Q3 Manufactured Housing REIT Highlights

- Rental Rates and Home Affordability: ELS reported a 5% average rent increase for 2025 in manufactured housing and a 5.5% increase for RV annual leases. The average price of a new home in its communities remains 75% less than comparable site-built homes, ensuring affordability.

- Occupancy Strength: ELS maintained a 95% occupancy rate across its MH portfolio, with key markets like Florida, California, and Arizona performing above 97%, supporting steady cash flows.

- Income and Operational Efficiency: ELS achieved a 6.2% year-over-year increase in core rental income, with utility recovery rates improving by 200 basis points, highlighting effective cost management.

- Rental Rates and Growth: SUI announced 2025 rent increases averaging 5.2% for manufactured housing, 5.1% for annual RV leases, and 3.7% for marinas and UK properties, showcasing stable growth across its portfolio.

- Occupancy and Site Conversions: The company converted 900 transient RV sites to annual leases in Q3 2024, making up 85% of revenue-producing site gains year-to-date and contributing to reliable income streams.

- Debt and Asset Management: SUI sold eight non-core MH communities and two land parcels for $392 million year-to-date, reducing its total debt by $450 million while strengthening its balance sheet.

- Rental Growth and Portfolio Expansion: UMH achieved 5% annual rent growth and added 443 rental homes in 2024, with plans to develop 800 new homes in 2025, fueling steady income growth.

- Occupancy Gains: Occupancy rose by 120 basis points to 87.4% year-over-year, supported by its infill strategy and the deployment of new rental homes in high-demand regions.

- Investments and Diversification: UMH expanded its self-storage footprint with over 1,000 units adjacent to its communities and launched a solar shingle pilot program, driving diversified revenue streams and sustainability.

Thoughts from the CEO's

Equity Lifestyle Properties

Marguerite M. Nader

President, Chief Executive Officer & Director

- “Our RV annual revenue continues to show strength with growth of 6.9% year-to-date. The attractive price point of the vacation cottage product at our properties drives a stable annual revenue base. Our digital marketing efforts and partnerships have expanded our reach, helping us connect with target customers across the U.S. and Canada, ensuring sustained growth in our communities.”

Sun Communities

Gary A. Shiffman

Chairman, Chief Executive Officer, and President

- “The business fundamentals of our portfolio remain strong, and we are confident that by continuing to execute on our strategic priorities, the company will be positioned for growth, thereby demonstrating the long-term value of our assets.”

UMH Properties

Samuel A. Landy

President & Chief Executive

Officer

- “Our communities continue to experience strong demand for homes, driving occupancy growth and increasing revenue. With 800 new rental homes planned for 2025, we are focused on leveraging our existing vacant sites and expanding our development pipeline to meet the growing need for high-quality affordable housing. This positions us for sustainable internal growth while remaining prepared for strategic acquisitions.”

Macroeconomic Highlights

Recession Fears and Economic Outlook:

Economic uncertainty continues to weigh heavily on sentiment as the U.S. economy faces growing concerns about a potential recession. While GDP growth remained positive in Q3, the Federal Reserve’s aggressive interest rate hikes aimed at reining in inflation have sparked fears of a slowdown. Consumer spending, a key driver of economic activity, has shown resilience but is expected to decelerate as excess pandemic-era savings are depleted and borrowing costs rise. The labor market, while still robust, is beginning to show signs of strain, with an uptick in delinquencies among subprime borrowers and the resumption of federal student loan payments adding further pressure to household budgets. Despite these headwinds, pockets of optimism persist, driven by continued investment in infrastructure and technology sectors.

Geopolitical Tensions and Their Impact on CRE:

The commercial real estate (CRE) market is navigating the ripple effects of recent geopolitical tensions and evolving federal policies following the U.S. presidential election. With shifts in corporate tax structures, environmental mandates, and infrastructure spending, investors are closely monitoring policy changes that could significantly impact industrial, office, and multifamily real estate. Stricter regulations and potential tax increases have prompted stakeholders to reassess long-term strategies.

Moreover, Federal Reserve interest rate policies and economic stimulus measures remain critical factors influencing CRE investment decisions. These dynamics contributed to a cautious market in Q3, with transaction activity slowing as participants adjusted to the post-election policy landscape and its implications for 2025 and beyond.

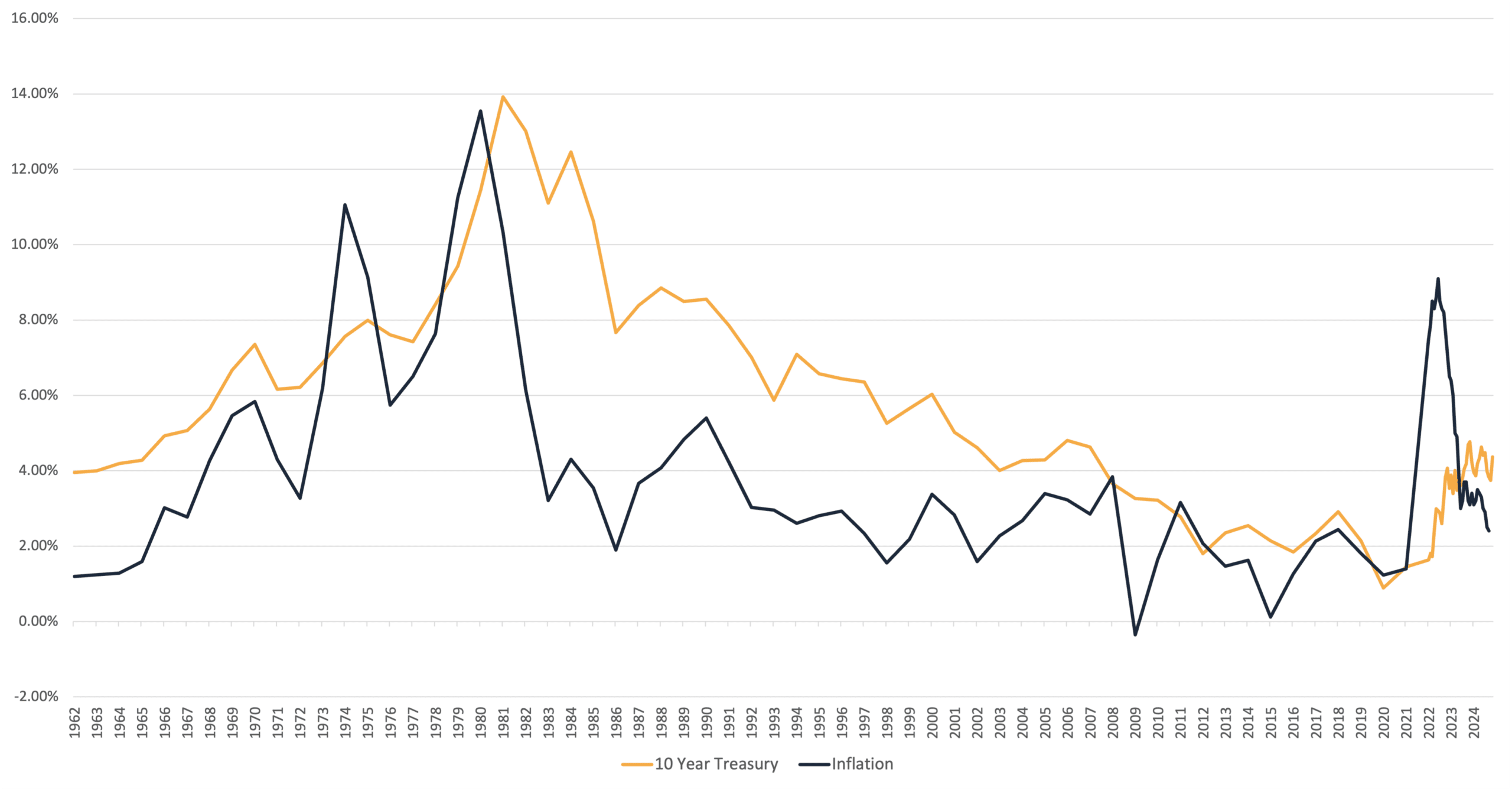

Inflation and the 10-year Treasury Since 1962

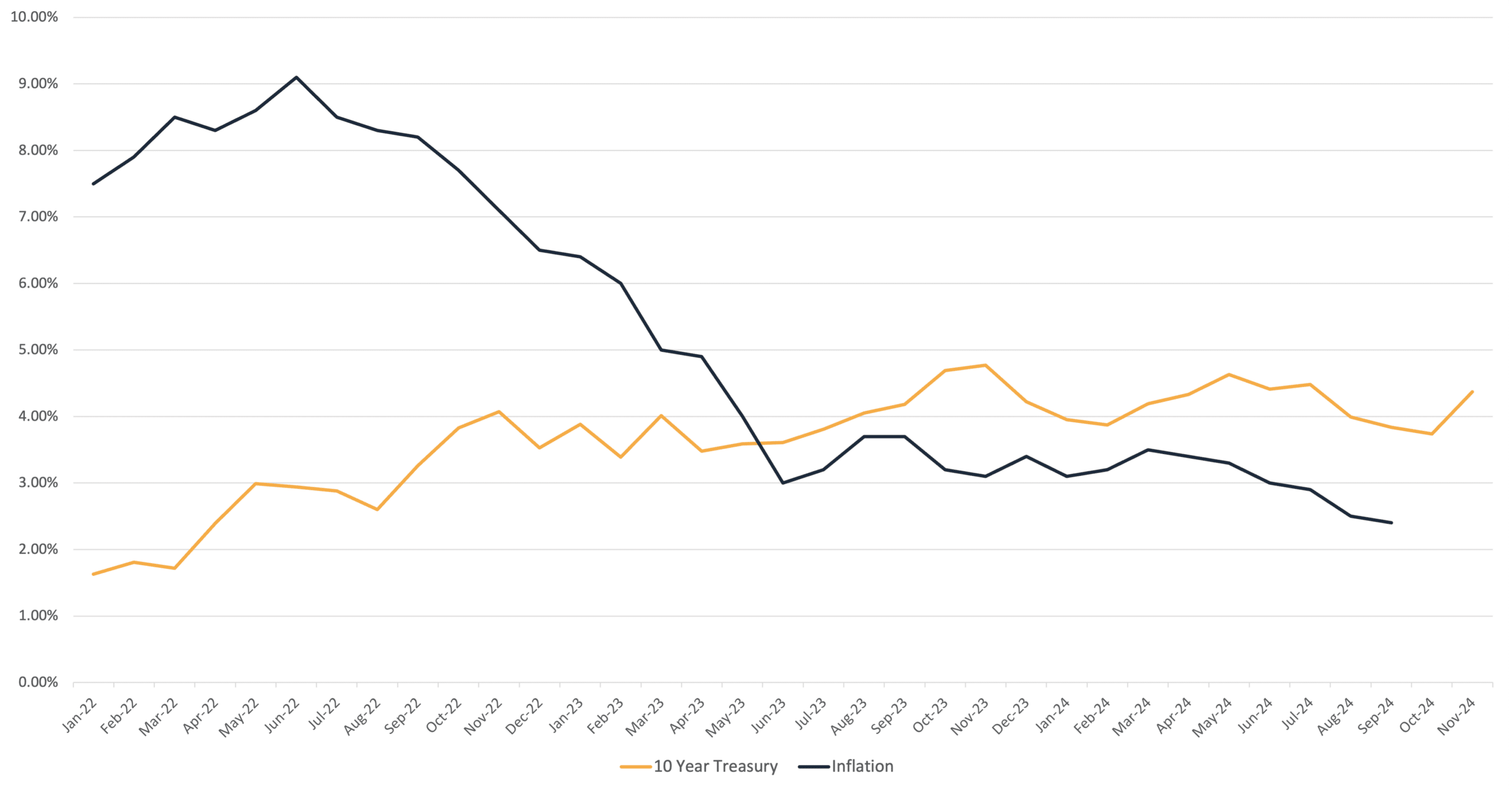

Inflation and the 10-year Treasury Since 2022

Q3 2024 Manufactured Housing REIT Data Overview

| Equity Lifestyle Properties (ELS) | Sun Communities (SUI) | UMH Properties (UMH) | |||||

| Ending Occupancy (Same Store) | 2024 | 95.00% | 97.30% | 87.70% | |||

| 2023 | 94.90% | 97.00% | 88.40% | ||||

| YoY MH Rental Income Increase (Same Store) | 2024 | 6.2% | 6.5% | 7.7% | |||

| 2023 | 6.8% | 7.3% | 10.0% | ||||

| YoY MH Expense Increase (Same Store) | 2024 | 2.8% | 9.2% | 8.1% | |||

| 2023 | 5.1% | 5.7% | 6.0% | ||||

| YoY MH NOI Increase (Same Store) | 2024 | 5.8% | 5.3% | 7.4% | |||

| 2023 | 4.4% | 8.0% | 12.9% | ||||

| Rent Per Site (Same Store) | 2024 | $861 | $701 | $537 | |||

| 2023 | $813 | $661 | $519 | ||||

| Q3 MH Acquisitions | 0 | 0 | 0 | ||||

| Total MH Sites | 73,002 | 97,300 | 25,826 | ||||

Q3 2024 Manufactured Housing Operating Fundamentals

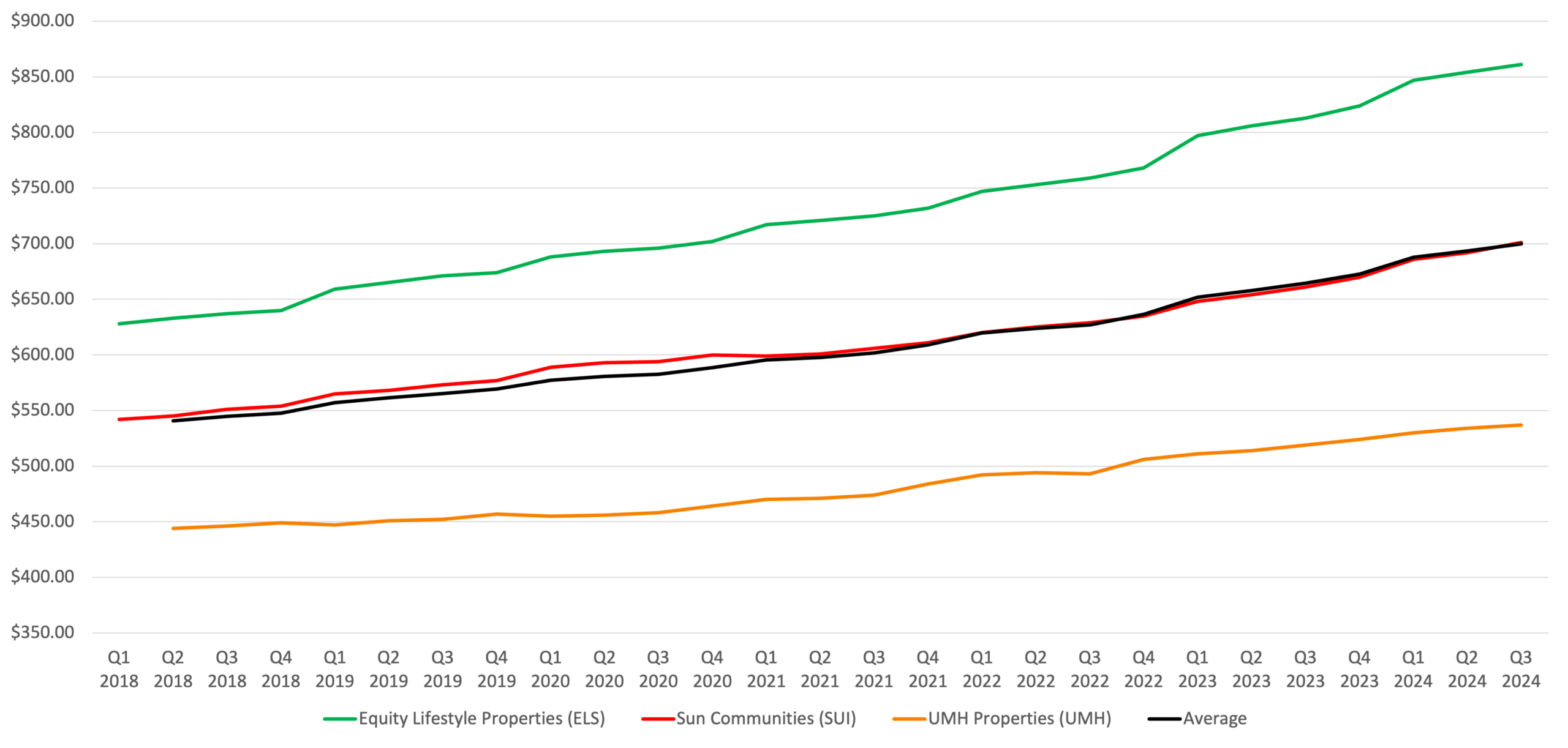

Manufactured Housing Rental Rates

Manufactured housing REITs have demonstrated strong rental rate growth across their portfolios, supported by high demand for affordable housing and constrained supply. Equity LifeStyle Properties (ELS) announced a 5% average rent increase for manufactured housing (MH) residents for 2025, with RV annual rents increasing by 5.5%. Over 50% of ELS residents have already received notices for 2025 rent adjustments, maintaining a consistent history of incremental rate hikes. Sun Communities (SUI) expects similar rent growth, with 2025 increases projected at 5.2% for MH and 5.1% for annual RV leases. UMH Properties echoed this trend, reporting 5% annual rent growth, driven by sustained occupancy gains and enhanced property upgrades. Across the board, manufactured housing REITs are balancing rent increases with affordability. For example, ELS highlighted that the average price of a new home within its communities is approximately $90,000—75% less than a comparable site-built home—ensuring that rents remain manageable even as they increase. This pricing dynamic continues to support steady tenant retention and predictable revenue streams.

Rent per Site (Same Store)

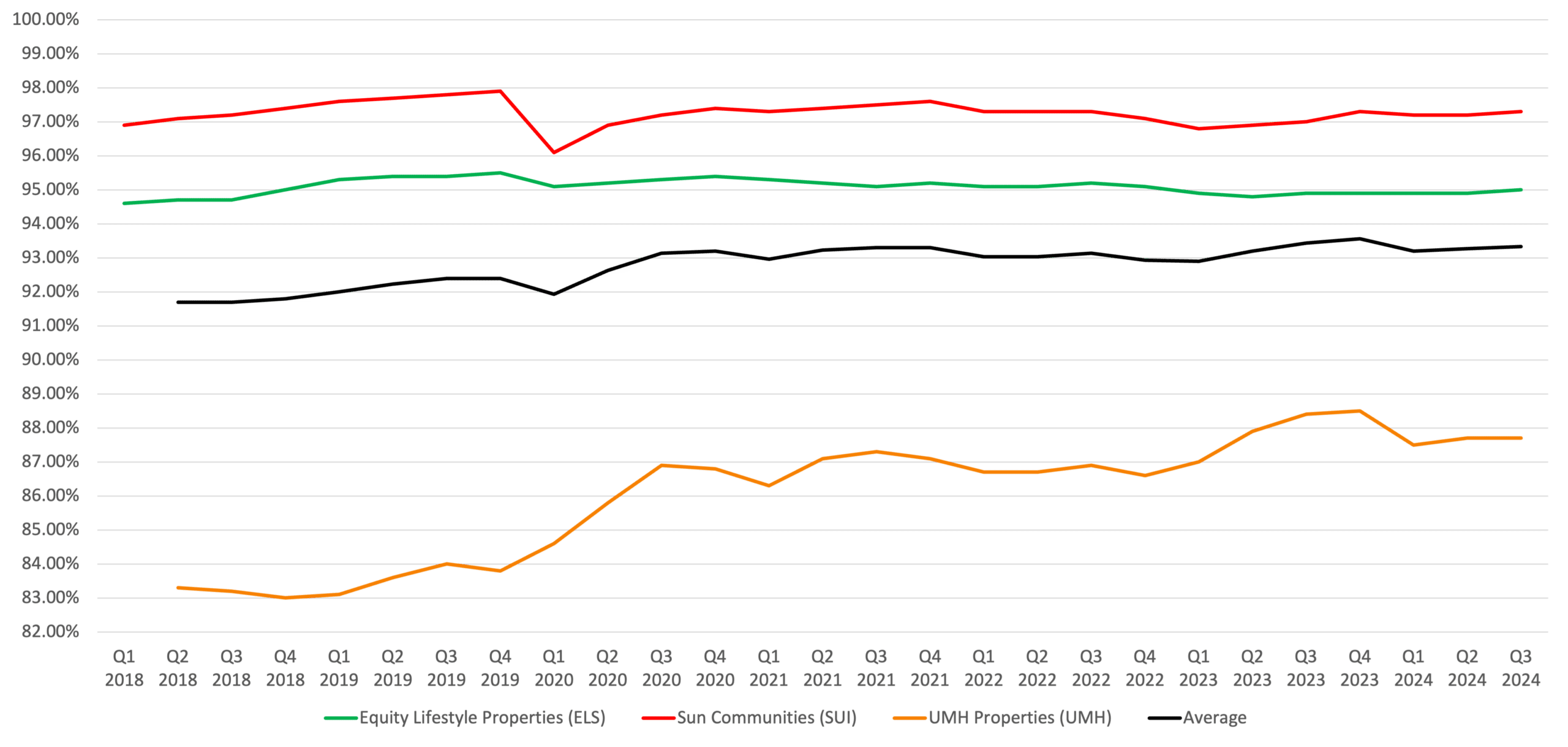

Manufactured Housing Occupancy

Occupancy across manufactured housing portfolios remains robust, driven by consistent demand and the stability of long-term lease structures. ELS maintained an occupancy rate of 95% in its MH portfolio, with regions like Florida, California, and Arizona performing above average at 97%. These three states alone account for approximately 70% of ELS’s MH revenue, demonstrating the strategic importance of Sunbelt markets. UMH Properties saw a period ending occupancy on same store properties at 87.7%, supported by its ongoing infill strategy. In 2024, UMH converted 443 homes from inventory to revenue-producing rentals and expects to add 800 new rental homes in 2025. SUI’s RV annualization efforts further enhanced occupancy, with 900 transient RV sites converted to annual leases in Q3 alone, making up 85% of new revenue-producing sites for the year. While occupancy remains strong overall, localized challenges persist in some Sunbelt regions due to increased supply and competition, particularly in the transient RV space. However, these impacts are mitigated by robust demand for affordable housing and the increasing preference for long-term leases.

Period Ending Occupancy (Same Store)

Manufactured Housing Income & Expenses

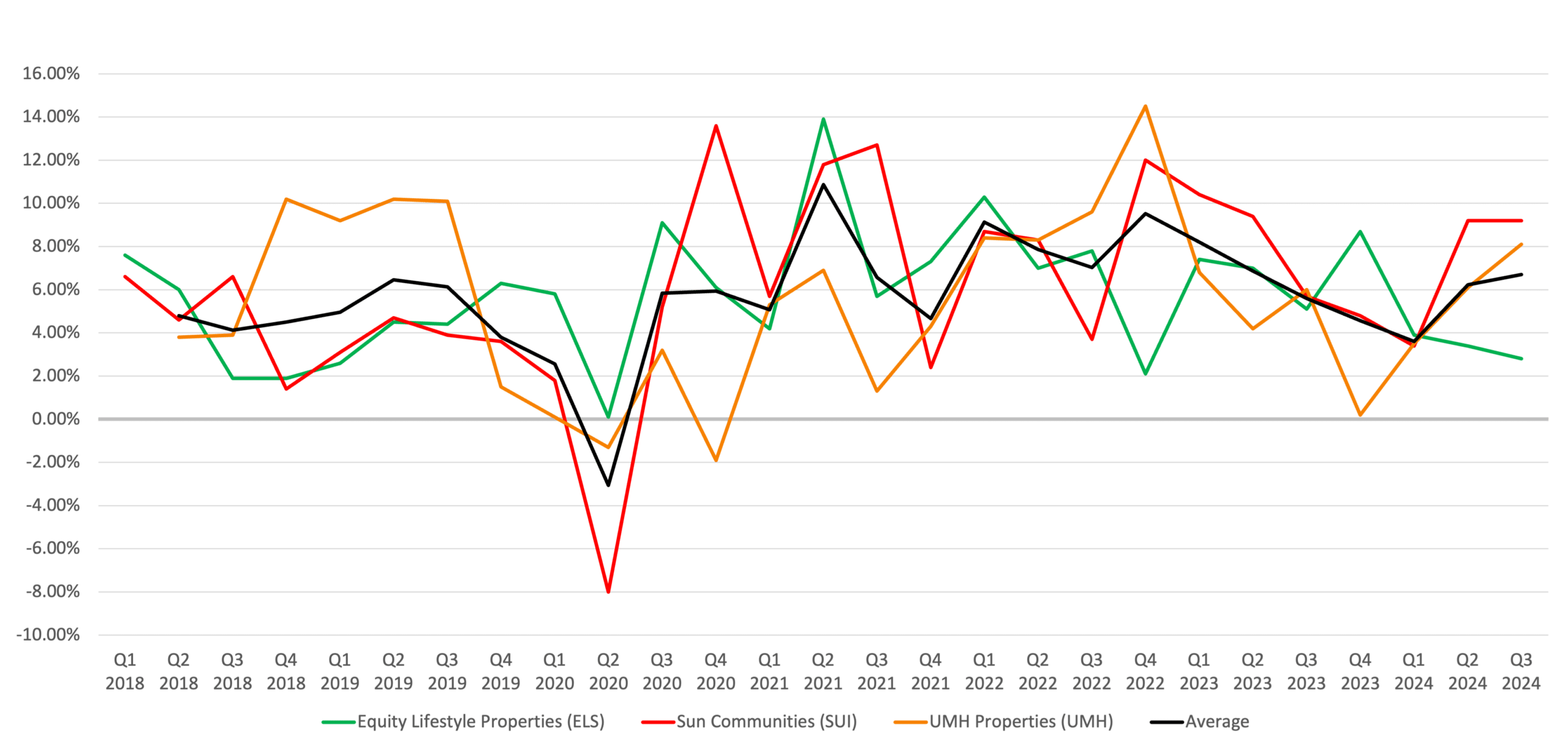

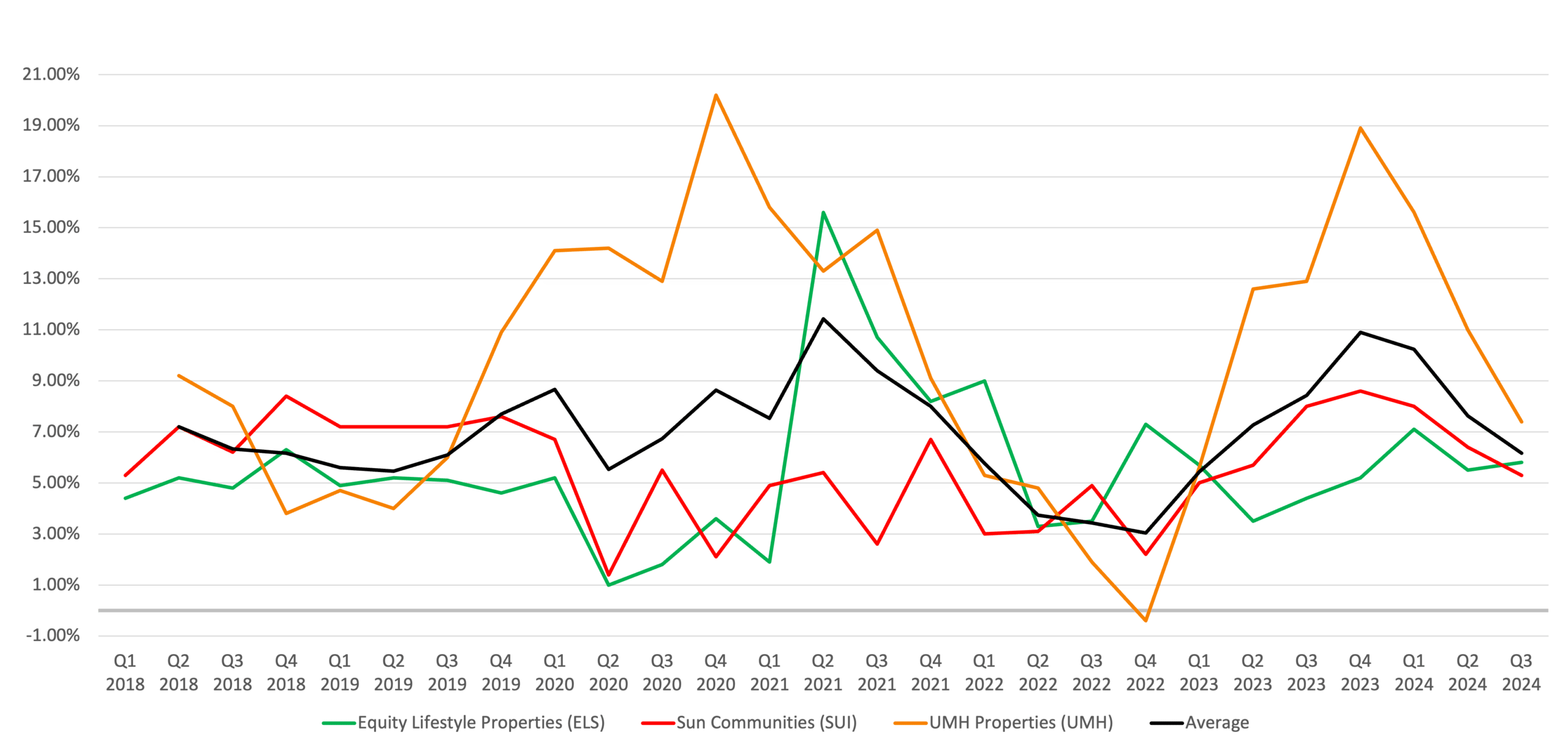

Income growth across manufactured housing REITs has been strong, but rising expenses—especially in property taxes, utilities, and repairs—pose challenges to operating margins. ELS reported NOI growth of 5.8% in Q3 2024, driven by a 6.2% increase in core community-based rental income. The company achieved this growth through strategic rent escalations and market-rate adjustments upon turnover, which averaged a 13% increase compared to previous tenant rents. Core utility income recovery improved to 46.7% in 2024, a 200-basis-point increase year-over-year, highlighting operational efficiencies. SUI’s MH segment also performed well, with same-property NOI growth of 5.3% in Q3, supported by annual rent growth and site conversions. However, elevated expenses—particularly in utilities and repairs—reduced its overall NOI growth. Similarly, UMH saw a same-property NOI increase of 7.4% in Q3, bolstered by rental rate growth and occupancy gains, despite rising payroll and storm cleanup costs. Across the board, cost-saving initiatives have partially offset inflationary pressures. For example, SUI implemented strategies to reduce reliance on third-party vendors for landscaping and maintenance, while UMH achieved efficiencies through scalable rental home deployment, yielding approximately 10% annual returns on capital invested in new homes.

YoY Rental Income Growth (Same Store)

YoY Expense Growth (Same Store)

YoY NOI Growth (Same Store)

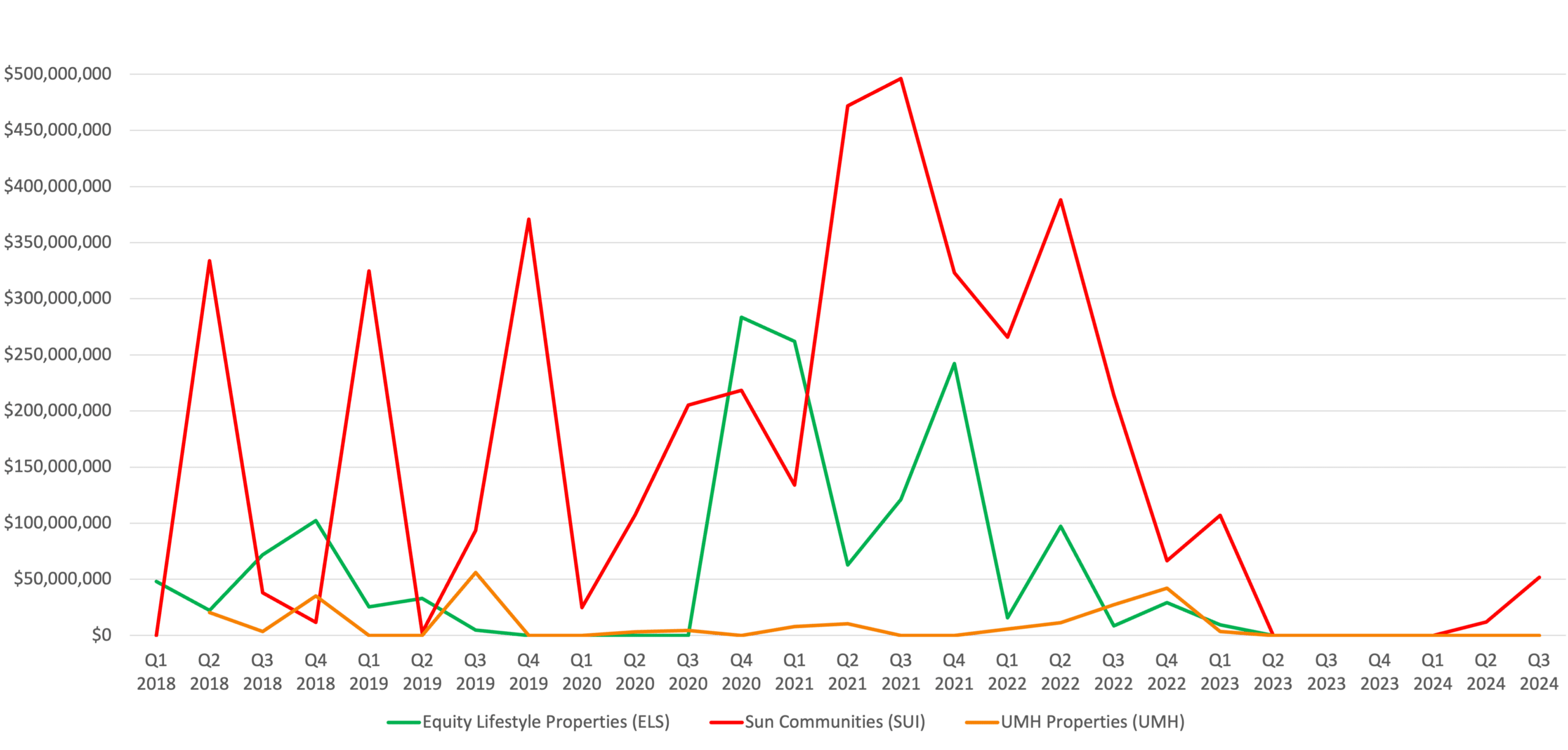

Manufactured Housing Investment & Transaction Activity

Investment activity has been robust, with manufactured housing REITs actively pursuing acquisitions and expansions in high-demand markets. ELS expanded its development pipeline with 1,500 new MH sites planned in Florida, capitalizing on the state’s high net migration and population growth. SUI sold eight non-core MH communities for $300 million in 2024, recycling capital into higher-quality acquisitions and site conversions. The company also reduced its debt by $450 million, further enhancing its financial flexibility. UMH added 443 rental homes to its portfolio in 2024 and has 300 more in various stages of setup, with plans to develop 300-400 new sites annually. UMH also announced a joint venture with a homebuilder to develop 131 acres in Vineland, New Jersey, potentially yielding 150 high-value homes. Beyond housing, UMH is expanding its self-storage footprint, now owning over 1,000 storage units adjacent to its communities, creating additional revenue streams while enhancing resident services. These investments demonstrate the REITs’ strategic focus on strengthening portfolio quality and addressing long-term housing demand.

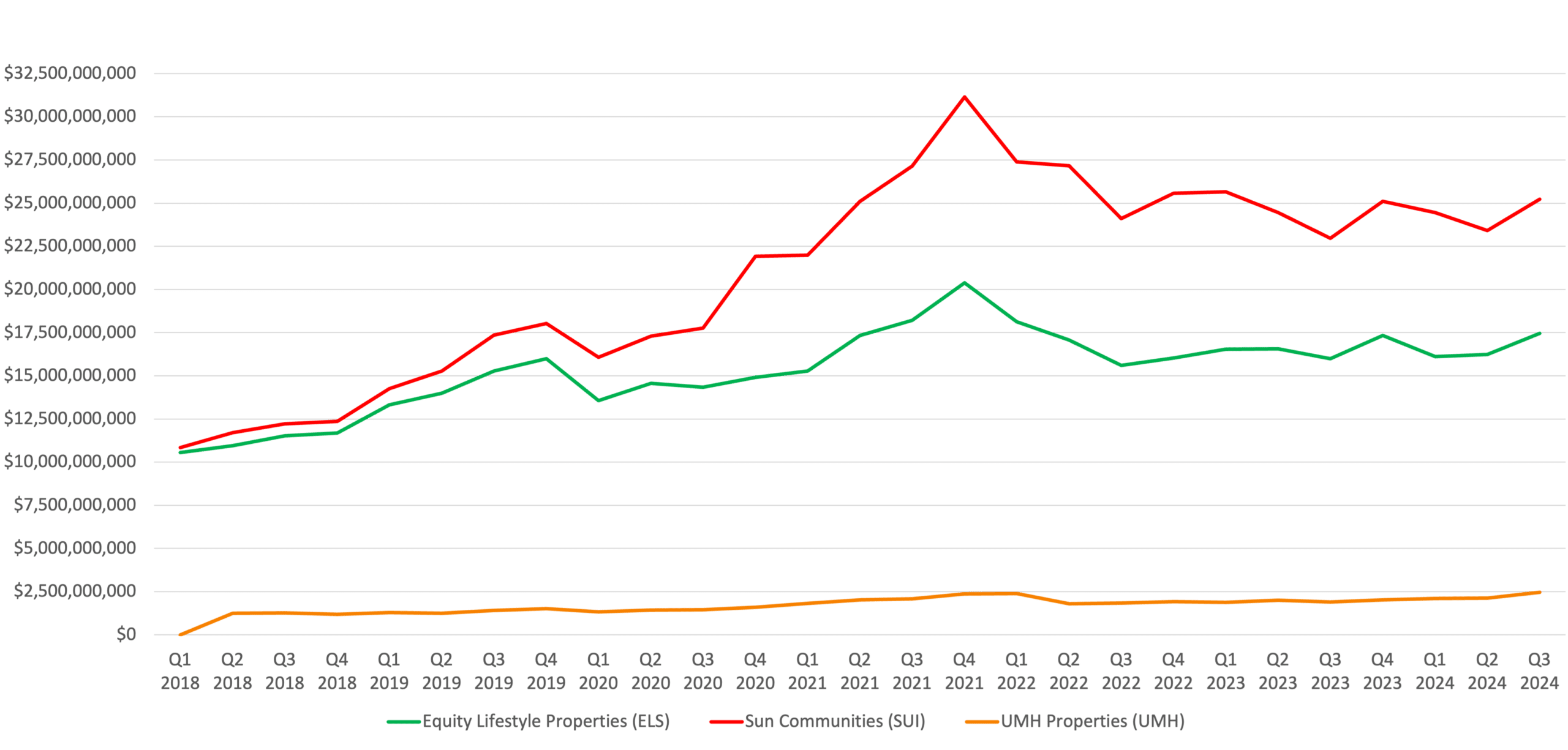

Acquisition Dollar Amount History

*Excludes Sun Communities Acquisition of Park Holidays in April 2022 for $1.2 Billion

Manufactured Housing Monthly Transactions 2018-2024

* Source: CoStar

Manufactured Housing Cap Rates & Bid-Ask Spread

Cap rates in the manufactured housing sector remain competitive but are adjusting to higher interest rates and inflationary pressures. Recent acquisitions have reflected stabilized yields in the 5.5%-6.5% range. SUI reported cap rates of approximately 6% for its 2024 transactions, aligning with market expectations in the MH and RV segments. UMH highlighted the increased value of its communities, which have doubled in appraised value over the past decade, creating opportunities for refinancing. For example, UMH expects to refinance $116 million in community mortgages in 2025, leveraging these gains to fund further expansions. ELS emphasized disciplined capital deployment to ensure acquisitions meet internal return thresholds, particularly in Florida and other high-growth markets. The narrowing bid-ask spread, driven by increased seller flexibility and stable demand, has created favorable conditions for REITs to deploy capital into accretive acquisitions.

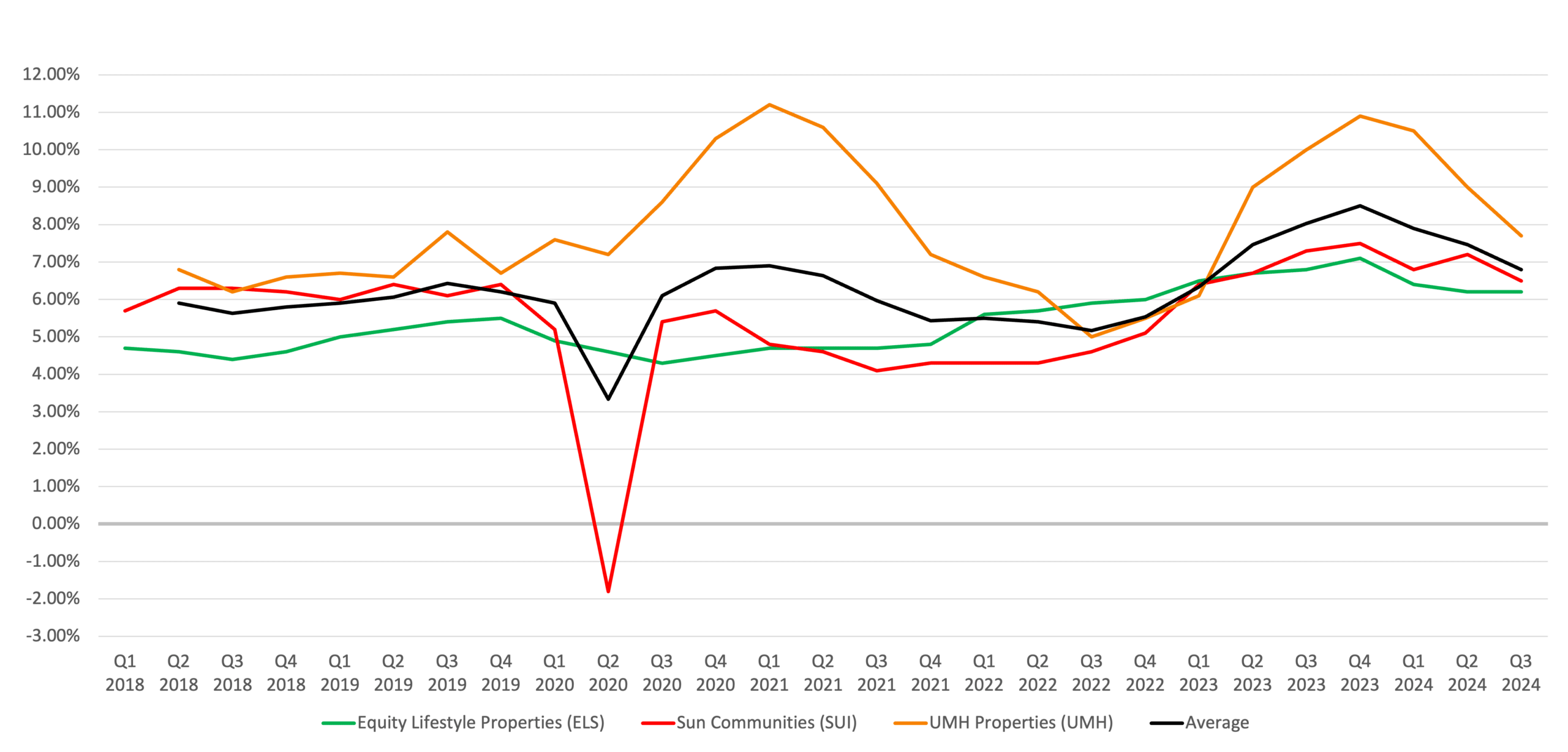

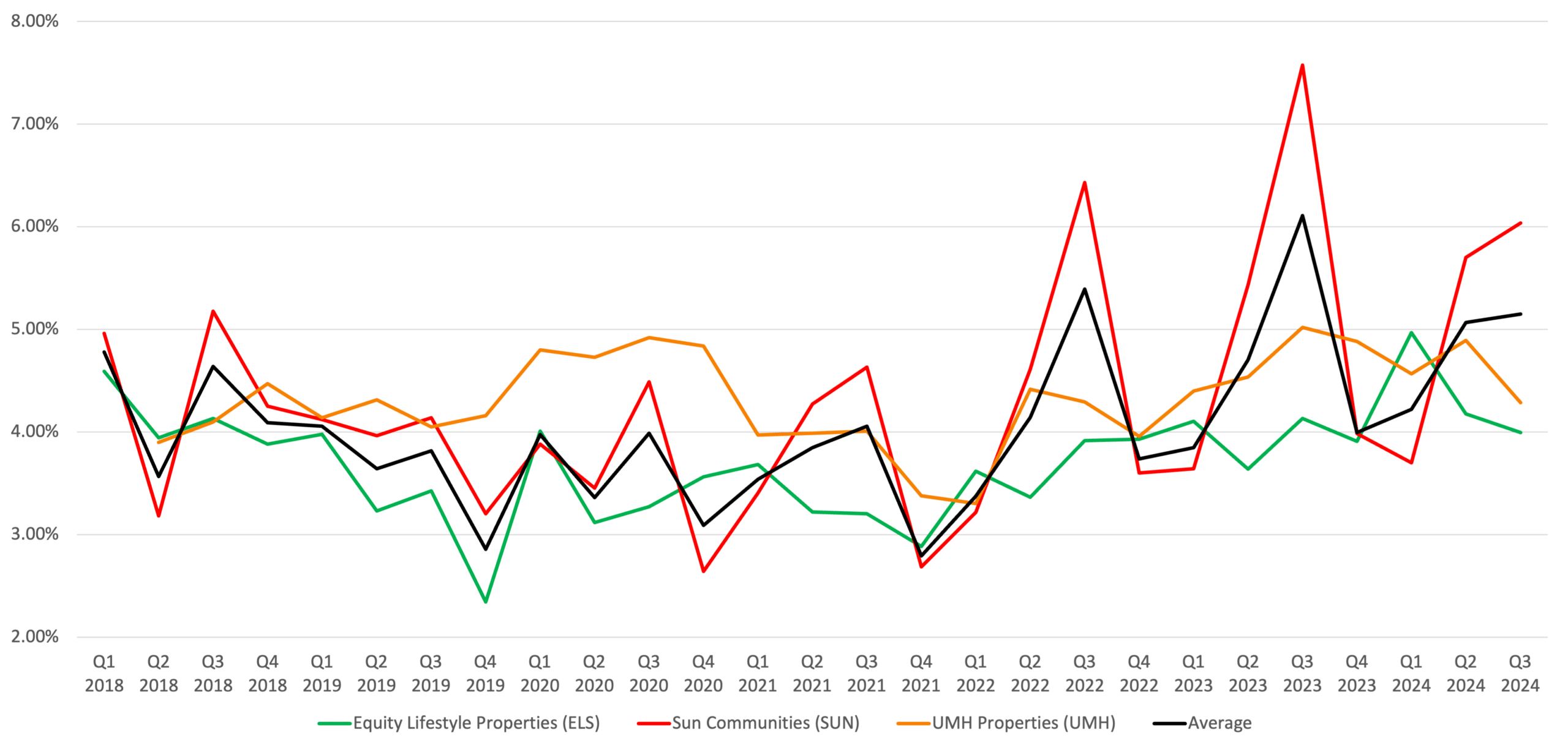

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Enterprise Value History

Headwinds in the Manufactured Housing Market

Despite its resilience, the sector faces notable headwinds. Rising construction and labor costs have increased the cost of new site development, with UMH reporting costs of $70,000-$75,000 per single-wide rental home. Zoning restrictions and regulatory hurdles further constrain new community development, limiting supply in high-demand regions. Environmental risks, particularly hurricanes, remain a significant challenge. Hurricanes Helene and Milton caused damages to properties in Florida, including tree removal, structural repairs, and cleanup costs. For example, UMH incurred an additional $140,000 in tree removal expenses and $100,000 in R&M costs following severe storms. These recurring weather events are likely to drive up property insurance premiums. Additionally, rising interest rates have increased the cost of debt financing, creating challenges for acquisitions and development projects. As a result, REITs have focused on optimizing their existing portfolios and implementing cost-saving measures to sustain profitability amidst these challenges.

Tailwinds in the Manufactured Housing Market

The manufactured housing market benefits from strong demographic and economic tailwinds. The national housing shortage, estimated at 4 million units, underscores the demand for affordable housing, with manufactured homes offering a cost-effective solution. ELS noted that manufactured homes are approximately 75% cheaper than site-built homes, making them an increasingly attractive option for price-sensitive buyers. The Sunbelt continues to drive growth, with Florida, Arizona, and Texas attracting significant population inflows. SUI and ELS derive approximately 70% of their revenue from Sunbelt markets, leveraging their strategic positioning in these high-demand regions. UMH emphasized government initiatives, including potential tax credits for first-time homebuyers and renewable energy programs like its solar shingle pilot project, which aims to reduce utility costs for residents. Demographic shifts, particularly among baby boomers and Gen Xers, further support demand for affordable, community-oriented living.

Contributors

Steven Paul

Senior Financial Analyst

Jared Bosch

Senior VP & Director of Manufactured Housing

Don Vedeen

Senior VP & Director of Manufactured Housing