Q2 Manufactured Housing REIT Highlights

- Rental Rates and Home Values: ELS highlighted that the average cost of purchasing a new home in their communities is around $100,000, significantly lower than the $500,000 average for new site-built homes. Renters in ELS communities pay approximately $1,400 per month, about 35% less than comparable apartments in the same markets.

- Occupancy: ELS maintained a 95% occupancy rate in its manufactured housing portfolio, supported by the sale of 255 new homes in Q2 2024, a 13% year-over-year increase.

- Income and Expense Information: ELS reported a 6.2% increase in core community-based rental income in Q2 2024, along with a 3.4% growth in operating expenses, 200 basis points lower than initial guidance, leading to a 5.5% increase in core NOI.

- Rental Rates and Home Values: Sun Communities reported that the average annual site rent for RVs is approximately $6,000, with seasonal site rents averaging $1,100 per month, marking a steady year-over-year increase. Rental rates in their manufactured housing communities have risen by 5-6% annually.

- Occupancy: The company maintained near-full occupancy in its manufactured housing portfolio, with some communities achieving occupancy rates above 97%, particularly in high-demand Sunbelt states.

- Income and Expense Information: Sun Communities saw a 6.4% increase in net operating income (NOI) for the first six months of 2024, driven by effective rent increases and high occupancy rates, while managing operating expenses.

- Rental Rates and Home Values: UMH Properties reported a 9% increase in rental and related income in Q2 2024, driven by the strategic expansion of their rental home inventory, which now totals 10,100 homes, yielding a 10% return on investment.

- Occupancy: UMH achieved an overall occupancy rate of 87% by the end of Q2 2024, with a 95% occupancy rate in their rental homes. The company added 64 new occupied units during the quarter and 196 units year-to-date.

- Income and Expense Information: UMH reported an 11% increase in NOI for Q2 2024, with same-property income rising by 9% and expenses by 6%. Effective cost control reduced their operating expense ratio from 42.6% to 41.9%.

Thoughts from the CEO's

Equity Lifestyle Properties

Marguerite M. Nader

President, Chief Executive Officer & Director

- “I am pleased to report the results for the second quarter of 2024. Our performance exceeded our expectations. For the first six months of 2024, we have seen an increase in NOI of 6.4% as compared to last year. We focus on translating NOI growth to normalized FFO growth.”

Sun Communities

Gary A. Shiffman

Chairman, Chief Executive Officer, and President

- “We are seeing growth in annual RV revenues, and while transient RV is still experiencing some headwinds, we are actively managing our controllable expenses. Our UK strategy remains focused on shifting a larger proportion of our income from home sale margins to the resilient, reliable NOI generated by real property rents. Finally, we are executing our capital recycling objectives. Year to date, we have sold over $300 million of properties and used the proceeds to pay down debt.”

UMH Properties

Samuel A. Landy

President & Chief Executive

Officer

- “We are proud that our communities are experiencing strong demand for our home sales and rentals. This demand is the result of investing in the right locations and rapidly improving the quality and reputation of our communities. Overall, occupancy increased by 64 units to 87% during the quarter and 196 units year-to-date.”

Macroeconomic Highlights

Recession Fears and Economic Outlook: Economic uncertainty remains a significant concern as the U.S. navigates the possibility of a recession. While GDP growth has been positive, the Federal Reserve’s interest rate hikes aimed at curbing inflation have led to concerns about a potential economic slowdown. Consumer spending has been resilient but is expected to weaken as pandemic-era savings dwindle and borrowing costs rise. Meanwhile, the labor market remains strong, but there are signs of stress, including rising delinquencies in subprime loans and the potential impact of restarting student loan payments.

Geopolitical Tensions and Their Impact: The upcoming election is likely to significantly influence the commercial real estate market as potential policy shifts could affect key areas such as taxation, regulation, and federal spending. Issues like corporate tax rates, environmental regulations, and infrastructure investment are particularly crucial for sectors like industrial, office, and multifamily properties. As the election approaches, market participants may adopt a cautious stance, leading to temporary uncertainty and slowed transaction activity. Additionally, the election’s outcome could impact interest rate policy and economic stimulus measures, both of which are vital to commercial real estate investment and development.

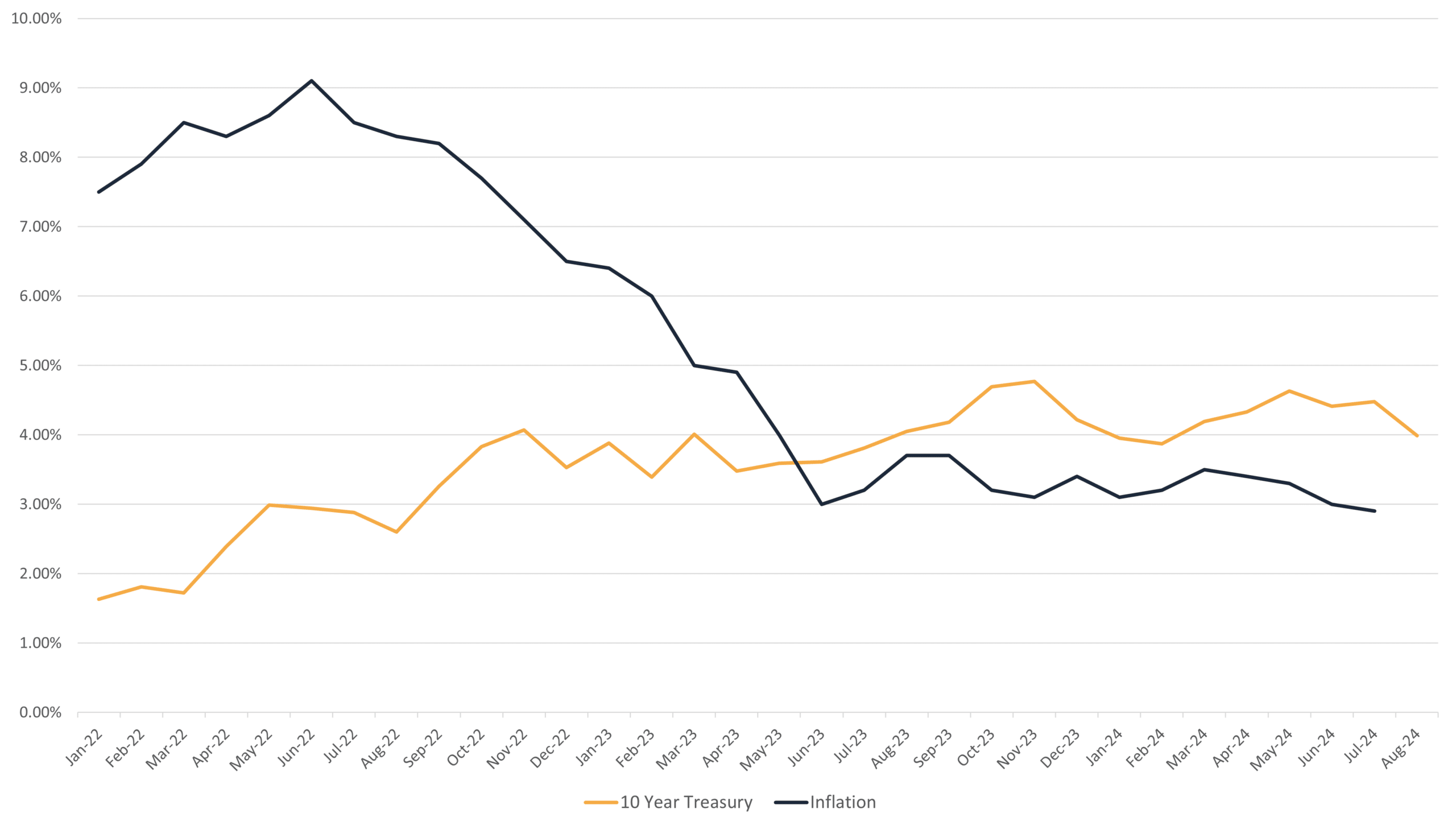

Inflation and the 10-Year Treasury Since 2022

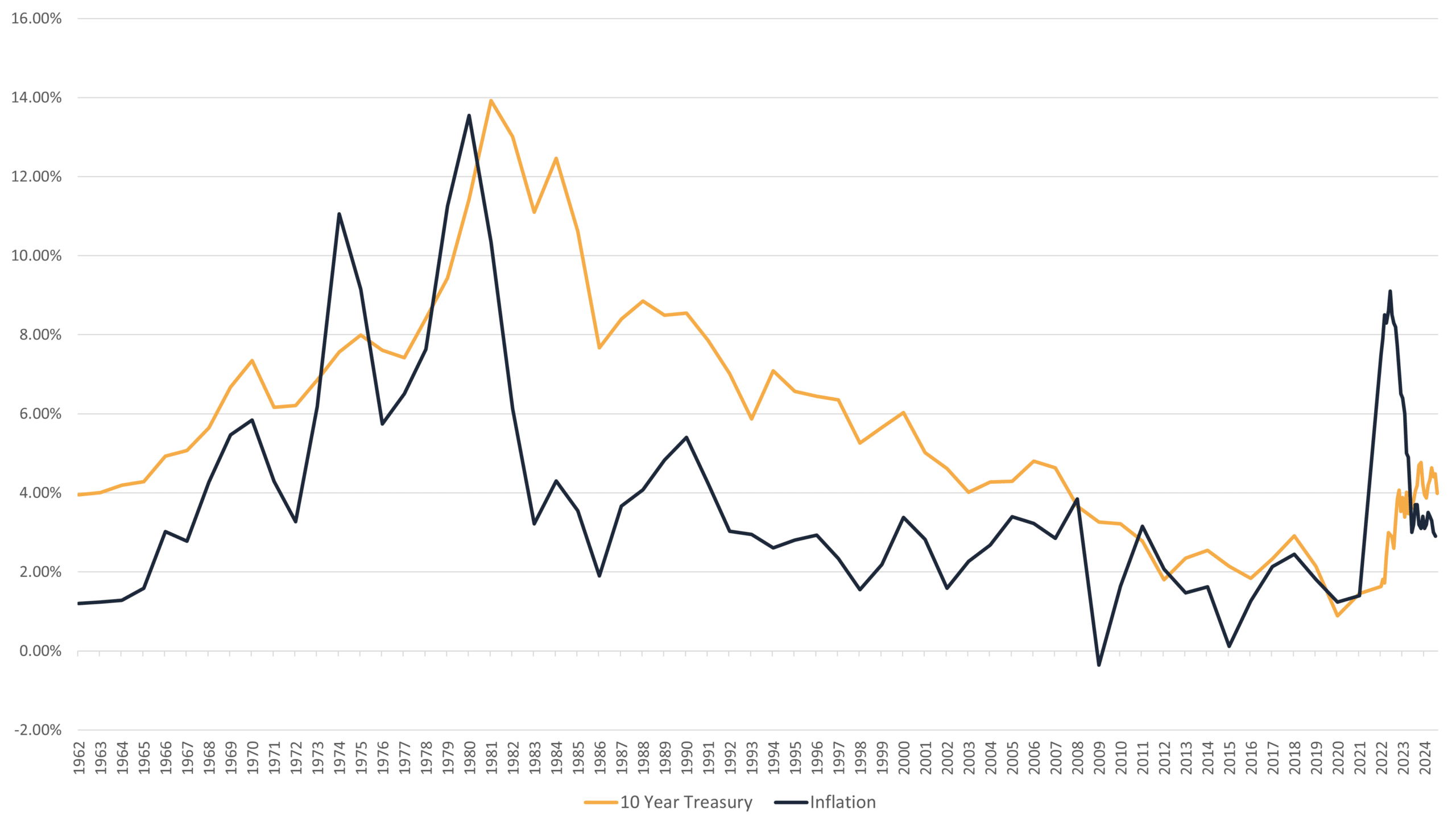

Inflation and the 10-Year Treasury Since 1962

Q2 2024 Manufactured Housing REIT Data Overview

| Equity Lifestyle Properties (ELS) | Sun Communities (SUI) | UMH Properties (UMH) | ||

| Ending Occupancy (Same Store) | 2023 | 94.90% | 97.20% | 87.70% |

| 2024 | 94.80% | 96.90% | 87.90% | |

| YoY MH Rental Income Increase (Same Store) | 2023 | 6.2% | 7.2% | 9.0% |

| 2024 | 6.7% | 6.7% | 9.0% | |

| YoY MH Expense Increase (Same Store) | 2023 | 3.4% | 9.2% | 6.1% |

| 2024 | 7.0% | 9.4% | 4.2% | |

| YoY MH NOI Increase (Same Store) | 2023 | 5.5% | 6.4% | 11.0% |

| 2024 | 3.5% | 5.7% | 12.6% | |

| Rent Per Site (Same Store) | 2023 | $854 | $692 | $534 |

| 2024 | $806 | $654 | $514 | |

| Q2 MH Acquisitions | 0 | 0 | 0 | |

| Total MH Sites | 73,006 | 100,160 | 25,787 | |

Q2 2024 Manufactured Housing Operating Fundamentals

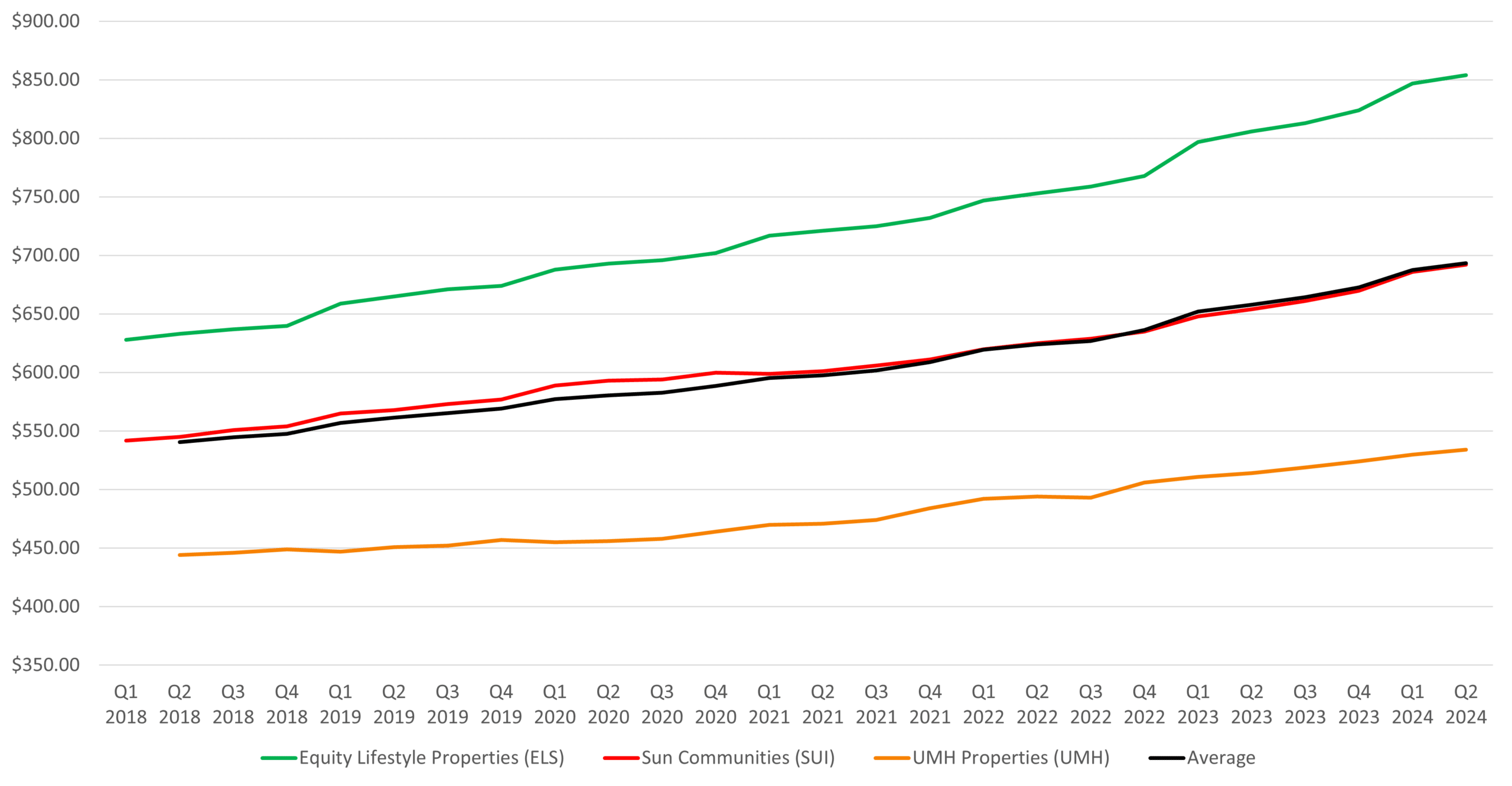

Manufactured Housing Rental Rates

Rental rates and home values in the manufactured housing REIT sector have shown substantial growth, largely driven by the widening affordability gap between traditional site-built homes and manufactured homes. Sun Communities reported that the average annual site rent for RVs is around $6,000, with seasonal site rents averaging $1,100 per month, marking a steady year-over-year increase. In their manufactured housing communities, rents have continued to rise by approximately 5-6% annually. Equity LifeStyle Properties (ELS) highlighted that the average cost of purchasing a new home in their communities is around $100,000, significantly lower than the $500,000 average for new site-built homes. Moreover, renters in ELS communities pay approximately $1,400 per month, which is about 35% less than comparable apartments in the same markets. This pricing advantage has been a key driver of demand, with ELS selling over 5,500 new homes in the past decade. UMH Properties reported a 9% increase in rental and related income in Q2 2024, driven by the strategic expansion of their rental home inventory, which now totals 10,100 homes. These new rentals yield an impressive 10% return on investment, reflecting the company’s focus on maximizing profitability in the face of rising housing costs.

Rent per Site (Same Store)

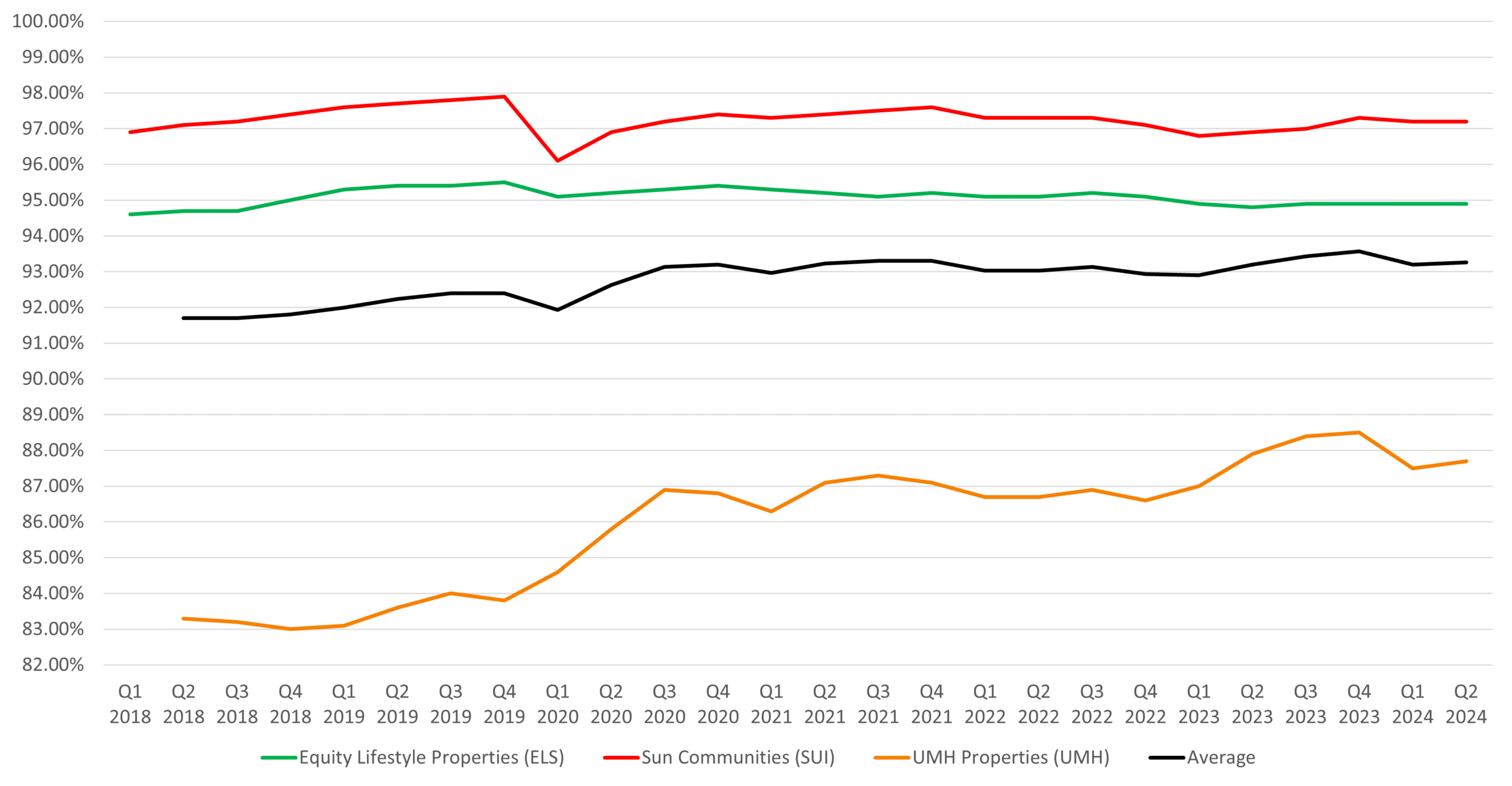

Manufactured Housing Occupancy

Occupancy rates across the major manufactured housing REITs have remained exceptionally high, underscoring the sustained demand for affordable housing. Sun Communities reported near-full occupancy in their manufactured housing portfolio, with some communities achieving rates above 97%. This strong performance is particularly notable in Sunbelt states, where demand for affordable housing continues to outpace supply. Equity LifeStyle Properties maintained a 95% occupancy rate in its manufactured housing portfolio, bolstered by the sale of 255 new homes in Q2 2024—a 13% year-over-year increase—that have enhanced the quality of their communities. ELS’s RV segment also performed strongly, with the annual segment achieving a 7% growth rate for the full year of 2024. UMH Properties reported an overall occupancy rate of 87% by the end of Q2 2024, with a 95% occupancy rate in their rental homes. UMH added 64 new occupied units during the quarter and 196 units year-to-date, demonstrating the effectiveness of their investment strategy and the strong demand for their affordable housing options.

Period Ending Occupancy (Same Store)

Manufactured Housing Income & Expenses

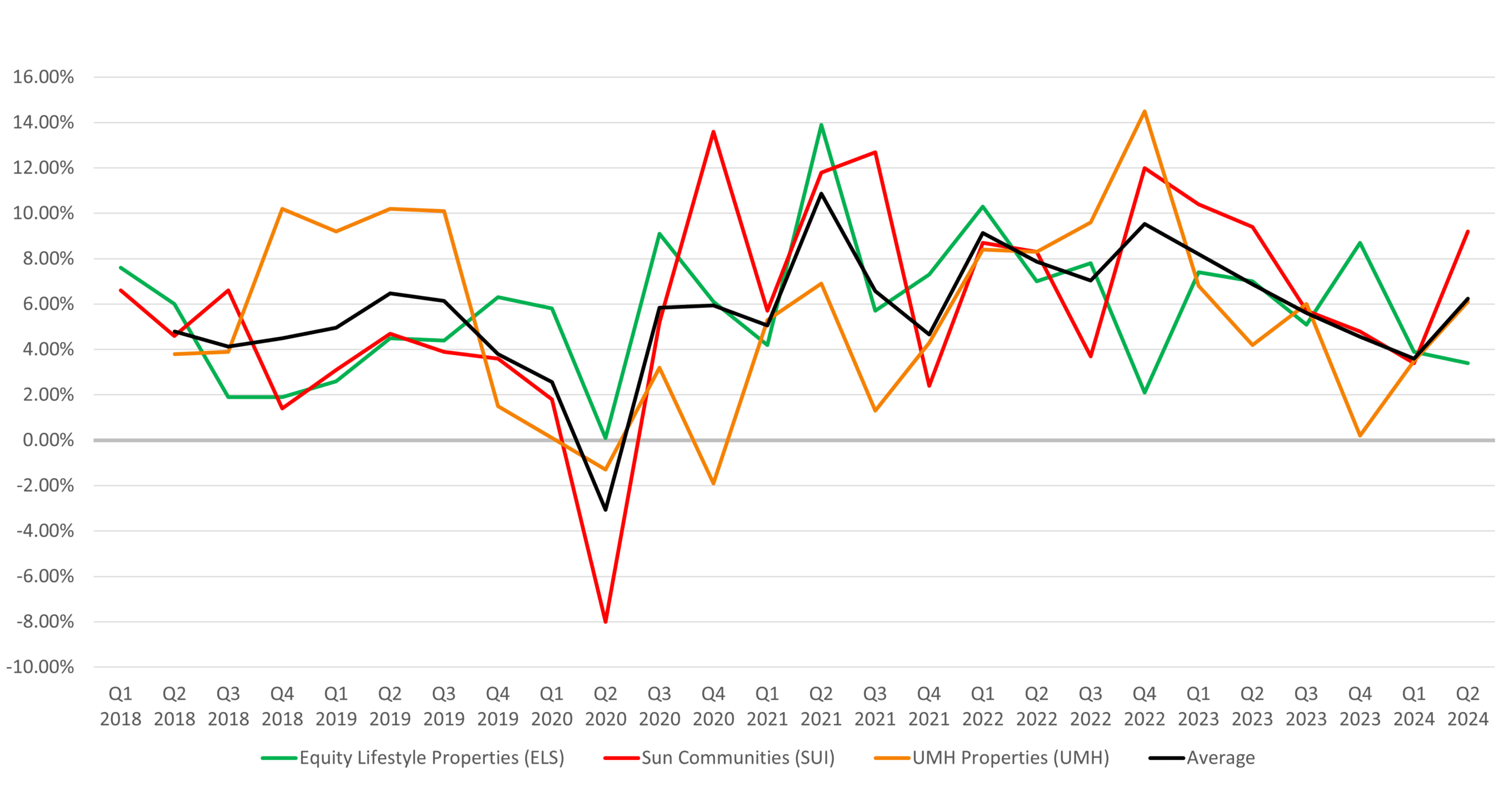

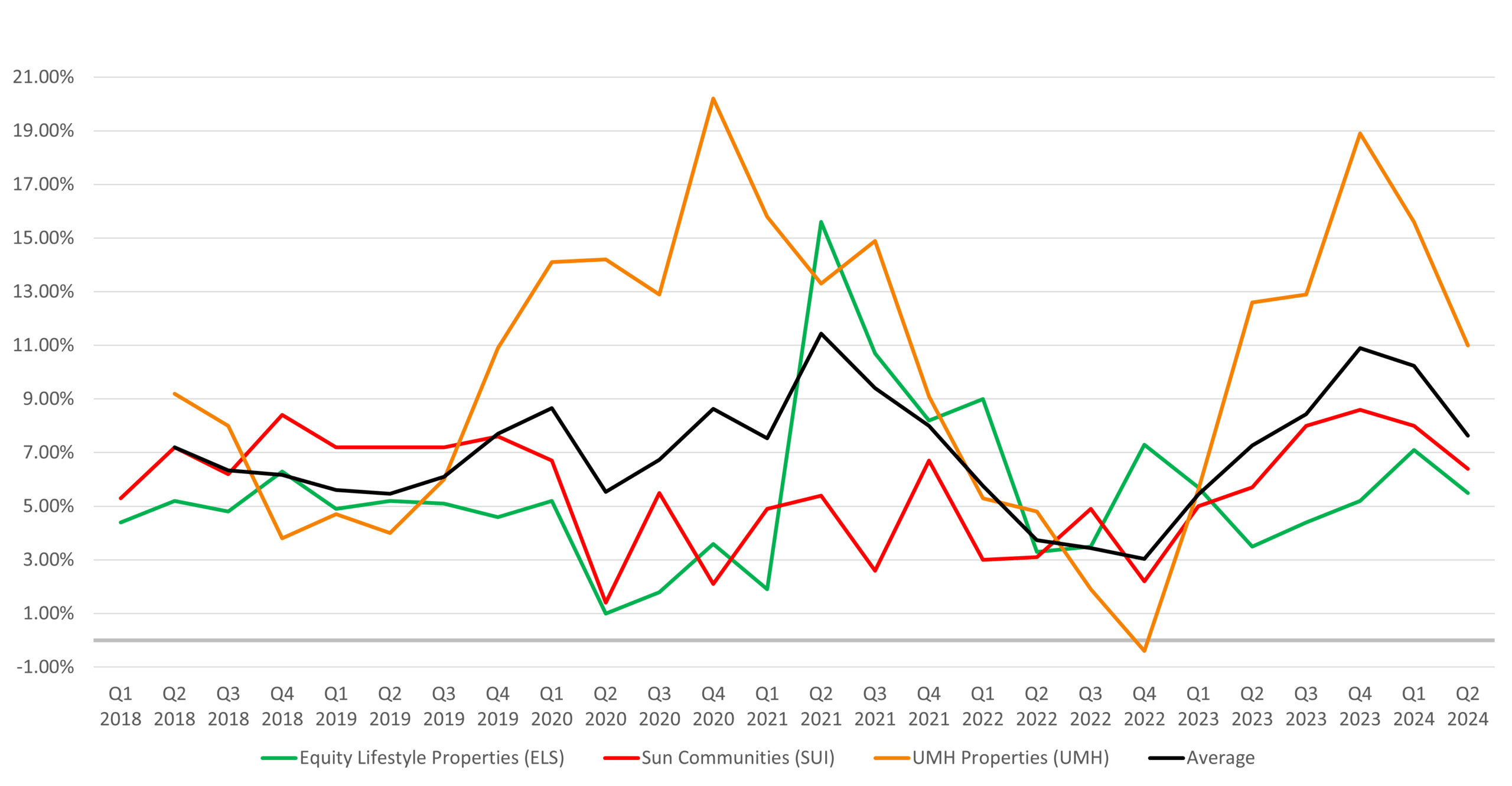

Income growth has been robust across the manufactured housing REIT sector, supported by higher rental rates, increased occupancy, and stringent expense management. Sun Communities reported a 6.4% increase in net operating income (NOI) for the first six months of 2024, translating to a 5.9% growth in normalized funds from operations (FFO). This growth was largely driven by effective rent increases and maintaining high occupancy rates, while managing operating expenses to offset rising costs in other areas, such as insurance and property taxes. Equity LifeStyle Properties saw a 6.2% increase in core community-based rental income in Q2 2024, driven by both rent increases for renewing residents and market rents for new residents. The company reported that operating expenses grew by just 3.4%, 200 basis points lower than their initial guidance, due to savings in payroll, maintenance, and insurance costs. This careful expense management allowed ELS to achieve a 5.5% increase in core NOI. UMH Properties reported an 11% increase in NOI for Q2 2024, with same-property income rising by 9% and expenses by 6%. UMH’s effective cost control, which reduced their operating expense ratio from 42.6% to 41.9%, was key to their strong financial performance, reflected in a 13% year-to-date increase in same-property NOI.

YoY MH Rental Income Growth (Same Store)

YoY MH Expense Growth (Same Store)

YoY MH NOI Growth (Same Store)

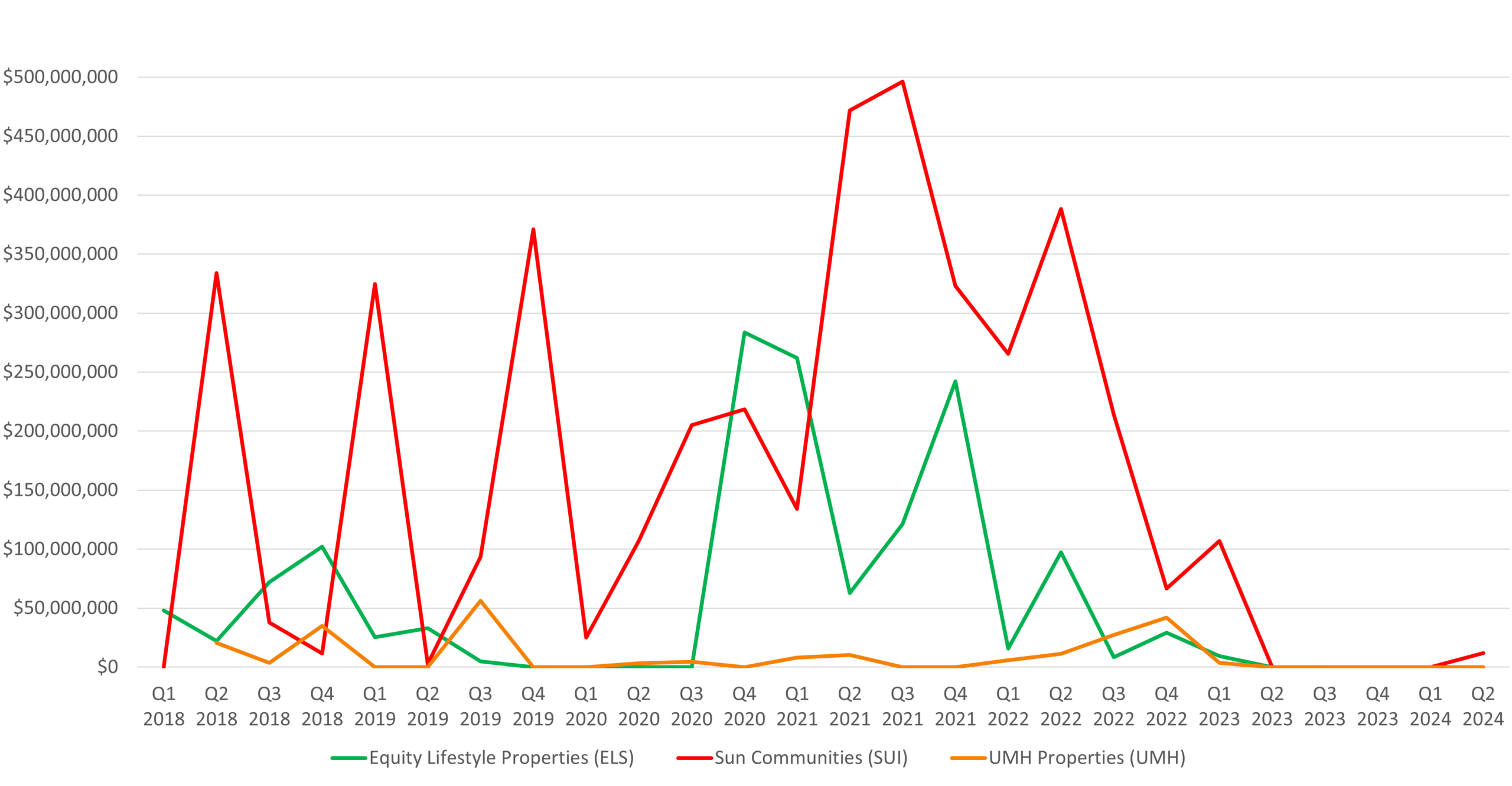

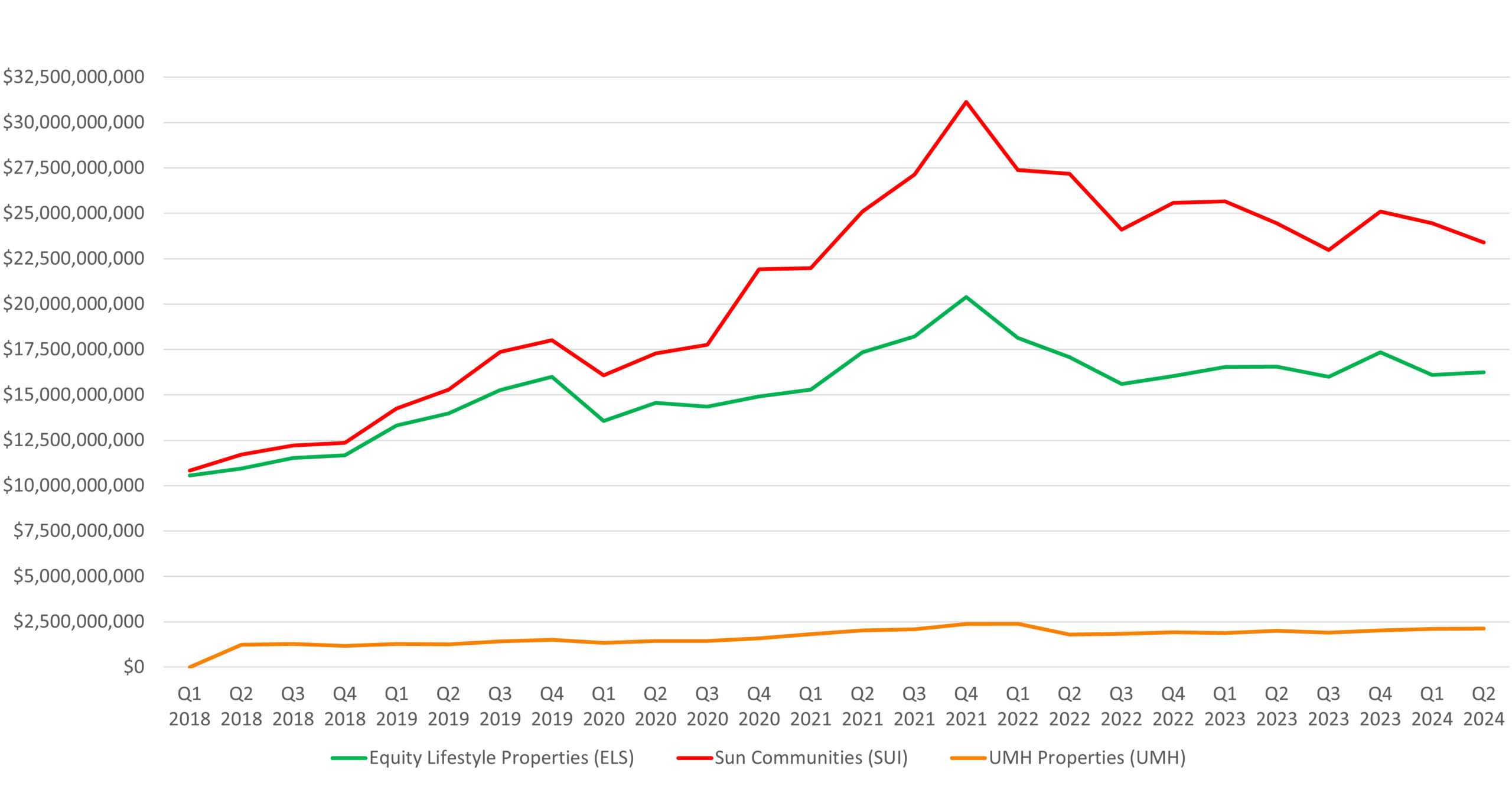

Manufactured Housing Investment & Transaction Activity

Investment in new properties, expansions, and community improvements has been a central strategy for manufactured housing REITs to enhance their portfolios and meet increasing demand. Sun Communities has been actively expanding both its manufactured housing and RV portfolios, focusing on properties in high-demand areas with strong economic fundamentals. The company’s recent investments have included the acquisition of properties in key Sunbelt states, where they continue to see strong demand. Equity LifeStyle Properties continues to invest in new home sales and rental programs, with 255 new homes sold in Q2 2024—a 13% increase from the previous year. These sales have improved the quality and appeal of their communities, driving higher occupancy and revenue. UMH Properties has been particularly focused on expanding its rental home inventory, adding 144 new rental homes in Q2 2024, bringing their total to 10,100 homes with a 95% occupancy rate. UMH is also exploring joint ventures to monetize their vacant land, including a potential development of 131 acres in Vineland, New Jersey, which could result in high-value luxury home sales.

Acquisition Dollar Amount History

*Excludes Sun Communities Acquisition of Park Holidays in April 2022 for $1.2 Billion

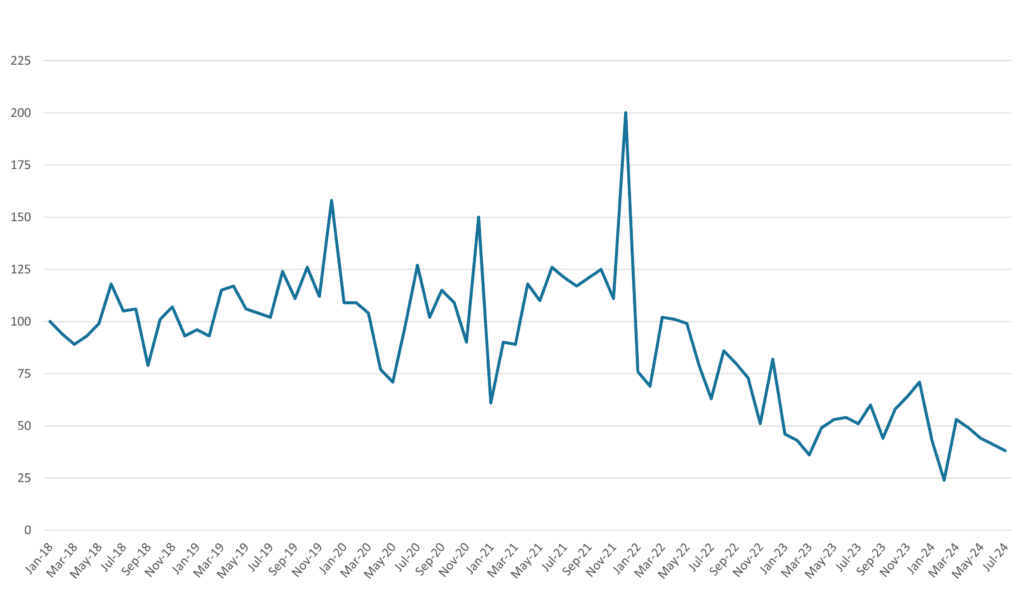

Manufactured Housing Monthly Transactions 2018-2024

* Source: CoStar

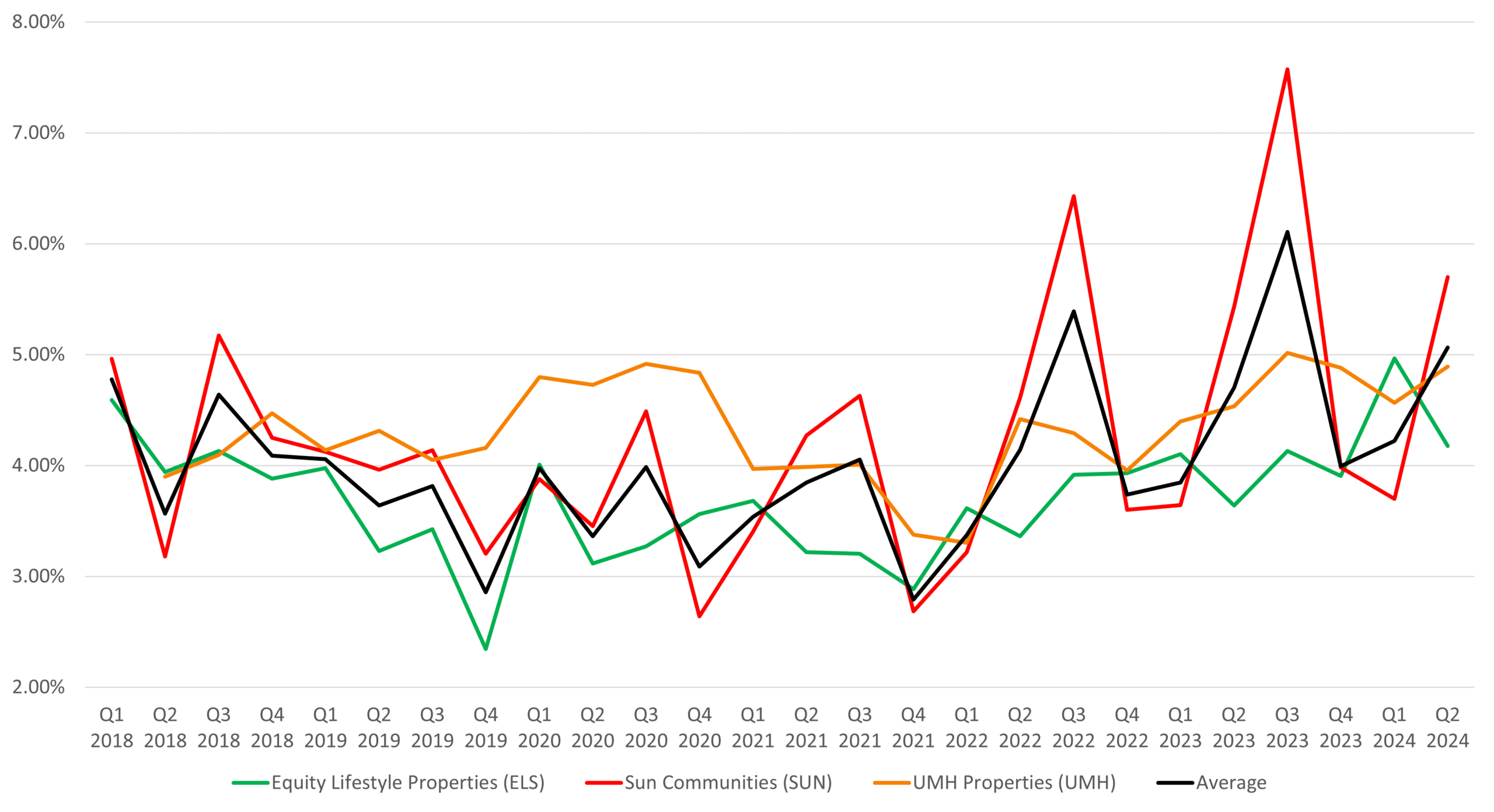

Manufactured Housing Cap Rates & Bid-Ask Spread

The rising interest rate environment has had a significant impact on cap rates and the bid-ask spread in the real estate market, creating both challenges and opportunities for manufactured housing REITs. Sun Communities noted that higher interest rates are widening the bid-ask spread, making it more challenging to secure acquisitions at attractive prices. However, Sun remains optimistic about their strong portfolio’s potential to deliver favorable returns, even in a more difficult financing environment. Equity LifeStyle Properties has maintained a stable cap rate environment by carefully selecting acquisitions that align with their long-term strategic goals and offer value in their existing markets. UMH Properties views the current interest rate environment as an opportunity, anticipating that higher rates may lead to an increase in sellers, thereby creating favorable acquisition opportunities for turnaround projects. UMH is particularly focused on acquiring properties where they can add value through renovations and operational improvements, leveraging the tightening bid-ask spread to secure deals at attractive cap rates.

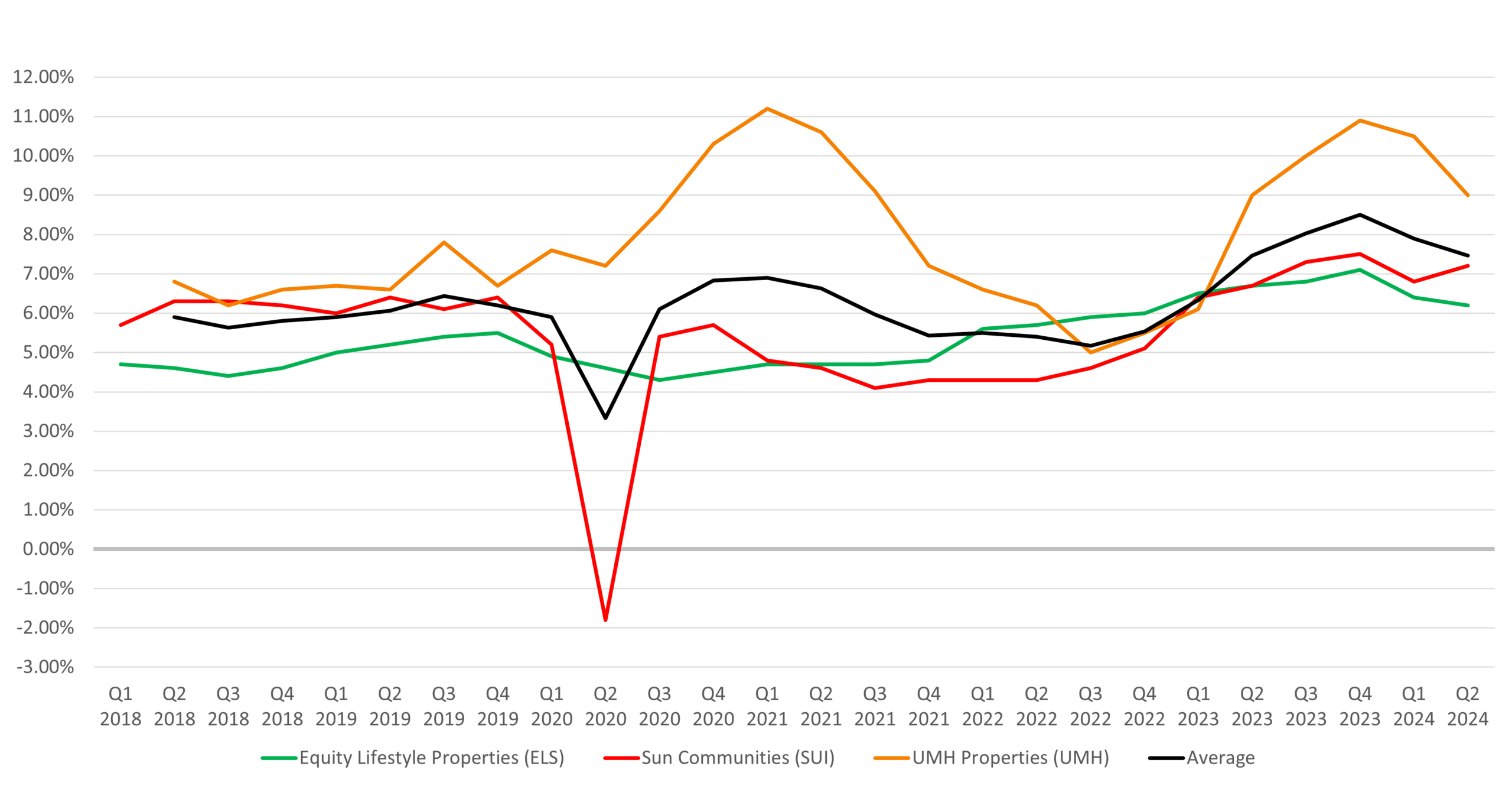

Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Enterprise Value History

Headwinds in the Manufactured Housing Market

Despite these favorable conditions, the manufactured housing REITs face significant headwinds, including rising interest rates, potential supply chain disruptions, and broader economic uncertainty. Rising interest rates have increased the cost of capital, potentially impacting acquisition opportunities and refinancing activities, as noted by UMH Properties, which anticipates a more competitive market with more sellers entering due to the higher financing costs. Supply chain disruptions, although currently under control, remain a looming risk that could impact the availability and cost of new home inventory, affecting occupancy growth and revenue. Economic uncertainty, particularly in a prolonged downturn, could affect residents’ ability to pay rent, leading to higher vacancy rates and reduced income. Both Sun Communities and Equity LifeStyle Properties have emphasized the need to maintain strong balance sheets and manage expenses carefully to navigate these potential challenges, as they continue to seek growth in a complex economic landscape.

Tailwinds in the Manufactured Housing Market

The manufactured housing REIT sector benefits from strong tailwinds, including the ongoing affordability crisis in traditional housing, favorable demographic trends, and the sector’s historical economic resilience. Rising construction costs and mortgage rates are pushing more people toward affordable manufactured homes, which offer a compelling value proposition, particularly for retirees and young families. Equity LifeStyle Properties, with 70% of its portfolio catering to seniors, is well-positioned to benefit from the aging baby boomer population. The company’s RV segment is also supported by the strong interest in RV travel among older adults, contributing to a 7% growth rate in 2024. The economic resilience of the manufactured housing sector, which has historically weathered downturns better than traditional housing markets, positions these REITs well amid current economic uncertainties and inflationary pressures, as their properties continue to attract residents seeking more affordable living options.

Contributors

Steven Paul

Senior Financial Analyst

Jared Bosch

Senior VP & Director of Manufactured Housing

Don Vedeen

Senior VP & Director of Manufactured Housing