About Our Latest Report

Our latest state-of-the-market includes the latest macro economic trends, unparalleled REIT performance data, and a custom transaction scope. Our experts utilize the latest technology stack to penetrate the market and tie these metrics together, procuring the most dynamic assessment in commercial real estate. The proprietary transaction details below deliver real-time informational value to our audience. The report provides a unique vantage point that is non-existent in any other information exchange.

Industry Transaction Analysis

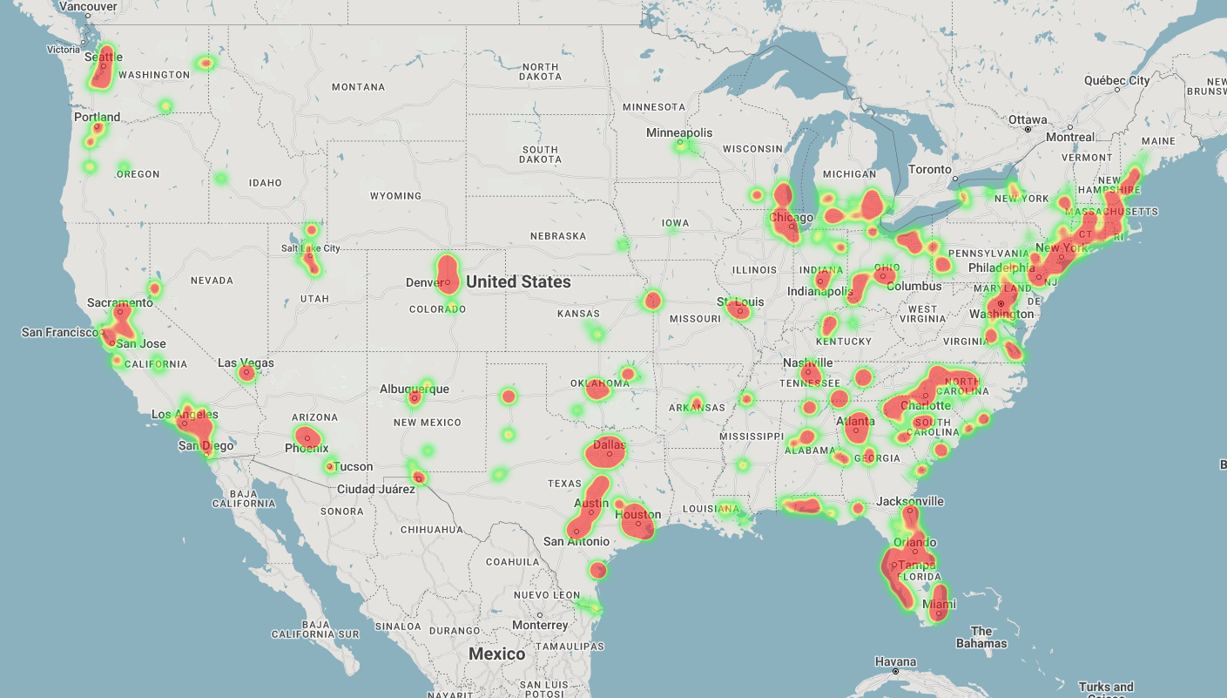

The heat map below visualizes total self-storage sales volume across the United States on a trailing 12-month basis, dating from July 2021 to July 2022.

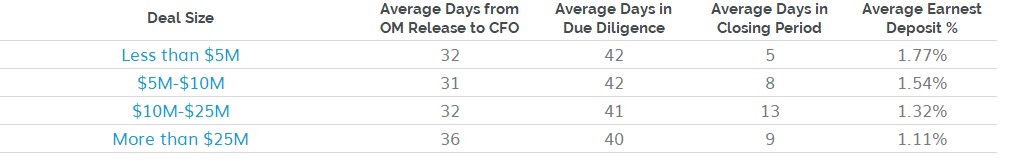

SkyView Advisors' Key Timeframes

Our metrics reflect the average time from offering memorandum release to call for offers deadline, average days in due diligence, average days in the closing period, and mean of the earnest deposit percentage for each deal size. This data creates full transparency on the transaction process timeline.

Below, SkyView’s on-market data is broken out from January 2021 to June 2022, categorized by deal size.

SkyView On Market Data - Jan 2021 to June 2022

The SkyView Offer Matrix - January 2021 to June 2022

The offer data below is broken out by deal type: stabilized, lease-up, and C/O deals. The average number of offers per closing for each deal type is featured to the right of each asset type.

Of the opportunities across the timeline presented in the data below, it is evident that on average, stabilized deals with value-add opportunities such as implementing a conversion or expansion, or adding in tenant insurance programs and competitive market rents, is the most lucrative to buyers in the current climate. Lease-up and deals underway that will be delivered at Certificate of Occupancy (“C/O”) trail just behind the value-add, stabilized opportunities. Demand is present for all self-storage deals; however, the buyer pool remains smaller for the latter two categories in today’s market.

Deal

Type

Average Number of Offers per Closing

Stabilized

10 Offers

Lease-Up

6 Offers

C/O

8 Offers

The State of the Market - Macro Economic Factors

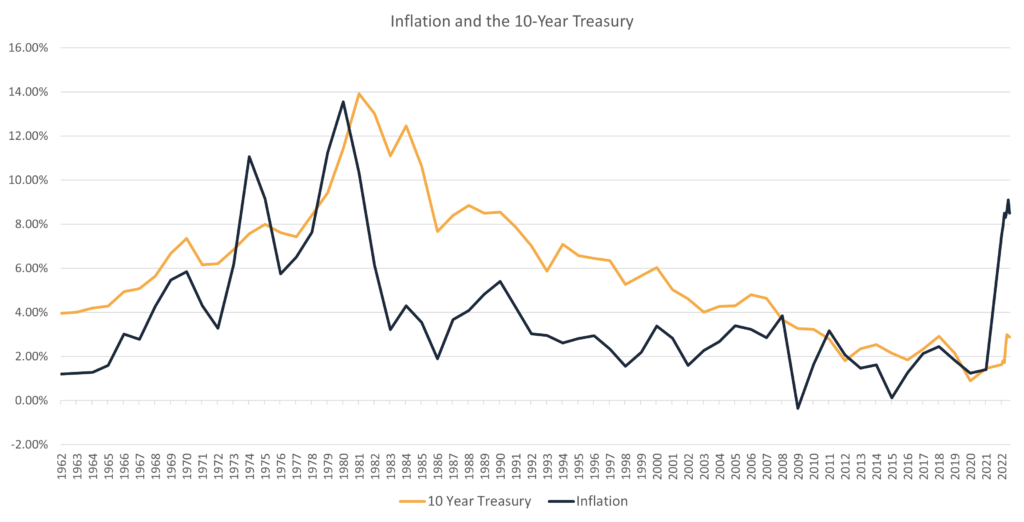

Economic shifts are continuing to impact the market as we enter the back half of 2022. The historic rise of inflation and interest rate hikes in quarter two continue to draw headlines as the industry’s most significant headwinds. These headwinds directly impacted several critical facets of the industry, including future development, rental rates, and cap rates.

A market correction was anticipated after the Federal Reserve went to zero during the pandemic, however, the historical inflation spike in 2022 is still unprecedented.

The visual below demonstrates that our economy is witnessing the highest rate of inflation in 40 years. However, as reflected above in the slight uptick in recent offers, early signs of market stabilization have just begun as inflation trends have decreased, albeit very minimally, in the past 90 days. The recent inflation decrease is reflected in the very far right of the visual below.

Moreover, continued outbreaks of COVID in China and the war in Ukraine have put constraints on the supply chain.

Despite the state of international affairs on the general economy, operating fundamentals for self-storage remain extraordinarily strong. Construction costs remain high, and new supply has been in balance with the demand for self-storage. Positive trends in the market over the last two months will continue to bolster self-storage for the remainder of quarter three, and into quarter four as the economy trends towards stabilization.

REIT Operating Fundamentals

Consensus revenue growth and demand is extremely robust. While the widening bid / ask spread between buyers and sellers is in effect, the REITs as well as private equity buyers are still pouring money into the sector with new acquisitions and developments. Revenue increases across the board are attributed to healthy rate increases, justified by strong occupancies and inflationary pressure. Fewer assets have entered the market this year, as rates on construction financing are now in the five percent range and rising. REIT inventory is relatively tight with steady move-in rates, which further justifies demand despite economic pressure. Moreover, achieved rates are up 15-20 percent year-over-year. Consumers and business customers are aggressively seeking space along with more traditional drivers for this time of year, including residential shifts and college move-ins across major markets.

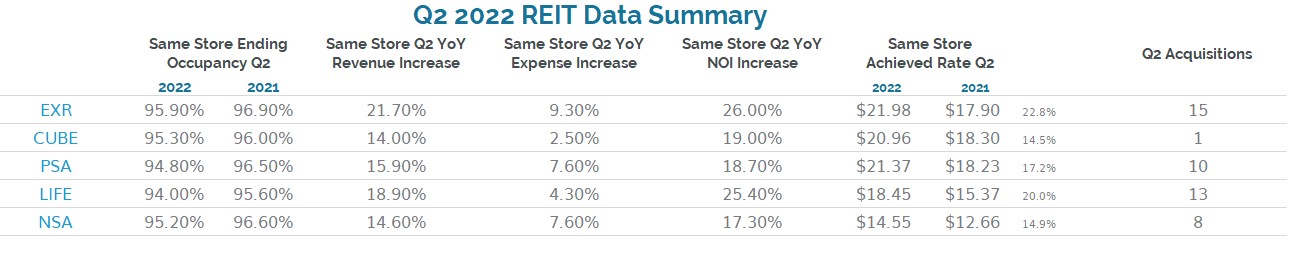

REIT Data

The visual below summarizes the most recent overall REIT performance metrics. Occupancy trends, revenue increases, expense increases, net operating income gains, and rates achieved year-over-year for quarter 2.

The industry is drawing back from the all-time peak of self-storage occupancy in Q2 of 2021 but is positioned still well above historical numbers at 95 percent. Moreover, the year-over-year NOI is on average 20 percent higher than it was last year, demonstrating the resiliency of the asset class, the need for storage space, and robust, ever-increasing fundamentals of the industry. Achieved rates are at an all-time high and are continuing to rise as demand is still very strong. With high occupancies, the REITs can push rates on their in-place tenants to record levels.

Proprietary Self Storage REIT Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Implied self-storage REIT cap rates were steadily hovering around four to five percent from 2018 to 2020. Once the pandemic hit, demand increased and asset performance improved. From Q2 of 2020 until Q4 of 2021, cap rates began to trickle down from the mid four percent range to the mid three percent range. Once interest rates began to rapidly increase in the first half of 2022, cap rates began to climb once again, as visualized below.

Achieved Rates and Achieved Occupancies Among REITs are displayed below. The timelines date back to 2018 and reflect rate trends for each quarter.

REIT rate trends remained consistent from Q1 2018 to Q2 2020. The effects of the pandemic are evident as rates began to climb in Q2 of 2020 due to strong demand, yielding all time high rental rates, and occupancies subsequently elevated to their peak as well. The trends are directly correlated as shown below.

As shown by the data below, Q2 continued to represent a consistent busy season for REITs across the board.

Occupancies remained consistent around the 92 percent range from 2018 to Q1 of 2020. The pandemic impact is evident starting in Q2 of 2020, as the demand for storage reached new highs with occupancies growing to 94 percent during the peak of COVID-19. In 2021, occupancies increased even further to all-time highs of 96 percent as displayed below.

Closing Remarks

As we continue to build our proprietary dataset and technology stack, our analytics will continue to evolve and lead the way. Our unique transaction analysis directly correlates to market conditions.

This next-level combination of informative statistics is geared to help you formulate a strategic business plan for your self-storage asset, regardless of your position. We look forward to leading the way as thought leaders in order to help you achieve your ultimate goals.

Scott Schoettlin

Managing Director

(813) 829 1248

sschoettlin@skyviewadvisors.com

Contributions:

Steven Paul

Senior Financial Analyst

Bryce Josepher

Head of Marketing

Maps Courtesy of Yardi Matrix