The SkyView Advisors Healthcare Real Estate team is pleased to present our State of the HRE Market newsletter for the third quarter of 2023. With the third quarter now completed, we look at the state of the healthcare real estate market year to date and look forward to what we can anticipate for 2024.

2023 Market Fundamentals

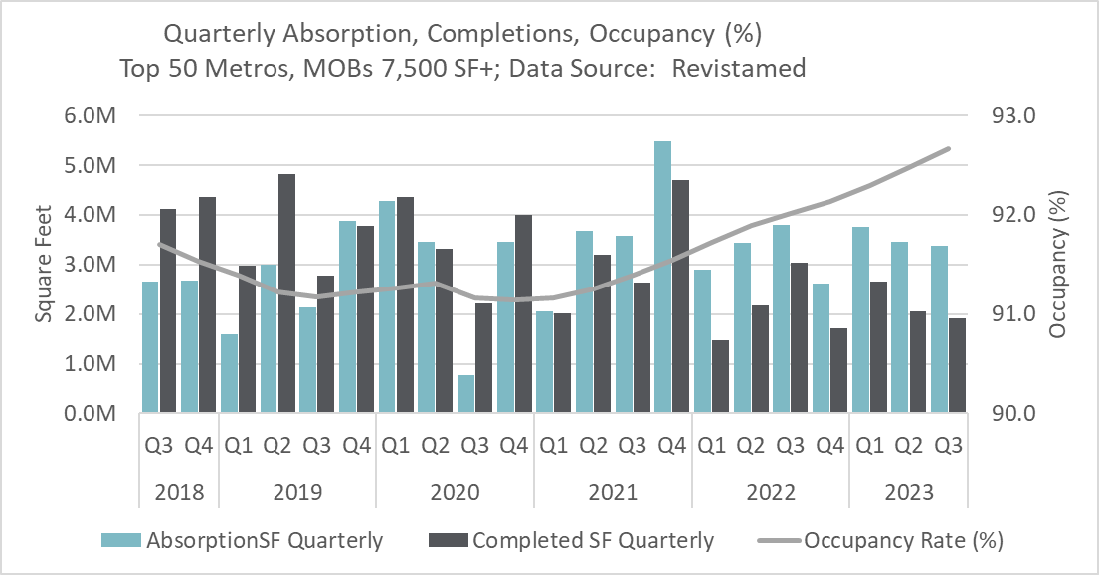

As an alternative commercial real estate asset class, healthcare real estate continues to exhibit very strong fundamentals and outshine the core sector assets, notably professional office and retail. Both occupancy expansion and rental rate growth continue a solid upward years long trend. The national occupancy rate in Q3 2023 was 92.7% continuing the rise commencing in Q1 2021 and up .7% year over year from Q3 of 2022. On a same store basis, the median occupancy rate change was up 5 basis points.

MOB Occupancy Climbing Across Top 50 Metro Areas

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

Rental rates also continue their growth trend, which has prevailed since 2019 began. In the top 50 metros, rates are increasing at almost 4% and national same store growth is trending over 3%.

Rent Inflation Impacting Outpatient Sector

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

Occupancy and rental rate expansion can significantly be attributed to tenants looking to occupy existing stock and being more selective in choosing new developments due to the inability to afford the new construction rents.

These strong fundamentals have played a significant role in supporting the value of MOB assets in the current macro-economic environment. Medical office building fundamentals have proven to be less volatile than other CRE asset classes, notably professional office post pandemic, offering investors a more secure and reliable investment option in an uncertain market. MOBs are having their time in the sun as a very resilient alternative real estate asset.

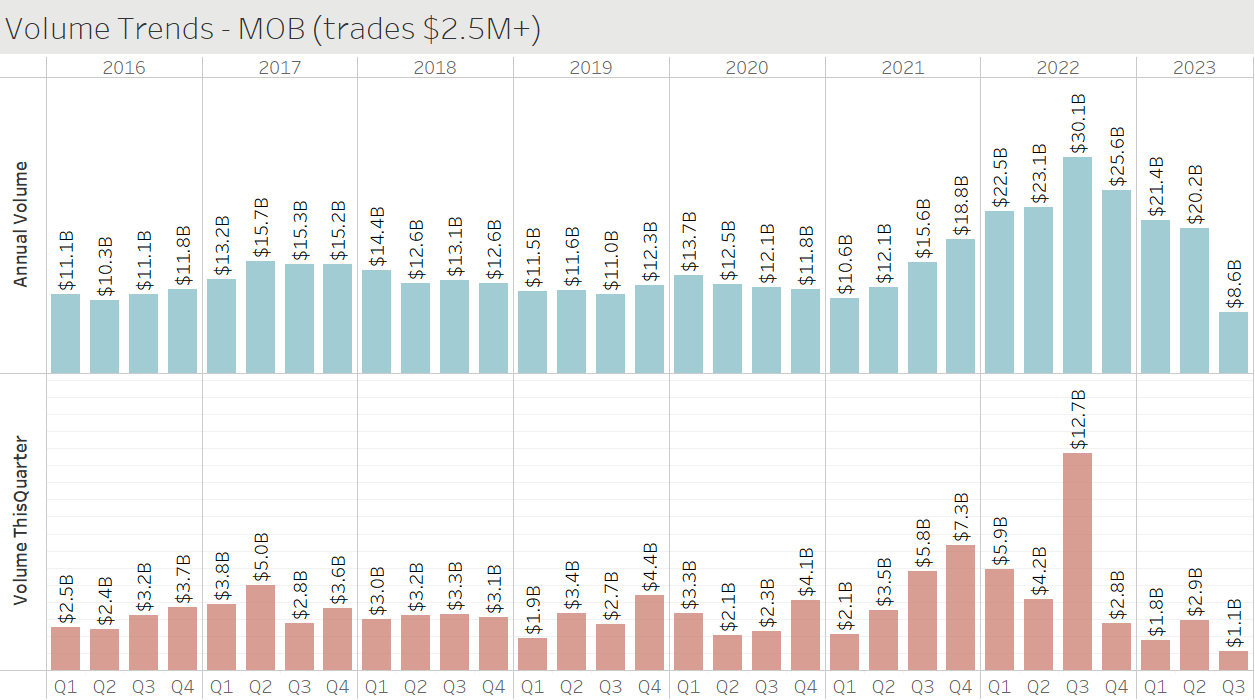

Transaction Volume

Nationally, year-over-year, the dollar value of transactions for healthcare properties is down substantially however the number of transactions taking place has only mildly declined. This is generally a reaction to the higher interest rate environment and the more restrictive debt market that we are experiencing and we are seeing a lack of large portfolio transactions with more velocity in the single asset space. The large portfolio transactions have tailed off also due to the inability to finance at scale.

Q3 2023 volume declined to $1.1 as compared to $2.9B and $1.8B the prior two quarters respectively. On an annual basis (TTM) we have 8.6B of transactions at the close of Q3 2023 as compared to 30.1 B closing Q3 2022. For comparative purposes, it needs to be noted that 2022 exhibited historically unprecedented levels of transaction volume across the board and the volume is substantially skewed by the merger of HTA and HR, an $11B transaction in Q3 2022. When we compare 12-month transaction volume to the more normalized years from 2016 to 2020 we see those years delivering volume ranges of $10.3B to $15.7B which exhibits a much more stable market currently.

It is noteworthy that the dollar volume decline does not tell the complete story about the health of the sector and demand for HRE properties. The first half of 2023 saw 362 transactions completed versus 426 in the first half of 2022, a decline of only 15% so the market is still robust. The decline in dollar volume contrast with transaction volume indicates the market is still very active but we are not seeing the large portfolio sales. Properties are trading but the transactions are in the sub $25MM dollar range and not the $100MM plus portfolio volume we saw in 2022. We anticipate the fourth quarter results will see the continuation of this trend.

Preliminary Data is Showing Another Slow Quarter

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

Providers Selling

While overall transaction volume has declined, an active cohort is the monetization of assets by providers, particularly independent physician groups. Undoubtedly, the pervasive trend of private physician groups selling their practices to opt for employment plays a key role in this. There are several other reasons private groups are electing to sell into this market including loan maturities, succession planning or capital requirements for operations and expansion.

Provider seller activity peaked in the middle of last year with an annual run rate of $3.3B and has come down somewhat in 2023, however, is still significantly above the typical activity we’ve seen in previous years and is certainly not showing the impact seen across other seller types.

As the data shows, by far the most active current buyers are private investors. These investors are focused on acquiring from providers, usually on a sale leaseback basis. Investors continue to be very focused on provider dispositions. With our extensive experience in the sale leaseback space and the benefits to our sellers of such a transaction we are uniquely positioned to assist owners with these transactions.

Who is Actively Buying?

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

Asset Pricing

While demand in the sector remains strong among a wide range of investors relative to other commercial real estate sectors, 2023 has seen some expansion of cap rates. While there is ample equity capital available in the space, many would-be investors are currently hindered from making purchases due to the cost of debt, which has been fueled by interest rate hikes instigated by the U.S. Federal Reserve Bank and a subsequent pullback by many lenders. In addition, current market conditions have led to a disconnect on pricing between sellers and buyers – the so-called “bid-ask gap.”

It is notable that the rise in cap rates in the HRE sector is minimal when viewed in terms of the rise of the cost of capital. Such a delta speaks to opportunity in HRE. Investors are clearly taking note of this and the strong fundamentals in the space and we have seen over $2.5B of equity capital enter the sector, 50% of which is from “new” investors. Primarily from the reallocation of “dry powder” from other CRE sectors, primarily professional office and retail.

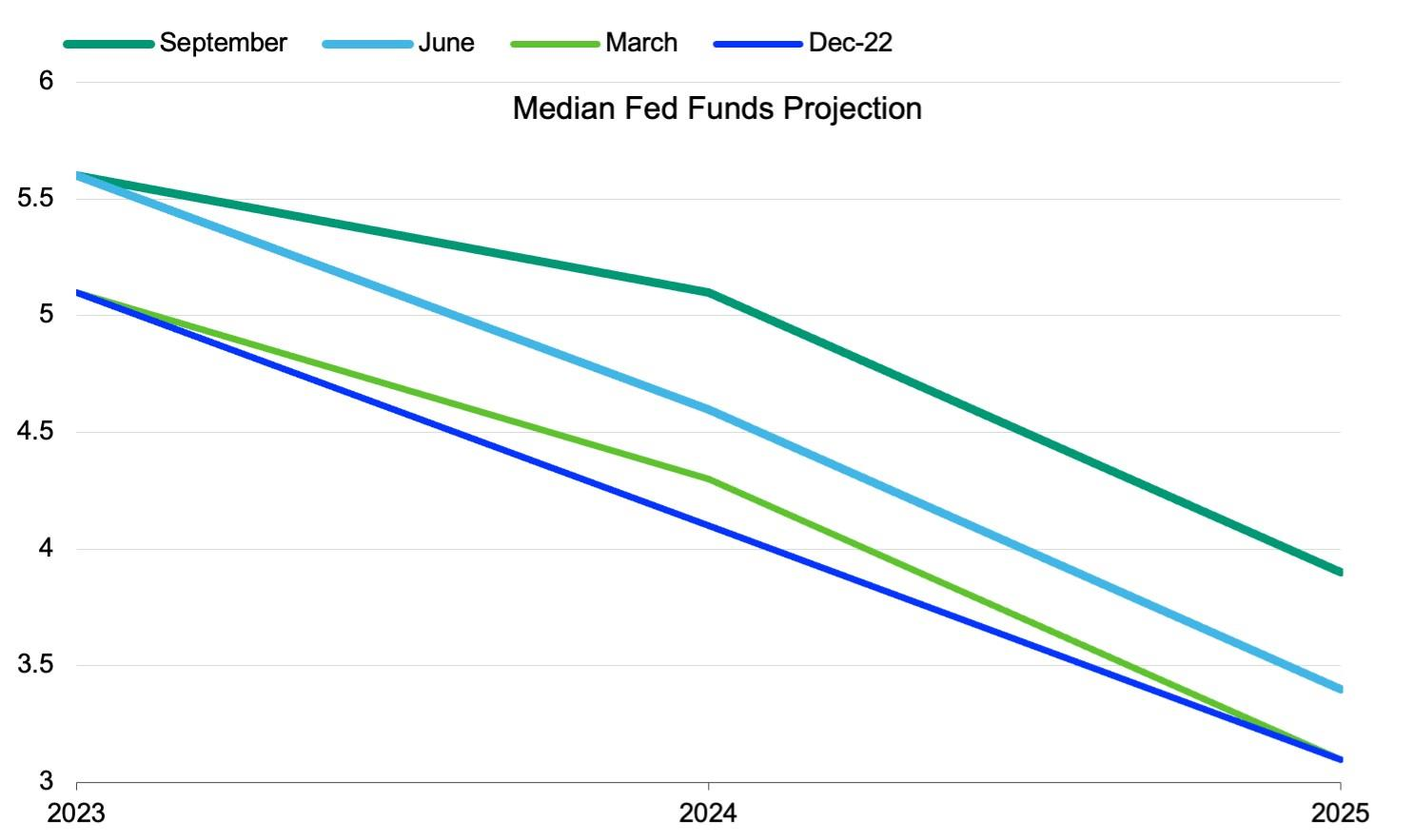

With the Federal Reserve pausing on interest rates in September and signaling the potential for easing in 2023 we anticipate cap rates to stabilize through the end of 2023 resulting in a normalization of pricing and leading to greater volume.

Portfolio Cap Rates Up 40 bps Sequentially

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

Cost of Capital

While there are plenty of lenders willing to provide financing, primarily for high quality assets, across the sector there has been substantial debt pricing increases and tightening of risk tolerance. As goes with transaction volume, the financing levels have declined. While the increase in debt costs have fortunately have not directly correlated to cap rate expansion, the decline in available financing for deals with shorter WALTS and weaker tenant credit is substantial. Adding to the debt issue is the uncertainty of pricing. With less transaction volume the cost of debt is hard to predict thus making underwriting more challenging for investors.

Debt Coming Due

An estimated $2.6 trillion of CRE loan maturities are expected through 2027. While HRE is not overly exposed in this regard, primarily due to strong market fundamentals, there could be significant challenges for some owners. Debt management will come to the fore in the near term. We are starting to see the beginning of a number of transactions taking place with sellers who must sell due to refinancing constraints on debt maturity. As interest rates ease the impact of this should become less pronounced.

Looking at 2024

The positive fundamentals of the healthcare industry and the HRE sector are the keys to an early return to the transaction volumes and asset pricing of the last few years. The overwhelming demographic shift towards more healthcare utilization and expenditure continues to drive the expansion of the healthcare industry. Coupled with the shift to outpatient facilities, a prime example of which is the growth of ambulatory surgery centers, the need for quality HRE space will continue to expand at an aggressive rate.

As noted, the fundamentals of HRE remain very strong with both occupancy and rental rates maintaining growth rates besting competing real estate asset classes, especially professional office. Substantial rent growth and steady occupancy and absorption rates continue to generate investor interest and support valuations. The HRE sector has proven to be less volatile than other asset classes, offering investors a more secure and reliable option in a difficult macro-economic market. This flight to the resiliency of HRE has resulted in ample capital to fuel a positive transition back to higher asset values with the cost of debt being the primary point of friction. These positive indicators demonstrate opportunities for investors in the HRE sector and has resulted in the significant movement of equity capital into the space.

In terms of trending locations and asset types, we continue to see the flight to quality assets and major metropolitan markets. Paradoxically, we are also seeing the growth of interest and activity in tertiary market rental rates, occupancy and transaction volumes. The strong fundamentals of these markets and the scarcity of opportunities are driving the available capital to seek alternatives.

Clearly, opportunities also lie in the identification of distressed assets due to loan maturity issues. We will see more activity from investors looking to acquire assets at a discount to the historically high pricing of recent years. Well capitalized buyers with strong lending relationships will continue to have access to advantageously priced debt capital and execute on the advantage.

It is important to note that any discussion of when the market will return to “normal” must be in the context of the historical high transaction volume and pricing of the last couple of years. Transaction volume in 2022 was at unprecedented levels, even when the $11B HTA-HR merger is removed. Undoubtedly a more stable and normalized interest rate environment will drive the bus on this journey. As of the end of the third quarter, the Federal Reserve has paused rate increases but stands ready to resume should inflation not show signs of retreating. The consensus appears to be that we will see stability into 2024 followed by some easing next year. The stability itself should contribute well to a more active market with greater availability of debt and higher pricing and we are seeing investors anticipate this unfolding and become more active in sourcing deals.

Elevated Interest Rates to be Maintained Longer

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision.

In today’s market it is imperative that owners contemplating a sale or simply seeking to understand the complex HRE landscape have an advantage. SkyView Advisors has the experience and expertise to provide that advantage. Our objective is to provide uncompromising personal service to every client, every time. Our goal is total reliability and producing the optimal results in every transaction.

Benefit from our knowledge and experience. Please contact our team.

Charts via Revista.