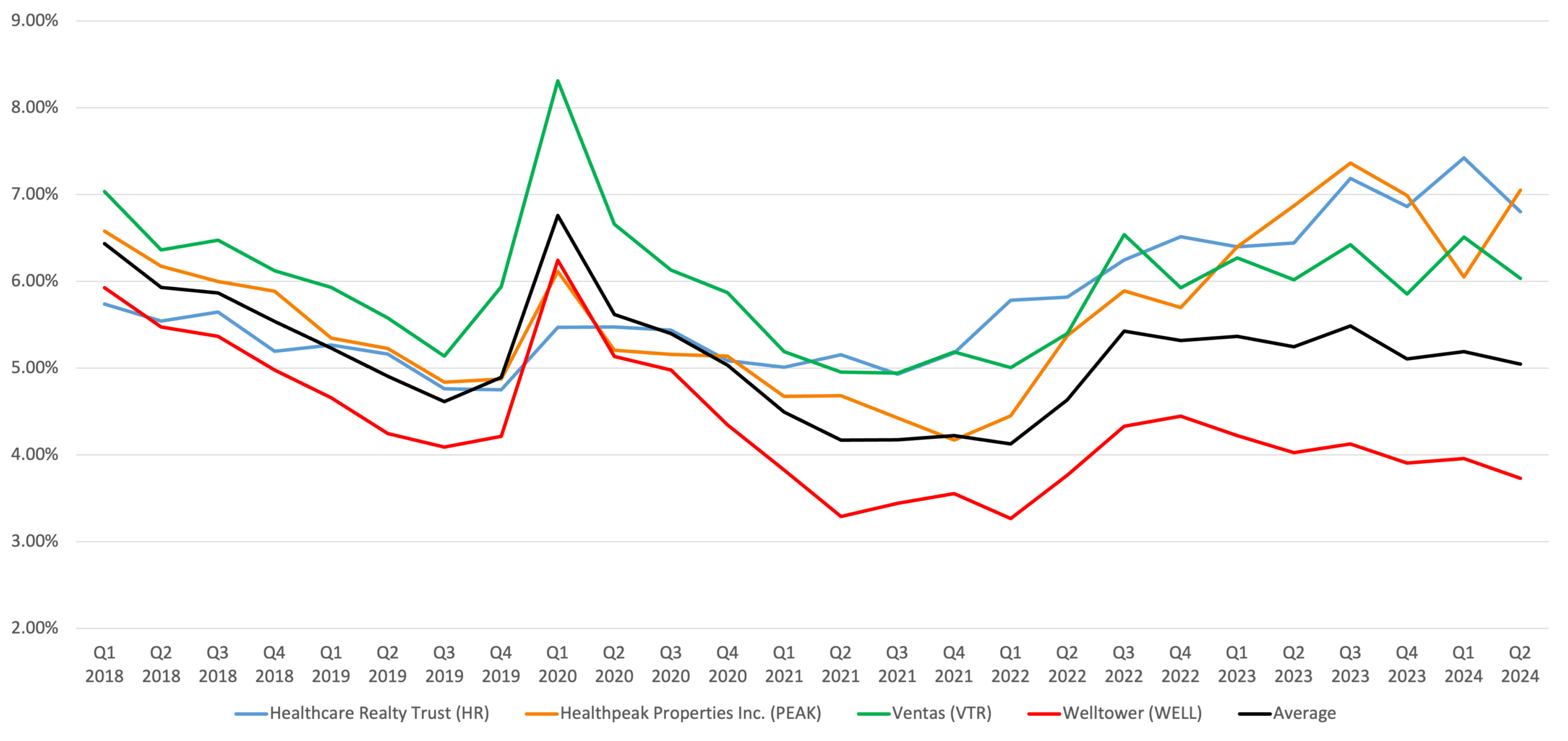

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Enterprise Value History

Top 100 MSA Medical Office Building TTM Cap Rate History

* Source: Revista

Headwinds in the Medical Office Market

Despite the positive outlook, the healthcare REIT sector faces significant headwinds, including rising interest rates, economic uncertainty, and potential regulatory changes. The Federal Reserve’s ongoing rate hikes have increased the cost of capital, making financing new acquisitions and developments more expensive and contributing to the widening bid-ask spread. Healthpeak Properties and Healthcare Realty Trust have both noted the challenges posed by higher interest rates, which have slowed transaction activity and increased the focus on capital efficiency. Additionally, the potential for changes in healthcare regulations, such as modifications to Medicare and Medicaid reimbursement rates, could impact tenant stability and leasing dynamics. Welltower has highlighted the need to maintain a strong balance sheet and operational flexibility to navigate these risks. These headwinds necessitate careful management and strategic planning to ensure continued growth and stability in the healthcare REIT sector.

Tailwinds in the Medical Office Market

The medical office market continues to benefit from several strong tailwinds, including favorable demographic trends and the shift toward outpatient care. The aging population, which is projected to increase by over 20 million people aged 65 and older by 2030, continues to drive demand for healthcare services, particularly in outpatient settings that are more cost-effective and convenient. Healthcare Realty Trust has capitalized on these trends by expanding its outpatient medical portfolio, with occupancy gains accelerating and retention rates improving to 85%. Healthpeak Properties is similarly positioned, with its focus on life sciences and outpatient medical properties aligning with growing demand. Welltower’s investments in outpatient care and senior housing also position it well to benefit from these demographic shifts. These tailwinds are expected to sustain long-term growth in the medical office market, supporting continued occupancy and rent increases.

Contributors

Steven Paul

Senior Financial Analyst

Robert King

Managing Director

David Kuper

Vice President