Key Takeaways

- Significant year-over-year increases in rental rates and home values across major REITs like Sun Communities, Equity LifeStyle Properties, and UMH Properties indicate robust demand and effective market strategies.

- Notable improvements in occupancy rates across the sector, with Sun Communities reaching 97.2%, ELS maintaining 95%, and UMH achieving 87.5%, reflecting high property desirability and effective management.

- Substantial increases in revenue and NOI for key players, coupled with controlled expense growth, demonstrate strong financial health and operational efficiency. Sun Communities, ELS, and UMH have all shown effective cost management and strategic investment in new rental homes.

- Positive market forces such as high demand for affordable housing, limited supply, and demographic shifts (e.g., baby boomers) support continued growth in rental rates, occupancy levels, and overall sector attractiveness.

Contributors

Steven Paul

Senior Financial Analyst

Aaron Sanchez

Managing Director

Jared Bosch

Senior VP & Director of Manufactured Housing

Q1 2024 Manufactured Housing REIT Data Overview

| Ending Occupancy (Same Store) | YoY Revenue Increase (Same Store) | YoY Expense Increase (Same Store) | YoY NOI Increase (Same Store) | Rent Per Site (Same Store) | Q1 Acquisitions | Total MH Sites | ||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||

| Sun Communities (SUI) | 97.20% | 96.80% | 6.8% | 6.4% | 3.4% | 10.4% | 8.0% | 5.0% | $686 | $648 | 0 | 99,930 |

| Equity Lifestyle Properties (ELS) | 94.90% | 94.90% | 6.4% | 6.5% | 3.9% | 7.4% | 7.1% | 5.7% | $847 | $797 | 0 | 73,008 |

| UMH Properties (UMH) | 87.50% | 87.00% | 10.5% | 6.1% | 3.5% | 6.8% | 15.6% | 5.6% | $530 | $511 | 0 | 25,785 |

Q1 Manufactured Housing REIT Highlights

- Sun Communities increased same-store rent per site by 5.9% YoY, driving an 8% rise in same-property NOI.

- Sun Communities’ same-property occupancy rates rose by 40 basis points YoY, reaching 97.2%.

- Sun Communities reported a 6.8% revenue increase for its manufactured housing segment, with an 8% overall NOI growth.

- Equity LifeStyle Properties reported a 5.6% rent increase for renewing residents, with new homes selling for around $100,000.

- ELS maintained a high occupancy rate of 95%, with 96% of units occupied by homeowners.

- ELS experienced a 6.4% increase in core community-based rental income and a 5.6% growth in core utility and other income.

- UMH Properties saw a 10.5% YoY growth in rental income, achieving an 87.5% occupancy rate on same-store communities.

- UMH’s overall occupancy increased from 87% to 87.5%, with rental unit occupancy improving to 95.1%.

- UMH achieved a 15.6% rise in community NOI, improving its community expense ratio from 44.3% to 41.9%.

Q1 2024 Manufactured Housing Operating Fundamentals

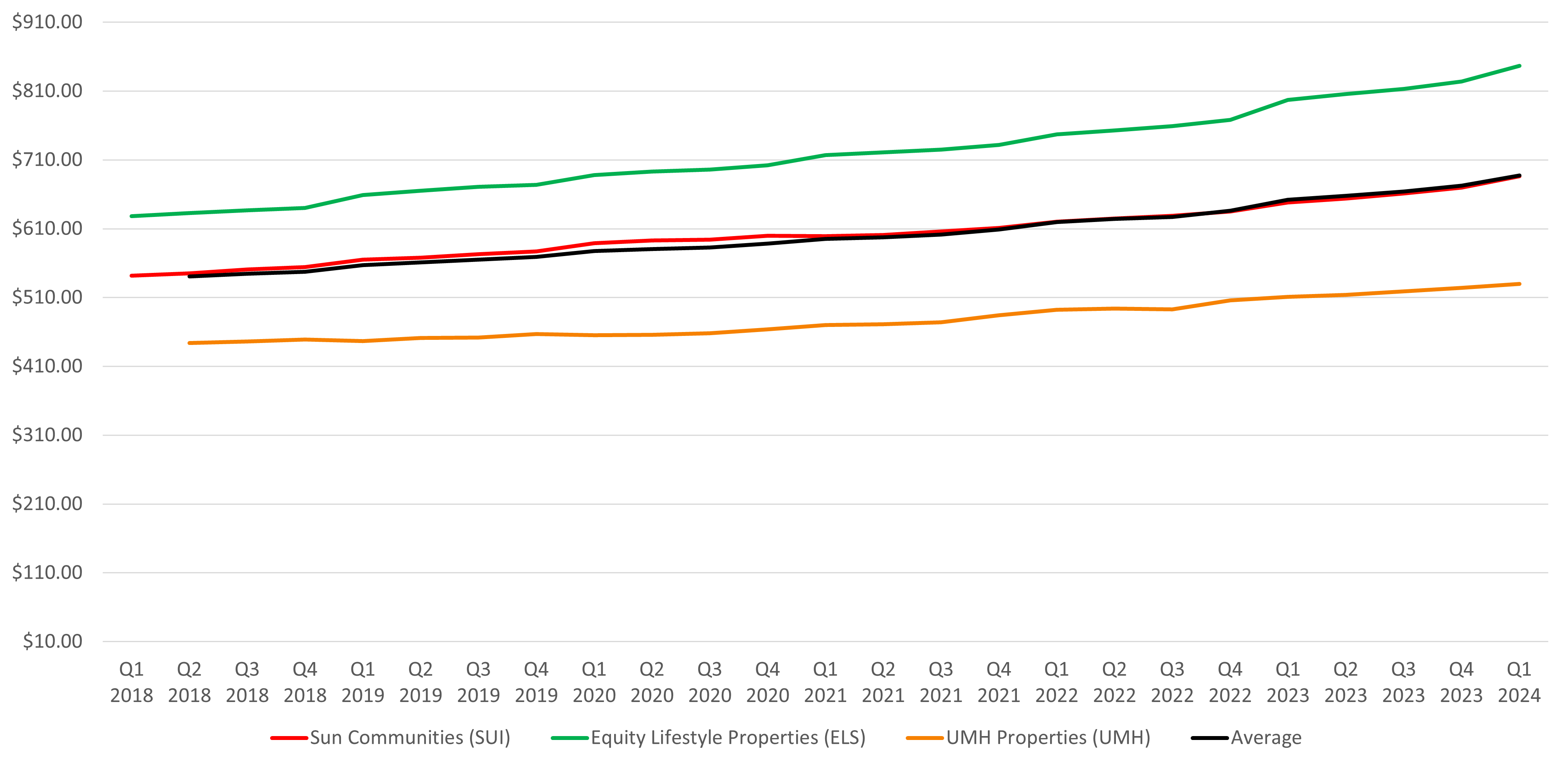

Manufactured Housing Rental Rates

During Q1 2024, the manufactured housing sector experienced significant growth in rental rates and home values across key REITs. Sun Communities increased their same store rent per site by 5.9% YoY, from $648 to $686, driving an 8% rise in same-property net operating income (NOI). Equity LifeStyle Properties (ELS) reported an average rent increase of 5.6% for renewing residents, with new homes selling for around $100,000 due to their high-quality construction and amenities. Similarly, UMH Properties saw an 10.5% year-over-year growth in rental income, attributed to annual rent increases and new rental homes, achieving a 87.5% occupancy rate on same store communities. These REITs’ robust rental rate hikes reflect strong demand and tight housing supply, which have pushed up home values and ensured the continued attractiveness and competitiveness of their properties, demonstrating effective market strategies and strong operational management.

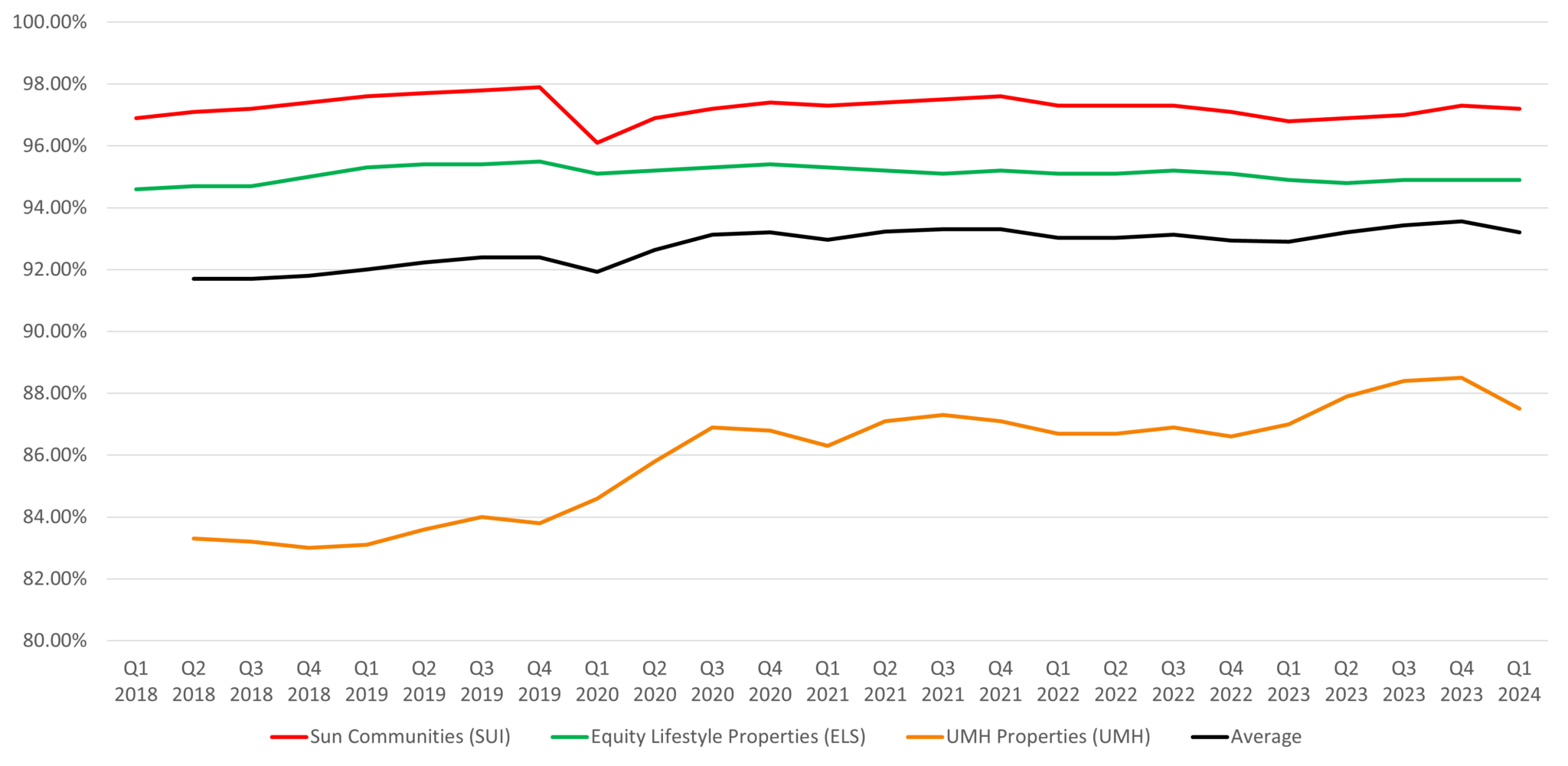

Manufactured Housing Occupancy

Occupancy levels in the manufactured housing REIT sector have shown notable improvements across several companies. Sun Communities achieved a significant increase in same-property occupancy rates by 40 basis points year-over-year, reaching 97.2%. ELS’s MH portfolio maintains a high occupancy rate of 95%, with 96% of units occupied by homeowners, ensuring low turnover and consistent revenue streams, with a long-standing low delinquency rate. UMH also reported an increase in occupancy rates, with overall occupancy rising from 87% to 87.5%, and rental unit occupancy improving to 95.1%. These increases highlight the effective management and high desirability of their properties, ensuring low turnover and stable resident tenure.

Manufactured Housing Income & Expenses

In the manufactured housing REIT sector, Sun Communities reported a 6.8% increase in revenue for its manufactured housing segment, while expenses rose by 3.4%, resulting in an 8% overall NOI growth. This indicates effective revenue management and cost control measures. The RV sector also saw an 8.1% NOI increase due to a 3.1% revenue rise and a 1.8% expense reduction, highlighting the company’s operational efficiency. ELS experienced a 6.4% increase in core community-based rental income in the MH sector for the first quarter of 2024, driven by rent increases and market rents from new residents. Core utility and other income grew by 5.6%, while operating expenses increased moderately by 3.9%, impacted by higher real estate taxes and insurance costs. UMH reported a robust financial performance with a 10.5% year-over-year increase in same-store rental and related income, and a 15.6% rise in community NOI, driven by higher occupancy rates and rent increases. Despite a 3.5% increase in community operating expenses, UMH improved its community expense ratio from 44.3% to 41.9%, demonstrating effective cost management and strategic investments in new rental homes.

Manufactured Housing Investment & Transaction Activity

During Q1 2024, Sun Communities continued its selective capital deployment by acquiring strategic marina properties for approximately $12 million and selling two manufactured housing properties, recycling approximately $52 million in proceeds. This capital recycling strategy allows for optimizing their portfolio and enhancing long-term growth prospects. ELS invested in new home constructions, resulting in the sale of 4,500 new homes over five years and an 8.5% increase in new home sales year-over-year for Q1 2024. UMH expanded its manufactured housing portfolio by installing and renting 800 new homes and refinancing older communities, revealing significant property value appreciation. Their sales pipeline and site developments are expected to further enhance revenue and asset base. Collectively, these strategic investments and transactions reflect disciplined approaches to maximizing shareholder value and strengthening their respective portfolios.

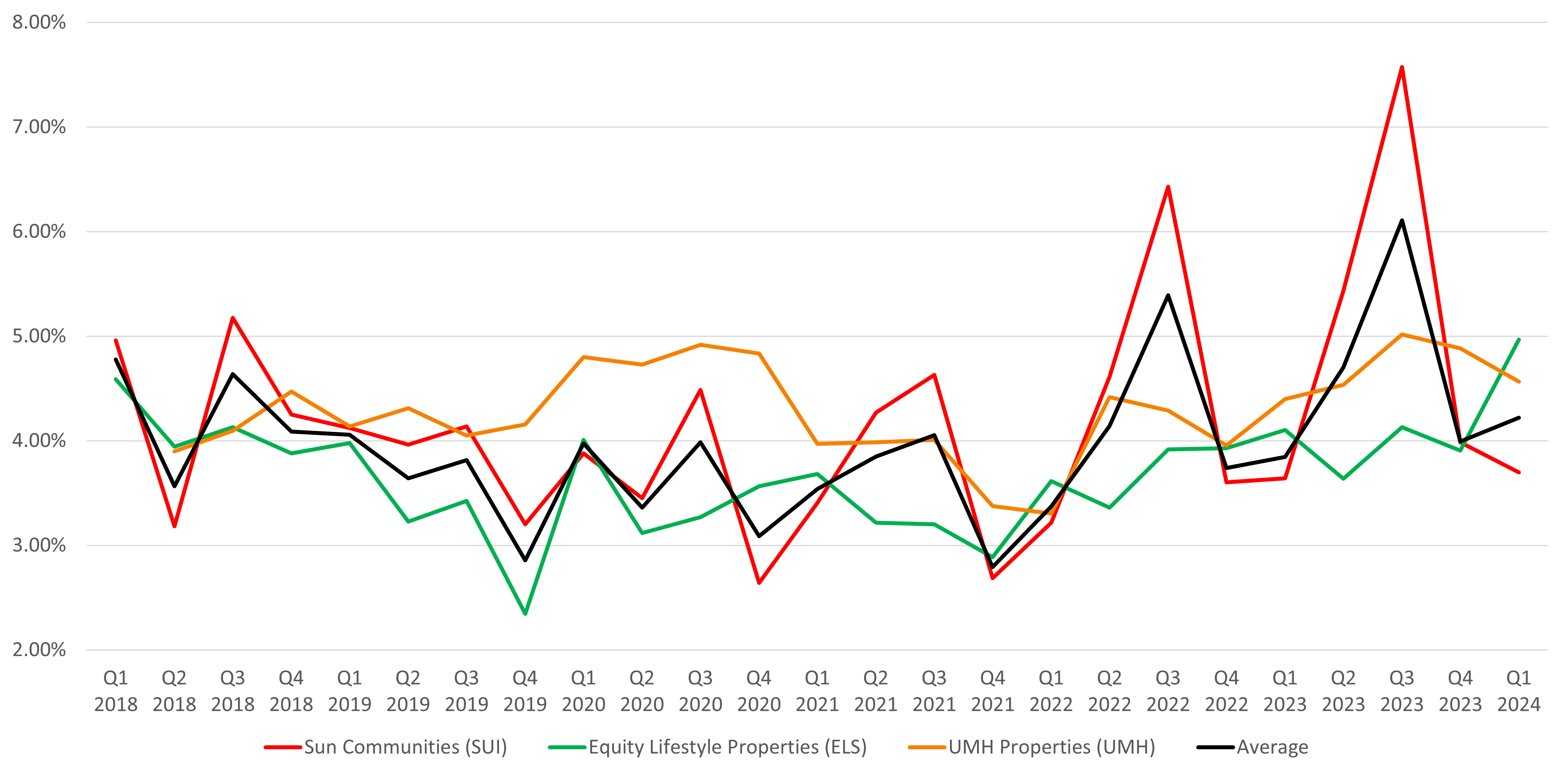

Manufactured Housing Cap Rates & Bid-Ask Spread

The manufactured housing REIT sector exhibits a strategic understanding of cap rate trends and a favorable bid-ask spread, as demonstrated by key players like Sun Communities, ELS, and UMH. Sun Communities’ successful transactions in the current market indicate a strategic approach to managing cap rates and navigating market fluctuations effectively, ensuring sustainable growth. ELS benefits from strong interest and favorable financing conditions, with 10-year loan terms for high-quality MH assets between 6% and 6.75%, maintaining competitive cap rates and a manageable bid-ask spread. UMH’s strategic investments and refinancing efforts have significantly increased property values, with a weighted average interest rate of 4.17% and 92% of total debt at fixed rates, highlighting effective financial management and a favorable cap rate environment. Together, these REITs demonstrate adeptness in capital allocation, ensuring profitable transactions and stable growth in the manufactured housing sector.

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Tailwinds in the Manufactured Housing Market

Several positive market forces are driving growth in the manufactured housing REIT sector. High demand for affordable housing, coupled with limited supply, continues to support rental rate increases and high occupancy levels for Sun Communities, Equity LifeStyle Properties (ELS), and UMH Properties. The strategic conversion of transient RV sites to annual leases by Sun Communities provides a more stable income stream, while the demographic shift of baby boomers turning 65 daily drives demand for retirement and vacation homes in desirable locations for ELS. Additionally, the stabilization of manufacturing backlogs and a supportive interest rate environment benefit UMH’s growth strategy. All three companies focus on high-quality properties and community expansions, positioning them well to capitalize on favorable market conditions and drive future growth.

Headwinds in the Manufactured Housing Market

Despite the overall positive outlook for Sun Communities, ELS, and UMH, each faces several headwinds that could impact future performance. Sun Communities is challenged by transient RV revenue headwinds, with forecasted NOI growth for this sector being negative, along with rising operating expenses, particularly in payroll and utilities. ELS must manage the potential impacts of economic downturns, adverse weather, rising insurance, and real estate tax costs. For UMH, increasing community operating expenses in payroll, taxes, and maintenance, as well as regulatory hurdles and slow approval processes for new land lease communities, present significant challenges. All three companies need to strategically manage costs and operational efficiency to mitigate these pressures, while also adapting to potential economic and market condition changes to sustain their growth trajectories.