March 24, 2017 | Business Observer

As commercial real estate goes, no sector has been as white hot this economic cycle as rental apartments.

Tens of thousands of new residences have been developed throughout the Gulf Coast during the past four years, even as investors have clamored for well-maintained and well-located existing complexes — buying at multiples not seen before in Florida.

Less noticed, however, despite its close ties to the multifamily industry, has been the equally explosive growth of self-storage properties in the shadow of the multifamily boom. As with apartments, hundreds of new units have been developed and existing facilities are being gobbled up.

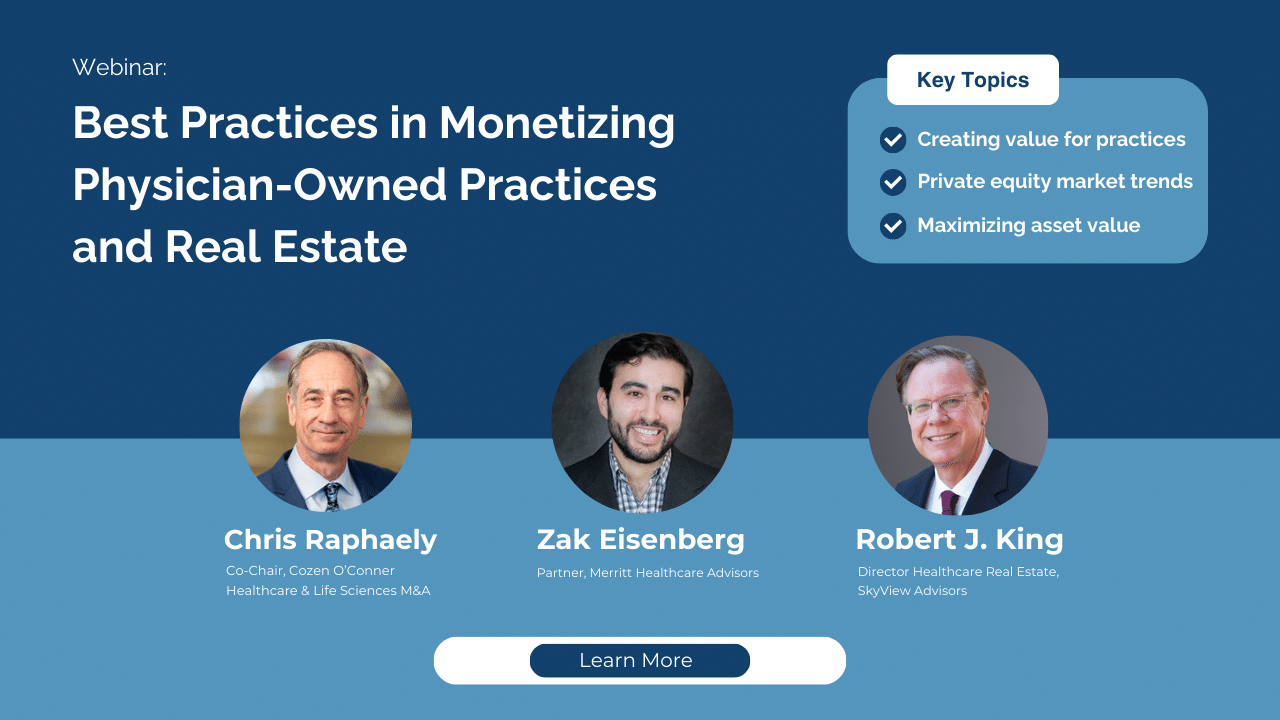

To take advantage of the trend, Jay Crotty founded SkyView Advisors in 2014. In the three years since, Tampa-based SkyView has established itself as a premier commercial real estate brokerage and debt-placement firm nationwide for self-storage properties.

“Pound for pound, I’d say they’ve done as many deals as anyone in the niche industry of self storage,” says Todd Amsdell, president of the Amsdell Cos., which runs a portfolio of 70 self-storage properties under the Compass Self Storage banner.

“They’ve done a very nice job of finding properties, putting deals together and making themselves known throughout the industry. They really burst onto the scene.”

Crotty’s decision to form SkyView came as generations of Americans — millennials and baby boomers alike — began eschewing home ownership in favor of renting.

Many were caught up in the foreclosure crisis of the past decade, or simply couldn’t afford the hefty mortgage down payment owning typically requires. As a result, today the rate of home ownership in the U.S. stands at its lowest rate since the 1960s.

At the same time, though, Americans’ collective fascination with stuff never waned. Where to put the chair your grandmother passed down or the power tools that someday will need to be fired up?

Self storage came to the rescue.

And despite yields that outpace more traditional commercial real estate investments, self storage for years failed to generate Wall Street or institutional buzz — until lately, the result of a spike in investor liquidity worldwide.

Just as significantly, the sector has been plagued for decades by fragmentation. Most self-storage properties nationwide have been developed by boutique developers or mom-and-pop firms. Today, just one-fifth of the roughly 55,000 self-storage facilities in the U.S. are owned by real estate investment trusts or other institutions, Crotty notes.

“Self storage remains a highly fragmented industry, one that’s ripe for consolidation and the application of standards of best practices,” says Crotty, 37, SkyView’s managing partner.

“In a world starved for returns, Wall Street has taken notice,” he adds. “Really, there’s been a perfect storm from an investment perspective: Self storage has enjoyed limited new supply at the same time as there’s been a lot of overall growth in demand.”

Crotty took notice of self-storage properties 16 years ago, when he joined commercial brokerage firm Marcus & Millichap’s Cleveland office following college.

Though he trained to sell apartments, Crotty recognized that self- storage properties had untapped potential and advantages multifamily complexes didn’t offer.

“Self storage to me then was unglamorous, but it was also largely virgin territory,” Crotty says. “The thing that attracted me to it was that they aren’t as management intensive as apartments — there aren’t plumbing or maintenance emergencies, no one calling in the middle of the night needing something right away.”

The interest in the sector followed him to Tampa in 2003 when he moved within Marcus & Millichap, a nationwide brokerage firm that generates more than $33 billion in total deals annually and remains the overall dominant player in the self-storage field.

Two years later, Crotty invested some of his brokerage commissions into a self-storage property and became hooked.

“It ended up being a terrific investment for me, but more than that, it began my love affair with the product type,” Crotty says. “Once I fully understood the numbers.”

By 2007, with commercial real estate markets nationwide still going full throttle, Crotty left Marcus & Millichap to help run TJR Global, a distribution firm.

It didn’t take him long to realize he knew little about how companies operated. Around the same time, the global economy tanked.

“It was the most stressful time,” Crotty says now. “The economy was poor, but I learned a heck of a lot about operations and growing a company.”

In 2013, Crotty sold his stake in TJR and pivoted back into real estate brokerage with newfound knowledge and a plan to differentiate SkyView.

He used as his model Apartment Realty Advisors Newmark, a Houston-based firm that is the nation’s largest multifamily brokerage company.

“I wanted to replicate them on the self-storage side, because they were best-in-class operators and attracted top-shelf talent,” Crotty says. “And I saw that there was a need for a professional advisory firm in self storage that specialized in investment sales and also had debt and equity capabilities.”

Crotty began cobbling together a business plan and the best people he could find — largely from outside the commercial real estate industry.

“I think I came to it with a unique vantage point, in that I had sales and operations experience with TJR,” he says.

Breaking from the model other boutique brokerages had set up, Crotty installed a centralized operations system.

“When you hire SkyView, you’re getting our entire team and capability, no matter where your property is,” he says. “We promise a certain level of service from our entire team, and we don’t take on a deal unless we can deliver on that.”

Today, SkyView has offices in Cleveland and Milwaukee in addition to its Tampa headquarters, which it plans on moving in the coming months to keep up with growth and its 15 employees. An expansion to Texas could take place, as well.

Within five years, Crotty expects to be No. 1 in self-storage property sales and deal volume nationwide — regardless of whether it remains David to Marcus & Millichap’s Goliath.

“If we’re not, I’ll feel like we’ve failed in what I’ve set out to do,” he says.

He maintains that even if the economy turns down, self storage will continue to be robust from a consumer and investor perspective. Crotty thinks the sector will bloom internationally in coming years, too, even though self storage has largely failed to gain traction in Europe and other parts of the globe as it has in the U.S.

“I think we’re really scratching the tip of the iceberg,” Crotty says. “I believe the best is yet to come for us and the sector, and that no matter what the economy as a whole looks like, there’s still so much room to grow and self storage will be well positioned for a long, long time.”