Market Conditions Supportive of Manufactured Housing

Overall, demand has been a bit slow in year-end 2023 into early 2024. While manufactured housing held up better than most asset classes, rising interest rates are leading to adjusted expectations. Increasingly, financing deals have moved into the low 7 range, so cap rates have moved up to enable yields that exceed debt cost. That being said, the highest quality deals have been able to trade at lower cap rates with some even trading in the 4 range, just in lower volumes.

Still, there is tremendous demand for affordable housing and modern manufactured homes offer a great value for quality equation, often priced up to 50% lower per square foot than traditional site-built homes. Over the past year, manufactured homes have made up over 10% of annual new home starts, in part because the total volume of new home starts has fallen.

Amidst the challenging commercial real estate landscape of the past year, market conditions continue to be supportive of manufactured housing. As buyers and sellers adapt to evolving market conditions, there’s potential for further growth and development in the commercial real estate sector. As we get into second half of 2024 and the expected rate cuts come to fruition, this should drive housing and increase demand, especially in areas where there is the most population in-migration.

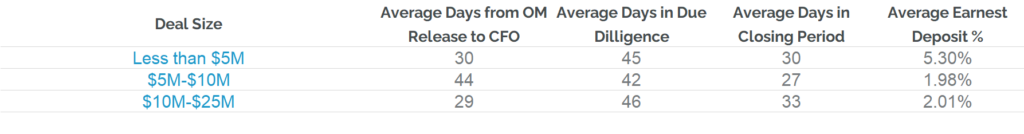

In the initial section of this report, we share proprietary SkyView metrics across our asset classes of self-storage, healthcare, and manufactured housing. The data reflects the average time from offering memorandum release to call for offers deadline, average days in due diligence, average days in the closing period, and mean of the earnest deposit percentage for each deal size. This data creates full transparency on the transaction process timeline. Below, SkyView’s on-market data reflects all 12 months of 2023, categorized by deal size. The latter sections of this report are based primarily on public REIT data.

SkyView On Market Data

REIT Operating Fundamentals

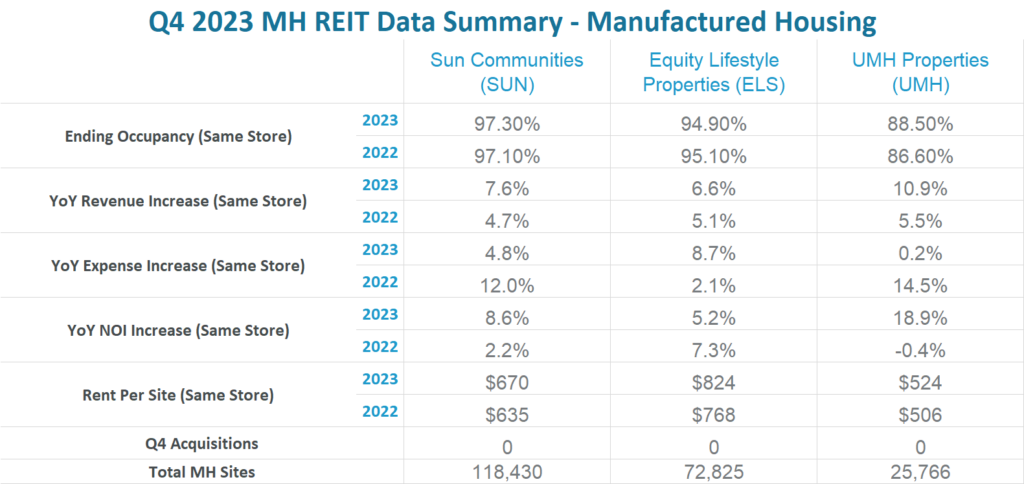

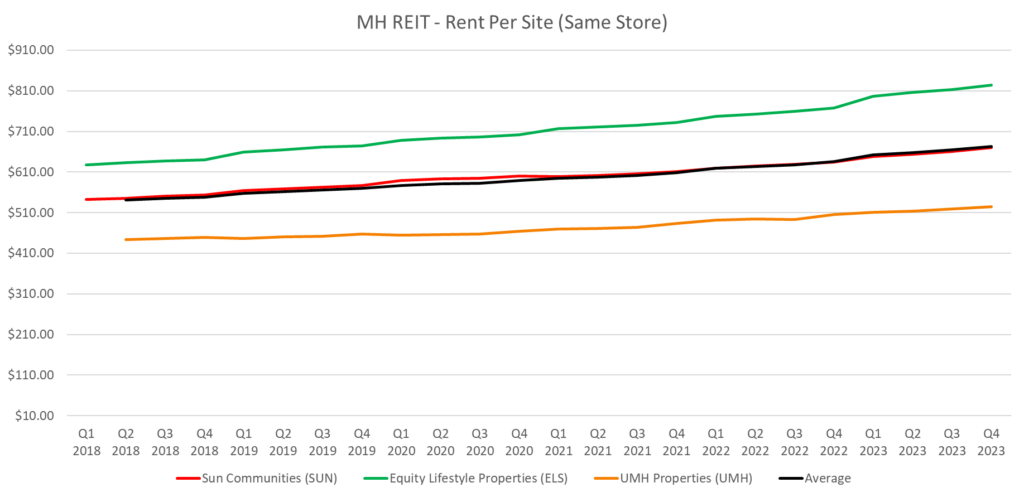

Rental Rates

Across the manufactured housing real estate investment trusts (REITs), strong rental rate growth characterized the market in 2023. Sun Communities showcased robust performance, the same community rent per site for manufactured housing sites in North America experienced significant increases of 5.5% for Q4. Equity LifeStyle Properties (ELS) reported a remarkable 13% mark-to-market rent increase for new homeowners in 2023, reflecting high demand for their community lifestyles. The core community-based rental income also grew by 6.8% for the full year, driven by increases for in-place residents and market-driven adjustments on turnover. UMH Properties implemented a 5% rent increase strategy, overcoming challenges in the first half of 2023 due to COVID-related inventory issues and manufacturing backlogs. Despite these hurdles, UMH successfully rented or sold 1,300 new homes and anticipates achieving similar or improved occupancy gains with reduced carrying costs, emphasizing the resilience of the rental market across these REITs.

Occupancy

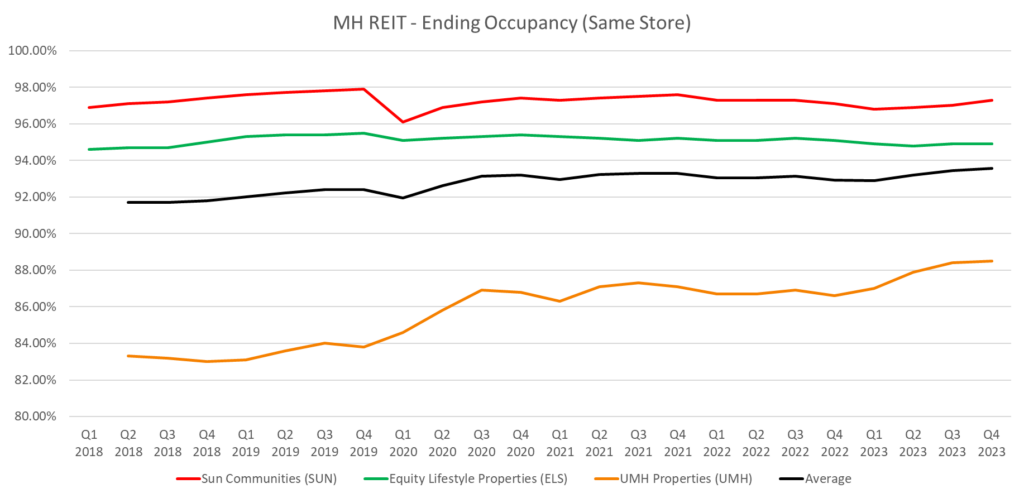

Overall, in the manufactured housing real estate investment trust (REIT) sector, positive trends in occupancy were observed across Sun Communities, ELS, and UMH Properties. Sun Communities reported a noteworthy increase in same-property occupancy for both manufactured housing (MH) and RV, growing by 230 basis points in 2023 compared to the previous year for the sectors combined. This rise was attributed to the successful conversion of transient RV sites to annual, resulting in more than 2,100 site conversions and reaching an impressive 98.9% adjusted occupancy. ELS maintained stable occupancy levels, boasting a 95% occupancy rate in the MH portfolio, with over 96% of MH sites occupied by homeowners. The company’s strategy of converting existing residents to homebuyers proved successful, contributing to a slight increase in occupancy during the fourth quarter of 2023. UMH Properties achieved significant progress, filling over 1,000 new rental homes and experiencing a net increase of 704 units or 210 basis points. The company highlighted the equivalent of building a 1,000-unit apartment complex in one year, with substantial occupancy gains during the second and third quarters and expectations for continued growth as manufacturing backlogs normalized.

Income & Expense Information

In 2023, the three manufactured housing Real Estate Investment Trusts (REITs) demonstrated positive financial performances. Sun Communities exhibited robust results with an 8.6% increase in same-property NOI on its MH portfolio during the fourth quarter, fueled by higher rental revenues from MH, coupled with efficient expense management across all segments. ELS reported strong income and expense figures for the full year, achieving a 5% growth in Net Operating Income (NOI) and a 5.8% increase in core operating revenue. However, in the fourth quarter, core operating expenses rose by 8.7%, attributed to real estate tax increases in several Florida counties. UMH also reported positive financial outcomes, showcasing a 10.9% same-property income growth and a 18.9% same-property NOI growth on its MH Portfolio for Q4.

Investment & Transaction Activity

In the manufactured housing real estate investment trust (REIT) sector, companies like Sun Communities (SUN), Equity LifeStyle Properties (ELS), and UMH Properties (UMH) have exhibited varying approaches to investment and transaction activity. SUN strategically pursued capital recycling, divesting its shares in Ingenia, liquidating a portfolio of manufactured housing consumer loans, and shedding its interest in Campspot. The company remains committed to selective development projects and acquisitions while directing free cash flow and capital proceeds toward deleveraging. Conversely, ELS reported minimal transaction activity in 2023, closing only one deal due to limited market opportunities. On the other hand, UMH invested approximately $27 million with Nuveen in both developed and undeveloped lots, aiming for full occupancy within three years. Additionally, UMH has around $40 million invested in 500 vacant expansion lots, anticipating a similar three-year occupancy horizon. The company is also actively working on seven turnaround properties acquired in the past two years, expecting them to contribute positively within the next two years.

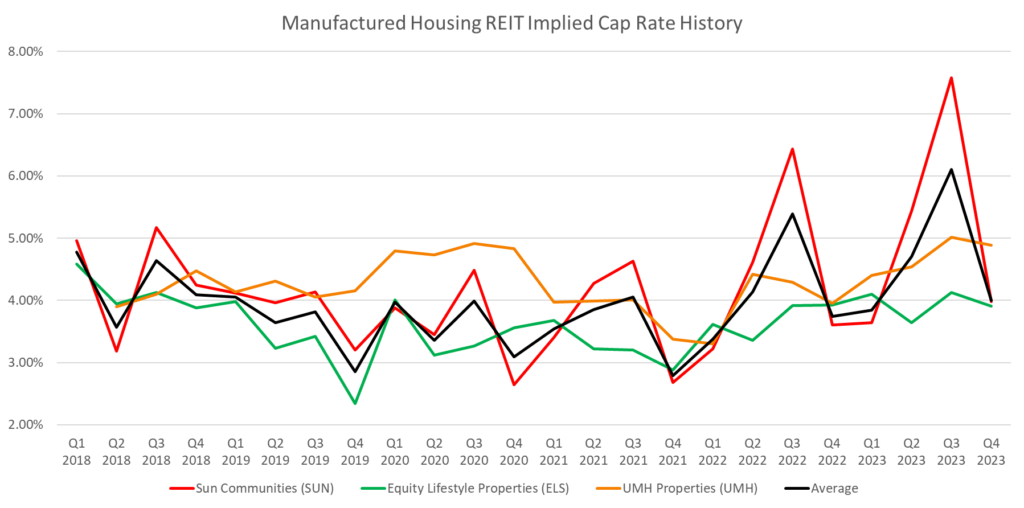

Cap Rates & Bid-Ask Spread

While Sun Communities did not explicitly disclose cap rates and bid-ask spreads in its earnings release, the company’s focus on capital recycling and strategic asset sales suggests a proactive approach to portfolio management, potentially influencing these metrics in specific transactions. In contrast, Equity LifeStyle Properties (ELS) provides insights into cap rates, with a representative noting that over the past 18 to 24 months, rates have fluctuated between 4% and 6%, contingent on property quality.

Tailwinds in the Market

Manufactured housing Real Estate Investment Trusts (REITs) are experiencing significant tailwinds in the market. Sun Communities (SUN) reports enduring robust demand and limited supply fundamentals across its portfolio, emphasizing the success of its strategy to convert transient to annual RV sites and the strong demand for wet slip and dry storage spaces in Marinas. Equity LifeStyle Properties (ELS) points to positive market dynamics with a 7% increase in home buying leads during the fourth quarter of 2023, driven by popular new home models and technology-driven online awareness. The Sunbelt properties in Florida, California, Arizona, and Texas continue to benefit from demographic trends, such as the aging baby boomer population and the projected growth of the 55-plus age group. UMH Properties (UMH) anticipates market tailwinds with a return to normal manufacturing backlogs, reducing the need for large inventory holdings. The company expects reduced interest expense and carrying costs, enabling it to generate similar overall occupancy and revenue gains in the following year. Overall, these REITs are capitalizing on positive market dynamics, showcasing sustained demand, and strategic initiatives that position them favorably in the manufactured housing sector.

Headwinds in the Market

Manufactured housing Real Estate Investment Trusts (REITs) are encountering various headwinds in the market. Sun Communities, operating in the UK, faced economic challenges attributed to higher inflation and interest rates, resulting in total noncash impairments of approximately $370 million related to the Park Holidays platform acquisition. These impairments were linked to macroeconomic dynamics in the UK, leading to a material weakness in internal control over financial reporting. Despite signs of stabilization in the second half of the year, Sun Communities anticipates a continuation of current volume and margin trends. Equity LifeStyle Properties (ELS), though not explicitly mentioning market headwinds, addressed challenges such as higher core operating expenses in the fourth quarter of 2023, particularly due to real estate tax increases in specific Florida counties. The company is actively addressing these issues through appeals and passing through increased real estate taxes to residents where lease terms allow. UMH, on the other hand, acknowledged challenges in 2022 and the first half of 2023, including high inventory levels, manufacturing backlogs, and increased COVID-related costs. However, the company emphasizes that these challenges are now in the past, allowing them to focus on future growth and anticipate improved results in 2024.

REIT Data Summary

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Rent Per Site & Ending Occupancies (Same Store)

MH REIT - Ending Occupancy (Same Store)

Proprietary Data

As we continue to build our proprietary dataset and technology stack, our analytics will continue to evolve and lead the way. Our unique transaction analysis directly correlates to market conditions. This next-level combination of informative statistics is geared to help you formulate a strategic business plan for your asset, regardless of your position. We look forward to leading the way as thought leaders in order to help you achieve your ultimate goals.

Contributions:

Steven Paul

Senior Financial Analyst

Don Vedeen

Managing Director

Jared Bosch

Senior VP and Director of Manufactured Housing