Slowly Turning to Cautious Optimism

Overall, demand has been a bit slow in year-end 2023 into early 2024. Amidst the challenging commercial real estate landscape of the past year, there is cautious optimism with an uptick in buyer demand as we head into the next lease-up season and as the market sentiment looks to several rate cuts towards end of 2024. As we get into second half of 2024 and the expected rate cuts come to fruition, this should drive housing and increase demand, especially in areas where there is the most population in-migration.

Despite some slowdown attributed to housing market fluctuations, promising investment opportunities have emerged in the self-storage industry, particularly in emerging markets and regions. Sunbelt areas such as Florida, Texas, the Carolinas, and Tennessee continue to attract buyers, while a notable trend is the growing interest in fast-growing secondary markets outside major metropolitan areas, exemplified by locations like Knoxville, Tennessee, Raleigh, North Carolina, and suburban areas around major Texas cities. Additionally, traditional markets like New York and California maintain their strength due to high street rates and formidable barriers to entry, discouraging significant new supply.

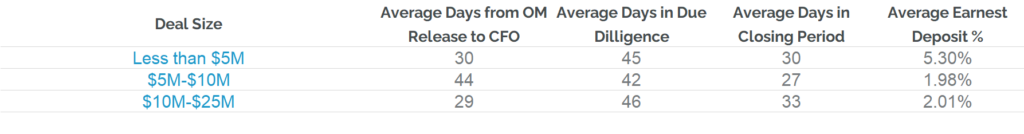

In the initial section of this report, we share proprietary SkyView metrics across our asset classes of self-storage, healthcare, and manufactured housing. The data reflects the average time from offering memorandum release to call for offers deadline, average days in due diligence, average days in the closing period, and mean of the earnest deposit percentage for each deal size. This data creates full transparency on the transaction process timeline. Below, SkyView’s on-market data reflects all 12 months of 2023, categorized by deal size. The latter sections of this report are based primarily on public REIT data.

SkyView On Market Data

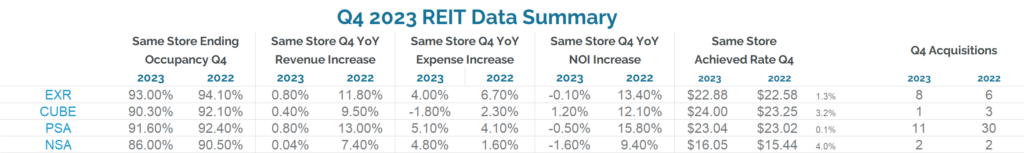

REIT Operating Fundamentals

Rental Rates

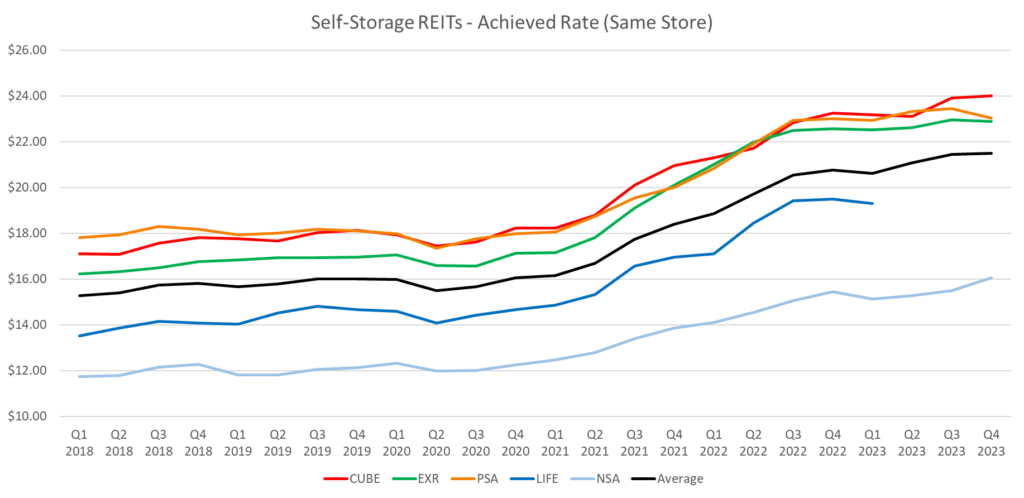

In the fourth quarter of 2023, the self-storage REITs exhibited varied performances in rental rates. Extra Space Storage faced challenges, maintaining negative rates of around 10% for new customers despite steady demand, attributed to higher negative churn. CubeSmart reported stabilized trends with a 1.8% growth in rental rates per square foot, navigating a competitive housing market’s price sensitivity for new customers. Public Storage displayed robust financial performance, achieving an 80 basis points increase in revenue for the same-store portfolio, signaling effective strategies in optimizing rental rates. On the other hand, National Storage Affiliates Trust (NSA) encountered a challenging environment, experiencing a negative 14.2% year-over-year change in street rates for Q4. NSA focused on balancing rental rates and occupancy, leveraging technology and testing markets cautiously for rate improvements during the peak leasing season. Same store achieved rates are up across all 4 REITS with CubeSmart having the biggest gain in same store rental rate increases of 3.2% followed by Extra Space at 1.3% .

Occupancy

In the self-storage Real Estate Investment Trust (REIT) sector, occupancy levels varied across key players in the fourth quarter. Extra Space Storage reported positive trends, with its same-store pool maintaining high occupancy at 93%, contributing to a 0.8% growth in same-store revenue. The occupancy gap between Legacy Life Storage and Extra Space Storage narrowed from 350 to approximately 200 basis points by year-end. CubeSmart, on the other hand, experienced a decline of 110 basis points in average occupancy compared to the same quarter last year with an ending occupancy of 90.3% on same store properties but highlighted stability in operating trends, especially in urban markets. Public Storage showcased a positive trend in occupancy, closing the year-end gap by 70 basis points compared to the beginning of the year resulting in a year end occupancy of 91.6% on same store facilities. The company’s CEO, Tom Boyle, mentioned variations in market performance, with certain regions experiencing acceleration in the first quarter. Finally, NSA reported an occupancy decline, ending the fourth quarter at 86%, with a 450 basis points year-over-year decrease on same store facilities. Despite challenges, NSA expressed optimism about a potential bottom in February and anticipated a seasonal uptick in rates and occupancy in the coming months.

Income & Expense Information

In the self-storage REIT sector, Extra Space reported results aligned with expectations, but lower new customer rates impacted revenue growth, partially mitigated by lower-than-expected property taxes. The completion of the migration of Life Storage customers is anticipated to yield $16 million in synergies, surpassing the original estimate by $4 million in 2024. CubeSmart achieved a 1.2% growth in same-store NOI for Q4 2023, driven by increased same-store revenues and higher realized rents per square foot. Expenses declined by 1.8%, mainly due to significant refunds and tax reductions. Public Storage demonstrated effective expense management despite a 5.1% increase in same-store cost of operations, maintaining solid financial performance. The non-same-store portfolio exhibited robust growth, contributing to positive occupancy trends and reinforcing the company’s competitive position. For NSA, flat revenue growth on a same-store basis was observed, with a 3.6% increase in rent revenue per square foot. Expenses grew by 4.8% in the fourth quarter and 4.7% for the full year, primarily attributed to property tax, marketing, and insurance expenses, partially offset by payroll efficiencies.

Investment & Transaction Activity

In the self-storage Real Estate Investment Trust (REIT) sector, notable investment and transaction activity were observed across key players in the recent quarter. Extra Space Storage exhibited robust external growth by adding 74 third-party managed stores, acquiring 8 additional stores, and securing $129 million in bridge loans. This aligns with the company’s strategic focus on optimizing performance for both recently acquired Life Storage assets and existing Extra Space locations. CubeSmart, while acknowledging a subdued transaction market influenced by rising interest rates, emphasized its investment-grade balance sheet and maintained readiness to capitalize on attractive opportunities when market conditions improve. Public Storage achieved significant milestones, including the acquisition and integration of the $2.2 billion Simply Self Storage portfolio, marking the largest private acquisition in the company’s history. The company also expanded its high-growth non-same-store pool, comprising almost 30% of the overall portfolio. Although the investment environment showed a continued reluctance among property owners to sell, Public Storage remained engaged in discussions for potential transactions. Lastly, NSA executed significant portfolio optimization strategies, selling a portfolio of 71 properties for $540 million, contributing assets to joint ventures, and securing capital commitments for future acquisitions through debt placement. Overall, these REITs navigated diverse investment landscapes, strategically positioning themselves for growth, operational efficiency, and capital generation.

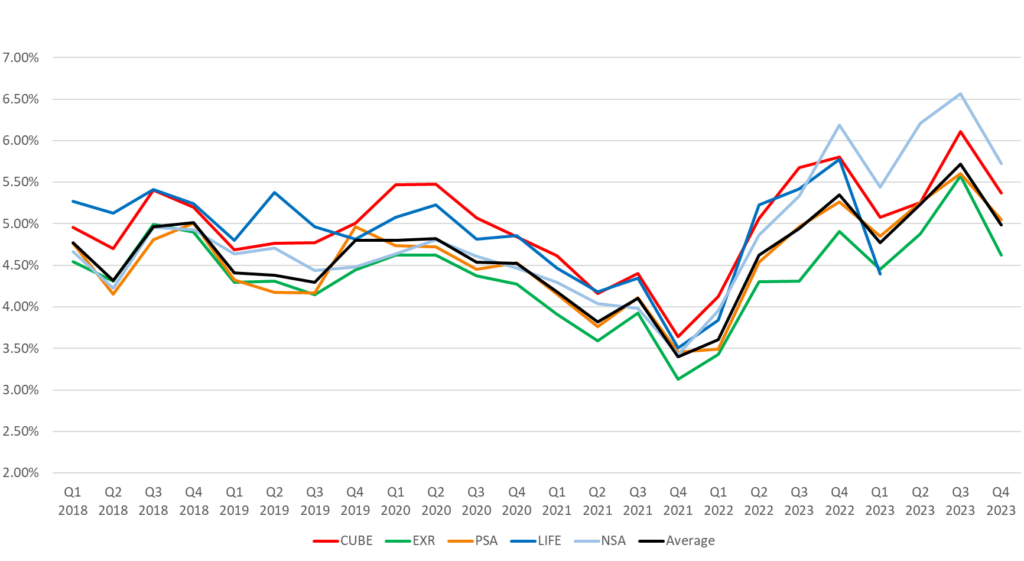

Cap Rates & Bid-Ask Spread

In the self-storage REIT sector, executives from leading companies such as Extra Space, CubeSmart, Public Storage, and NSA provided insights into their acquisition strategies and the challenges associated with determining market capitalization rates (cap rates). Extra Space faced difficulty in establishing a market cap rate due to low transaction volume, despite having most of their acquisition guidance under contract. CubeSmart observed a narrowing bid-ask spread, expressing cautious optimism for potential deals within the 6 cap or better range and outlining an acquisition guidance ranging from $100 million to $200 million. CubeSmart stated that for the majority of 2023 they witnessed a bid ask spread of around 20%, currently they are seeing a decreased spread closer to 10%. Public Storage faced a persistent gap between seller expectations and what the company deemed prudent for allocating capital, with a reluctance among sellers to adjust valuations based on changing market conditions. NSA CEO Dave Cramer highlighted significant portfolio restructuring, including the sale of 71 assets at a 6% cap rate, while a low six percent cap rate for assets contributed to the joint venture. Overall, the industry faced challenges in determining cap rates, with varying degrees of optimism and caution expressed by different REITs regarding potential acquisition opportunities.

Tailwinds in the Market

In the dynamic landscape of Self Storage Real Estate Investment Trusts (REITs), several key players are poised to benefit from positive market tailwinds. Extra Space is confident in the long-term outlook, citing factors such as moderated new supply, robust third-party management, a strong bridge loan pipeline, and a successful joint venture program. Cubesmart recognizes positive market trends, particularly in urban areas like New York City, with a robust demographic profile supporting performance across economic cycles. Public Storage expresses optimism for 2024, foreseeing stabilization in the move-in environment, favorable macro conditions, and reduced competition from new facilities nationally. Similarly, NSA identifies tailwinds, placing confidence in the long-term growth of Sunbelt markets driven by broader population and migration trends. Despite short-term challenges, these REITs are strategically positioned to capitalize on the positive momentum in the self-storage sector.

Headwinds in the Market

In the current self-storage real estate investment trust (REIT) landscape, companies such as Extra Space Storage, CubeSmart, Public Storage, and NSA face various headwinds. Extra Space Storage acknowledges challenges in achieving full property level synergies, citing lower-than-anticipated new customer rates at both Extra Space and Life Storage locations. CubeSmart identifies tight housing markets, heightened price sensitivity, and a challenging competitive environment as key market headwinds. Public Storage recognizes a challenging new customer environment but anticipates stabilization in demand for 2024, leveraging competitive advantages and strategic growth initiatives. NSA faces a competitive environment for new customers, with challenges in specific markets and uncertainties related to interest rates. Despite these obstacles, all REITs express confidence in their ability to navigate challenges through strategic initiatives, maintaining optimism about the long-term health of the self-storage market.

REIT Data Summary

Self Storage REIT Implied Cap Rate History

*The implied cap rate data indicates the market value of each REIT.

The implied capitalization rate is a culmination of the company value and total debt of each company divided by its NOI.

Achieved Rates & Occupancies (Same Store)

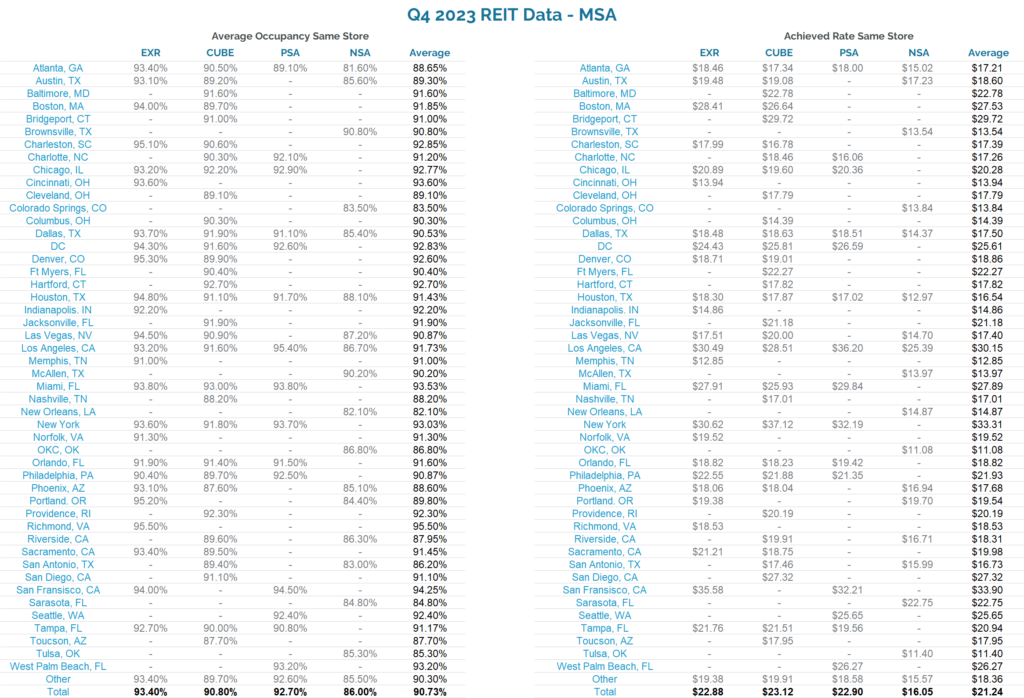

REIT Data by MSA

Our Proprietary Data

As we continue to build our proprietary dataset and technology stack, our analytics will continue to evolve and lead the way. Our unique transaction analysis directly correlates to market conditions. This next-level combination of informative statistics is geared to help you formulate a strategic business plan for your asset, regardless of your position. We look forward to leading the way as thought leaders in order to help you achieve your ultimate goals.

Contributions:

Steven Paul

Senior Financial Analyst

Scott Schoettlin

Managing Director

Aaron Sanchez

Managing Director