Q4 Healthcare REIT Highlights

- Leasing Performance: Healthcare Realty signed nearly 2 million square feet of new leases in 2024, with an all-time quarterly high of 690,000 square feet in Q4, highlighting record leasing momentum and sustained demand for outpatient medical space.

- Occupancy Gains: Multi-tenant occupancy increased by 149 basis points year-over-year, driven by strong new leasing and tenant retention rates, placing their occupancy growth rate at 50% higher than peer averages.

- Market Positioning: The REIT’s focus on densifying clusters around major health systems and targeting high-growth metros reinforces the durability of its leasing pipeline and rent growth potential in 2025.

- Leasing Volume: Healthpeak completed over 6.2 million square feet of leasing in 2024 across its outpatient medical portfolio, achieving 7% rent increases on renewal leases, far exceeding historical norms for medical office.

- Occupancy Stability: Occupancy ended the year at 92.2%, with tenant retention of 88%, underscoring the strength of long-term health system partnerships and sticky tenancy in its core markets.

- Portfolio Strategy: After selling $1.3 billion of non-core assets, Healthpeak has repositioned its capital toward development loans and health system-driven growth projects, aiming to expand its footprint in high-demand outpatient submarkets.

- Leasing Acceleration: Medical office leasing increased by 15% compared to the prior year, with over 34% of its 2025 leasing target already completed by the start of the year, reflecting strong leasing visibility and demand.

- Occupancy Trends: While the portfolio saw some modest occupancy declines in Q4, early 2025 leasing success positions Ventas to recover occupancy losses and achieve net positive absorption during the year.

- Portfolio Focus: Ventas is prioritizing health system-anchored properties in Sunbelt states, where outpatient demand is highest, and continues to dispose of non-strategic assets, keeping its portfolio aligned with demographic growth trends.

- Occupancy and Retention: Welltower’s outpatient medical portfolio maintained 94.3% occupancy with 93.6% tenant retention, demonstrating remarkable stability and the benefit of deep clustering around major healthcare hubs.

- Operational Efficiency: Through its regional clustering strategy, Welltower achieved operational efficiencies across maintenance, staffing, and capital expenditures, helping to offset rising insurance costs in 2024.

- Essential Demand Drivers: With healthcare delivery shifting steadily into outpatient settings and the aging population fueling long-term visit growth, Welltower expects sustained rent escalations and low turnover to support continued NOI growth.

Thoughts from the CEO's

Healthcare Realty Trust

Constance Moore

President & Chief Executive Officer

- “We also achieved new lease commitments of nearly 600,000 square feet in the fourth quarter and 2 million square feet for the year, both all-time records. For occupancy absorption, we had projected 100 points to 150 points of occupancy gains in the multi-tenant portfolio.

We finished the year delivering 149 basis points, at the high end of our plan. We did what we said we would do. We also continued our efforts to focus on operational efficiency. We reduced controllable operating expenses by 100 basis points..”

Healthpeak Properties Inc.

Scott M. Brinker

President & Chief Executive Officer

- “The merger with Physician Realty closed less than a year ago and has already proven to be highly successful. The merger was accretive to our earnings, balance sheet and platform. It highlighted our ability to execute and to exceed expectations, for example, with merger synergies and a common spirit renewal. We’ll build on that momentum in 2025 by continuing to internalize property management across our portfolio, which is both financially and strategically accretive.”

Ventas

Debra A. Cafaro

Chairman and Chief Executive Officer

- “2024 was a year of occupancy outperformance with year-over-year occupancy increasing 300 basis points in our same-store communities. SHOP same-store cash NOI grew nearly 16%.”

Welltower

Shankh Mitra

Chief Executive Officer

- “We ended 2024 on a high note, delivering strong Q4 results as the company continues to fire on all cylinders. Whether it be it business fundamentals, capital allocation, a further strengthening of our balance sheet, or progress on the operating platform build out, the result was another quarter of solid bottom-line growth.”

Macroeconomic Highlights

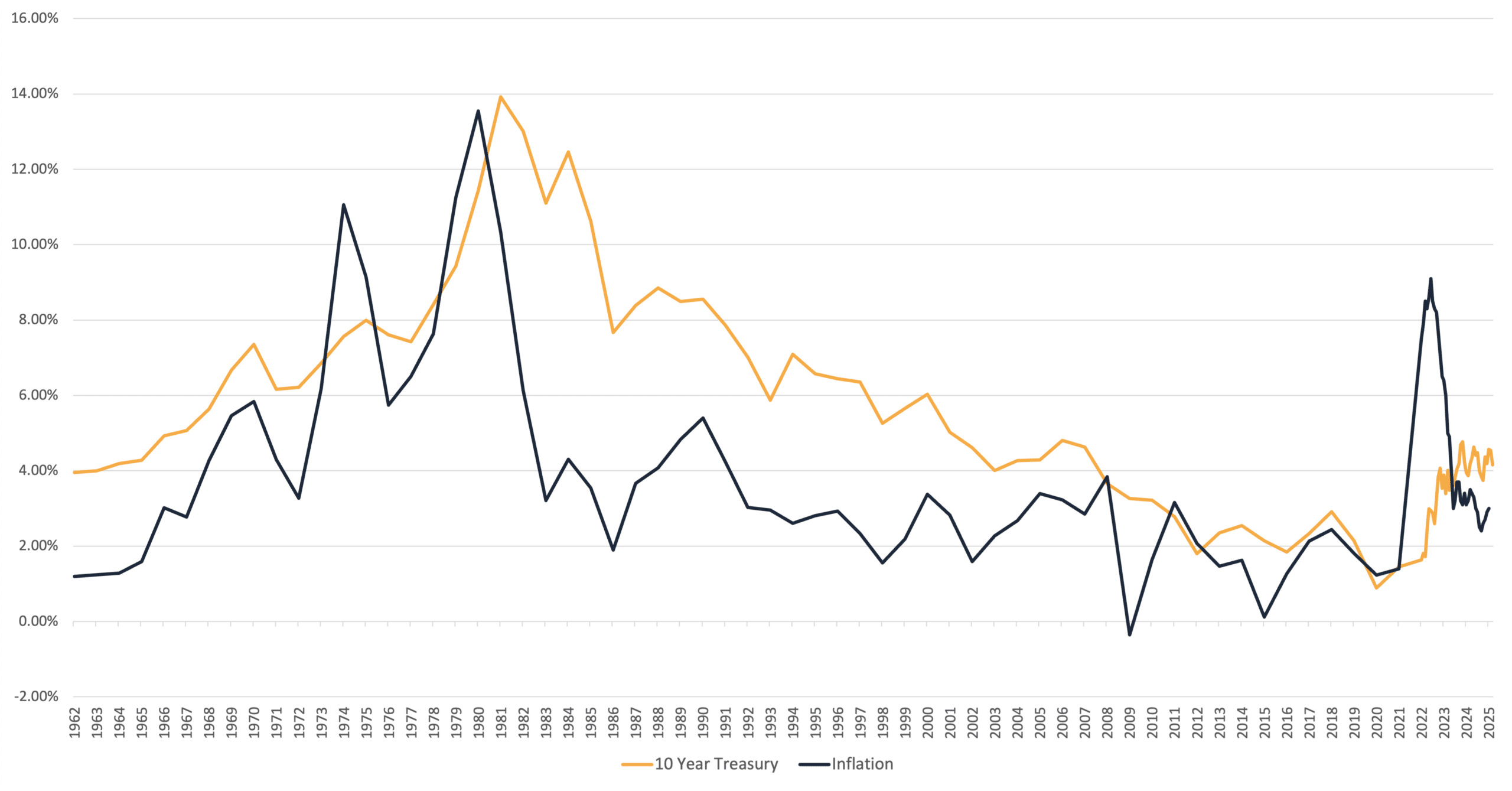

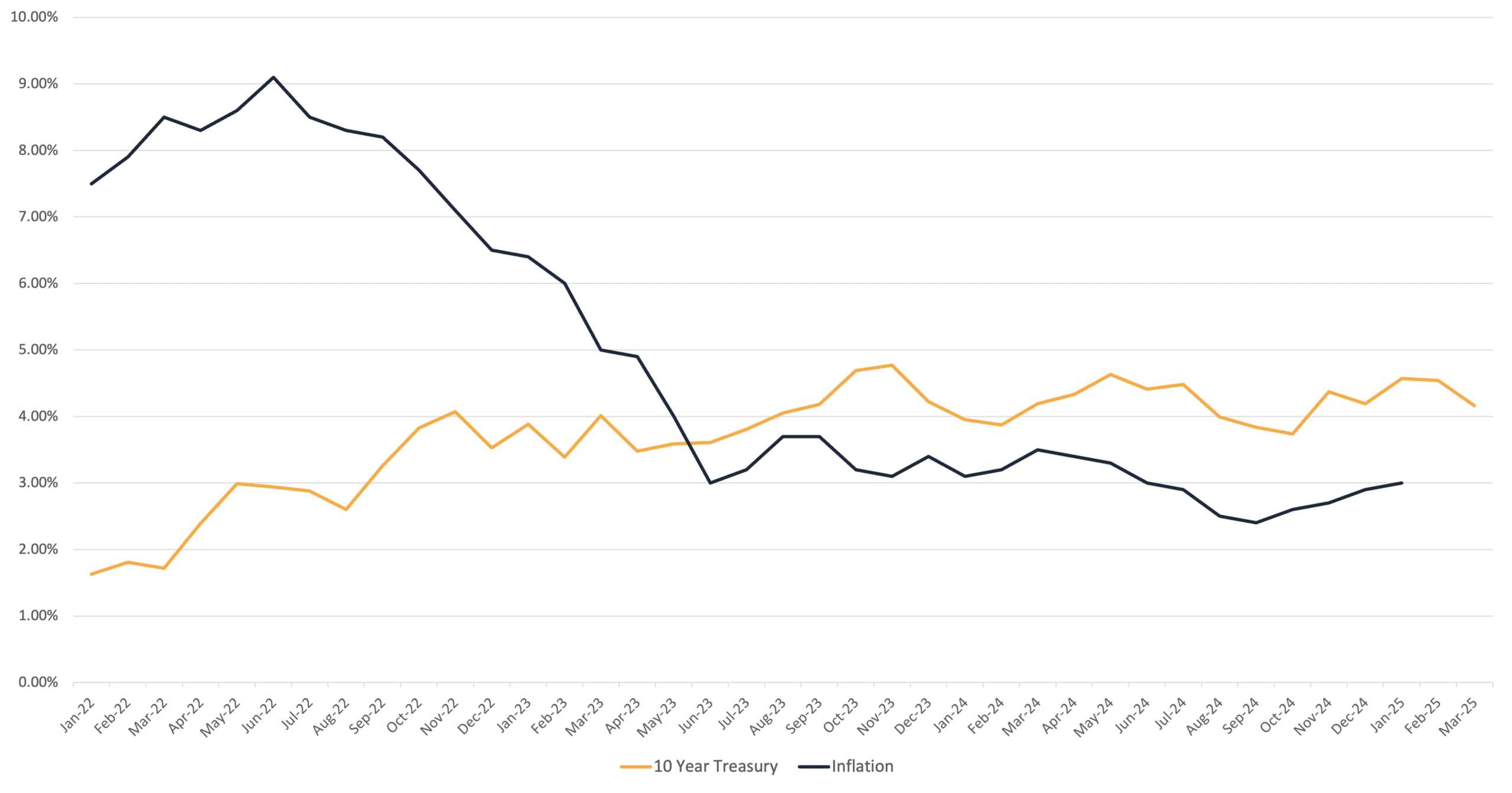

Interest Rates and Economic Slowdown: Economic uncertainty continues to weigh on the commercial real estate sector as the Federal Reserve’s higher-for-longer rate stance shapes capital markets and borrowing decisions. GDP growth slowed to an annualized rate of approximately 1.9% in Q4, down from stronger expansion earlier in the year, as elevated borrowing costs restricted consumer spending, home sales, and business investment. While inflation moderated to around 3%, the Fed emphasized that persistent cost pressures in services, insurance, and labor-intensive industries could delay rate cuts until the second half of 2025. For real estate, particularly sectors reliant on housing turnover or discretionary consumer spending, this environment limits pricing power and keeps transaction volume subdued until financing conditions ease.

Capital Markets and Post-Election Policy Shifts: Following the 2024 presidential election, attention has shifted to new fiscal priorities and their implications for commercial real estate investment. Early policy signals suggest a focus on healthcare spending reforms, renewed climate resilience programs, and potential adjustments to corporate tax rates, all of which will impact investor underwriting for assets. In addition, tightening global credit conditions and slower cross-border investment flows have reduced liquidity for larger transactions, reinforcing a flight to quality, where institutional investors prefer core assets in proven markets. For self-storage and medical office, this favors high-barrier, infill locations with strong demand drivers, while pricing uncertainty persists for secondary and tertiary markets where capital access remains constrained.

Inflation and the 10-Year Treasury Since 1962

Inflation and the 10-Year Treasury Since 2022

Q4 2024 Healthcare REIT Data Overview

| Healthcare Realty Trust (HR) | Healthpeak Properties Inc. (PEAK) | Ventas (VTR) | Welltower (WELL) | ||

| Ending Occupancy (Same Store) | 2024 | 89.80% | 92.20% | 90.10% | 94.40% |

| 2023 | 89.20% | 91.60% | 91.90% | 94.90% | |

| YoY Revenue Increase (Same Store) | 2024 | 2.9% | 4.4% | 2.4% | 4.1% |

| 2023 | 3.2% | 3.9% | 3.5% | -0.3% | |

| YoY Expense Increase (Same Store) | 2024 | 2.7% | 7.1% | 3.6% | 9.0% |

| 2023 | 4.1% | 3.2% | 6.9% | -7.3% | |

| YoY NOI Increase (Same Store) | 2024 | 3.1% | 3.1% | 1.8% | 2.0% |

| 2023 | 2.7% | 4.3% | 2.1% | 2.8% | |

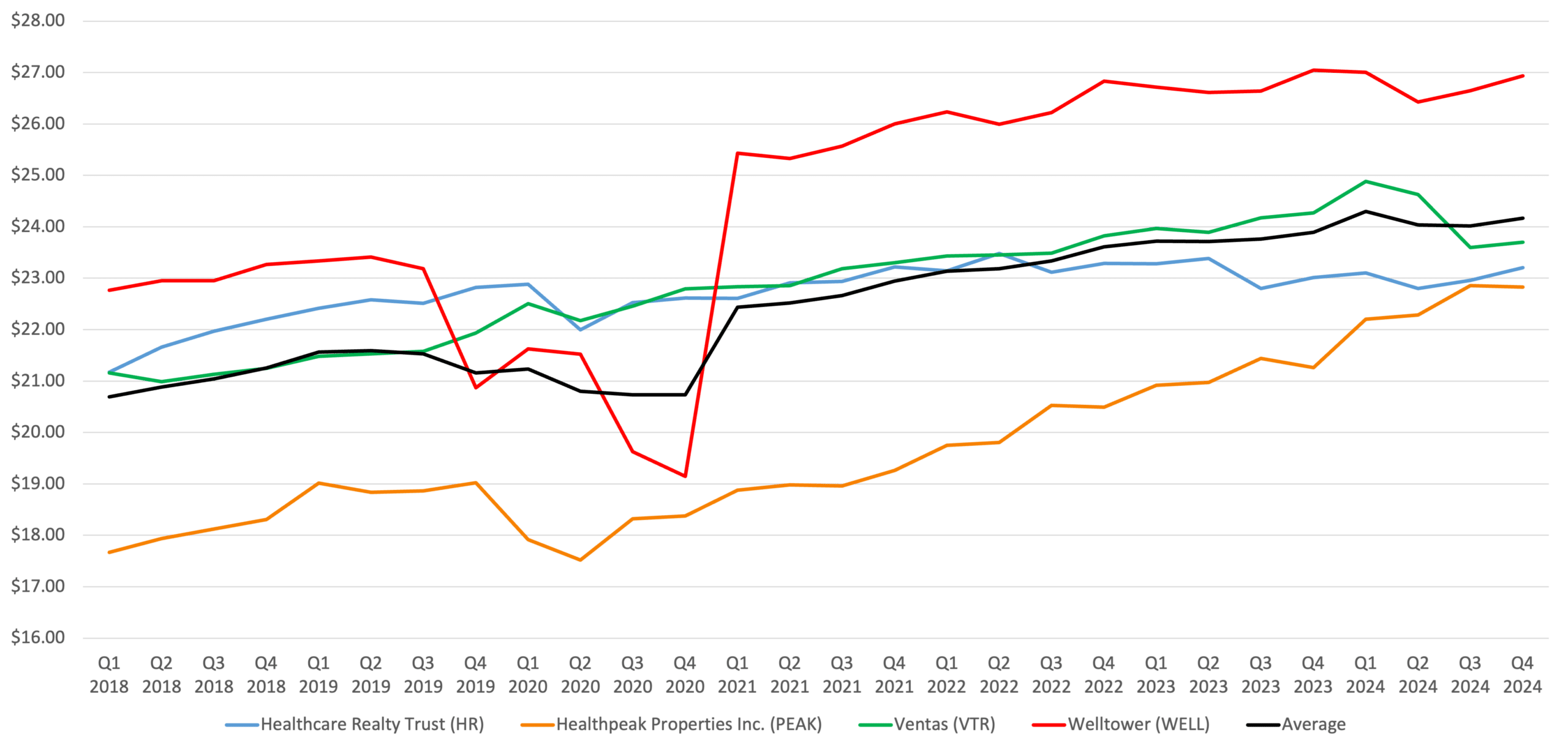

| NOI/Occupied SF (Same Store) | 2024 | $23.21 | $22.83 | $23.70 | $26.94 |

| 2023 | $23.01 | $21.26 | $24.27 | $27.04 | |

| Average Lease Term Remaining (Yrs) | 4.4 | 6.2 | 6.8 | 7.0 | |

| Q4 Medical Office Acquisitions | 0 | 0 | 0 | 0 | |

| Total Properties | 651 | 519 | 397 | 429 |

Q4 2024 Healthcare Real Estate Operating Fundamentals

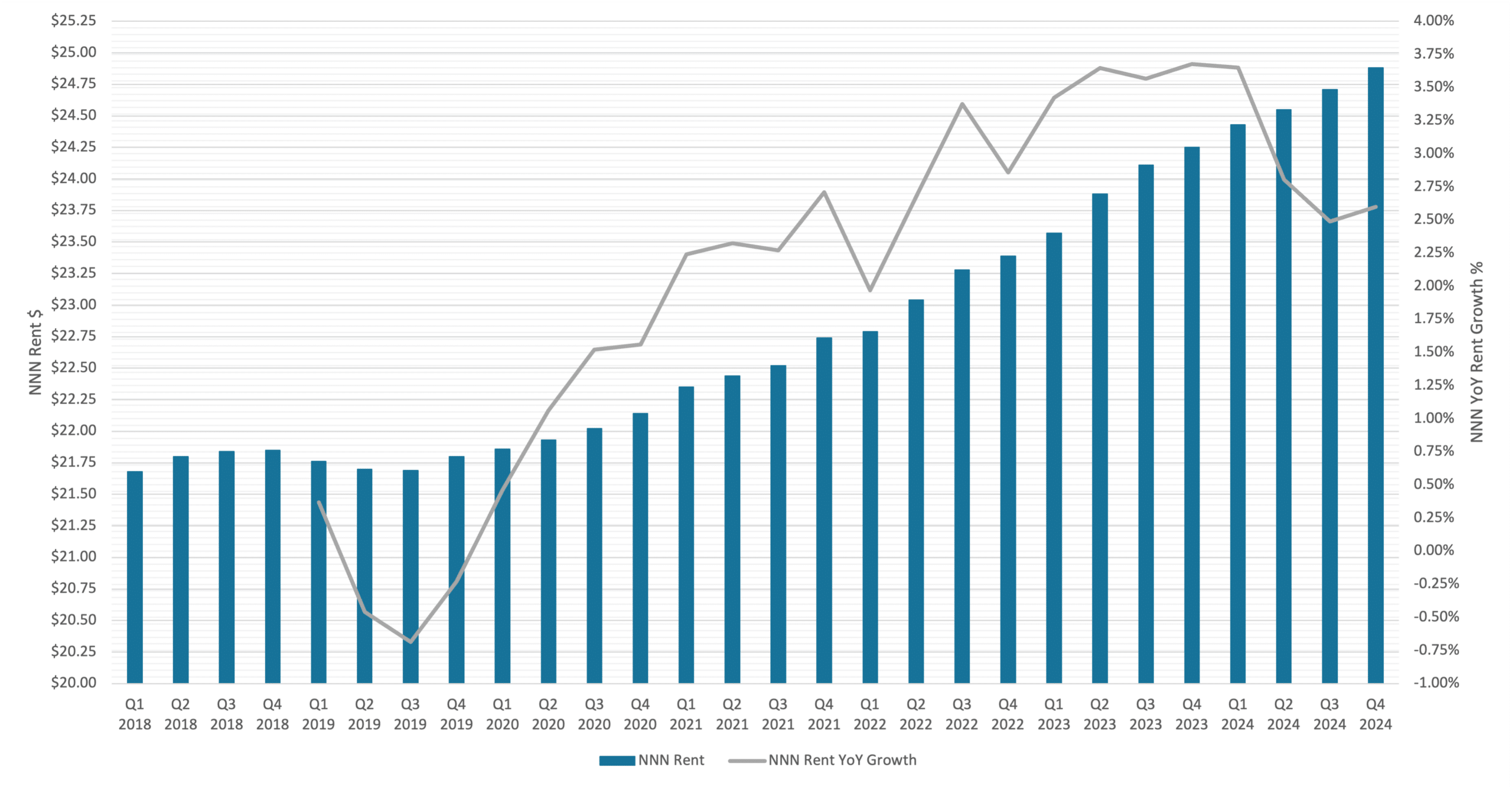

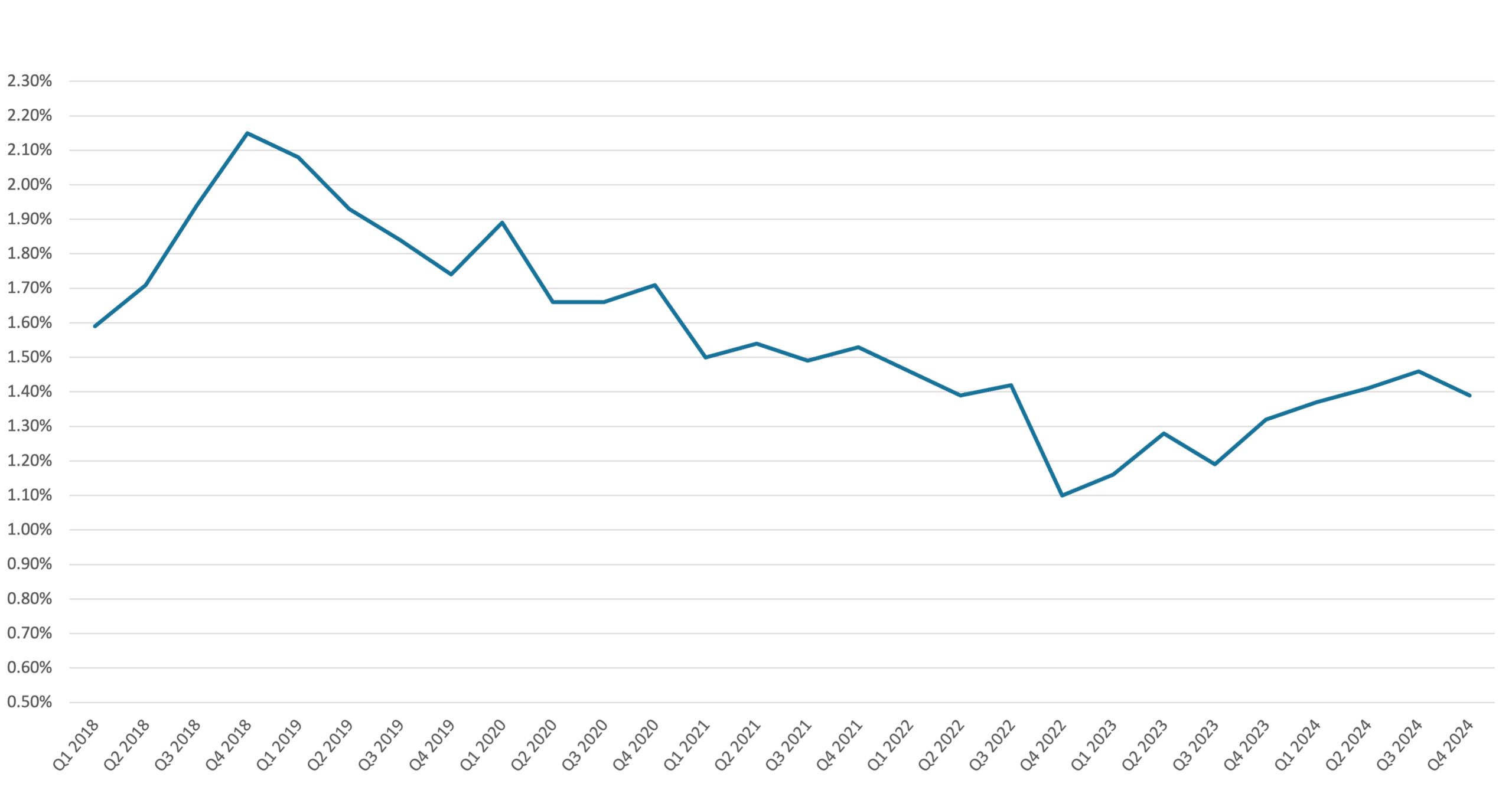

Healthcare Real Estate Lease Rates

The fourth quarter of 2024 saw robust leasing activity across the medical office REIT sector, reflecting strong demand and strategic operational efforts. Healthpeak Properties executed 6.2 million square feet of leases, achieving a positive 7% rent mark-to-market on renewals in their outpatient medical segment, alongside an impressive tenant retention rate of 88%. This performance reflects a strong demand environment and effective portfolio management. Healthcare Realty Trust reported record leasing activity, securing nearly 600,000 square feet of new lease commitments in the fourth quarter and a total of 2 million square feet for the full year, both all-time records for the company. This momentum underscores their strategic leasing initiatives and market positioning.

NOI/Occupied SF (Same Store)

Top 100 MSA Medical Office Building NNN Rent

* Source: Revista

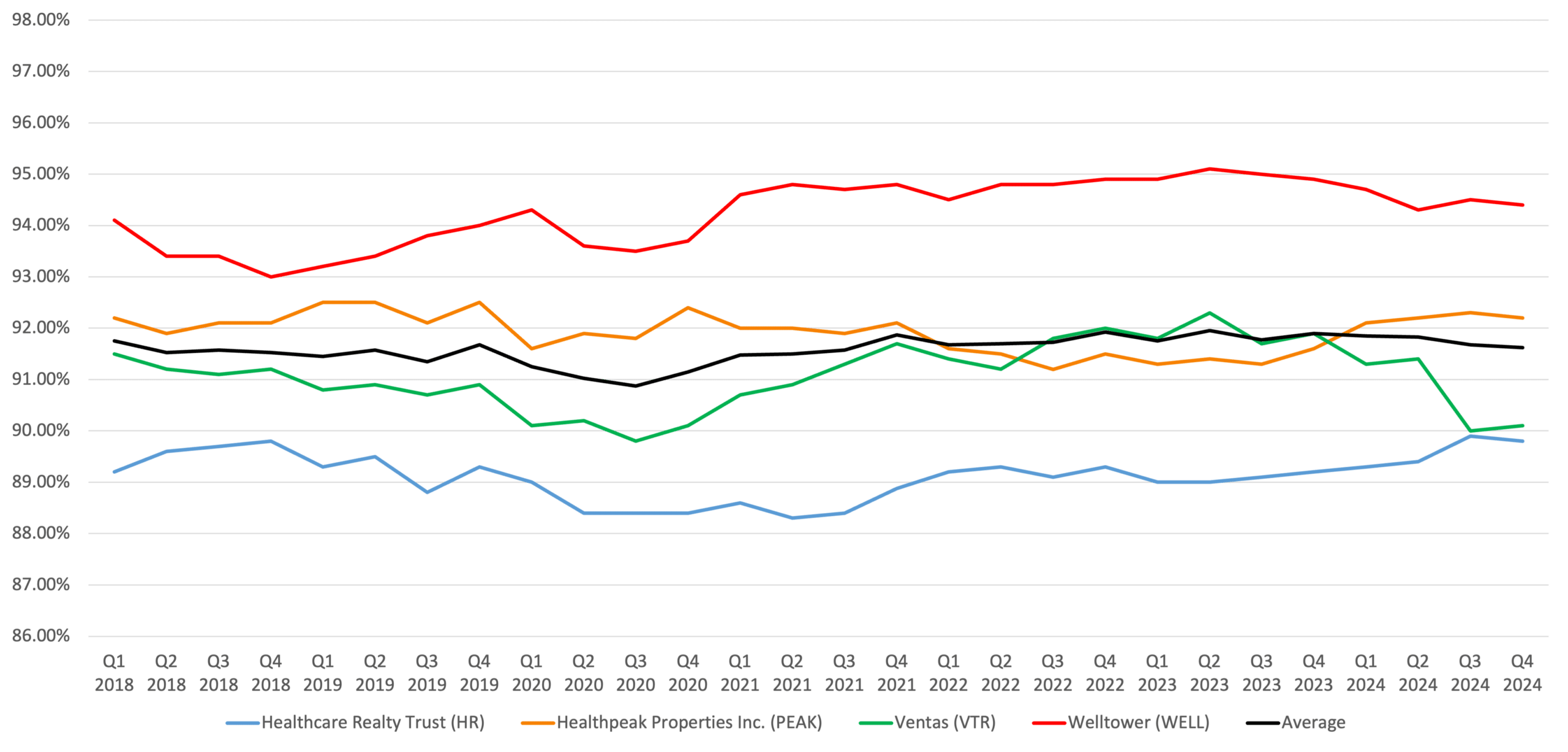

Healthcare Real Estate Occupancy

Occupancy metrics across the medical office REIT sector were largely positive. Welltower maintained an industry-leading occupancy rate of 94.4% in their outpatient medical segment. Ventas reported strong occupancy gains, with year-over-year same-store cash NOI growth of nearly 16% in their senior housing operating portfolio (SHOP), driven by a 300 basis point increase in same-store occupancy. Healthcare Realty Trust achieved 44 basis points of multi-tenant occupancy gains during the fourth quarter and nearly 150 basis points for the full year, driven by strong tenant retention and robust leasing activity.

Period Ending Occupancy (Same Store)

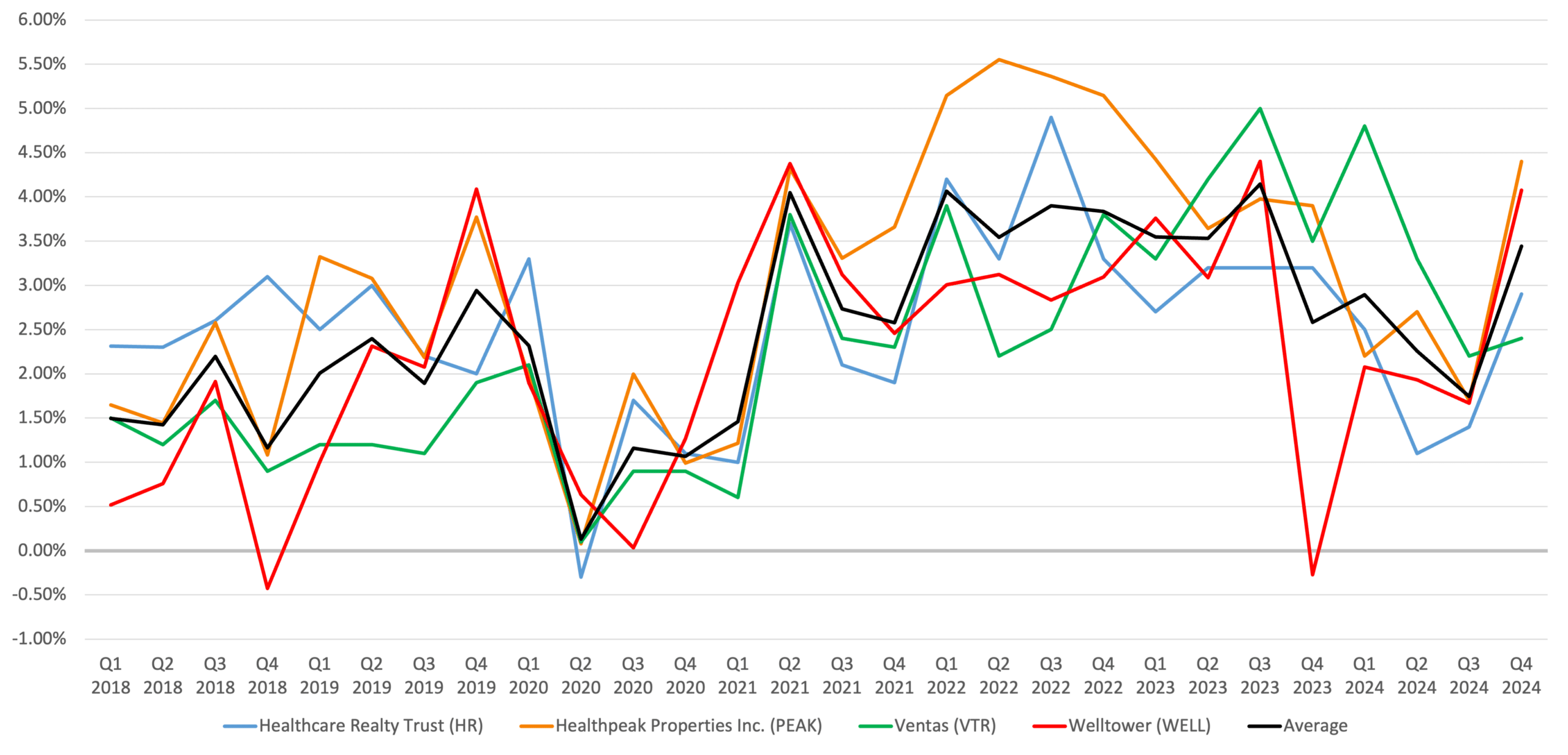

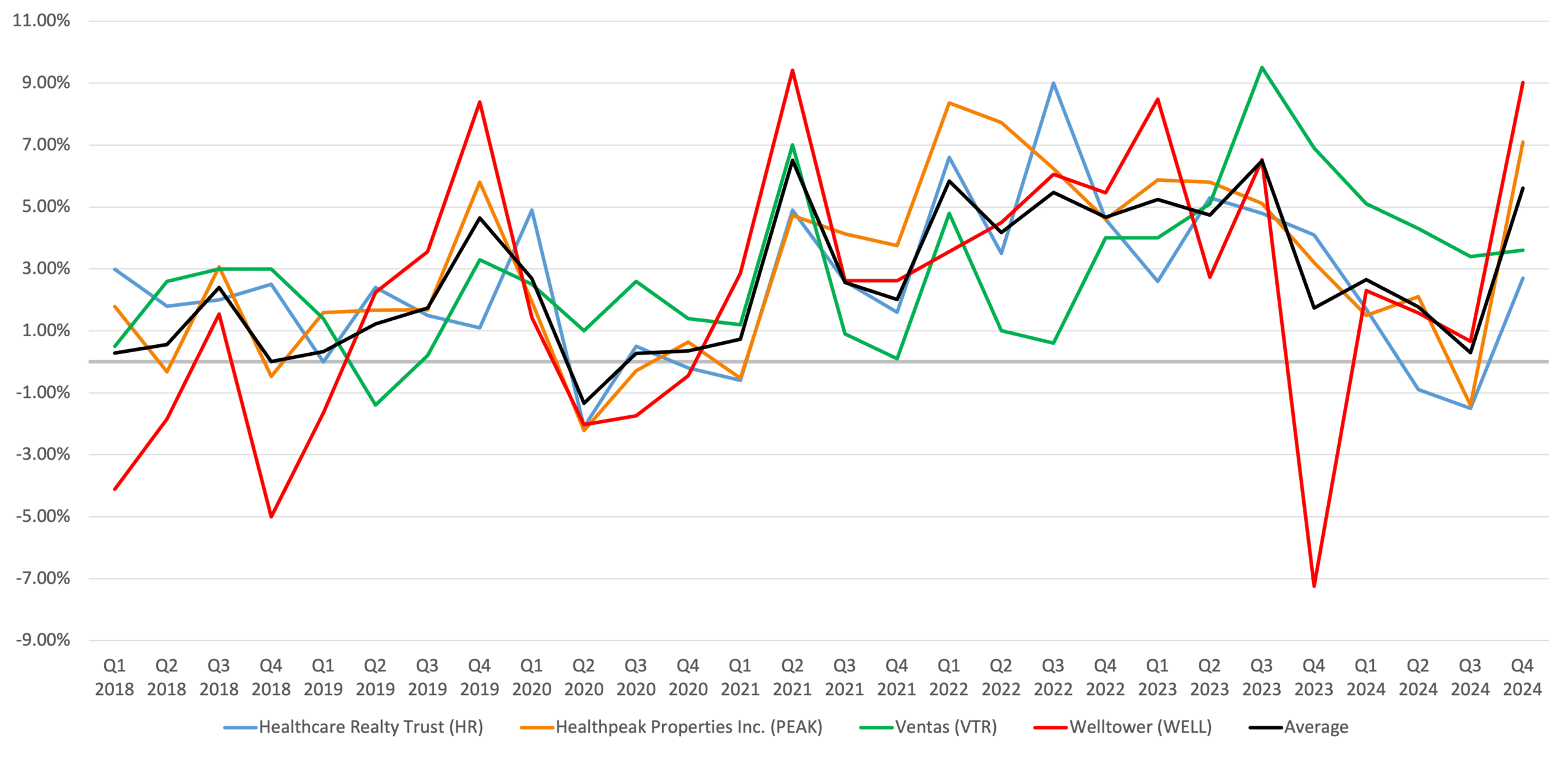

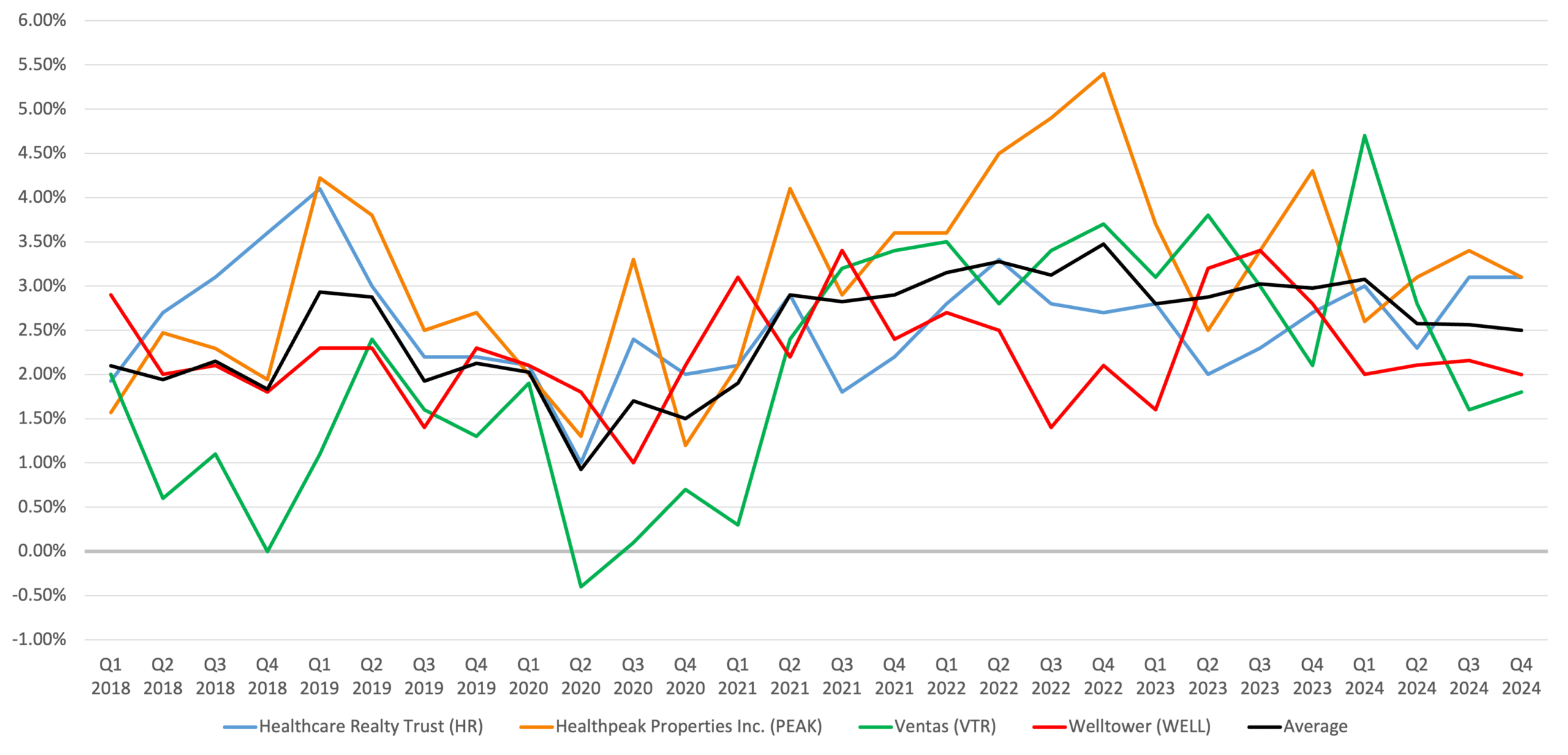

Healthcare Real Estate Income & Expenses

The medical office REIT sector demonstrated varied income and expense dynamics in the fourth quarter of 2024, with companies focusing on strategic cost management and operational efficiencies to drive growth. Healthpeak Properties reported total portfolio same-store growth of 5.4%, reflecting strong leasing activity and effective cost management strategies, particularly in their outpatient medical segment, which maintained high occupancy rates. Ventas highlighted significant growth in their senior housing operating portfolio (SHOP), with year-over-year same-store cash NOI growth of nearly 16%, driven by a 300 basis point increase in same-store occupancy, underscoring their strategic initiatives in managing expenses and optimizing operational efficiencies. Healthcare Realty Trust reported same-store cash NOI growth of 3.1% for the fourth quarter and 2.9% for the full year, reflecting their focus on operational efficiency and strategic leasing efforts, with an emphasis on managing controllable expenses and driving occupancy gains. Overall, these REITs focused on strategic cost management and operational efficiencies to drive income growth while managing expenses effectively in a dynamic market environment.

YoY Revenue Growth (Same Store)

YoY Expense Growth (Same Store)

YoY NOI Growth (Same Store)

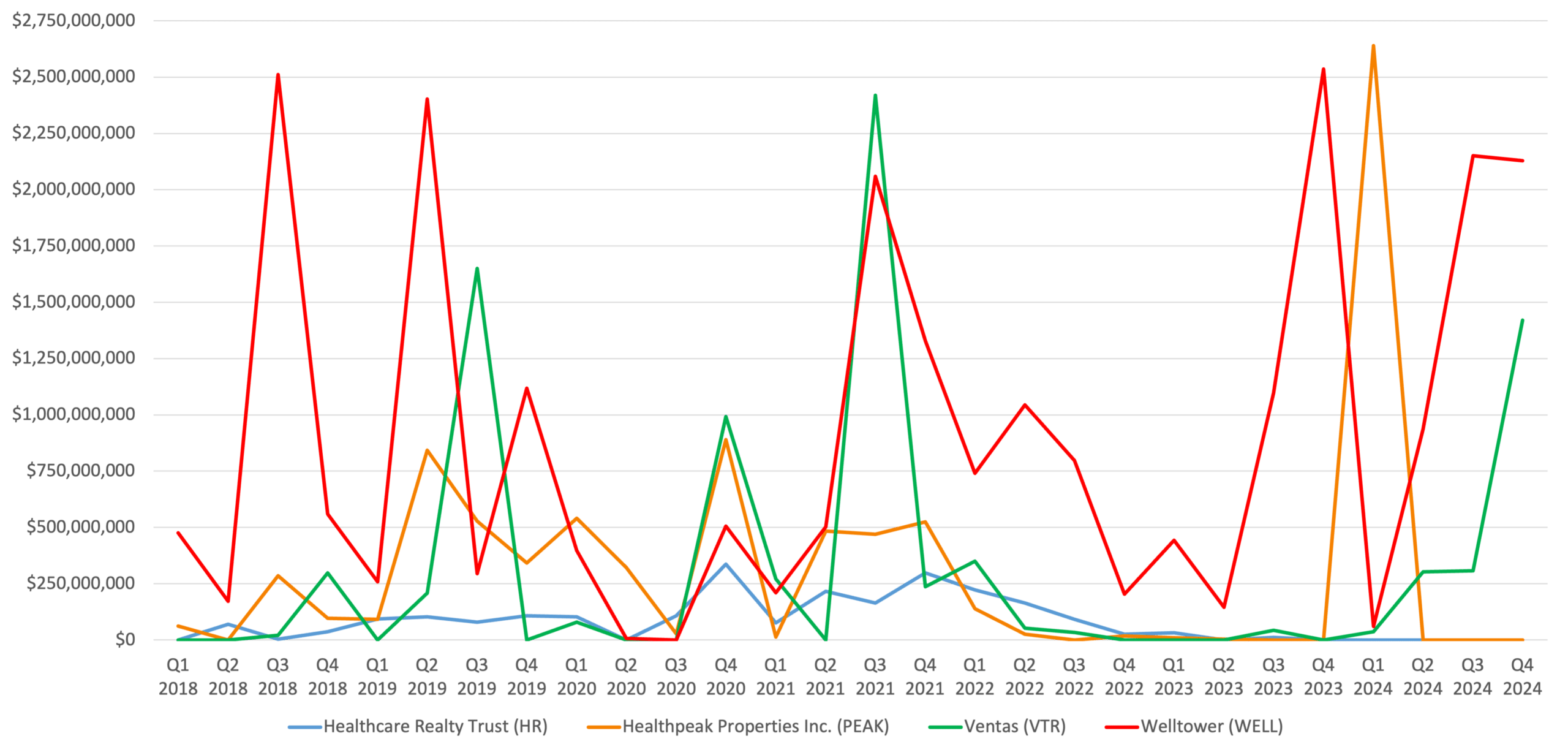

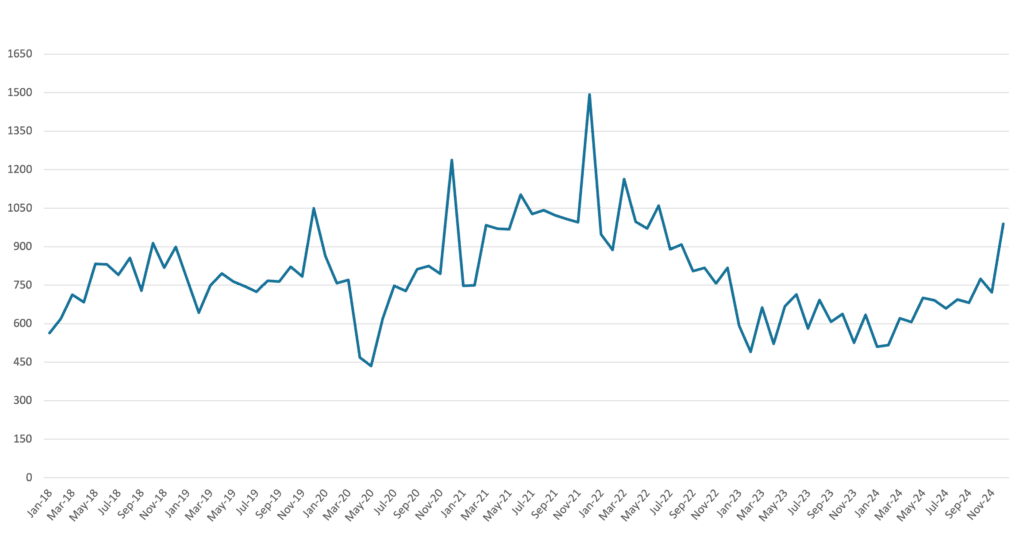

Healthcare Real Estate Investment & Transaction Activity

Investment and transaction activities were pivotal for several REITs, reflecting strategic efforts to optimize portfolios and drive growth. Ventas completed over $2 billion in accretive investments focused on senior housing, including $1.4 billion in the fourth quarter alone. These investments, funded with equity, were expected to drive significant NOI growth and enhance Ventas’ financial profile. Healthpeak Properties closed $1.3 billion of asset sales at a compelling cap rate of 6.4%, primarily stabilized outpatient medical buildings, allowing the company to focus on higher-growth opportunities. Healthcare Realty Trust generated nearly $1.3 billion in proceeds during the year, including nearly $500 million of non-core asset sales, and executed over $500 million in share repurchases and $350 million in debt paydown, demonstrating a commitment to enhancing shareholder value and strengthening its balance sheet.

Acquisition Dollar Amount History

*Excludes Healthcare Realty Trust merger with Healthcare Trust of America, for $7.75 billion in Q2 2022

Healthcare Real Estate Monthly Transactions 2018-2024

* Source: CoStar

Top 100 MSA Medical Office Building SF Under Construction as a % of Starting Inventory

* Source: Revista

Top 100 MSA Medical Office Building SF Delivered as a % of Starting Inventory

* Source: Revista

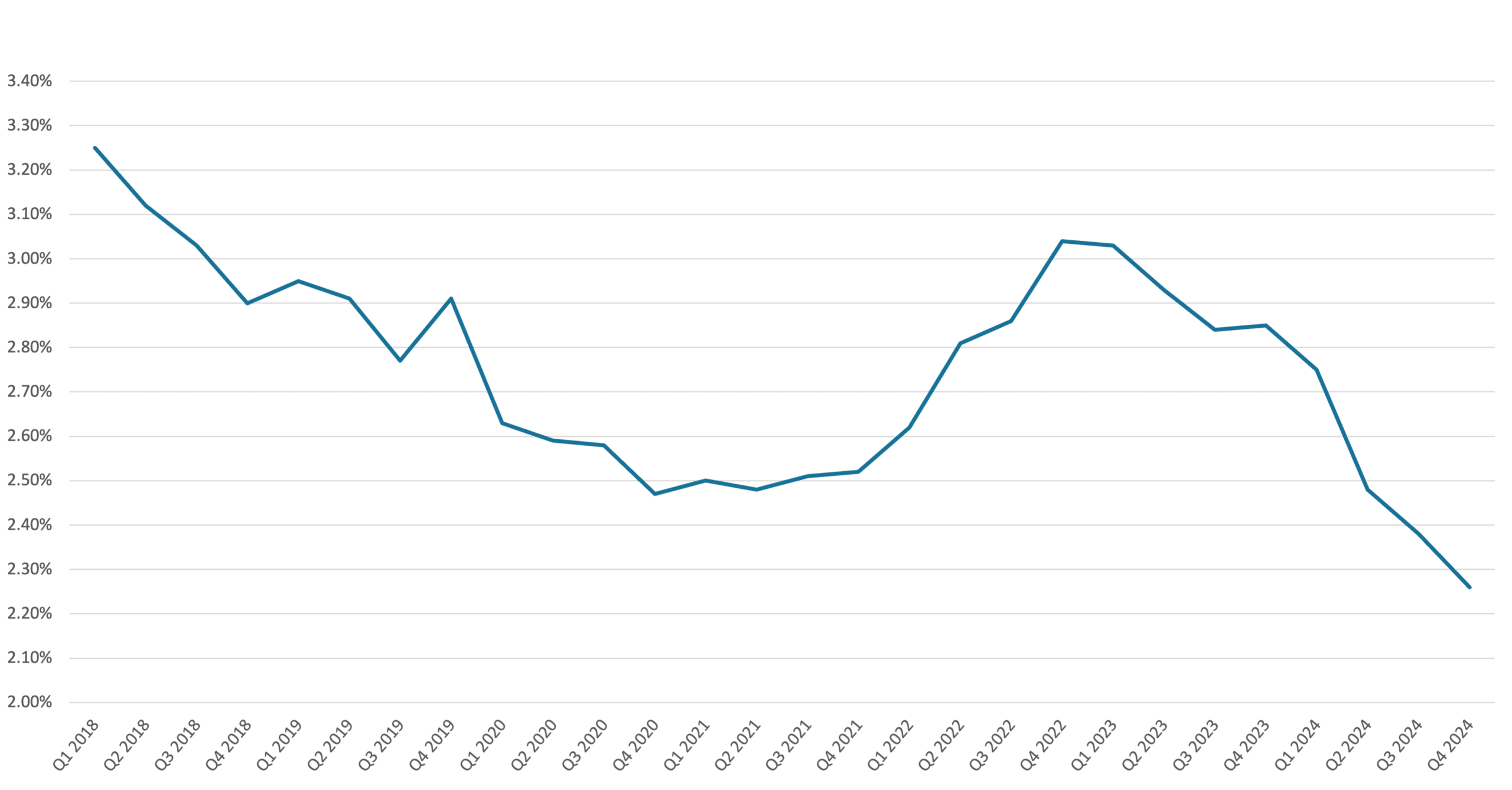

Healthcare Real Estate Cap Rates & Bid-Ask Spread

Cap rates and bid-ask spreads were crucial metrics for these REITs. Ventas reported acquiring senior housing investments at a 7-8% expected year 1 NOI yield, with low to mid-teens unlevered IRRs, reflecting a strategic investment approach aimed at driving significant NOI growth. Healthpeak Properties mentioned a weighted average yield of 8% on their investments, focusing on loan investments that provide immediate accretion and future acquisition rights. Healthcare Realty Trust reported a cap rate on asset sales of 6.6% in 2024 and expects a cap rate of 6.8% to 7.3% in 2025, primarily due to the non-core nature of some of those assets.

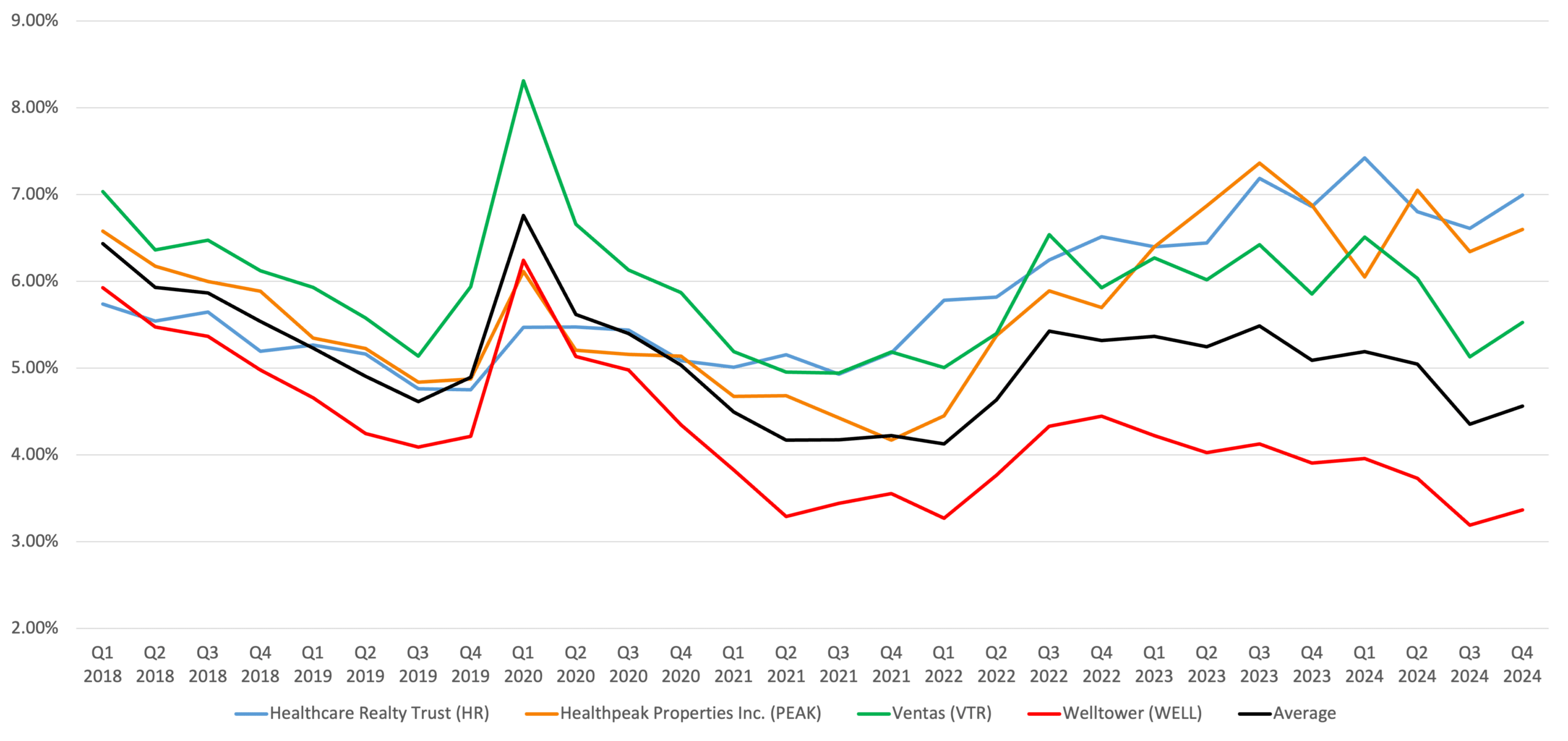

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Top 100 MSA Medical Office Building TTM Cap Rate History

* Source: Revista

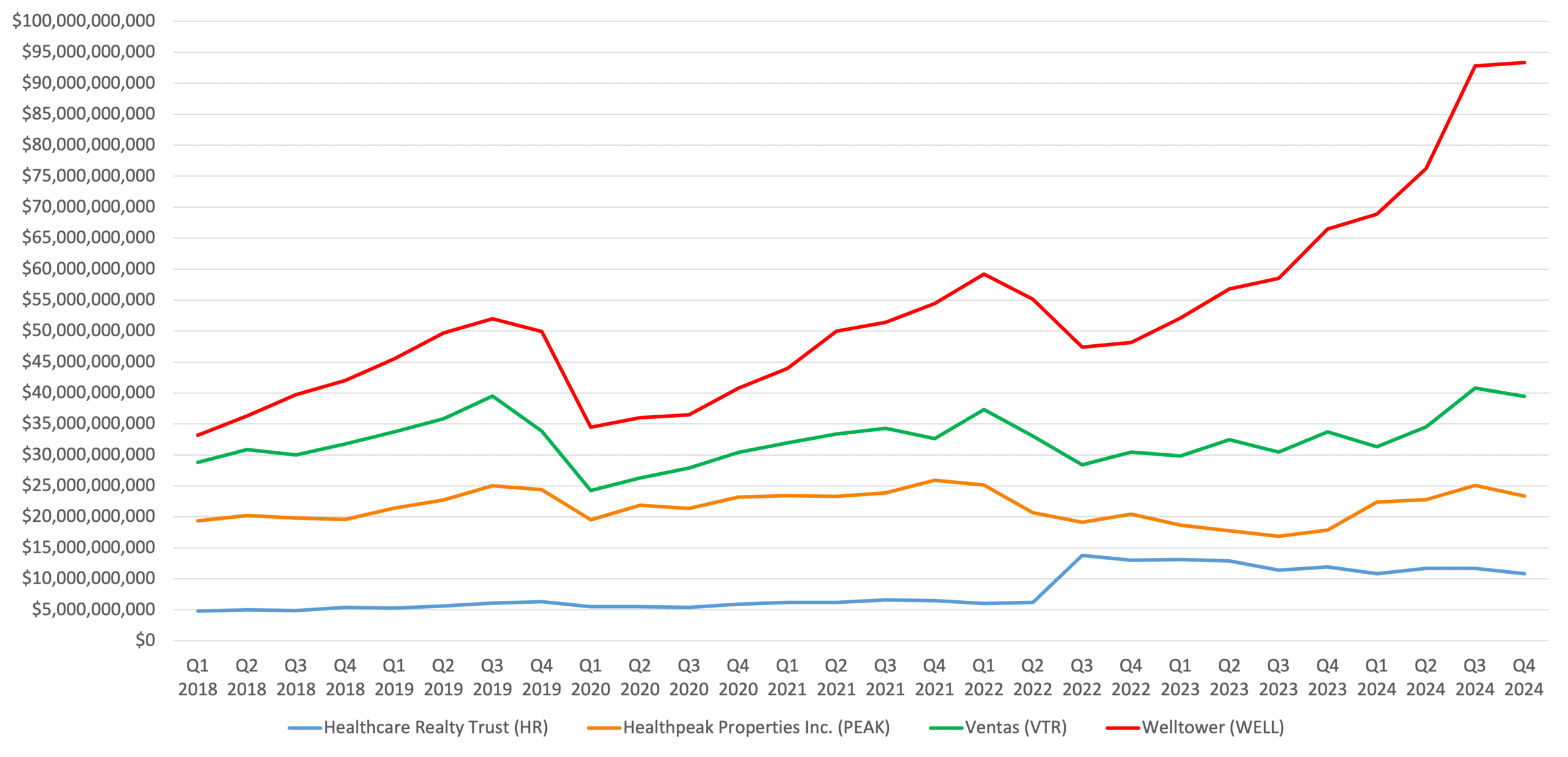

Enterprise Value History

Headwinds in the Healthcare Real Estate Market

Despite the tailwinds, several headwinds were also noted in the medical office market, reflecting the challenges and uncertainties facing the sector. Healthpeak Properties noted challenges in the life science sector, including a lack of liquidity and opportunities for accretive investments, which could impact their investment activity and financial performance. Ventas mentioned the potential impact of NIH funding changes under the new administration, although the long-term prospects for biomedical research in the U.S. remain positive. This uncertainty could affect the company’s financial performance and investment activity. Healthcare Realty Trust highlighted the earnings headwind from debt refinancing costs and the focus on reducing leverage to address upcoming debt maturities, reflecting a strategic focus on balance sheet management to support long-term growth and stability. The company reported nearly $1.3 billion in proceeds during the year, including nearly $500 million of non-core asset sales, demonstrating efforts to optimize their portfolio and manage financial obligations.

Tailwinds in the Healthcare Real Estate Market

The medical office market experienced several tailwinds, including strong demand driven by health systems shifting patient care into lower-cost outpatient settings, as noted by Healthpeak Properties. This trend is expected to continue, supporting the long-term growth prospects of the medical office sector. Ventas highlighted an unprecedented multiyear growth opportunity in senior housing, driven by compelling secular demand, favorable pricing environments, and robust investment opportunities. The company reported year-over-year same-store cash NOI growth of nearly 16% in their senior housing operating portfolio (SHOP), underscoring the strong demand dynamics in the sector. Healthcare Realty Trust emphasized the steady, long-term growth of the outpatient medical space, benefiting from powerful secular demographic tailwinds and constrained supply, with new construction starts at historically low levels.

Contributors

Steven Paul

Senior Financial Analyst

Robert King

Managing Director

David Kuper

Vice President